Key risk events today:

Limited.

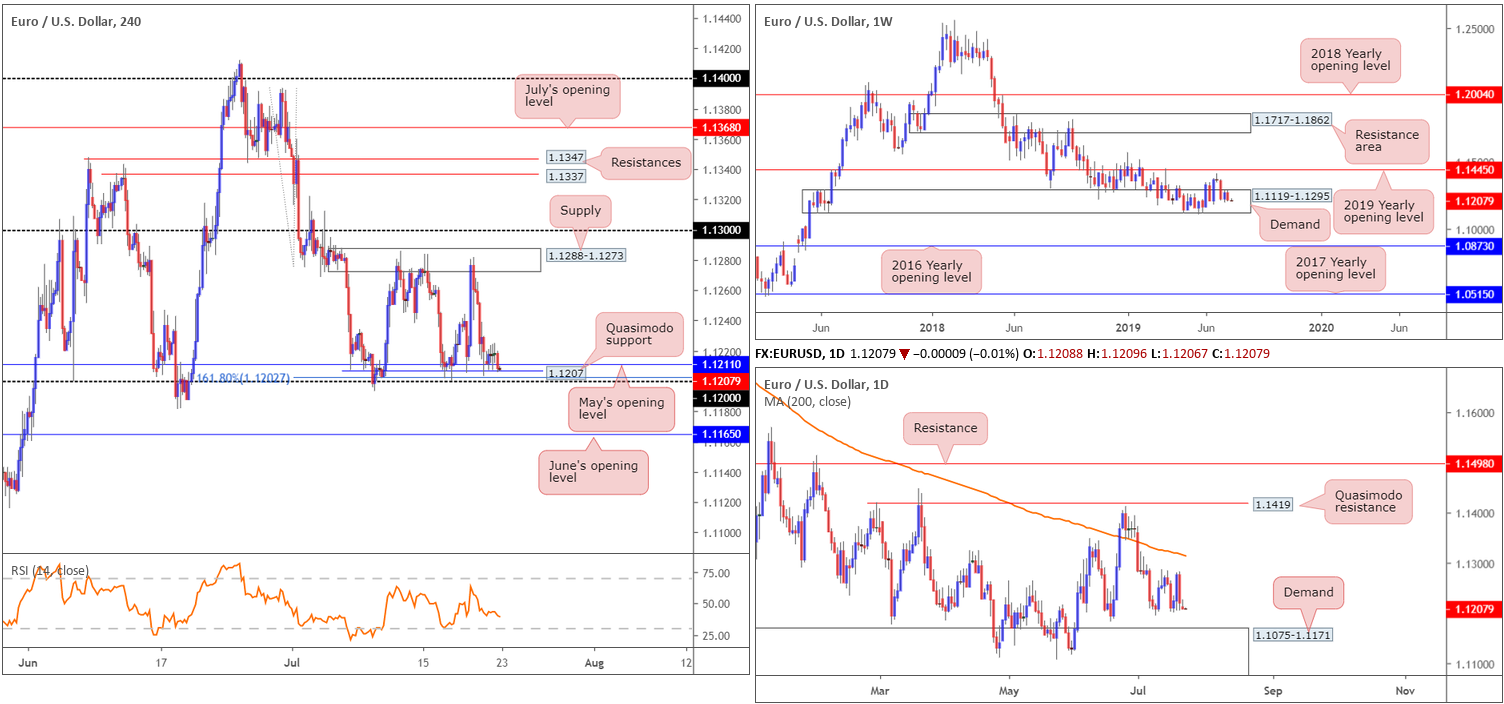

EUR/USD:

Europe’s shared currency and the US dollar traded flat Monday, as traders look ahead to the ECB on Thursday.

As we head into Asia Pac hours, the EUR/USD’s H4 candles remain toying with the lower edge of its 70-point range between 1.12 and supply at 1.1288-1.1273. As underlined in earlier reports, 1.12 brings with it a 161.8% Fibonacci ext. point at 1.1202, a Quasimodo support at 1.1207 and May’s opening level at 1.1211. It is also worth recalling the 1.13 handle positions itself just north of the current supply zone, and June’s opening level at 1.1165 – merges closely with the top edge of daily demand at 1.1075-1.1171 – is seen south of the said range.

Higher-timeframe structure remains unchanged as we head into Tuesday’s sessions. Here’s what Monday’s briefing had to report:

From the weekly timeframe:

Since November 2018, the weekly candles have been warring for position between long-standing demand at 1.1119-1.1295 and the 2019 yearly opening level (resistance) at 1.1445. Areas outside of the said barriers to be aware of fall in around the 2016 yearly opening level at 1.0873 (support) and a resistance area drawn from 1.1717-1.1862.

As of the week’s close, price action concluded deeper within the limits of the said demand area, further weakening the chances of a bullish move and erasing all of the prior week’s gains.

