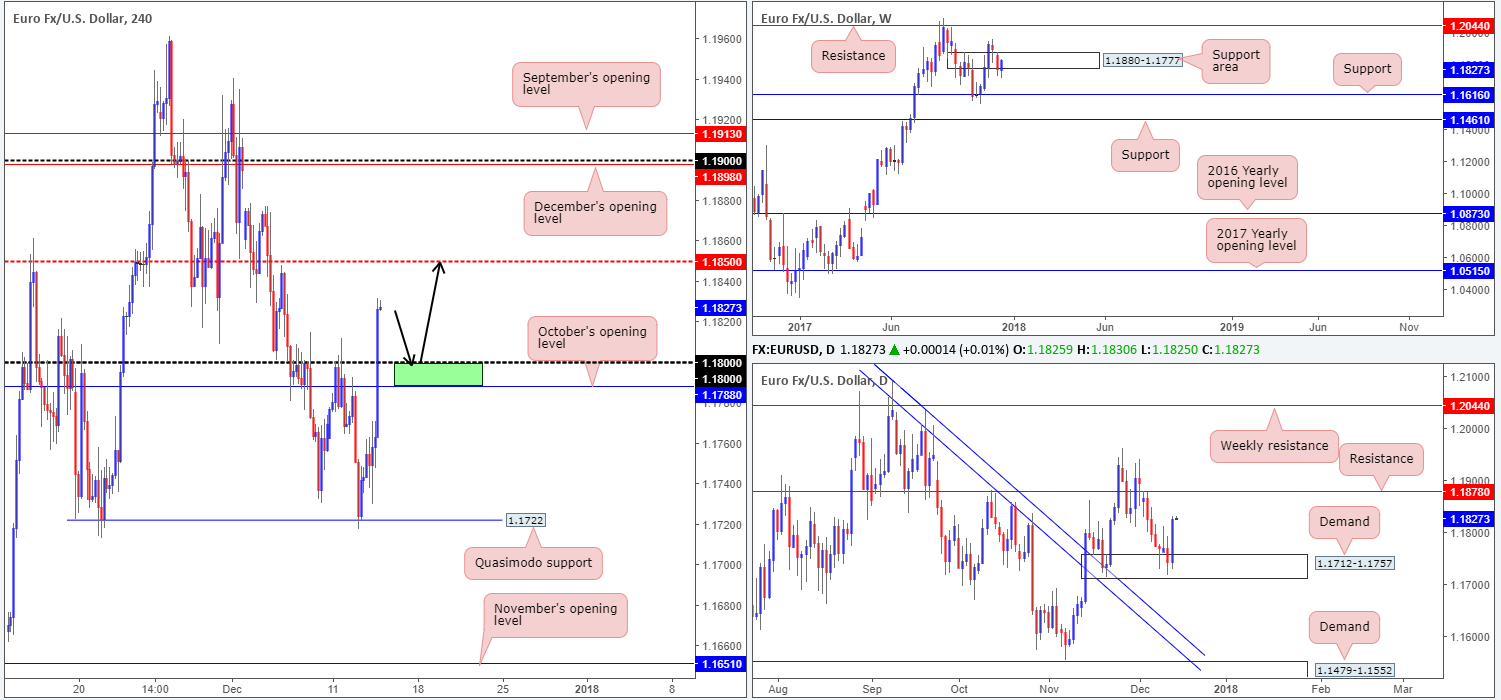

EUR/USD:

In recent sessions, the EUR/USD extended its bounce from the H4 Quasimodo support level at 1.1722, taking out October’s opening level seen on the H4 timeframe at 1.1788 and also the 1.18 handle. The Federal Reserve, as expected, increased its benchmark interest rate by 25bps to 1.50%. However, as far as we can see, the US dollar was sold on the fact that the rate hike was priced in. Furthermore, the fact that the Fed’s optimistic growth forecast for 2018 is based on the assumption that the government will fiscally stimulate the economy has not gone down well with investors.

