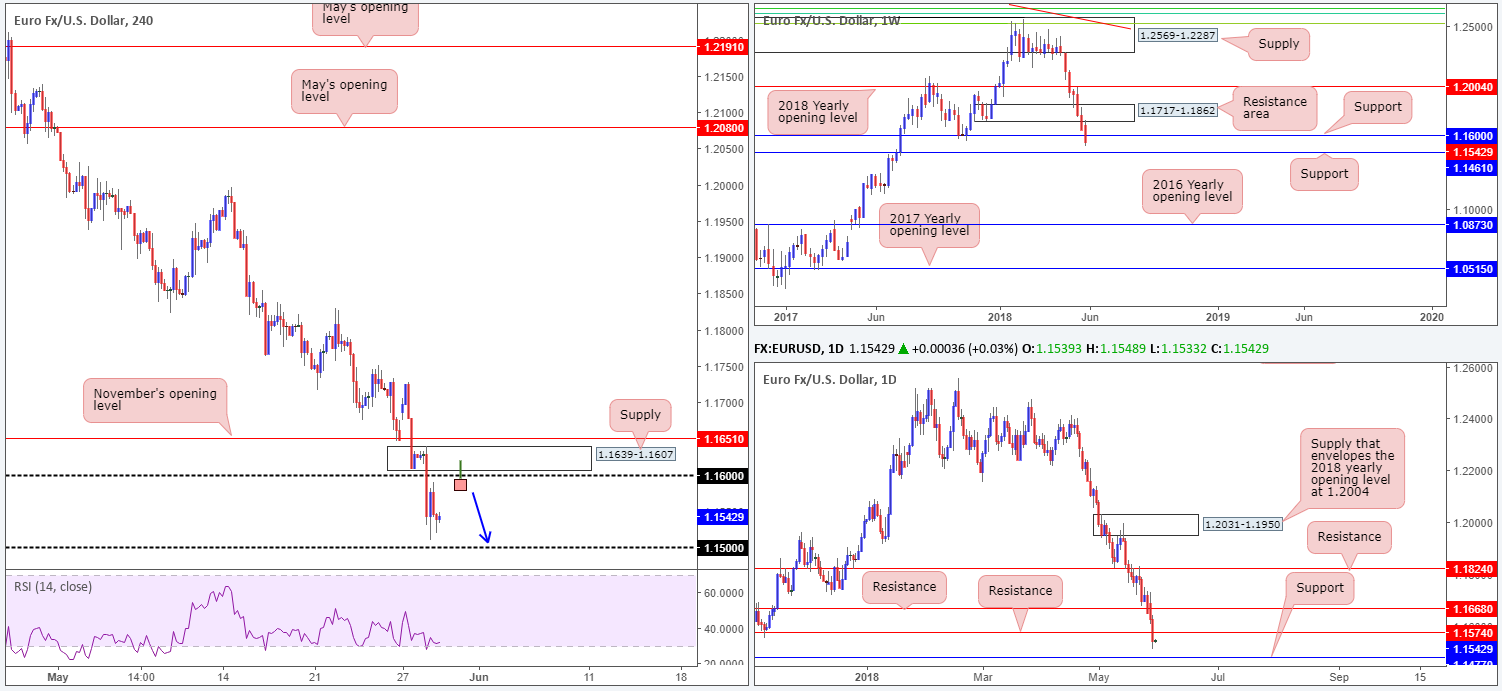

EUR/USD:

The single currency, as you can see, lost considerable ground against its US counterpart on Tuesday. Political unrest in Italy continued to plague the markets, triggering broad risk aversion. Italy’s PM designate Cottarelli left a meeting with President Mattarella without reaching an outcome on forming a government, but reports suggested he will try again on Wednesday.

