Waiting for lower timeframe confirmation is our main tool to confirm strength within higher timeframe zones, and has really been the key to our trading success. It takes a little time to understand the subtle nuances, however, as each trade is never the same, but once you master the rhythm so to speak, you will be saved from countless unnecessary losing trades. The following is a list of what we look for:

- A break/retest of supply or demand dependent on which way you’re trading.

- A trendline break/retest.

- Buying/selling tails/wicks – essentially we look for a cluster of very obvious spikes off of lower timeframe support and resistance levels within the higher timeframe zone.

- Candlestick patterns. We tend to stick with pin bars and engulfing bars as these have proven to be the most effective.

We typically search for lower-timeframe confirmation between the M15 and H1 timeframes, since most of our higher-timeframe areas begin with the H4. Stops are usually placed 1-3 pips beyond confirming structures.

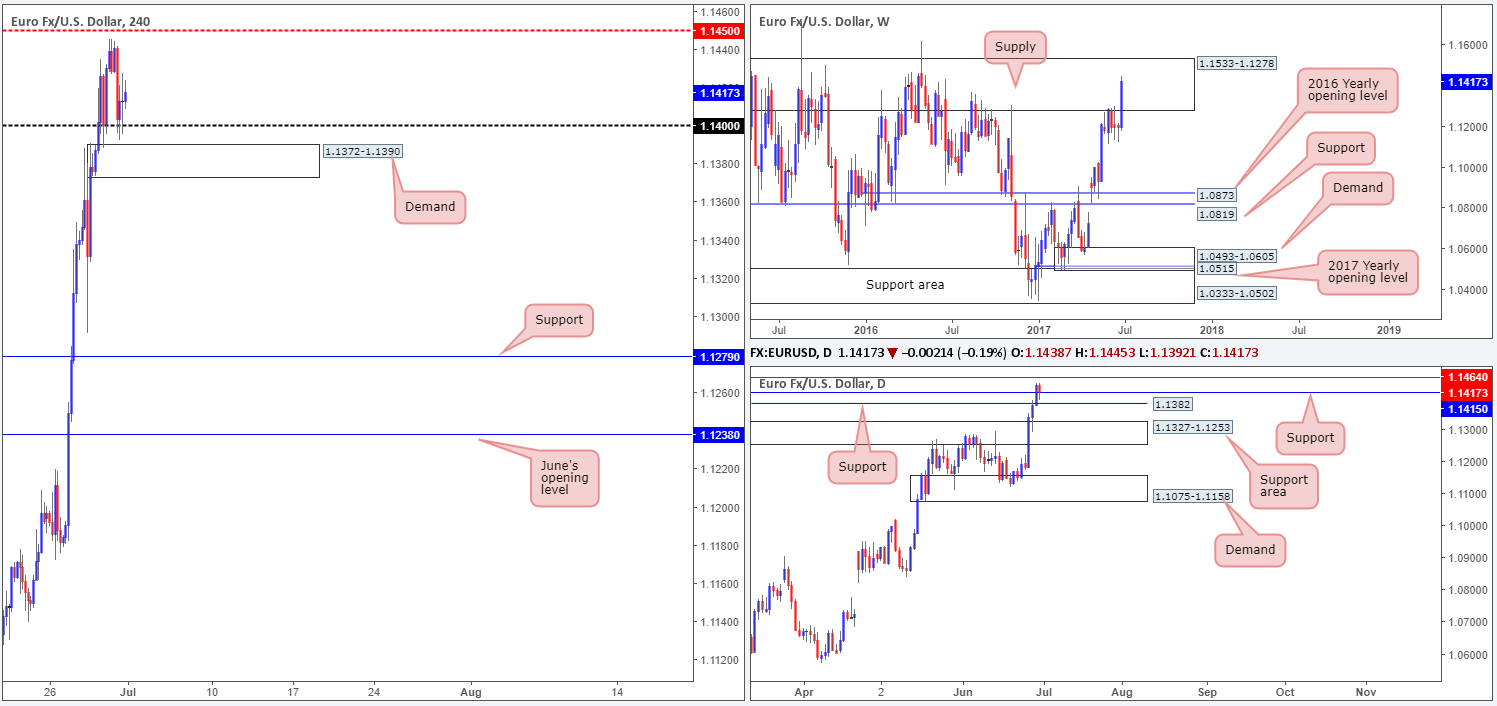

EUR/USD:

Weekly gain/loss: + 225 pips

Weekly closing price: 1.1417

Over the last week, the EUR/USD bulls went on the offensive and aggressively closed within the walls of a major weekly supply zone drawn from 1.1533-1.1278. Considering that this area has been in motion since May 2015, and held price lower on several occasions since then, we feel the bears will not give up without a fight here!

Branching down to the daily candles, we can see that Friday’s session turned red, consequently breaking a three-day bullish phase. With that being said though, the pair was unable to close below support at 1.1415. Should the bulls reignite momentum from here, the next area of interest can be seen at 1.1464: a major Quasimodo resistance level.

A quick recap of Friday’s movement on the H4 timeframe reveals that the 1.14 handle, once again, provided support to this market. This number is closely supported by a demand coming in at 1.1372-1.1390, which we consider to be the original ‘decision point’ that enabled price to initially break above 1.14. Also in view is the mid-level resistance at 1.1450. 34 pips above this number sits a strong-looking supply area (see back to the 4th May 2016) at 1.1529-1.1484 (seen higher on the chart), which along with the daily Quasimodo resistance level mentioned above at 1.1464, is the last remaining areas of higher-timeframe structures within the aforementioned weekly supply.

Our suggestions: While the bulls did have an incredibly strong week, we cannot ignore the fact that price remains trading within a major weekly supply. Additionally, it’s also closely positioned to a major daily Quasimodo resistance as well as the H4 showing a strong-looking supply located nearby (see above for values).

Therefore, our team will be watching for price to strike the 1.1484/1.1464 region today/this week (underside of H4 supply/daily Quasimodo resistance) for a possible short trade. It might also be worth noting that stops set above 1.1450 (buy stops), alongside breakout buyers’ orders, will likely provide liquidity for bigger players to sell! Just to be on the safe side though, we are recommending that a trade should only be qualified as viable should the H4 candles print a reasonably sized bearish candle, preferably in the shape of a full-bodied candle.

Data points to consider: US ISM manufacturing PMI at 3pm GMT+1.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 1.1484/1.1464 ([waiting for a reasonably sized H4 bear candle – preferably a full-bodied candle – to form before pulling the trigger is advised] stop loss: ideally beyond the candle’s wick).