Daily timeframe:

According to the daily timeframe, the EUR/USD represents a ranging phase. Despite this, the research team’s structural analysis has resistance mounted just north of the range at the 200-day SMA (orange – 1.1318) and support seen lower on the curve by way of demand located at 1.1075-1.1171. It might also interest traders to note the demand is glued to the underside of the current weekly demand area.

Areas of consideration:

Considering Monday’s lacklustre performance, the research team’s outlook remains unaffected:

Having seen the H4 candles form a range between supply at 1.1288-1.1273 and 1.12/1.1211, traders may find the lower edge of the said range of use today (see above). Trading within this area is certainly possible due to its size, large enough to secure reasonable risk/reward. Protective stop-loss orders are generally located a couple of points beyond the range extreme, targeting the opposing range limit.

In the event the upper edge of the current range is taken out this week, selling opportunities exist between the 200-day SMA on the daily timeframe at 1.1318 and the 1.13 handle on the H4. Not only will sellers likely be active here, liquidity in the form of triggered buy stops above the current range edge will be a strong selling point for traders with deeper pockets. The same can be said for June’s opening level (given its connection to daily structure), only for buying opportunities.

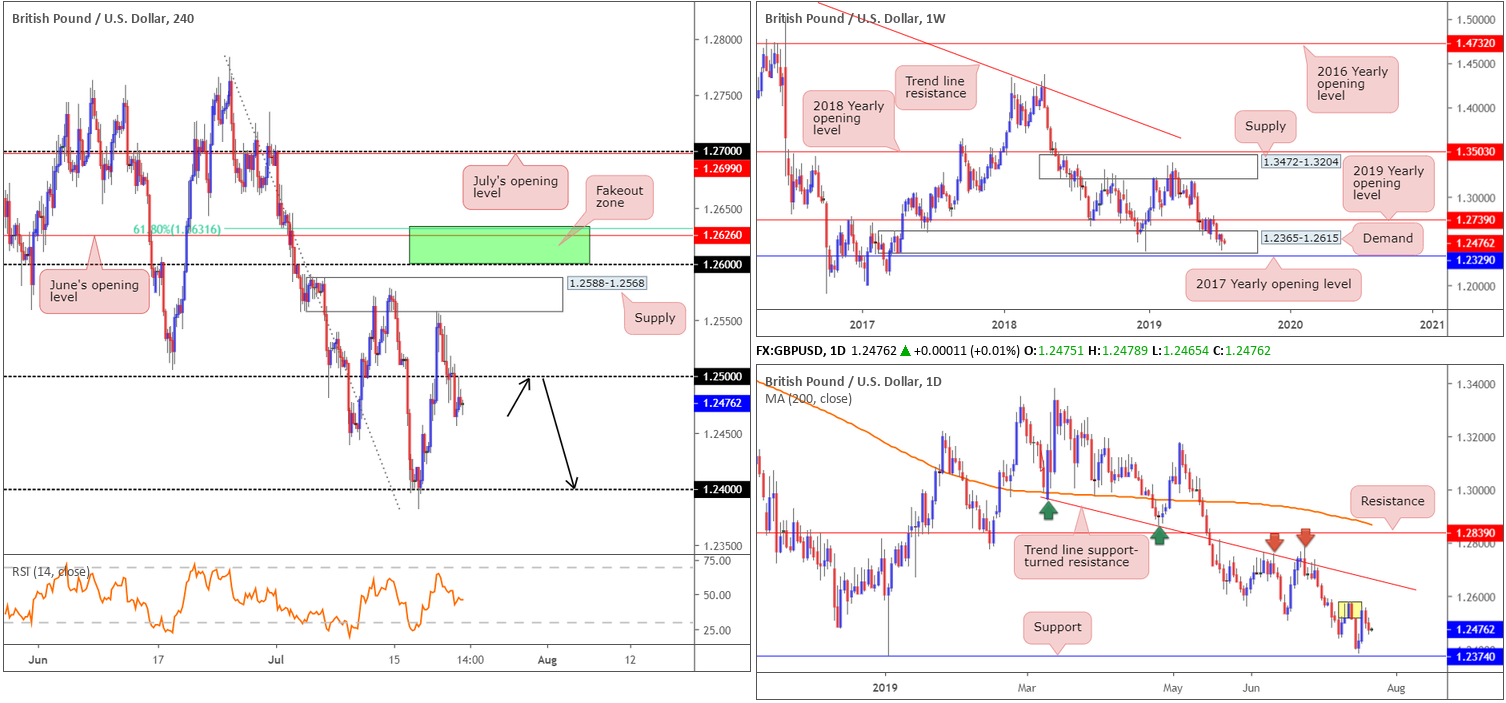

GBP/USD:

The British pound came under mild pressure Monday, ahead of frontrunner Boris Johnson’s almost inevitable conservative leadership election victory. Johnson’s victory is expected to drive sterling lower as it would raise the odds of a no-deal Brexit.

H4 movement reclaimed 1.25 to the downside in early London, and clocked lows of 1.2455 as the market transitioned into US hours. A near-retest at 1.25 followed, consequently attracting offers going into the close. In terms of support below 1.25, 1.24 appears the next logical base on the H4 timeframe.