Longer term, weekly price recently breached major support fixed at 1.1600. Further downside from this point has the weekly support at 1.1461 to target. Lower down on the curve, daily movement erased support at 1.1574 (now acting resistance) and has potentially cleared the rubble for price to approach support plotted at 1.1477. Tuesday’s intraday action on the H4 timeframe witnessed a break of 1.1600 in dramatic fashion, offering the 1.15 handle as the next viable support.

Areas of consideration:

What really jumps out at us this morning is the H4 supply seen positioned above 1.16 at 1.1639-1.1607. It screams ‘fakeout zone’! There are likely a truckload of sellers waiting for price to pullback and retest 1.16 as resistance to join the current downtrend, with the likely position for stop-loss orders being a few pips above. Don’t be one of those traders!

An ideal sell signal here would be for H4 price to print a bearish pin-bar formation that pierces through 1.16 (see H4 chart) and drives reasonably deep into the said supply (ripping through stop-loss orders above the round number). Entering short on the close of the candle is considered high probability, with stops best placed above the noted H4 supply and the first take-profit target set at 1.15, followed then by daily support mentioned above at 1.1477.

Today’s data points: German retail sales m/m; German prelim CPI m/m; Italian 10-y bond auction; US ADP non-farm employment change; US prelim GDP q/q.

GBP/USD:

Broad market risk aversion weighed heavily on an already vulnerable British pound on Tuesday, falling to lows of 1.3204 amid early European trade.

H4 price, as is evident from the chart, found support around 1.3222, which is bolstered by a H4 AB=CD (red arrows) completion point seen around the 1.3237ish mark. Over on the bigger picture, nevertheless, support is limited. In recent movement, weekly flow breached demand coming in at 1.3301-1.3420, likely triggering a round of stop-loss orders in the process. The next support target on this scale can be found at 1.3047. In conjunction with weekly action, daily price is seen trading firmly below support at 1.3314 (now acting resistance), and shows little in terms of supportive structure until reaching 1.3063: a daily support that’s sited just north of the aforementioned weekly support (not seen on the screen).

Areas of consideration:

While the H4 AB=CD completion point is currently holding firm, overhead selling pressure from the higher timeframes certainly puts a damper on things! In fact, we feel it is going to be a challenge for the bulls to overcome 1.33, given daily resistance being positioned at 1.3314.

Despite the clear bearish sentiment, though, selling this market, from a technical standpoint, is, as far as we can see, only viable on a H4 close below 1.32 as there’s ample room seen for the bears to stretch their legs from here.

Today’s data points: US ADP non-farm employment change; US prelim GDP q/q.

AUD/USD:

Kicking off with a look at the weekly timeframe this morning shows us the buyers are clearly struggling to maintain any sort of bullish presence at the moment above weekly demand at 0.7371-0.7442. Should this area eventually give way, the next port of call on this scale can be seen at 0.7282: the 2016 yearly opening level. Drilling down to the daily timeframe, price clearly remains compressing within a descending channel formation (0.8135/0.7758) right now. Areas also worthy of note are the daily demand base at 0.7371-0.7429 and daily resistance area plotted at 0.7626-0.7665. It may also be worth penciling in that price found resistance around the 0.7590 mark, mirroring previous pullbacks (see red arrows).

Across on the H4 timeframe, the candles are currently seen testing the 0.75 handle as support, as well as its 1:1 127.2% H4 Fib ext. completion point. A close beneath this number would likely encourage further selling down to H4 demand penciled in at 0.7448-0.7467.

Areas of consideration:

In the event that you’re long off 0.75, 0.7541: the 38.2% H4 Fib resistance value taken from the 1:1 move (legs A-D) at 0.7541 can be used as a breakeven trigger, and the 61.8% H4 retracement value of legs A-D at 0.7566 for the final/partial take-profit target.

Today’s data points: AU. Building approvals m/m; US ADP non-farm employment change; US prelim GDP q/q.

