EUR/USD:

During the course of Tuesday’s sessions we witnessed price action plummet amidst the first half of London trade, reaching lows near mid-1.16 (on the H1 you’ll see this was achieved in the shape of a AB=CD corrective pattern). Going into the US session, the pair reversed course and retraced its downside to turn positive above the 1.17 handle on the H4 timeframe. Imbalance, as far as we can see, favors the bulls at this time, which could lead to a move being seen towards the H4 supply area drawn from 1.1793-1.1768.

Movement on the bigger picture is interesting. Daily price appears to be working towards a test of resistance coming in at 1.1824, while weekly action is seen kissing the underside of a weekly resistance area at 1.1717-1.1862.

Areas of consideration:

Despite recent buying, the underside of the noted weekly resistance area is not really a zone you want to buy into, especially medium/long term. As such, we still feel that initiating long trades above the 1.17 handle on the H4 remains a venturesome move.

In the event that the euro does gain momentum against its US counterpart, however, eyes will likely be on the H4 supply mentioned above at 1.1793-1.1768 for potential shorts, targeting 1.17 as the initial take-profit zone. Not only does the supply boast strong momentum to the downside, it is also positioned within the walls of the noted weekly resistance area. The only caveat here is the possibility of a fakeout above this area towards either the 1.18 handle or the daily resistance highlighted above at 1.1824.

Today’s data points: Limited.

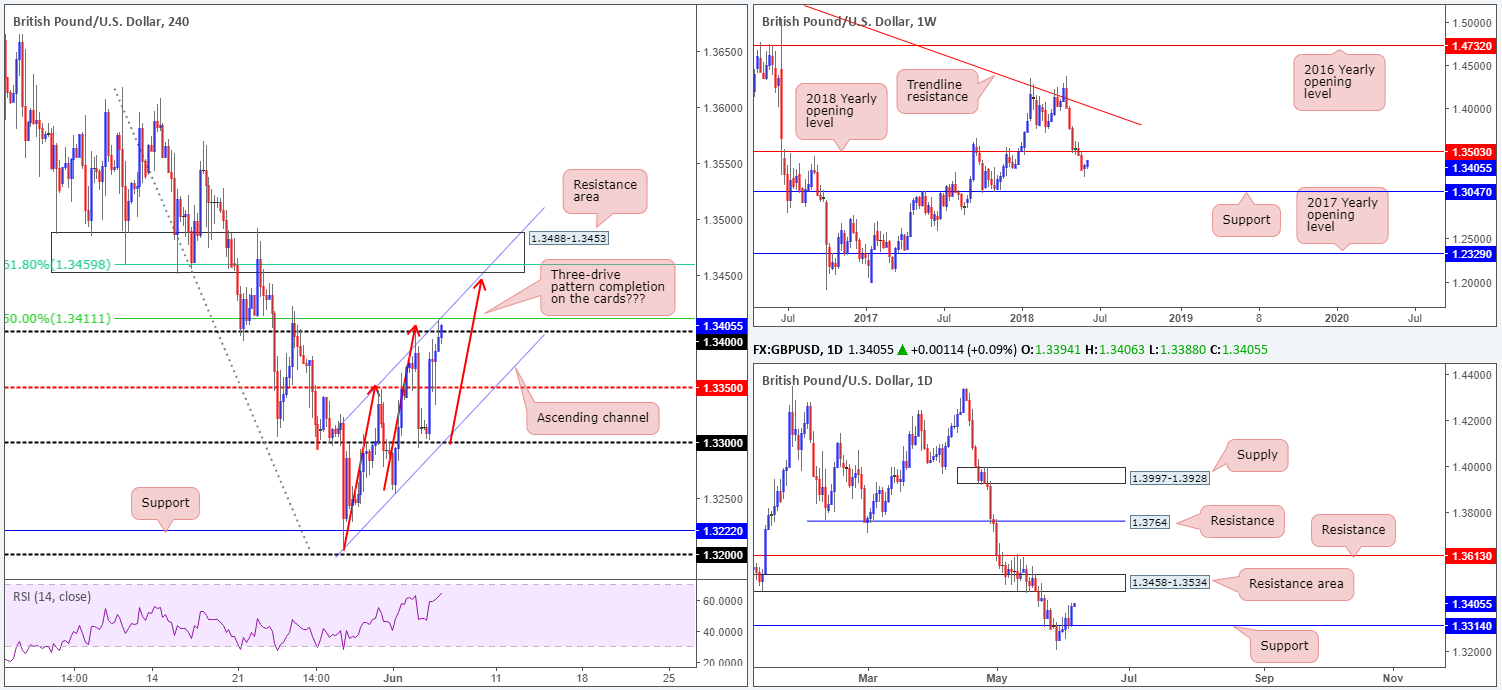

GBP/USD:

The British pound received a boost to the upside amid early trade in London on Monday, after services PMI data showed an upward surprise. Sterling continued to build on earlier gains amid US hours, following a retest of 1.3350 as support, consequently towing H4 price up to 1.34 into the close. Points to consider on the H4 scale are as follows:

- 1.34 is bolstered by a H4 channel resistance taken from the high 1.3347 and a 50.0% Fib resistance value at 1.3411.

- A break above 1.34 would likely imply the completion of a H4 three-drive pattern into a nearby H4 resistance area seen at 1.3488-1.3453, which happens to converge nicely with a 61.8% H4 Fib resistance value at 1.3459.

The vibe over on the higher timeframes, however, appears somewhat positive at the moment. Daily structure shows room to appreciate north until we reach the daily resistance area coming in at 1.3458-1.3534. Also worth noting is that within these walls we can see the 2018 yearly opening level situated on the weekly timeframe at 1.3503.

Areas of consideration:

Although H4 price may chalk up a response off 1.34 given its H4 confluence, the team favors the H4 resistance area at 1.3488-1.3453 for possible sells. Here’s why:

- The H4 zone is glued to the underside of the aforementioned daily resistance area.

- Boasts a 61.8% H4 Fib resistance value at 1.3459 within its walls.

- H4 three-drive formation in the works which completes around the underside of the noted H4 zone.

The only grumble here is a possible fakeout above the area to tag in orders around 1.35, which also represents the 2018 yearly opening level on the weekly timeframe at 1.3503. To help avoid this fakeout, one could simply wait and see if H4 price can print a full or near-full-bodied bearish candle before pulling the trigger. This helps show seller intent and allows one to position stops above the candle’s wick, sometimes offering a more favorable risk/reward scenario.

Today’s data points: MPC Members Tenreyro and McCafferty speak.

AUD/USD:

In recent movement, the commodity currency traded softly off the 161.8% H4 Fib ext. point at 0.7667 seen within H4 supply at 0.7682-0.7655. RBA stood pat on policy, with the Aussie also suffering from downside in commodity prices, as well as negative news flow regarding global trade.

For those who read Tuesday’s report you may recall the team highlighting a potential move lower from the noted H4 supply, targeting 0.76. Well done to those who managed to hook this move.

As you can see, 0.76 has so far held firm as support as traders await the GDP q/q report.

While buying may be in view on the H4 scale, traders may want to note what they are buying into on the higher timeframes. Weekly price is seen interacting with supply at 0.7812-0.7669 and its intersecting channel support-turned resistance (extended from the low 0.6827). Further to this, daily activity is showing signs of bearish movement out of a resistance area coming in at 0.7626-0.7665, which also intersects with a channel resistance brought in from the high 0.8135.

Areas of consideration:

Technically speaking, entering long in this market, particularly on a medium-term basis, is considered a chancy move, according to our reading.

With that being the case, the team has noted to keep eyeballs on 0.76 for a break lower. A H4 close printed below here that’s followed up with a successful retest as resistance has the 61.8% H4 support at 0.7549 as an initial target.

Alternatively, the current H4 supply could offer traders another opportunity to get short should price continue to climb from 0.76. Given the recent test of this zone potentially weakening it along with the threat of a fakeout above to April’s opening level seen on the H4 timeframe at 0.7690, though, we would strongly recommend waiting and seeing if H4 price can print a full or near-full-bodied bearish candle before pulling the trigger. This helps show seller intent and allows one to position stops above the candle’s wick, sometimes offering a more favorable risk/reward scenario.

Today’s data points: AUD GDP q/q.

USD/JPY:

USD/JPY prices remained unchanged on Tuesday despite ranging in excess of 50 pips. As is evident from the H4 timeframe, price action shook hands with the 110 handle and clocked lows near mid-106.50, before paring losses into the close. Owing to this somewhat lackluster movement, much of the following analysis will echo thoughts put forward in Tuesday’s report.

Apart from the 61.8% H4 Fib resistance seen at 110.14, there’s not a whole lot of resistance to stop price moving higher above 110. Turning our attention to daily structure, the next port of call to the upside can be seen at 111.71-110.78: a strong resistance area that converges with a 61.8% daily Fib resistance value at 110.91 (green line). Further to this, we can also see that the daily area unites with long-term weekly trend line resistance extended from the high 123.67.