As underscored in Monday’s briefing, the research team feel with buyers’ sell stops likely filled beneath 1.25, and breakout sell orders triggered, further downside could be on the cards.

With respect to higher-timeframe structure, Monday’s report remains valid:

Weekly timeframe:

Since May 20, buyers and sellers have been battling for position between long-standing demand at 1.2365-1.2615 and the 2019 yearly opening level at 1.2739 (resistance). Despite recent movement drilling further into the said demand, price action chalked up a second consecutive buying tail last week, perhaps signifying buyer intent. Areas outside of the current range to be conscious of this week falls in around the 2017 yearly opening level at 1.2329 (support) and supply coming in at 1.3472-1.3204.

Daily timeframe:

Leaving support at 1.2374 unchallenged Wednesday, increased demand for the British pound lifted the market higher Thursday, swelling amid a combination of a waning greenback and increased optimism UK parliament would be able to act to prevent a no-deal Brexit. Things turned mildly sour Friday, however, after shaking hands with supply marked in yellow at 1.2578-1.2519.

Beyond the current supply, the path appears clear for an approach to trend line support-turned resistance taken from the low 1.2960.

Areas of consideration:

Outlook unchanged.

Should the unit retest the underside of 1.25 today in the form of a H4 bearish candlestick configuration, a sell to 1.24 is worth considering, followed by daily support at 1.2374.

Also worth keeping a tab on is the green H4 zone highlighted in Friday’s briefing. Between the 61.8 Fibonacci retracement at 1.2631, June’s opening level at 1.2626 and the round number 1.26, located above the H4 supply at 1.2588-1.2568, this area has ‘fakeout to me’ written all over it, with buy stops above the current supply providing liquidity to sell into. Entry anywhere within the green zone is valid, with protective stop-loss orders positioned a couple of points above 1.2631. Conservative traders may, however, opt to wait for additional candlestick confirmation to form before pulling the trigger. This helps identify seller intent and provides entry and risk levels to work with.

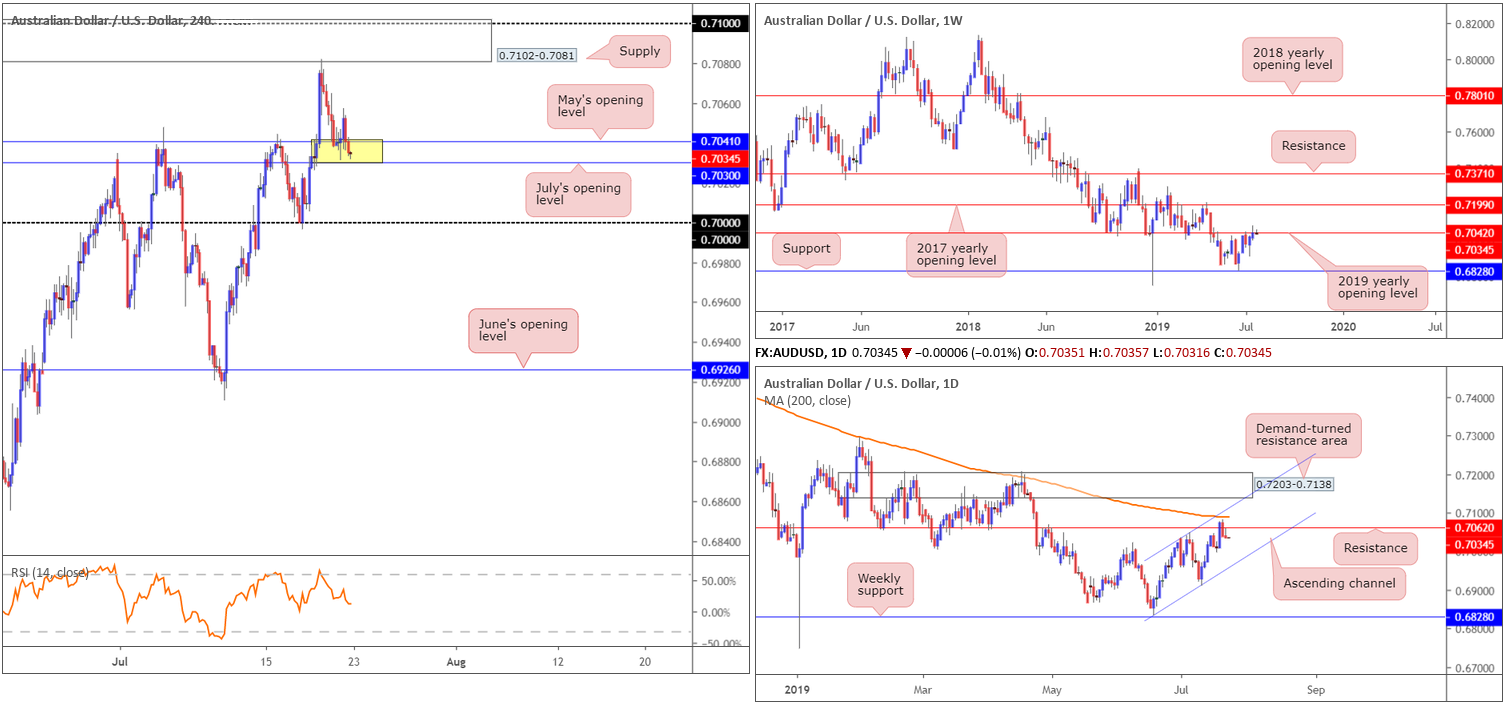

AUD/USD:

The Australian dollar eked out marginal losses vs. its US counterpart Monday, down 0.05%. Despite mild selling, a H4 support area formed by July’s opening level at 0.7030 and May’s opening level at 0.7041 (yellow) held ground. Overhead, supply resides at 0.7102-0.7081, which happens to envelope the 0.71 handle, whereas beneath the current support area we have the key figure 0.70 in sight.

Higher-timeframe flow remains unchanged, with weekly activity meandering a few points south of the 2019 yearly opening level (resistance) at 0.7042. Having seen this base serve well as support on several occasions in the past and hold price action lower early July, there’s a good chance sellers may make an appearance here. The next downside support target can be seen at 0.6828. In the event we push north this week, however, traders may wish to note the 2017 yearly opening level at 0.7199.

From the daily timeframe, Monday’s action concluded by way of a bearish selling wick, almost retesting the underside of resistance at 0.7062. Above here, traders’ crosshairs are likely fixed on the 200-day SMA currently circulating around 0.7091 and channel resistance taken from the high 0.7034. Continued selling from current price, nonetheless, could lead to a move being seen towards channel support extended from the low 0.6831 this week.

Areas of consideration:

Having seen weekly resistance at 0.7042 remain in the fold, and daily price close back beneath resistance at 0.7062 as well as produce a bearish candlestick configuration, entering long from the current H4 support area is chancy.

Taken from Monday’s briefing:

Outlook unchanged.

Assuming the technical studies presented above are correct and we press lower, short-term selling opportunities exist between 0.7030 and 0.70. However, do ensure risk/reward is factored into any sells here, targeting at least a 1:2 ratio. The key figure 0.70 is a support level by and of itself given the interest it attracts.

Should 0.70 fail to offer support, we then have room to potentially push as far south as June’s opening level at 0.6926.