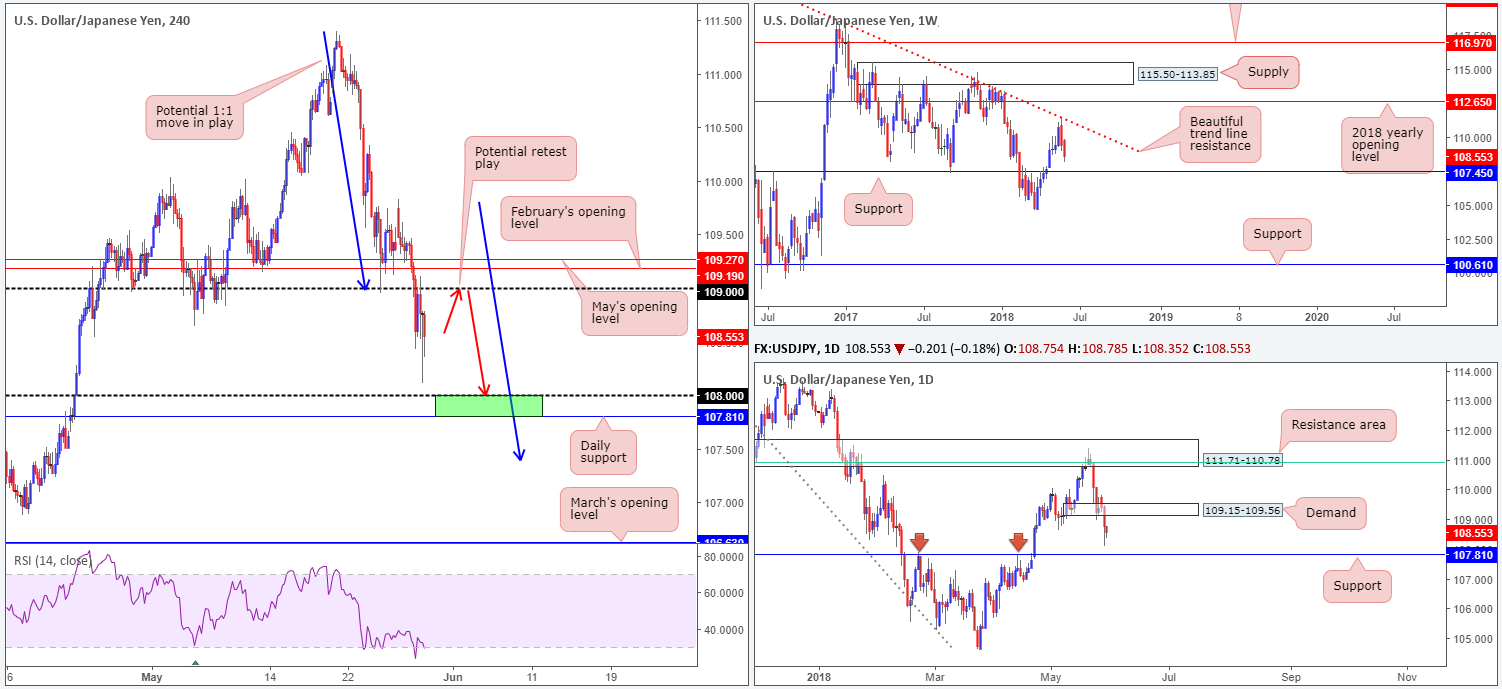

USD/JPY:

In recent sessions, we’ve seen a clear run to safety amid headlines out of Italy. The 109 handle on the H4 timeframe was taken out during early European hours and retested as resistance going into US trade.

Technically speaking, this market has plenty of room to probe lower. The H4 scale shows limited support until we reach the 108 handle, while weekly price is currently targeting support at 107.45 along with daily flow seen eyeing support at 107.81. Also notable from a technical perspective is the potential (steep) 1:1 move lower (see blue arrows) on the H4 scale that terminates around the 107.40 neighborhood.

Areas of consideration:

Further selling is certainly a strong possibility at the moment, so do keep eyes on the 109 handle for a possible retest play, targeting 108 (as per the red arrows).