The break above the 1.18 handle placed the H4 mid-level resistance at 1.1850 in sight. Yesterday’s push higher has also ‘confirmed’ buyer interest from the daily demand pegged at 1.1712-1.1757. Continued buying from this area will likely see the candles shake hands with daily resistance at 1.1878. Over on the weekly timeframe, the weekly support area at 1.1880-1.1777 is now back in the fight, despite dipping to lows of 1.1717.

Direction:

· Long: A retest of 1.18 could provide traders a platform to buy. As most are aware, though, psychological bands are prone to whipsaws. Therefore, a fakeout below 1.18 into October’s opening level mentioned above at 1.1788 is a strong possibility, so do be prepared for this! Should one manage to pin down a long from 1.1788/1.18, the first take-profit target could be set at 1.1850, followed closely by the daily resistance level at 1.1878.

· Short: All three timeframes point to further buying.

Data points to consider: French flash manufacturing PMI at 8am; German flash manufacturing PMI at 8.30am; Euro flash manufacturing PMI at 9am;Euro minimum bid rate at 12.45pm; ECB press conference at 1.30pm; US retail sales m/m and weekly unemployment claims at 1.30pm GMT.

Areas worthy of attention:

Supports: 1.1722; 1.18 handle; 1.1788; 1.1880-1.1777; 1.1712-1.1757.

Resistances: 1.1850; 1.1878.

GBP/USD:

In the early hours of Wednesday’s London session, UK employment figures came in less than expected, consequently forcing the British pound lower marginally lower. Shortly after, US core CPI data (measures the price change of goods and services, excluding food and energy) printed a less-than-stellar number, and therefore revived demand for the GBP and broke October’s opening level seen on the H4 timeframe at 1.3367. Following this, the pair received an additional boost after the FOMC statement. The US dollar suffered as a dovish tone emanated from Yellen’s final scheduled press conference, forcing the unit to crack through the 1.34 handle. Amid yesterday’s movement, the pound also managed to push back above daily resistance at 1.3371 (now acting support).

Direction:

· Long: As can be seen on the H4 timeframe, price is currently respecting the 1.34 band as the candle retests the number as support. This could encourage further buying up to the H4 mid-level resistance at 1.3450. However, a trade from here lacks confluence, as far as we can see, and is not a setup we would personally consider high probability.

· Short: The same goes for selling. Technically, there’s little suggesting a short in this market at present.

Data points to consider: UK retail sales m/m at 9.30am; MPC action at 12.00pm; US retail sales m/m and weekly unemployment claims at 1.30pm GMT.

Areas worthy of attention:

Supports: 1.34 handle; 1.3371.

Resistances: 1.3450; weekly channel resistance taken from the high 1.2673.