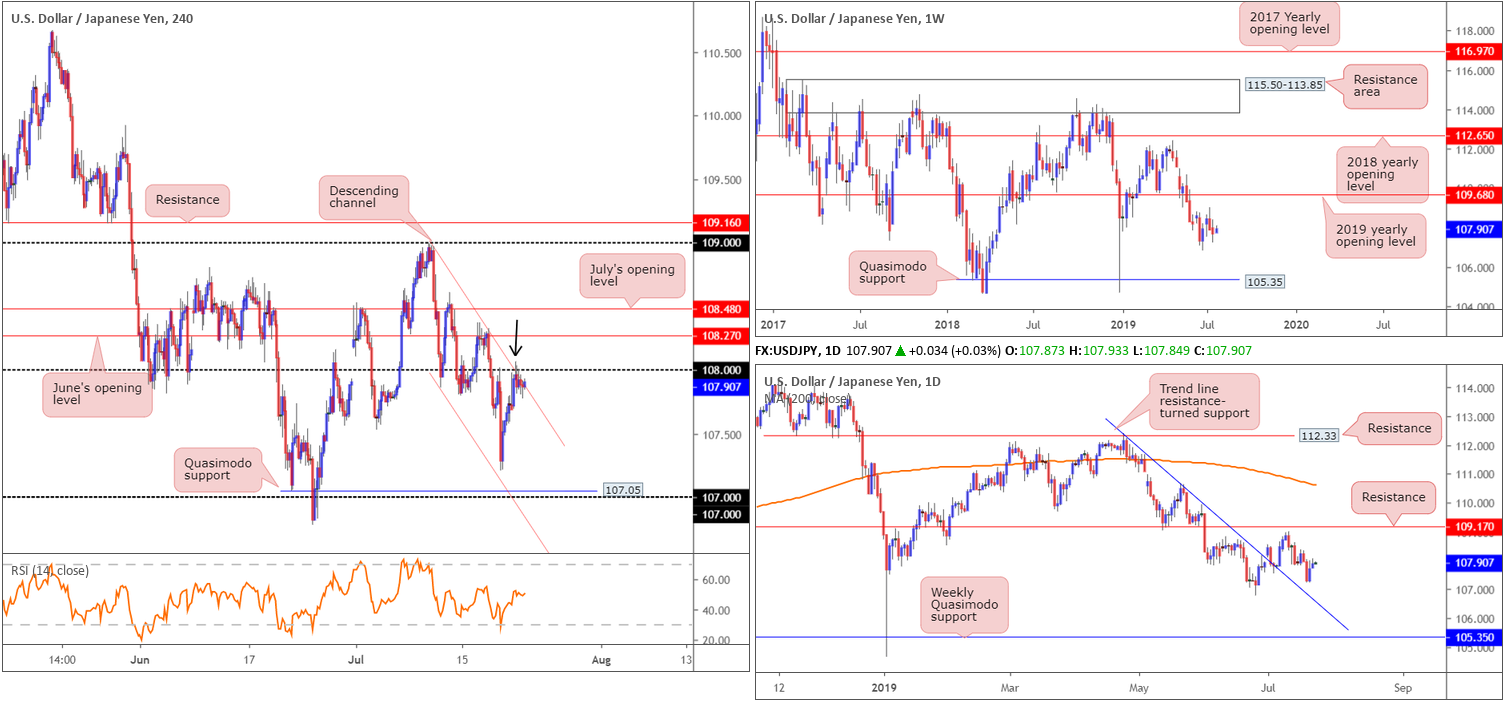

USD/JPY:

Following Japanese PM Abe’s upper house election victory, this fuelled risk appetite amid Asia Monday, prompting mild buying, though was swiftly capped under 108.

As we head into Tuesday’s sessions, the H4 candles are shaking hands with channel resistance etched from the high 108.99, sited just south of 108. Should sellers make an appearance here, the 107.21 18th July low can be seen as the next support hurdle, closely shadowed by Quasimodo support located just north of 107 at 107.05. Above 108, on the other hand, June’s opening level at 108.27 is next in the firing range in terms of resistance.

Regarding the higher timeframes, yesterday’s limited movement keeps Monday’s analysis fresh:

Weekly timeframe:

Extending losses for a second consecutive week, the USD/JPY pair erased a little more than 20 points. According to technical structure on the weekly timeframe, long-term resistance is set by way of the 2019 yearly opening level at 109.68 and support is not expected to emerge until reaching a Quasimodo formation at 105.35.

Daily timeframe:

Since topping just south of resistance at 109.17, the pair slowly grinds southbound. The next port of call, in regards to support, is trend line resistance-turned support (extended from the high 112.40), aligning with the 106.78 June 25 low, followed by the weekly Quasimodo support mentioned above at 105.35.

Areas of consideration:

For traders who read Monday’s briefing you may recall the piece highlighted the possibility sellers may enter the mix from the point 108 and the H4 channel resistance (see above) merge. Forming a H4 shooting star Japanese candlestick signal off 108 in early trade Monday was, according to the technical studies presented here, enough to consider a short, targeting the 107.21 18th July low as the initial take-profit target. Well done to any of our readers who managed the sell here.

