Release time: 13.30pm GMT/8.30am EST.

Retail sales data is one of the timeliest economic indicators of consumer spending. According to Henry Hazlitt, author of Economics in One Lesson, US consumers account for approximately 70% of the national economy. Spending is an important role of consumers.

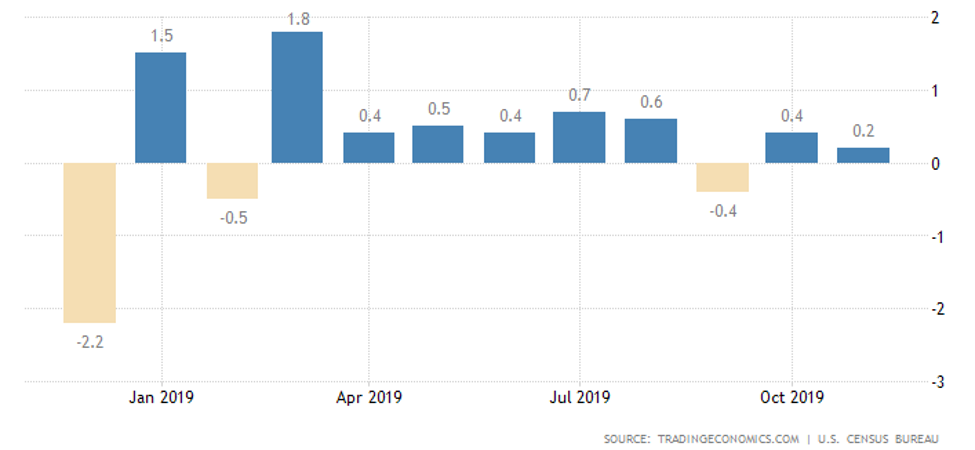

Headline US retail sales are expected to rise by 0.4% month-over-month, picking up from the 0.2% reading in November. The core metric, change in the total value of sales at the retail level, excluding automobiles, is also set to rise by 0.4% vs. the prior 0.1%.

US retail sales fell for the first time in seven months in September, raising fears of a slowdown in the American manufacturing sector. The decline was the first and biggest decline in retail trade since February, mostly due to lower sales in motor vehicles, building materials, hobbies and online purchases.

According to the Census Bureau, advance estimates of U.S. retail and food services sales for November 2019, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $528.0 billion, an increase of 0.2 percent from the previous month, and 3.3 percent above November 2018.

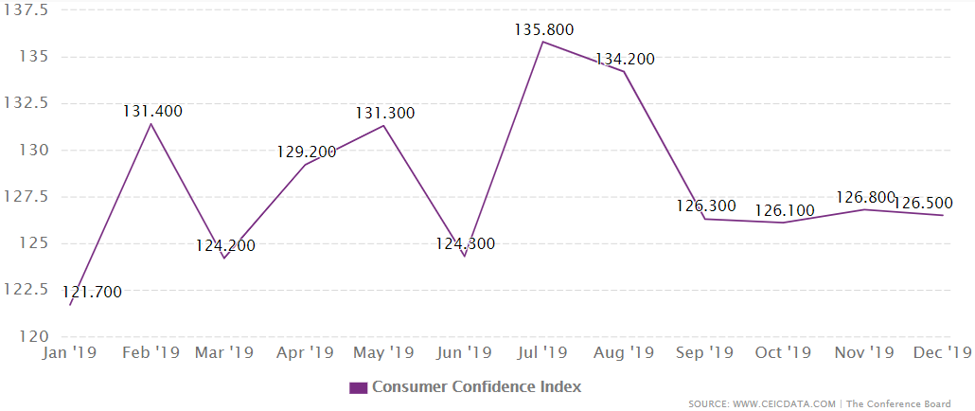

The Conference Board (CB) Consumer Confidence Index decreased marginally in December, following a slight increase in November. The Index now stands at 126.5 (1985=100), down from 126.8 (an upward revision) in November, according to The Conference Board. The CB also noted:

While consumers’ assessment of current conditions improved, their expectations declined, driven primarily by a softening in their short-term outlook regarding jobs and financial prospects. While the economy hasn’t shown signs of further weakening, there is little to suggest that growth, and in particular consumer spending, will gain momentum in early 2020.