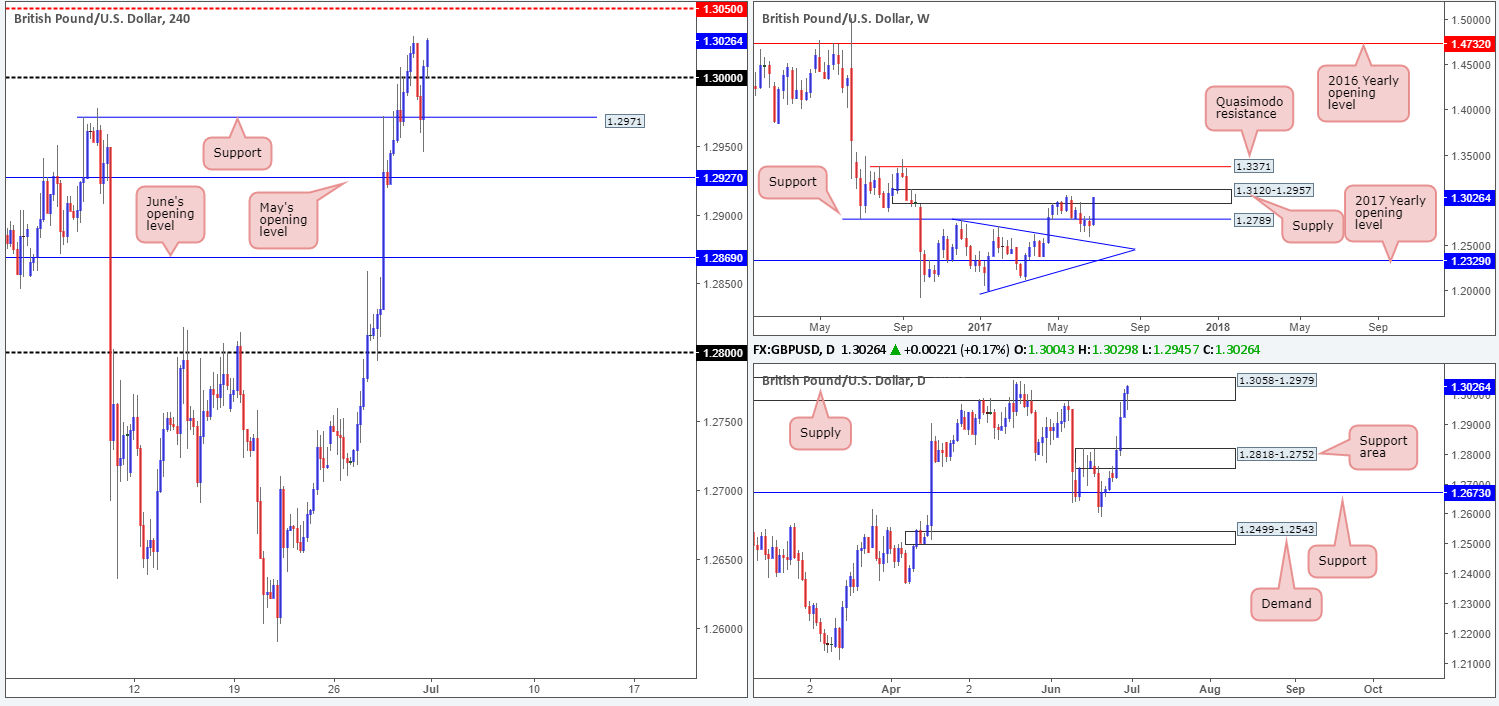

GBP/USD:

Weekly gain/loss: + 308 pips

Weekly closing price: 1.3026

The GBP/USD had an absolutely smashing week, netting over 300 pips! This resulted in a near-full-bodied weekly bullish candle being created, which closed within the confines of a weekly supply zone printed at 1.3120-1.2957. In the event that the bulls continue to remain dominant, the next area in the firing range is a weekly Quasimodo resistance level at 1.3371.

From the daily timeframe, apart from Monday’s session, the bulls printed back-to-back bullish candles throughout the week. This concluded with the unit closing trade within the walls of a supply zone marked at 1.3058-1.2979, which is essentially a partner supply to the aforementioned weekly supply. Beyond this barrier, the next base in view will likely be the supply area visible at 1.3278-1.3179 (seen higher on the chart).

H4 support at 1.2971, once again, held steady on Friday, following a selloff from highs of 1.3029. What’s also notable from a technical perspective is that this occurred around the large psychological number 1.30. With the H4 candles seen closing strongly back above 1.30 on Friday, is there a chance that the bulls may continue to lift this market north today/this week? Well, in our opinion, there’s little H4 structure to the left of current price that appears troubling until we reach the H4 mid-level resistance at 1.3050, followed by a Quasimodo resistance level at 1.3091 (seen higher on the chart).

Our suggestions: While a long is tempting above the 1.30 boundary given that it is a closely watched number, it is not a position that we’d label high probability considering the higher-timeframe technical landscape we’re in at the moment.

In fact, shorts would probably be the better bet. Here’s why:

- Weekly supply at 1.3120-1.2957.

- Daily supply at 1.3058-1.2979.

- Mid-level H4 resistance at 1.3050/H4 Quasimodo resistance at 1.3091/1.31 psychological number.

For us, the best trade would be a short from the above noted H4 Quasimodo resistance level. Not only do we have the option of then placing stops ABOVE the said weekly supply, but we, alongside the bigger players, can use these stops taken from above the noted daily supply as liquidity i.e. looking to take advantage of a possible fakeout. Remember, stops above supplies are buy orders, and are thus liquidity for sellers!