The green area marked on the H4 timeframe between daily support at 107.81 and the 108 round number is a zone we expect the buyers to attempt to make an appearance. Do bear in mind, though, that weekly price could still pull prices beyond this area to weekly support mentioned above at 107.45. As such, waiting for H4 price to print a full or near-full-bodied H4 bull candle out of this area may be worth waiting for before pulling the trigger.

Today’s data points: US ADP non-farm employment change; US prelim GDP q/q.

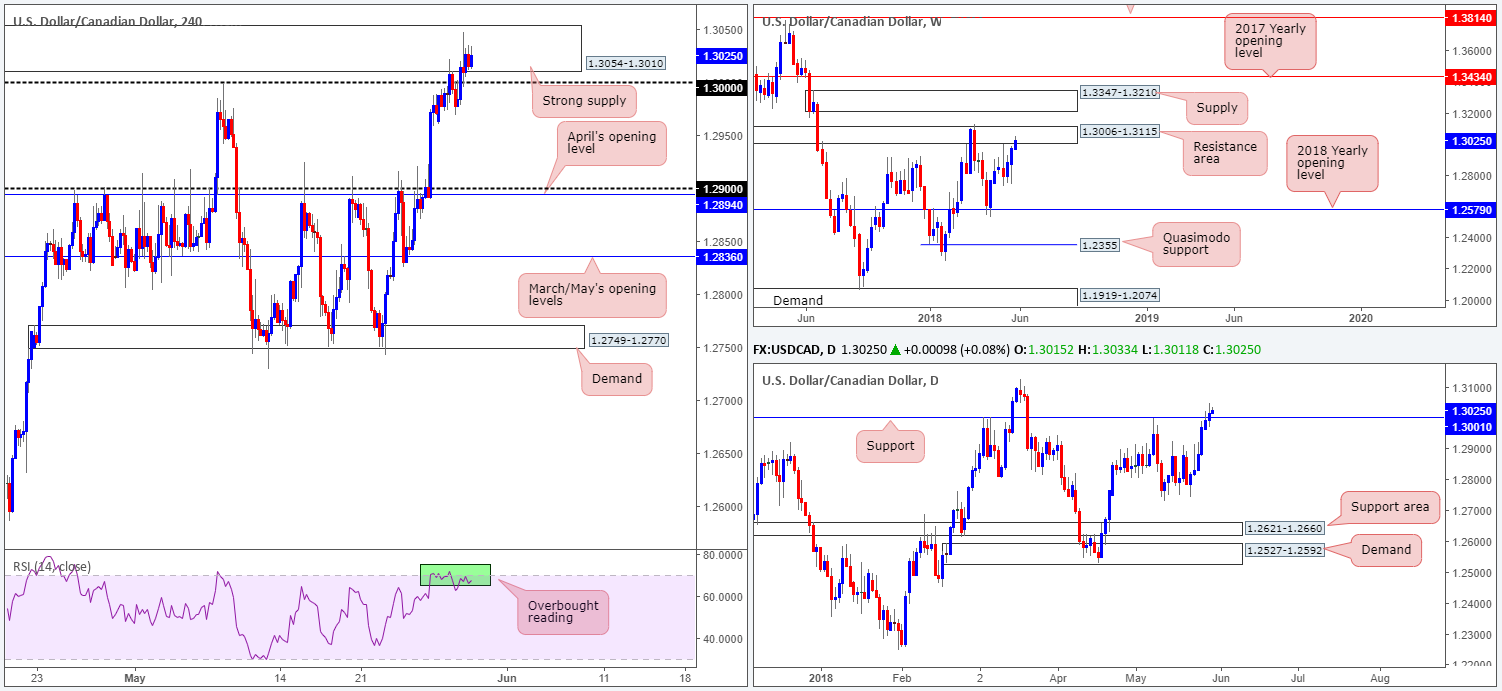

USD/CAD:

The USD continued to grind higher against its Canadian counterpart on Tuesday, breaking through the key level 1.30 on the H4 scale and dominantly testing nearby H4 supply at 1.3054-1.3010. We have labelled this area as a strong base since it is seen glued to the underside of a weekly resistance area at 1.3006-1.3115, along with a clear H4 RSI overbought reading present. There is one caveat to this H4 zone, however, and that is daily movement. As you can see from the daily timeframe, yesterday’s action forced its way above resistance at 1.3001 and is now eyeing 1.3124: March 19 highs.