Areas of consideration:

Given the higher timeframes display possible intent to gravitate higher, selling from the 110 neighborhood is still not really a trade we’d label high probability.

Instead of looking for shorts, the team has noted that longs above the 110.14/110 region are worthy of attention. This is due to the space seen on the higher timeframes before reaching the daily resistance area mentioned above at 111.71-110.78.

An ideal setup, as far as we can see, would be for H4 price to decisively close above 110.14/110 followed then by a retest of the area as support in the shape of a full or near-full-bodied bull candle. A long on the close of this candle, with stops tucked below the tail will likely offer favorable risk/reward should your take-profit target be set at the underside of the noted daily resistance area!

Today’s data points: Limited.

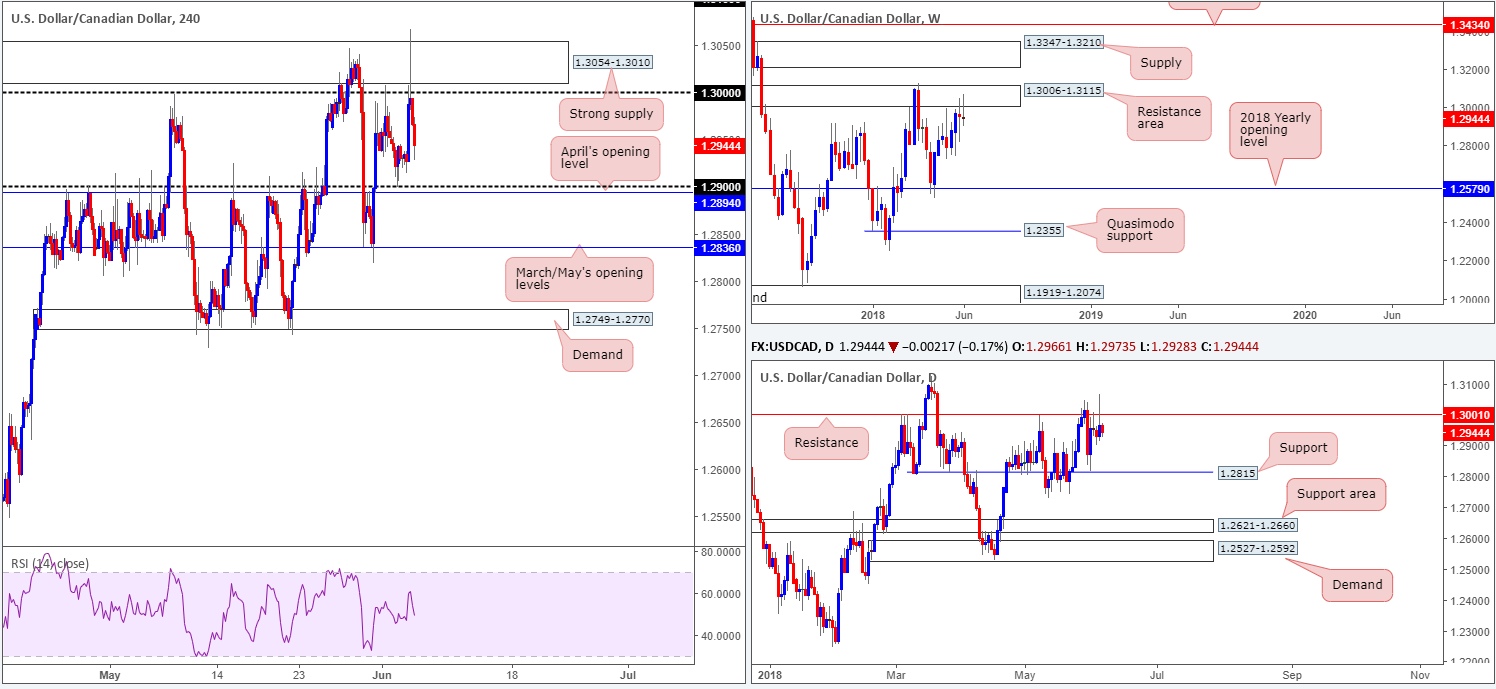

USD/CAD:

Heading into US hours on Tuesday, traders witnessed a pop higher after White House economic advisor Kudlow suggested that Trump was erring towards bilateral negotiations (rejected by Canada and Mexico), sending the Loonie above H4 supply at 1.3054-1.3010. Market sentiment, however, quickly reversed, forcing the unit to retake 1.30 into the close.