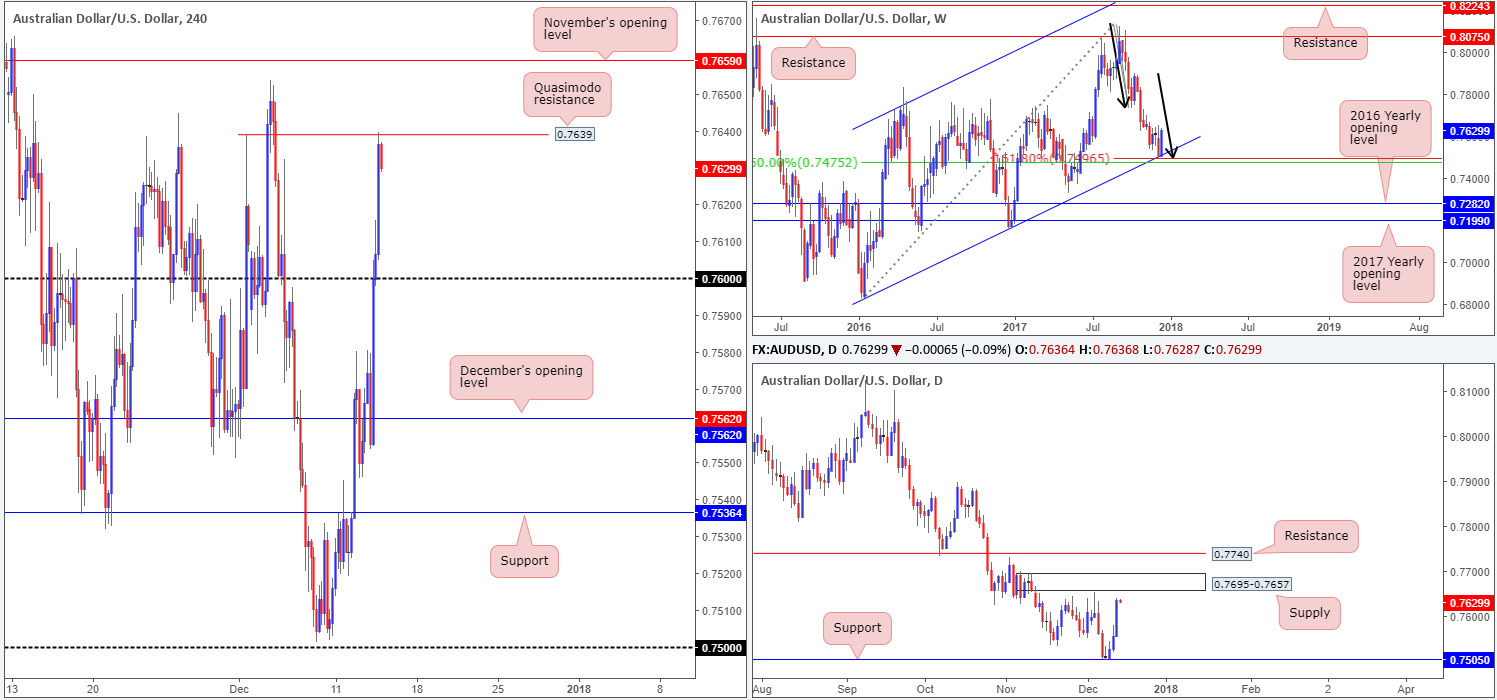

AUD/USD:

After a somewhat aggressive retest of December’s opening level seen on the H4 timeframe at 0.7562 amid early London hours, the pair drove skywards. The first round of buying appeared to be on the back of disappointing US inflation figures, which lifted the commodity currency up to the 0.76 handle. A few hours later, the dollar sustained further losses after the Fed cranked up its benchmark interest rates to 1.50%, elevating the Aussie to highs of 0.7639. Dollar losses, from our point of view, can be attributed to a dovish Yellen at the final scheduled press conference.

After clearing the 0.76 handle, the pair had a relatively clear run up to 0.7639: a H4 Quasimodo resistance level, which, as you can see, is currently doing a fine job in holding back the buyers. From a technical standpoint, sellers may struggle to secure this line since daily buyers may be targeting the daily supply zone printed above it at 0.7695-0.7657.

In addition to this, we must also remember that this week’s upside was likely aided by the daily support at 0.7505 and the weekly channel support extended from the low 0.6827(merges closely with a weekly 50.0% value at 0.7475 taken from the high 0.8125, and a nice-looking weekly AB=CD [see black arrows] 161.8% Fib ext. point situated at 0.7496). Both levels were highlighted as clean support areas to keep an eyeball on in previous reports.

Direction:

· Long: Ultimately, further buying is still likely on the cards, despite H4 price currently finding resistance beneath the aforementioned Quasimodo. A push above this line, however, would not be considered a buy signal since H4 price would then be within striking distance of the noted daily supply and also November’s opening level seen on the H4 timeframe at 0.7659.

· Short: A sell from November’s opening level could be an option today, given that it is sited around the lower edge of the aforesaid daily supply (placing stops beyond this base may also be an option). Be that as it may, shorting from this region will place you in direct conflict with potential weekly buying, so trade cautiously!

Data points to consider: US retail sales m/m and weekly unemployment claims at 1.30pm GMT.