Areas of consideration:

From our perspective, sellers still have the upper hand here in terms of market structure and a pullback is likely. If the current H4 supply is engulfed, though, our bias will likely change, since it’s possible that we’ll be seeing a test of the upper edge of the weekly resistance area mentioned above at 1.3006-1.3115, followed closely by March 19 highs at 1.3124. Should the unit witness a H4 close back beneath 1.30, on the other hand, shorts are high probability down to at least 1.29 (waiting for a retest of 1.30 as resistance is preferable, though).

Traders may also want to pencil in potential volatility for today’s BoC interest rate decision. The central bank is seen holding rates at 1.25% for the third straight meeting, according to 26 of 29 analysts surveyed by Reuters.

Today’s data points: US ADP non-farm employment change; US prelim GDP q/q; CAD current account and RMPI m/m; BoC rate statement and overnight rate decision.

USD/CHF:

Despite risk-off sentiment reviving demand for the safe-haven CHF, H4 price remains sandwiched between a H4 resistance area at 0.9969-0.9956 and the 0.99 handle/May’s opening level at 0.9907. Bolstering the top edge of this range is a daily resistance level coming in at 0.9949, while the next support target on the daily scale does not come into view until 0.9841.

Weekly price continues to emphasize a bearish climate. After a strong push lower from the 2016 yearly opening level at 1.0029, there’s really not very much support seen in view until the unit reaches the 2018 yearly opening level marked at 0.9744.

Areas of consideration:

A H4 close below 0.99, we feel, is a strong enough cue to begin considering shorts in this market, with an initial downside target set at the daily support mentioned above at 0.9841, followed closely by H4 support at 0.9835.

Ultimately, though, we would advise waiting and seeing if H4 price can retest the underside of 0.99 and hold as resistance before pulling the trigger. Fakeouts around psychological numbers are incredibly common! Waiting for the retest to play out helps avoid this.

Today’s data points: US ADP non-farm employment change; US prelim GDP q/q; CHF KOF economic barometer; Credit Suisse economic expectations; SNB Chairman Jordan speaks.