Data points to consider: UK manufacturing PMI at 9.30am, BoE Gov. Carney speaks at 1pm. US ISM manufacturing PMI at 3pm GMT+1.

- Buys: Flat (stop loss: N/A).

- Sells: 1.3091 (stop loss: 1.3122).

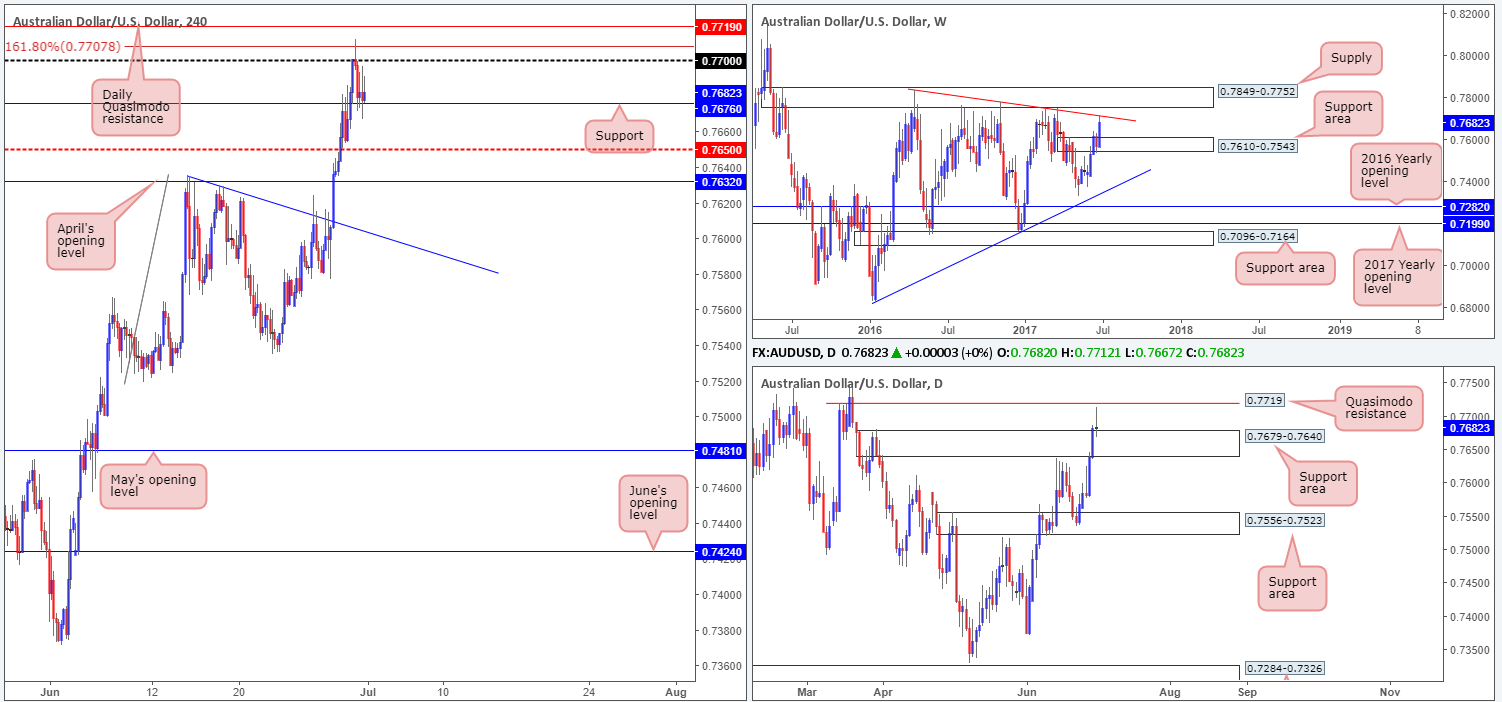

AUD/USD:

Weekly gain/loss: + 114 pips

Weekly closing price: 0.7682

After breaking above 0.7610-0.7543 and retesting this area as a weekly support, this revived demand for the Aussie dollar last week and ended with price testing a weekly trendline resistance extended from the high 0.7835. In view of this line being positioned just beneath a weekly supply at 0.7849-0.7752, we believe there’s a chance the pair may see the unit punch higher before turning south.