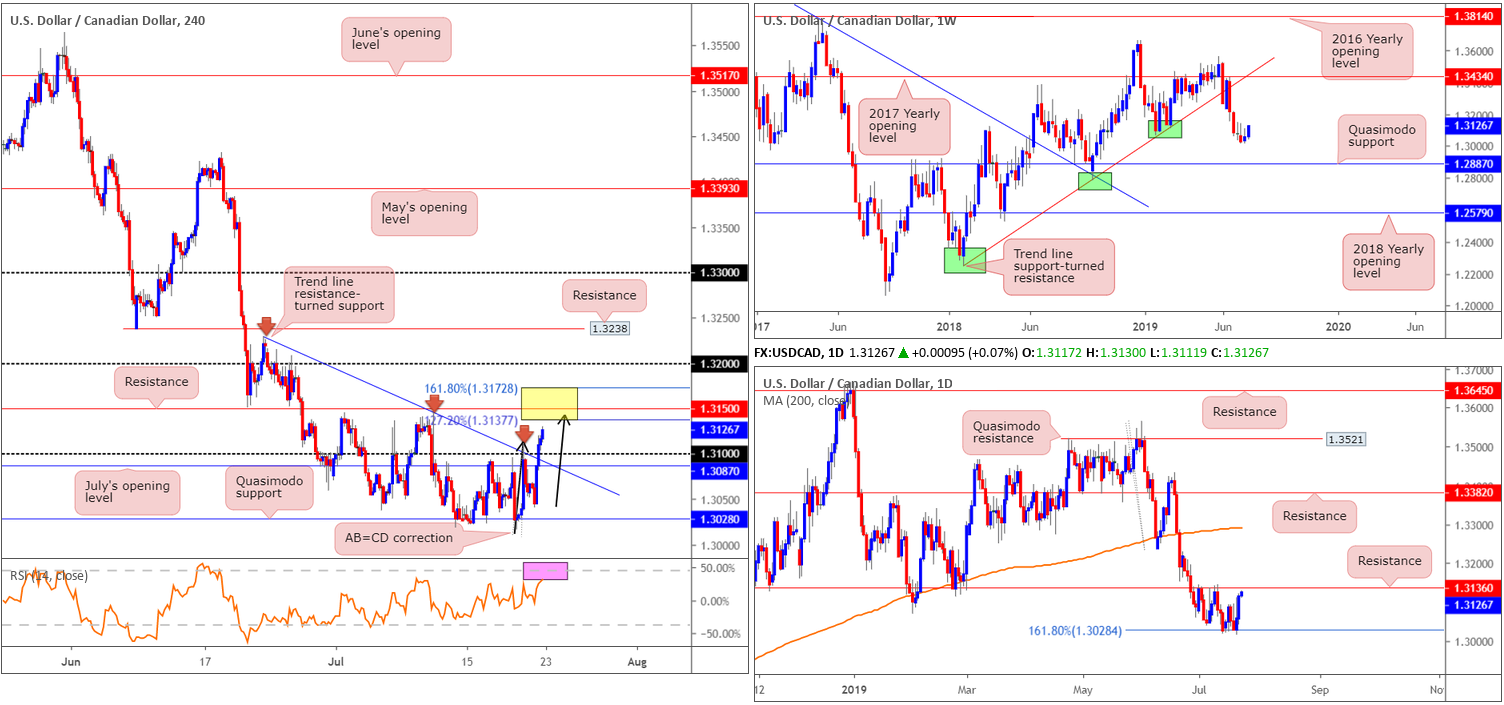

USD/CAD:

Weaker-than-expected Canadian wholesale trade data, along with a modestly stronger US dollar across the board, lifted the USD/CAD pair to higher ground Monday, up 0.45%.

As is evident from the H4 timeframe, recent trade overthrew July’s opening level at 1.3087, a trend line resistance (taken from the high 1.3229) and the 1.31 handle, potentially setting the stage for a run to resistance at 1.3150. What’s interesting from a technical perspective is the approach to the said resistance forms by way of an AB=CD correction (black arrows), which has a termination point (yellow) between the 161.8% and 127.2% Fibonacci ext. points at 1.3172/1.3137. Indicator-based traders may also wish to acknowledge the RSI is seen nearing overbought territory.

In addition to H4 confluence supporting a sell in this market, as well as the immediate trend facing a southerly bearing since topping in late May at 1.3565, daily resistance is also present around the 1.3136 neighbourhood (aligns closely with the lower edge of the H4 AB=CD reversal zone at 1.3172/1.3137.

Areas of consideration:

Keeping it simple this morning, the research team favours a reaction from the H4 AB=CD reversal zone at 1.3172/1.3137, given its local and higher-timeframe confluence. Entry at the H4 resistance plotted within at 1.3150 is likely eyed, with a protective stop-loss order plotted a couple of points above 1.3172. Considering the first take-profit target, the 1.31 handle is likely to be problematic for sellers, as is July’s opening level at 1.3087 and the intersecting trend line resistance-turned support (1.3229).