Looking across to the bigger picture this morning, it’s clear that weekly flow remains capped around the underside of a resistance area seen at 1.3006-1.3115. In conjunction with weekly structure, the daily candles are seen interacting with resistance coming in at 1.3001. Providing a strong ceiling of resistance since March this year, on top of yesterday’s bearish pin-bar formation, further selling could be in store. The next downside support target on the radar falls in at 1.2815, followed then by a daily support area at 1.2621-1.2660.

Areas of consideration:

Having noted that both weekly and daily price show potential to selloff, we see the two potential scenarios:

- Wait and see if H4 price can close below 1.29 and retest the underside of this number as resistance. A successful retest should be enough to draw in intraday sellers with an initial target objective set at 1.2836 (March/May’s opening levels), followed by daily support priced in at 1.2815.

- A pullback to 1.30/H4 supply at 1.3054-1.3010 for a sell, targeting 1.29 as the initial take-profit target.

Today’s data points: CAD trade balance; CAD building permits; Crude oil inventories.

USD/CHF:

Going into London trade on Tuesday, USD/CHF bulls went on the offensive but quickly lost momentum just south of the 0.99 handle. This sparked an aggressive round of selling into US trade, pulling the pair down to H4 support at 0.9835. Overall, though, H4 action remains trading within a consolidative phase between the noted H4 support and the 0.99 handle/May’s opening level at 0.9907. Surrounding structure on the H4 scale falls in at the 0.98 handle and a H4 resistance zone coming in at 0.9969-0.9956.

Traders may have also noticed that supporting the lower edge of the H4 range is a daily support level seen at 0.9814. This level boasts historical significance stretching as far back as mid-2013. Therefore, it is not a barrier one should overlook! Contrary to this, though, weekly movement continues to reflect a bearish stance. The pair sustained further losses during last week’s action, marking the unit’s third consecutive weekly loss off the 2016 yearly opening level seen on the weekly timeframe at 1.0029. In terms of weekly structure, there’s really not very much support seen in view until the unit reaches the 2018 yearly opening level marked at 0.9744.

Areas of consideration:

Intraday, traders may look to the current H4 range for opportunity. We would, however, advise waiting for additional candle confirmation in the shape of a full or near-full-bodied candle rotation, be it on the H4 or H1 timeframe, before pulling the trigger. Stops are best placed beyond the candles rejection wick/tail and the take-profit targets are best set at the opposite end of the range.

Longer term, this market is at conflict. Daily price suggests buying could be in store, whereas weekly action indicates that we could be in for further downside.

Today’s data points: Limited.