Areas worthy of attention:

Supports: weekly channel support extended from the low 0.6827; weekly AB=CD 161.8% Fib ext. point situated at 0.7496; 07505; 0.76 handle.

Resistances: 0.7639; 0.7659; 0.7695-0.7657.

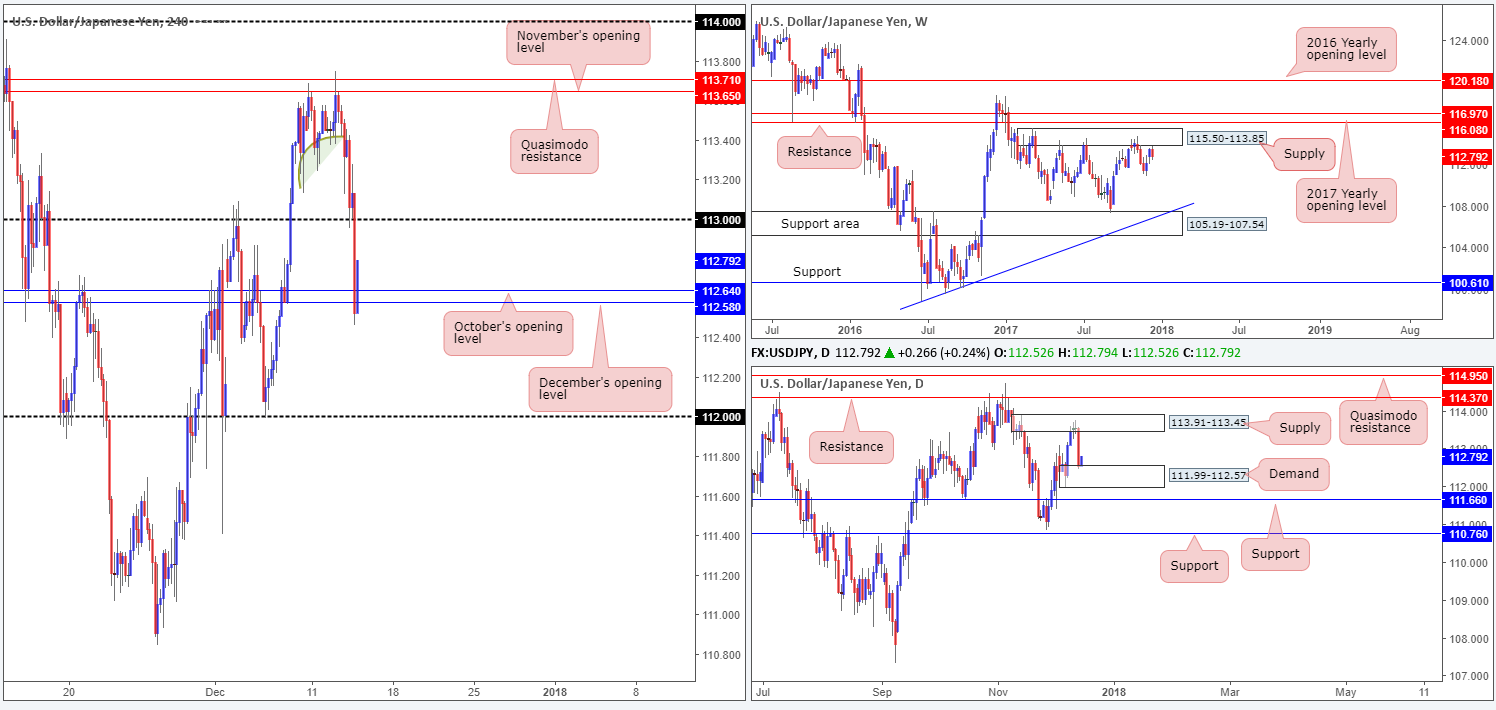

USD/JPY:

For those who read Wednesday’s report you may recall that we felt further selling was on the cards, as nearby H4 demand appeared to be consumed (check out the H4 buying tails marked with a green arc). Weak US inflation and a somewhat dovish Yellen helped force the US dollar aggressively lower on Wednesday. Well done to any of our readers who held shorts from 113.71/113.65 (H4 Quasimodo resistance/November’s opening line).