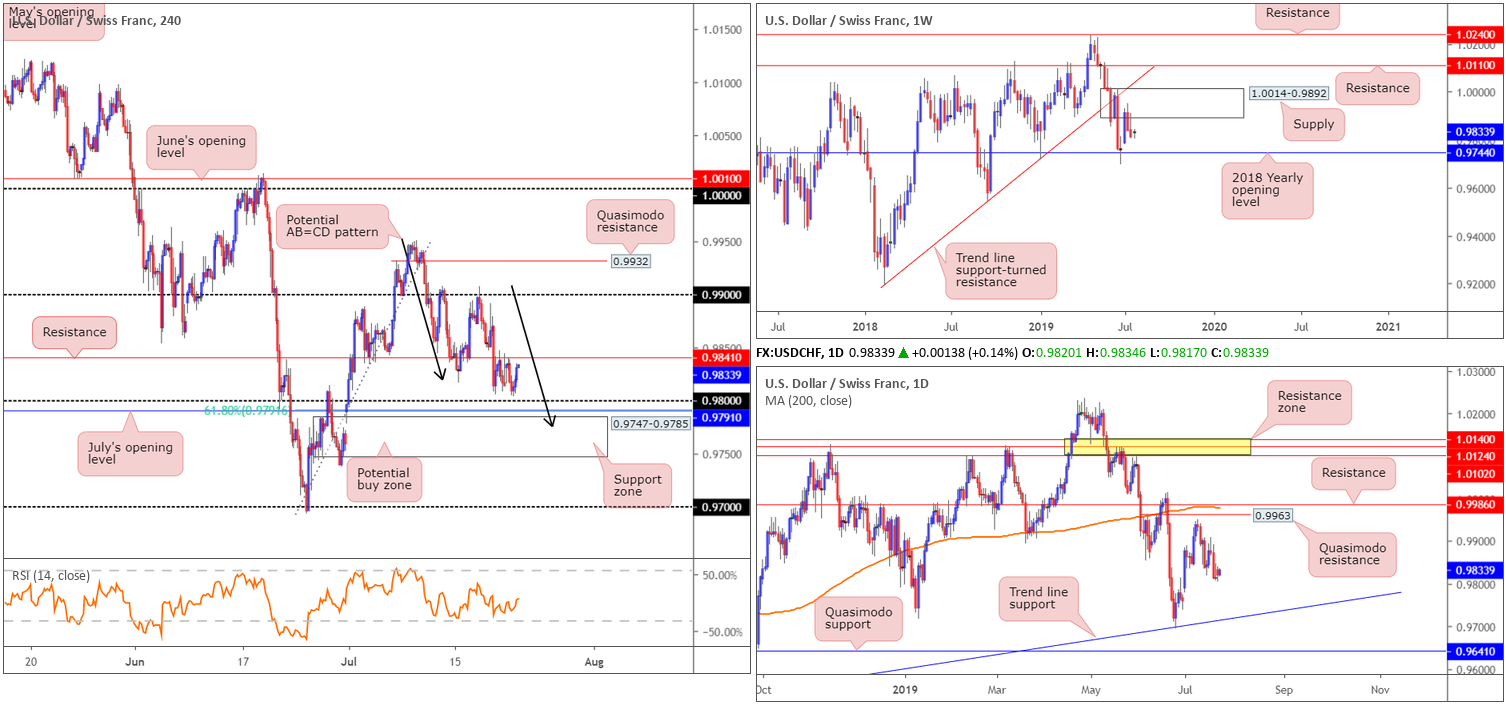

USD/CHF:

Technically, USD/CHF prices remain unchanged as we head into Tuesday. The pair failed to capitalise on broad-based USD bidding underpinned by tempered expectations for an aggressive Fed rate cut in July.

H4 resistance at 0.9841 remains in motion, as does the possibility of a move towards the 0.98 handle for potential longs. Closely trailed by July’s opening level at 0.9791, a 61.8% Fibonacci retracement value, a support zone at 0.9747-0.9785 and a possible AB=CD correction point (black arrows) at 0.9777, the surrounding area offers strong local confluence for a move higher.

On a wider perspective, however, Monday’s briefing had the following to report:

From the weekly timeframe, the US dollar surrendered another portion of recent gains off the 2018 yearly opening level at 0.9744 last week, following a rotation lower out of supply at 1.0014-0.9892 by way of a strong bearish selling wick. While this could lead to a revisit of 0.9744, traders may also find use in noting the trend line support-turned resistance (extended from the low 0.9187), closely followed by resistance at 1.0110, should we turn higher this week.

Daily timeframe:

Closer examination of price action on the daily timeframe shows the unit pressing south after failing to test Quasimodo resistance at 0.9963 early July, followed closely by resistance at 0.9986 and the 200-day SMA (orange). To the downside, limited support is in view until reaching trend line support taken from the low 0.9542.

Areas of consideration:

Outlook unchanged.

Longer-term flow remains unchanged and suggests selling could still be in store from weekly supply at 1.0014-0.9892.

Medium-term flow, also unchanged in terms of tradable zones, has eyes on the 0.98 region (given its surrounding confluence highlighted above) for potential longs. Stop-loss placement, therefore, is best positioned beneath 0.9747-0.9785.