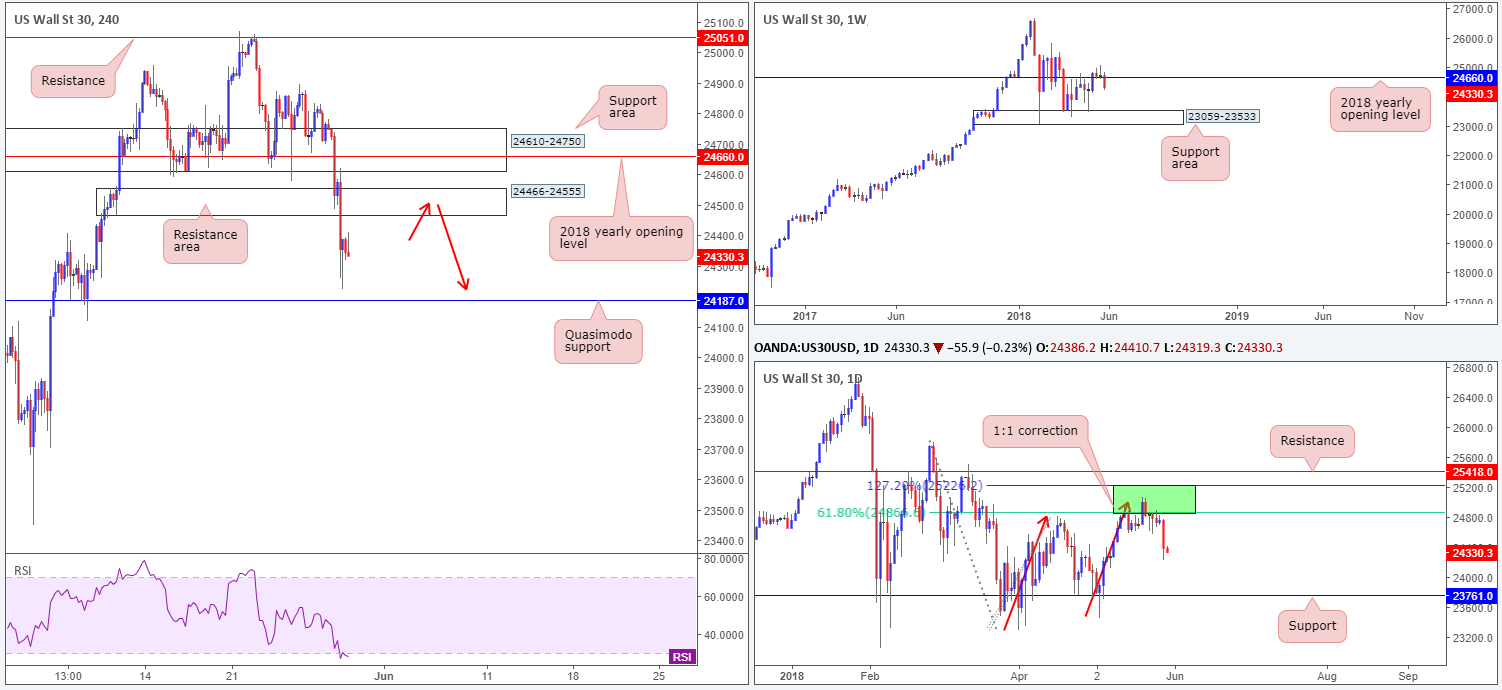

Dow Jones Industrial Average:

US equities depreciated across the board on Tuesday amid Italy’s political turmoil. This sent weekly price tumbling back beneath the 2018 yearly opening level seen at 24660, potentially paving the way for a test of a weekly support area seen at 23059-23533.

Daily action, as you can see, respected 25229/24866 beautifully: an area marked in green comprised of a 61.8% daily Fib resistance value and a 127.2% 1:1 correction (see red arrows) daily Fib ext. point. Continued selling from here has support at 23761 on the radar.

As for H4 movement, we can see that yesterday’s bout of selling broke through a H4 demand area at 24466-24555 (now acting resistance) in strong fashion, bottoming just north of a H4 Quasimodo support level coming in at 24187.

Areas of consideration:

As mentioned in Tuesday’s briefing, shorting this market is a possibility on the break of the noted H4 demand base. As we already have this, traders should now be on the lookout for a retest of 24466-24555 as resistance that holds firm which, in our view, would be enough evidence to press the sell button, targeting the H4 Quasimodo support mentioned above at 24187, followed by daily support at 23761.

Today’s data points: US ADP non-farm employment change; US prelim GDP q/q.

XAU/USD (Gold)