The 113 handle, despite an earnest attempt seen from the bulls, was eventually engulfed; allowing the unit to cross swords with December/October’s opening levels seen on the H4 timeframe at 112.58/112.64. Traders may have also noticed that these monthly levels are bolstered by a daily demand at 111.99-112.57.

Direction:

· Long: In view of the current H4 monthly open levels in play, alongside the aforesaid daily demand at 111.99-112.57, a retest of the 113 handle is likely to be seen today. Buying the unit is tricky; nevertheless, since we have to take into account that weekly price is seen trading from the underside of a weekly supply zone at 115.50-113.85.

· Short: Although weekly price is seen trading from the underside of a weekly supply zone, selling this market is just as awkward as buying given that we know a daily demand was recently brought into the fray!

Data points to consider: US retail sales m/m and weekly unemployment claims at 1.30pm GMT.

Areas worthy of attention:

Supports: 112.58; 112.64; 111.99-112.57.

Resistances: 113 handle; 113.91-113.45; 115.50-113.85.

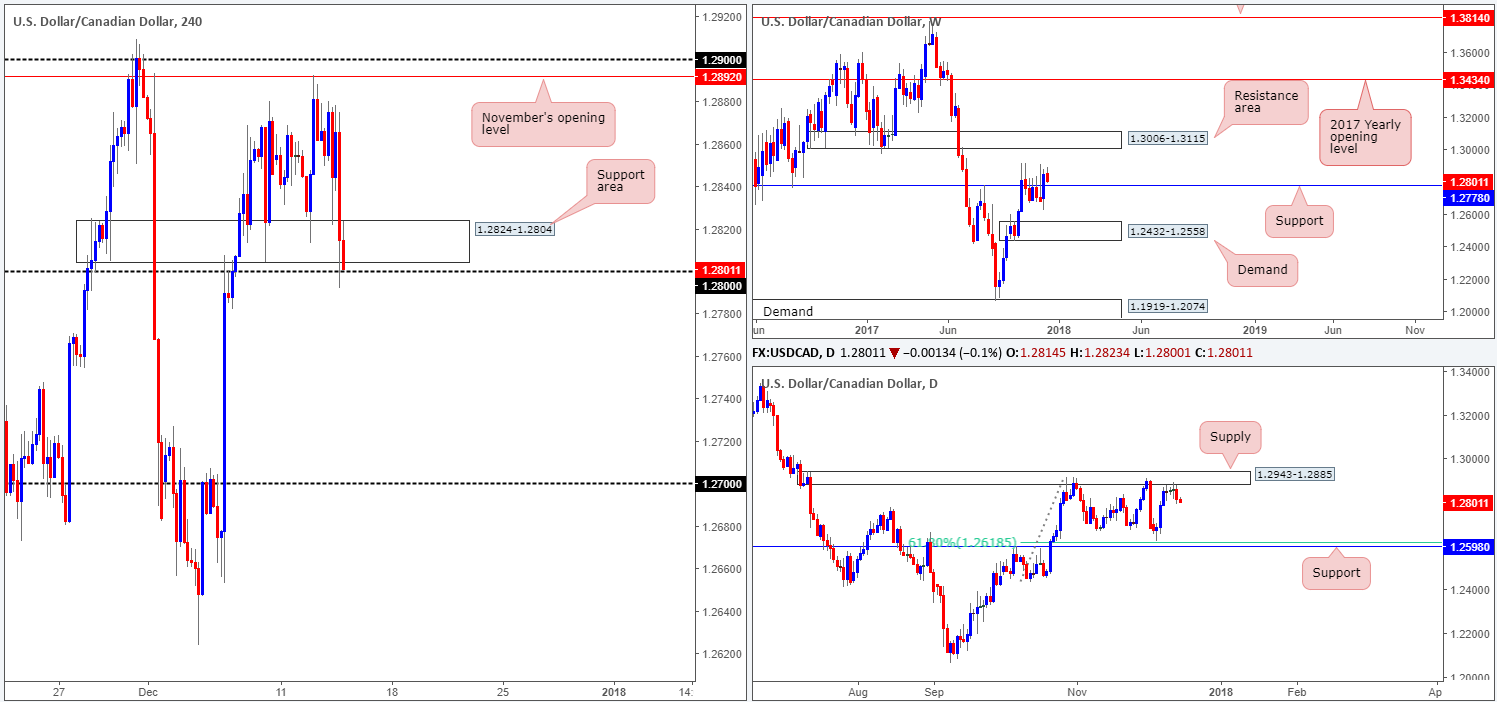

USD/CAD:

Following a somewhat subdued start to the day on Wednesday, the USD/CAD lost its footing in early US hours as US inflation came in slightly lower than expected. Additional selling was seen in the later hours of US trading after a dovish Yellen at the final scheduled press conference, forcing H4 price to surpass the H4 support area at 1.2824-1.2804 and test the 1.28 handle.