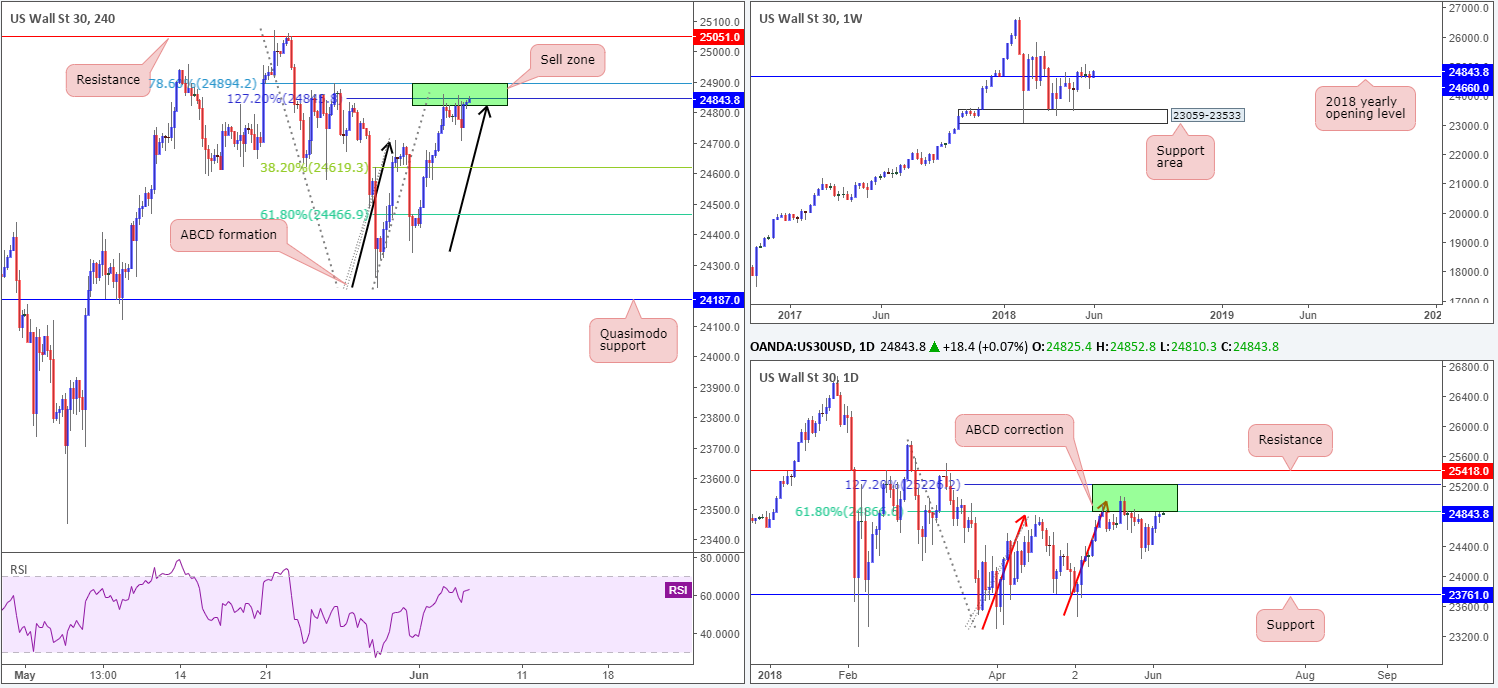

Dow Jones Industrial Average:

US equity prices are little changed this morning as concerns over international trade war, along with the US recently imposing tariffs, clearly remains a focal point for the markets.

Meanwhile, the technicals reveal that H4 price remains flirting with 24894/24823 as a possible area for shorts. Note the clear H4 127.2% ABCD (see black arrows) approach at 24849, and the 78.6% H4 Fib resistance at 24894.

What’s also notable from a technical perspective is the 25229/24866 area seen on the daily timeframe bolstering the top edge of the current H4 sell zone. The daily area marked in green is comprised of a 61.8% daily Fib resistance value and a daily 127.2% ABCD (see red arrows) daily Fib ext. point. The only grumble for sellers here is the fact that weekly price is seen attempting to reclaim the 2018 yearly opening level at 24660.

Areas of consideration:

Those who are short the ABCD completion on the H4 timeframe, we see two notable areas below to keep eyeballs on. One could possibly use the 38.2% H4 Fib support off legs A-D at 24619 (Leg A is 24224 and leg D falls in at 24859) as a breakeven trigger, and the 61.8% off legs A-D at 24466 as a level for taking full or partial profits.

Today’s data points: Limited.

XAU/USD (Gold)

Influenced by a somewhat waning USD on Tuesday, the price of gold advanced north and concluded the day closing just south of a daily resistance area priced in at 1301.6-1307.5. Over the past week or so, the team has been supportive of a lower low taking place on the H4 scale (a break of the swing low 1285.8). Regardless of yesterday’s buying, this expectation remains in view and will only be discounted on a close above the clear lower high seen on the H4 timeframe at 1307.7. Also worthy of note on the H4 scale is the recent formation of a descending channel (1306.8/1295.3).

Skimming over to the daily timeframe, price action remains sandwiched between the aforementioned daily resistance area and a daily support level drawn in from 1289.4. In similar fashion, weekly movement is also seen tightly confined between the 2018 yearly opening level at 1302.5 and the lower edge of a weekly bullish flag formation taken from the low 1346.1.

Areas of consideration:

As the expectation is for a lower low to form on the H4 timeframe, should H4 price retest the current daily resistance area and print a full or near-full-bodied bearish candle, shorts would be favored, with stop-loss orders placed above 1307.7.

The use of the site is agreement that the site is for informational and educational purposes only and does not constitute advice in any form in the furtherance of any trade or trading decisions.

The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets does not warranty, guarantee or make any representations, or assume any liability with regard to financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www.icmarkets.com.au, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness. All such information is subject to change at any time without notice. IC Markets assumes no responsibility for the content of any linked site. The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site.

IC Markets is not liable for any harm caused by the transmission, through accessing the services or information on this site, of a computer virus, or other computer code or programming device that might be used to access, delete, damage, disable, disrupt or otherwise impede in any manner, the operation of the site or of any user’s software, hardware, data or property.