Zooming in and looking at the daily timeframe, we can see that the candles swallowed the 0.7679-0.7640 area on Thursday and retested it as support on Friday. The retest, however, was not convincing and concluded forming a rather aggressive selling wick. This was, we believe, due to two things:

- Weekly price connecting with the said weekly trendline resistance!

- Daily price coming within an inch of testing a daily Quasimodo resistance level at 0.7719.

A brief look at recent dealings on the H4 timeframe shows price whipsawed through the 0.77 handle and touched gloves with a 161.8% ext. at 0.7708 taken from the low at 0.7519. This, as you can see, sent the pair back down to support at 0.7676 going into Friday’s close.

Our suggestions: Through the lens of a technical trader, this is a somewhat difficult market to trade at the moment. Although the weekly timeframe suggests that selling could be the way forward, both the H4 and daily charts suggest otherwise! Therefore, we believe neither a long nor short is attractive right now.

Data points to consider: Chinese Caixin manufacturing PMI at 2.45am. US ISM manufacturing PMI at 3pm GMT+1.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Flat (stop loss: N/A).

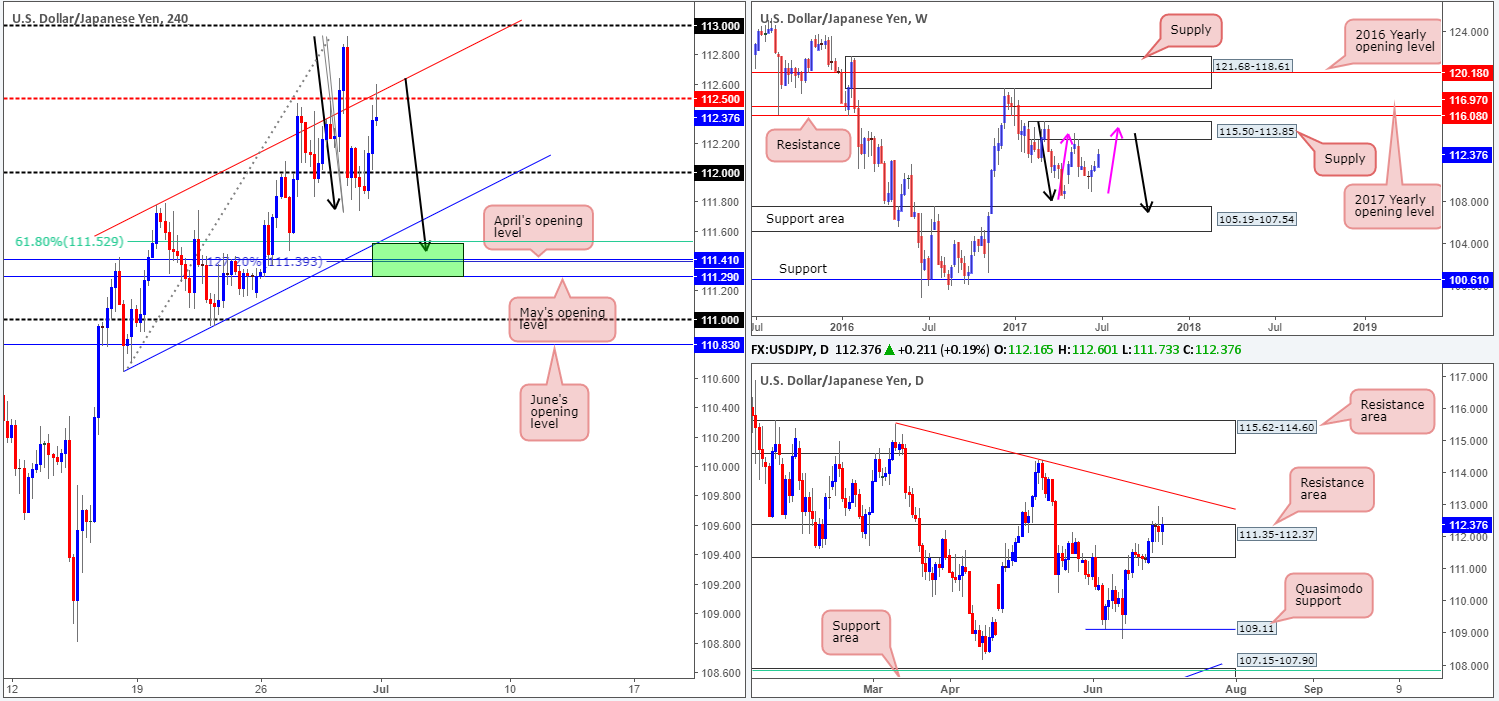

USD/JPY:

Weekly gain/loss: + 108 pips

Weekly closing price: 112.37

With weekly price recently finding a floor of support around the 110.30 mark, a potential AB=CD correction (see pink arrows) that completes within supply pegged at 115.50-113.85 could take shape this week. What’s also notable from a technical perspective is that this supply zone has already managed to cap upside beautifully in early May, so there’s a good chance of history repeating itself here.

Despite weekly price showing signs of heading higher this week, daily action continues to hang on by a thread around the upper edge of a daily resistance area penciled in at 111.35-112.37. This zone has been active since late January, so it is certainly not a base one should ignore. Providing that this area remains in position, the next downside target from here can be seen at 109.11: a Quasimodo support level. A break to the upside, nevertheless, has the trendline resistance taken from the high 115.50 to target.