Continued selling in this market will likely see weekly price retest the weekly resistance-turned support at 1.2778. A closer look on the daily timeframe, nonetheless, shows that the sellers could potentially drag this market as far south as the daily support level registered at 1.2598 (merges with a 61.8% daily Fib support at 1.2618).

Direction:

· Long: Entering into a buy trade from the 1.28 region is a chancy move, in our humble opinion. We say this simply because the weekly support level at 1.2778 is lurking below, which could encourage a fakeout to take place. What’s more, let’s not forget where daily price is selling from!

· Short: A sell on the H4 timeframe below the 1.28 line is appealing on this scale, due to the room seen for price to move down to 1.27. In conjunction with this, one would also have daily sellers backing the move! However, given that there is a weekly support level at 1.2778 positioned just beneath 1.28, selling the break of 1.28 is just asking for trouble. Why not consider waiting for a H4 close below the weekly support to take shape. That way, the path south is likely going to be relatively free down to at least 1.27, and quite possibly beyond.

Data points to consider: US retail sales m/m and weekly unemployment claims at 1.30pm; BoC Gov. Poloz speaks at 5.25pm GMT.

Areas worthy of attention:

Supports: 1.2824-1.2804; 1.28 handle; 1.2778.

Resistances: 1.29 handle; 1.2892; 1.2943-1.2885.