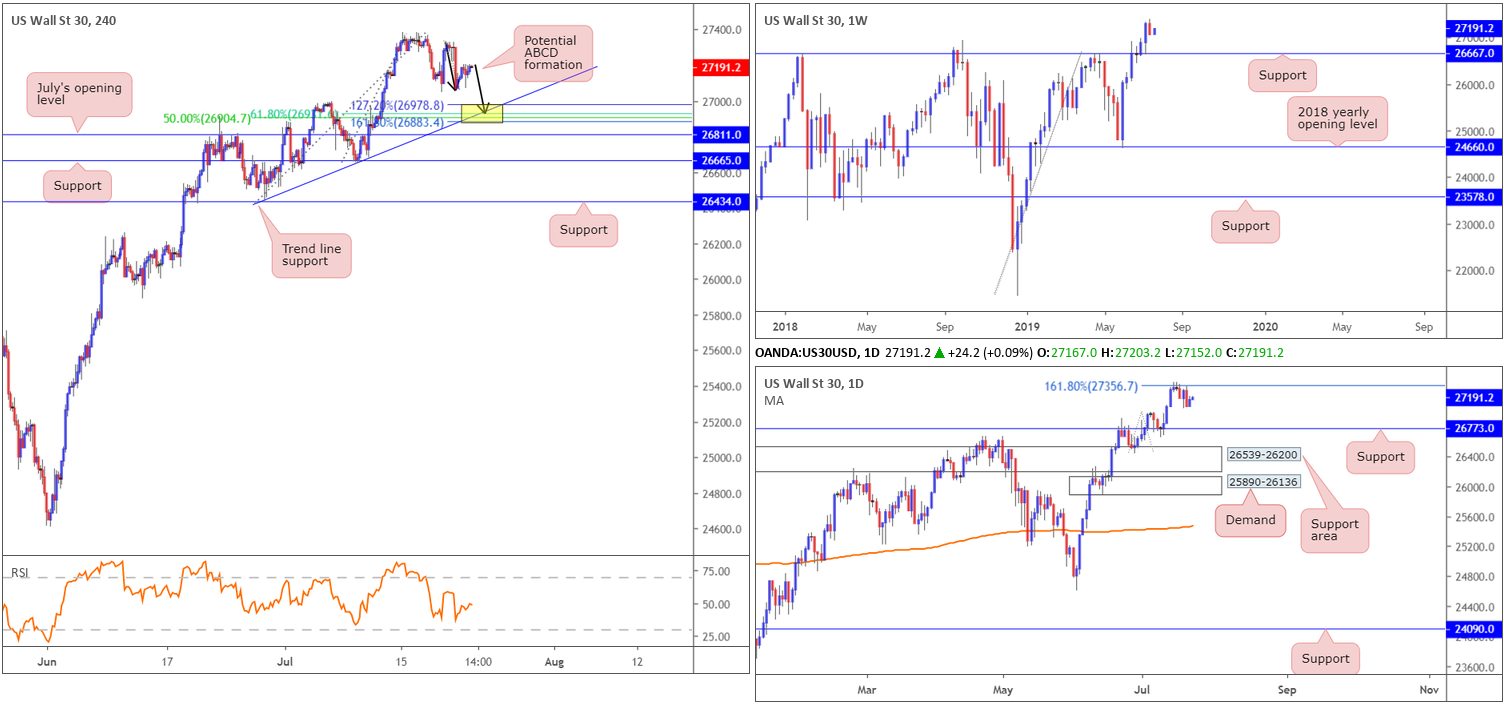

Dow Jones Industrial Average:

US equity indexes concluded marginally higher Monday, underpinned by tempered expectations for an aggressive Fed rate cut at the end of the month. The Dow Jones Industrial Average added 0.07%; the S&P 500 advanced 0.28% and the tech-heavy Nasdaq 100 rallied 0.90%.

From a technical viewpoint, nonetheless, the research team are still exploring the possibility of a dip in price to H4 trend line support (extended from the low 26436). Note this ascending support brings with it a 61.8% Fibonacci retracement at 26930, a 50.0% support value at 26904 and a potential ABCD (black arrows) correction terminating between the 161.8% and 127.2% Fibonacci ext. points (yellow) at 26883/26978.

However, the technical landscape on the bigger picture remains at conflict, with Monday’s report voicing the following:

From the weekly timeframe:

Aside from a brief spell of indecision four weeks back, and last week’s retracement losing more than 230 points, the Dow Jones Industrial Average has emphasised a strong bullish tone since shaking hands with the 2018 yearly opening level at 24660 in early June.

Taking out resistance at 26667 and shortly after retesting it as support has so far provided a floor to this market. With limited resistance in sight until connecting with 28070 (not visible on the screen), a 127.2% Fibonacci ext. point taken from the low 21425, additional buying could still be seen over the coming weeks.

Daily timeframe:

Contrary to weekly price, daily action is defending the underside of 27356: the 161.8% Fibonacci ext. point. Continued selling from here has a downside support target set at 26773, located just north of weekly support at 26667.

Areas of consideration:

Should the index shake hands with H4 trend line support and merging Fibonacci levels (see above), a long could be considered, with a stop-loss order fixed beneath 26883. The first take-profit target from this point will depend on the approach, but overall the research team have 27356 on the daily timeframe in sight.

XAU/USD (GOLD):

Having seen the US dollar explore higher ground Monday, bullion struggled to generate much upside momentum.

In recent hours, the market observed a run to lows of 1415.8, drawing the H4 candles to within touching distance of two merging trend line supports (1385.5/1437.7 – green). Beyond here, H4 structure offers July’s opening level at 1395.0.

Weekly structure, as highlighted in Monday’s briefing, crossed paths with a 1:1 correction (black arrows) around 1453.2 shaped from the 1160.3 August 13 low last week. As is evident from the chart, selling has so far been reasonably strong from 1453.2, though will it be enough to reclaim 1417.8 – the next downside support on the weekly timeframe?

The technical landscape on the daily timeframe observed a break of the top edge of a supply zone at 1448.9-1419.9 late last week. While this move was likely enough to trip a portion of the stop-loss orders above here, it’s unlikely to have cleared the path north to supply at 1495.7-1480.3 just yet, given Friday’s run south erasing 1.49%. As for downside targets on this scale, the research team notes to be aware of the 1381.9 July 1 low, followed by support at 1356.8.

Areas of consideration:

Although weekly price is selling off from its 1:1 correction point at 1453.2, weekly support is also in motion at 1417.8. This weekly support – coupled with the nearby H4 trend line support mentioned above – is an area buyers may be looking to get involved. Conservative traders, threatened by recent selling, might opt to wait and see if a H4 bullish candlestick configuration develops before pulling the trigger. This helps recognise buyer intent and provides traders with entry and risk levels to work with.

The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets does not warranty, guarantee or make any representations, or assume any liability regarding financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www.icmarkets.com.au, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness. All such information is subject to change at any time without notice. IC Markets assumes no responsibility for the content of any linked site.

The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site. IC Markets is not liable for any harm caused by the transmission, through accessing the services or information on this site, of a computer virus, or other computer code or programming device that might be used to access, delete, damage, disable, disrupt or otherwise impede in any manner, the operation of the site or of any user’s software, hardware, data or property.