Moving over to the H4 timeframe, the picture shows a possible AB=CD bullish formation in the works. The competition point for this pattern (the green area) is comprised of both May/April’s opening levels at 111.29/111.41, the AB=CD 127.2% ext. at 111.93 and a 61.8% Fib support at 111.52. What’s also interesting here is that this buy zone is positioned just beneath a H4 channel support line extended from the low 110.64, so this could encourage a possible fakeout below the ascending line.

Our suggestions: While a buy from the green H4 area is tempting, we have to take into account that there’s no higher-timeframe support converging with this zone. Therefore, despite the confluence, it is still a risky trade. One way of overcoming this is to wait for a H4 bull candle to form, preferably in the shape of a full-bodied candle, as this will help pin down buyer intent.

Data points to consider: US ISM manufacturing PMI at 3pm GMT+1.

Levels to watch/live orders:

- Buys: 111.29/111.52 ([waiting for a reasonably sized H4 bull candle – preferably a full-bodied candle – to form before pulling the trigger is advised] stop loss: ideally beyond the candle’s tail).

- Sells: Flat (stop loss: N/A).

USD/CAD:

Weekly gain/loss: – 303 pips

Weekly closing price: 1.2962

The USD/CAD suffered a nasty decline in value last week, losing over 300 pips in the process! Consequent to this, weekly price is now trading beneath the 1.3006-1.3115 area, which was a respected area of support. Worryingly for the bulls on the weekly timeframe is that the the next area of interest is a weekly support level coming in at 1.2538. By the same token, the daily timeframe also shows room to move down to at least the demand base drawn from 1.2822-1.2883.

Recent trading on the H4 timeframe shows us that the large psychological number 1.30 was taken out and then later retested as a resistance on Friday. There are two things we like here:

- Not only is there room seen for the pair to trade lower on the higher timeframes, but there is also space for a move lower on the H4 timeframe down to demand penciled in at 1.2910-1.2923.

- Friday’s closing candle is, in our humble opinion, a signal to suggest that the bears will now look to take things lower.

Our suggestions: With the above two points in mind, our team has taken a small short position at 1.2970 with a stop-loss order positioned above 1.30 at 1.3005 (a 35-pip stop). The initial target is the aforementioned H4 demand. So, this gives a 47-pip target – nearly 1.5 times our risk.

Data points to consider: US ISM manufacturing PMI at 3pm GMT+1.

Levels to watch/live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: 1.2970 ([live] stop loss: 1.3005).