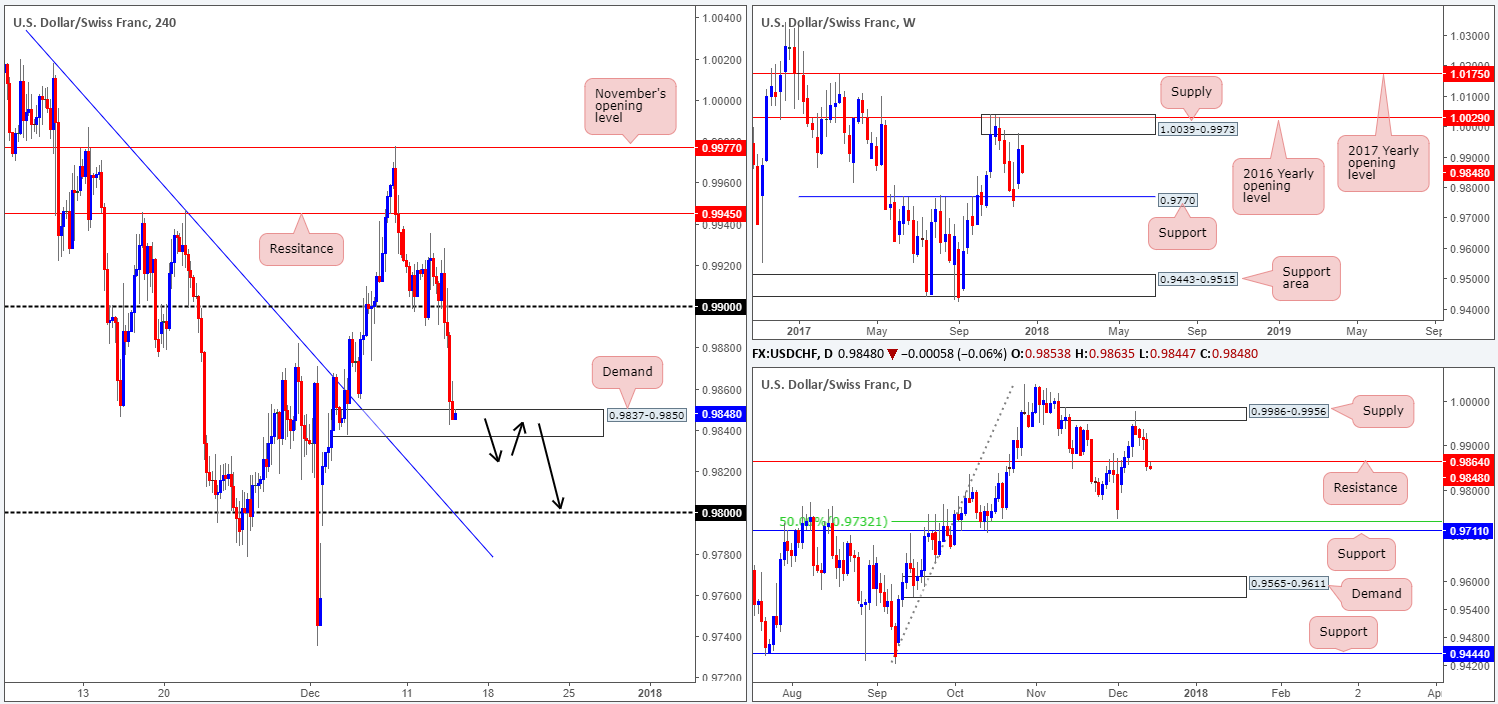

USD/CHF:

Wednesday’s weak US inflation number drove USD/CHF prices southbound in early US trading, consequently chewing through the 0.99 handle. The pair continued to paint a bearish tone and, on the back of a dovish Yellen, ended the day bumping heads with a H4 demand base located at 0.9837-0.9850. While current price appears to be showing signs of bullish intent from here, daily price recently crossed below a daily support level marked at 0.9864. In addition to this, traders might also want to note that weekly price shows room to continue punching as far south as weekly support pegged at 0.9770.

Direction:

· Long: A buy from the current H4 demand faces an awful lot of opposition from the higher timeframes. Therefore, it may be best to pass on buying this zone.

· Short: Looking to sell on the break/retest of the current H4 demand might be something to consider today, targeting the 0.98 handle, followed closely by the weekly support level at 0.9770. However, it would be advisable to only consider this trade if there is a risk/reward ratio of over 1R down to 0.98. That way, one can reduce risk to breakeven and take partial profits.

Data points to consider: US retail sales m/m and weekly unemployment claims at 1.30pm; CHF PPI m/m at 8.15am; CHF Libor rate and SNB monetary policy assessment at 8.30am; SNB press conference at 9am GMT.

Areas worthy of attention:

Supports: 0.9837-0.9850; 0.98 handle; 0.9711; 0.9770;

Resistances: 0.99 handle; 0.9864.