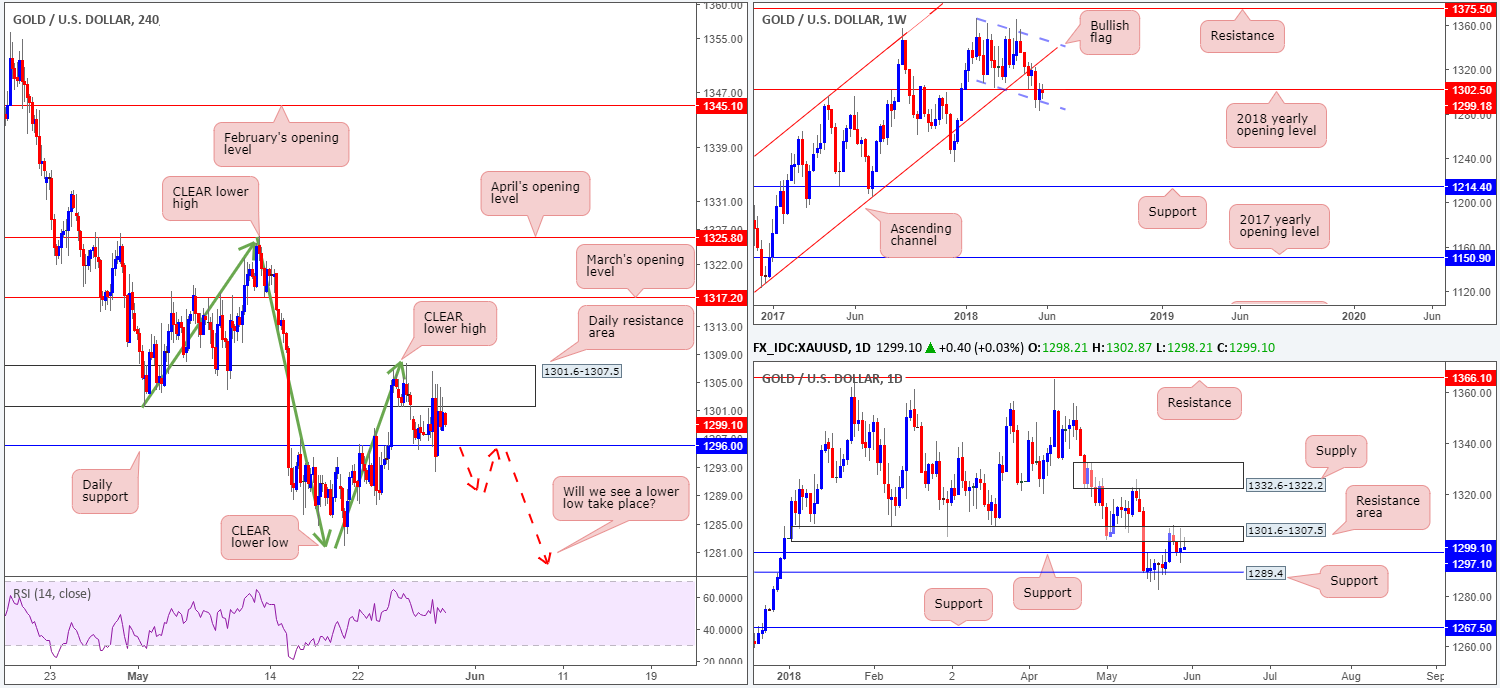

As can be seen on the H4 timeframe, the yellow metal, once again, had a difficult time finding direction on Tuesday. Although tightly encased between a daily resistance area at 1301.6-1307.5 and a daily support drawn from 1296.0, further downside is still possible in this market we believe. Our confidence comes from knowing that the 2018 yearly opening level sited on the weekly timeframe at 1302.5 resides within the daily resistance area.

Areas of consideration:

Overall, we’re eventually expecting a lower low to form on the H4 scale (a break of the swing low 1285.8). So, waiting and seeing if H4 price can close below the noted daily support and chalk up a retest as resistance (see red arrows) is recommended, as this would be considered a high-probability shorting opportunity.

The use of the site is agreement that the site is for informational and educational purposes only and does not constitute advice in any form in the furtherance of any trade or trading decisions.

The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets does not warranty, guarantee or make any representations, or assume any liability with regard to financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www.icmarkets.com.au, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness. All such information is subject to change at any time without notice. IC Markets assumes no responsibility for the content of any linked site. The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site.

IC Markets is not liable for any harm caused by the transmission, through accessing the services or information on this site, of a computer virus, or other computer code or programming device that might be used to access, delete, damage, disable, disrupt or otherwise impede in any manner, the operation of the site or of any user’s software, hardware, data or property.