USD/CHF:

Weekly gain/loss: – 108 pips

Weekly closing price: 0.9583

The USD/CHF fell sharply last week, consequently running through the weekly support level at 0.9639 and shaking hands with weekly support at 0.9581. Providing that this level holds steady, we believe that 0.9639 will likely be retested as resistance.

The story on the daily chart shows that price has begun showing signs of buyer intent from an AB=CD 127.2% ext. at 0.9561, which is positioned just ahead of a support level pegged at 0.9546. Similar to the weekly timeframe, should the current daily level hold firm then the next area on the hit list will likely be the said weekly resistance level.

For those who read previous reports you may recall that our desk highlighted the green H4 area at 0.9546/0.9581 (comprised of weekly and daily supports – see above) as a possible buy zone. At the time of writing, our desk remains long this market from 0.9567 with a stop positioned below the daily support (0.9546) at 0.9544. The entry trigger came in the shape of near-full-bodied bullish candle late on Thursday.

Our suggestions: Ultimately, we’re looking for price to take out the 0.96 number, which should then free the path north up to the weekly resistance level at 0.9639 – an ideal take-profit level!

Apart from our current trade one could look to long on a close above 0.96. However, this would entail one finding a small enough stop-loss order to accommodate reasonable risk/reward up to 0.9639.

Data points to consider: US ISM manufacturing PMI at 3pm GMT+1.

Levels to watch/live orders:

- Buys: 0.9567 ([live] stop loss: 0.9544).

- Sells: Flat (stop loss: N/A).

DOW 30:

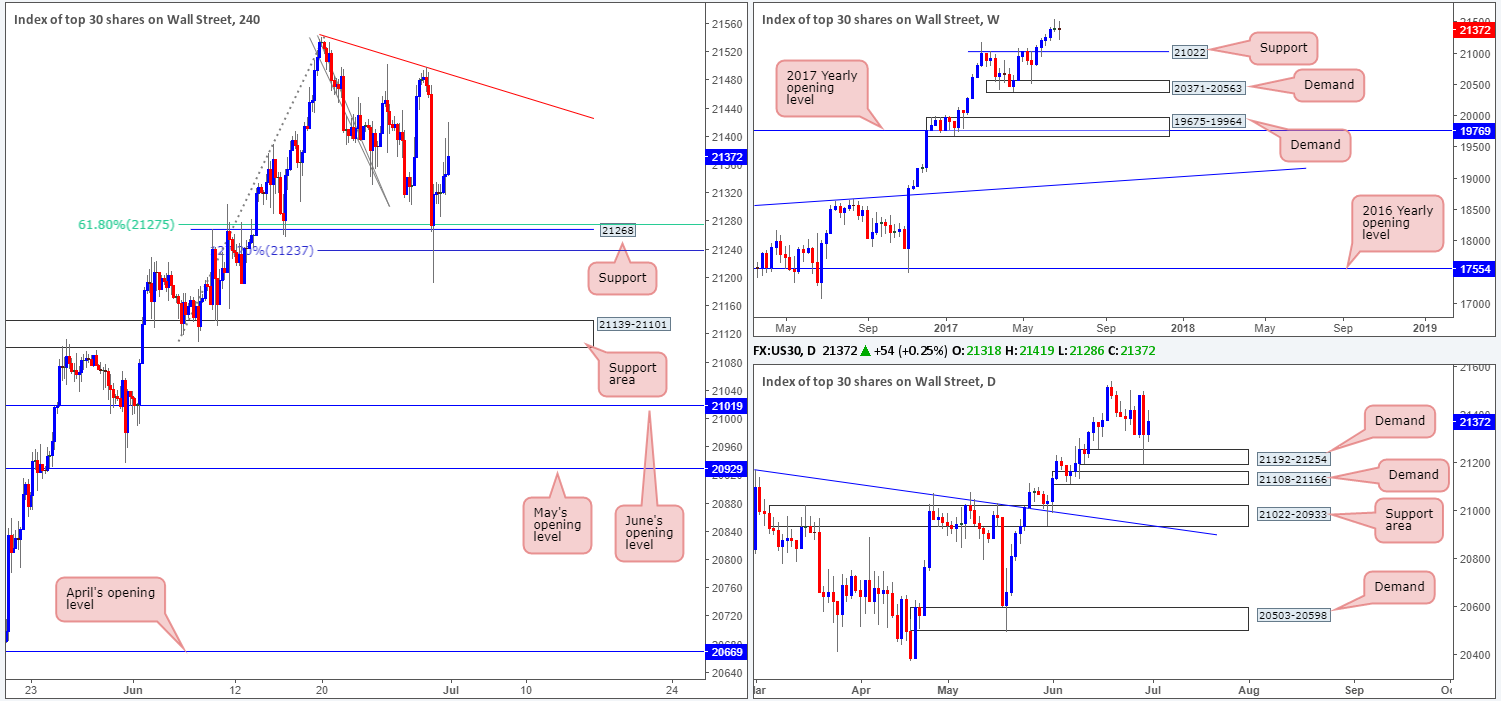

Weekly gain/loss: – 14 points

Weekly closing price: 21372

US equity prices are effectively unchanged this week, which led to a clear-cut weekly indecision candle forming. From the weekly timeframe, it is clear to see that this market’s underlying trend is strong. However, should the index pullback, the support level drawn from 21022 is likely the area where we’ll see the bulls make an appearance.

Daily demand at 21192-21254 was brought into view last week. Despite this area having its entire range challenged, it managed to remain strong.

In Friday’s report, we mentioned that our desk took a long trade at 21323, following the large H4 bull candle that formed off the H4 support level marked at 21268. What attracted us to this point was that the H4 level converged with a H4 61.8% Fib support level at 21275 taken from the low 21108 as well as a H4 127.2% Fib ext. point 21237 drawn from the high 21541 and also because of the aforementioned daily demand currently in play.

Our suggestions: Ultimately, we are watching for H4 price to challenge the trendline resistance extended from the high 21541. This is an ideal place to think about reducing risk to breakeven and maybe taking some of the position off the table.

Data points to consider: US ISM manufacturing PMI at 3pm GMT+1.

Levels to watch/live orders:

- Buys: 21323 ([live] stop loss: 21188).

- Sells: Flat (stop loss: N/A).

GOLD:

Weekly gain/loss: – $15

Weekly closing price: 1241.3

In last week’s weekly report, we highlighted the prominent weekly buying tail that took shape. Our reasoning behind this candle formation not qualifying as an eligible buy signal was due to where it formed: it had absolutely no support! As we can all see, in this instance we were correct and the bears continued to pummel the metal lower last week, consequently bringing the unit down to within striking distance of a weekly demand base coming in at 1194.8-1229.1.

From the daily scale, bullion is seen trading from a resistance area coming in at 1247.7-1258.8. Should the bears remain in the driving seat then the next area on the radar for our team would be the channel support extended from the low 1180.4, which happens to intersect with the said weekly demand.

April’s opening level at 1248.0 managed to hold firm as resistance last week on the H4 chart, which looks as though this will send the metal down to H4 support at 1235.0, followed closely by H4 demand at 1229.1-1231.6 (this area is positioned on top of the aforementioned weekly demand zone).

Our suggestions: Basically, given the above points our team is now watching the current H4 demand for a potential long opportunity this week. The stops beneath the said H4 support level will likely provide the big boys a reasonable amount of liquidity to buy into, and also let’s not forget how well connected the H4 demand zone is to both the weekly demand area and the daily channel support line (see above). However, seeing as this H4 demand base is rather small in size, a fakeout is likely to occur. We feel the best way to deal with this is simply wait for a H4 bullish candle to form, preferably a full or near-full-bodied candle, before pulling the trigger.

Levels to watch/live orders:

- Buys: 1229.1-1231.6 ([waiting for a reasonably sized H4 bull candle – preferably a full-bodied candle – to form before pulling the trigger is advised if you want to help avoid a potential fakeout] stop loss: ideally beyond the candle’s tail).

- Sells: Flat (stop loss: N/A).