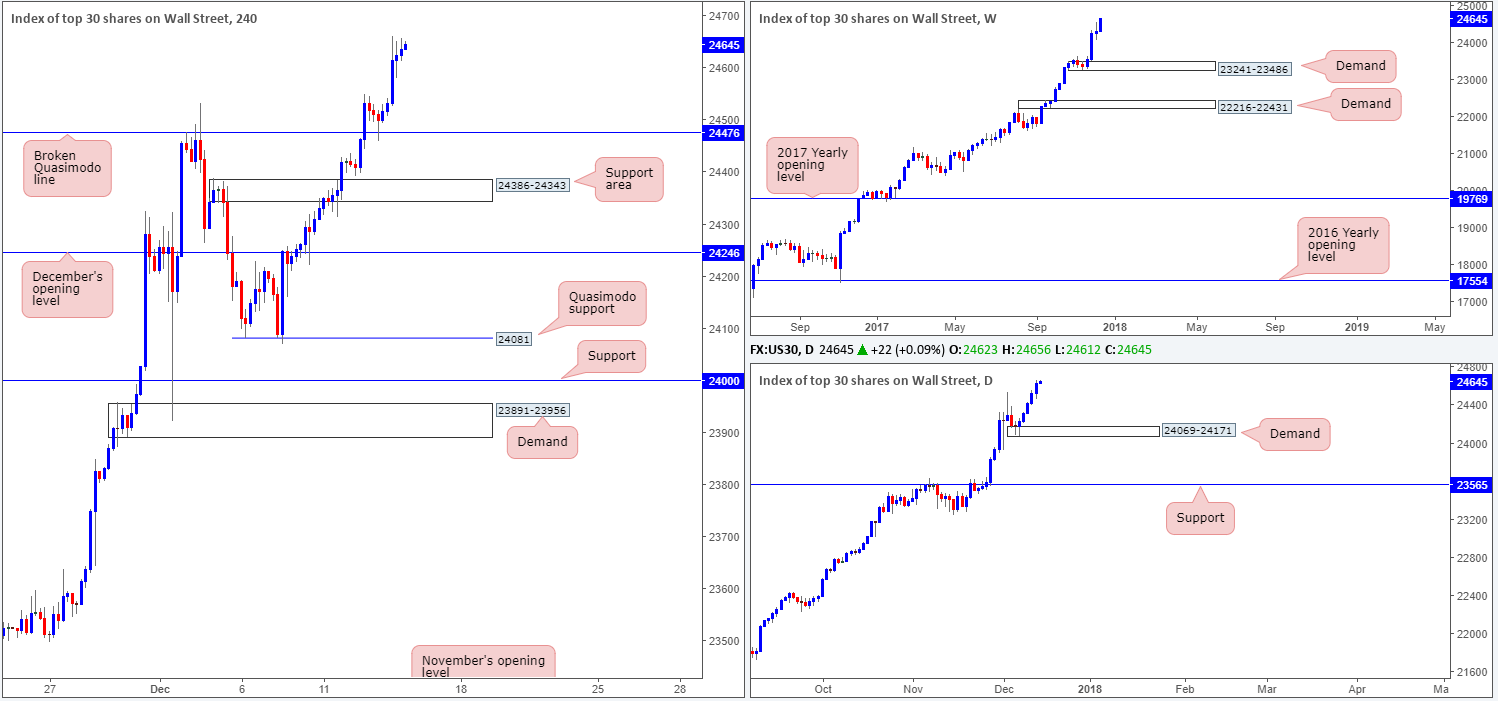

DOW 30:

In Wednesday’s report, we underscored a possible buy-the-retest scenario at a recently broken H4 Quasimodo line drawn from 24476. As is evident from the H4 timeframe this morning, price retested this line beautifully during yesterday’s segment, and even chalked up a nice-looking H4 buying tail as additional confirmation. Well done to any of our readers who managed to take advantage of this move. Broken Quasimodo levels are high-probability barriers!

Direction:

· Long: With 24476 now a proven support level, one may want to keep a tab on this level today for a possible second retest. Waiting for additional candle confirmation from here, however, is something to consider since buy orders may be weak, and therefore could encourage a move back down to the H4 support area coming in at 24386-24343.

· Short: Selling this market with absolutely no obvious resistance in sight is not a trade that most would label high probability. Therefore, sell with caution!

Data points to consider: US retail sales m/m and weekly unemployment claims at 1.30pm GMT.

Areas worthy of attention:

Supports: 24476; 24386-24343.

Resistances: …