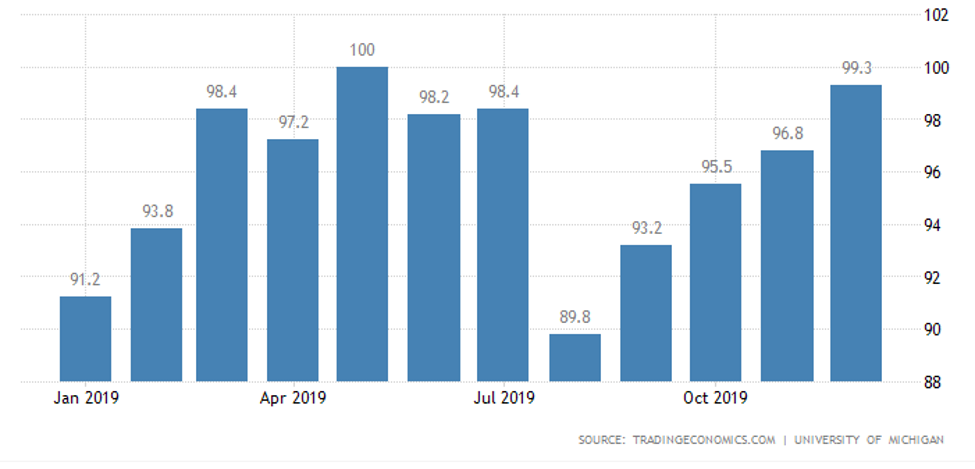

The University of Michigan’s consumer sentiment for the US was revised slightly higher to 99.3 in December of 2019 from a preliminary of 99.2 and 96.8 in November. It is the highest reading since May and the second best in 2019.

According to Surveys of Consumers chief economist, Richard Curtin, the Sentiment Index remained largely unchanged in late December at the same very favorable level recorded at mid-month. Most of the December gain was among upper income households, with those in the top third of the income distribution gaining 7.5% from last month and those in the bottom two-thirds posting a gain of just 0.8%. The recent shift favoring higher income households is in the opposite direction when compared with all-time peaks in the late 1990’s. The impeachment hearing had a barely noticeable impact on economic expectations, as it was mentioned by just 2% of all consumers in the December survey.

Retail sales and US labour:

Total nonfarm payroll employment rose by 266,000 in November, engulfing expectations. Job growth averaged 180,000 per month thus far in 2019, compared with an average monthly gain of 223,000 in 2018, according to the US Bureau of Labour Statistics.

2019 was the slowest average growth since 2011. Despite this, the reasonably strong end to the year should help keep consumer confidence supported in the early stages of 2020.

Both the unemployment rate, at 3.50% – levels not seen since May 1969 – and the number of unemployed persons, at 5.8 million, changed little in November, the US Bureau of Labour Statistics reported. The labour force participation rate was also little changed at 63.2% in November, and average hourly earnings for all employees on private nonfarm payrolls rose by 7 cents to $28.29. Over the last 12 months, average hourly earnings increased by 3.1%.

Technically, upbeat data could guide EUR/USD lower from a point of H1 confluence, comprised of a 127.2% AB=CD bearish formation around 1.1165, channel resistance, taken from the high 1.1146, a 61.8% Fibonacci retracement ratio at 1.1159 and a 50.0% retracement value at 1.1161.

Lower-than-expected data, on the other hand, may trigger a fakeout through the said channel resistance, running buy stops, and potentially making a play for the 1.12 handle.

IC Market’s analyst view: Given supporting data, the foundation for a rise in consumer spending is there. USD bidding likely to send EUR/USD lower.

Notes:

https://smallbusiness.chron.com/importance-consumer-spending-3882.html

https://tradingeconomics.com/united-states/retail-sales

https://www.census.gov/retail/marts/www/marts_current.pdf

https://www.ceicdata.com/en/united-states/consumer-confidence-index/consumer-confidence-index