Monday 27th November: Weekly technical outlook and review.

Waiting for lower timeframe confirmation is our main tool to confirm strength within higher timeframe zones, and has really been the key to our trading success. It takes a little time to understand the subtle nuances, however, as each trade is never the same, but once you master the rhythm so to speak, you will be saved from countless unnecessary losing trades. The following is a list of what we look for:

· A break/retest of supply or demand dependent on which way you’re trading.

· A trendline break/retest.

· Buying/selling tails/wicks – essentially we look for a cluster of very obvious spikes off of lower timeframe support and resistance levels within the higher timeframe zone.

We typically search for lower-timeframe confirmation between the M15 and H1 timeframes, since most of our higher-timeframe areas begin with the H4. Stops are usually placed 1-3 pips beyond confirming structures.

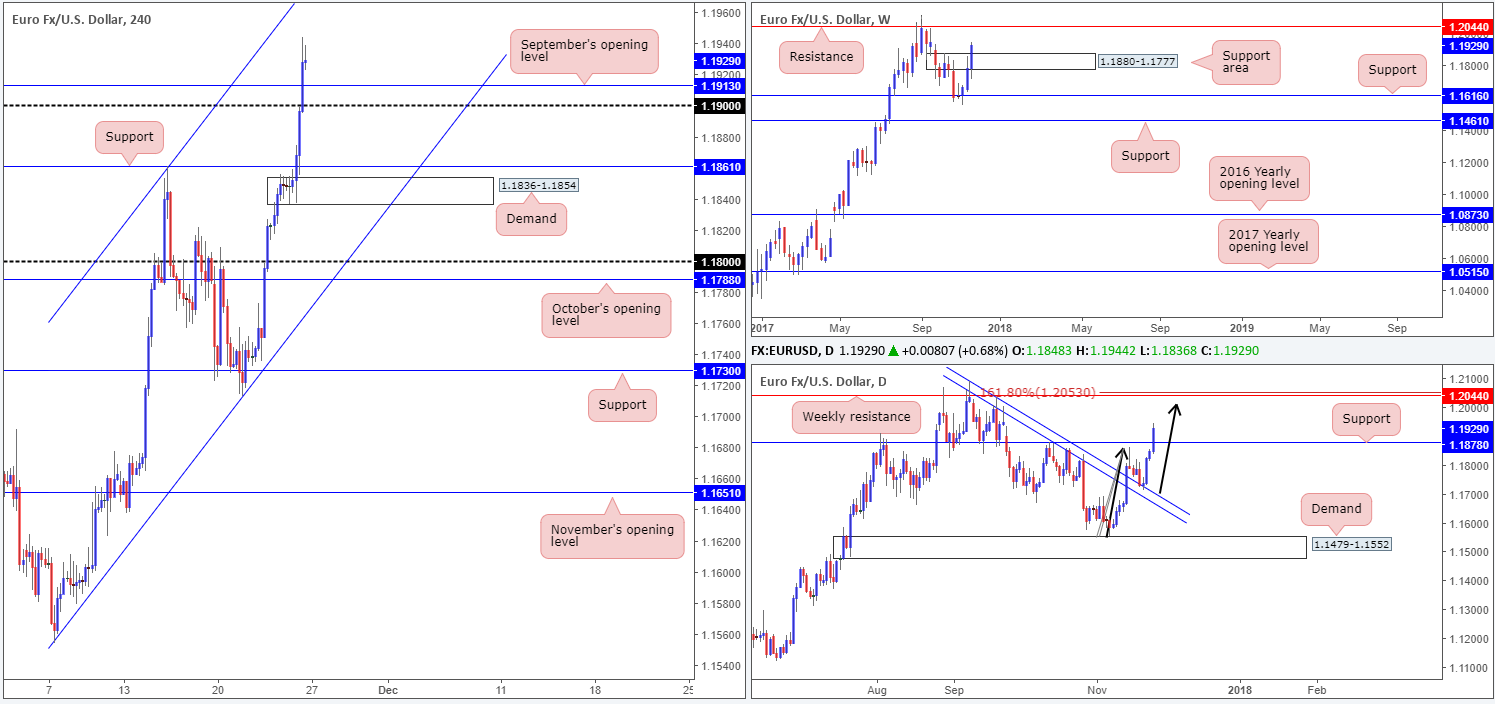

EUR/USD:

Weekly gain/loss: +1.16%

Weekly closing price: 1.1929

The shared currency enjoyed another successful week, increasing its worth by an additional 140 pips into the close. The weekly supply area at 1.1880-1.1777 (now acting support zone) was demolished as a result of the recent upside move. Scope to push higher and elbow into weekly resistance at 1.2044 could, therefore, be a possibility this week.

Turning our focus to the daily timeframe, it can clearly be seen that the euro established a base of support around the daily trendline extended from the high 1.2092. What followed from here, as you can see, was three days of strong buying, shaped by near-full bodied bull candles, which ended the week outmuscling daily resistance coming in at 1.1878 (now acting support). The other key thing to note is that beyond this daily level we do not see much in the way of active supply to the left of current price until we reach the aforementioned weekly resistance. In addition to this, the weekly level also coincides just beautifully with a daily AB=CD (see black arrows) 161.8% ext. point at 1.2053.

The combination of a robust euro and a deterioration of the greenback across the board forced H4 price above both the 1.19 handle and September’s opening line at 1.1913 amid Friday’s segment. As we moved into the later hours of US trading, nevertheless, the H4 candles began decelerating and mildly paring gains. This, as far as we can see, was due to the small weekend gap seen back on the 24th September.

Suggestions: Should we see a dip in early trading today, 1.19/1.1913 on the H4 timeframe will likely be brought into the spotlight. Whether this will hold or not is difficult to judge, as a few pips beneath the area sits daily support pegged at 1.1878 (anyone smell a potential fakeout here?).

A continued move to the upside, nonetheless, could see the H4 candles shake hands with channel resistance etched from the high 1.1861 and, quite possibly, the large psychological band 1.20 (located 44 pips below the aforesaid weekly resistance).

As far as we’re concerned, the trading area that offers the most quality right now is a sell zone fixed between the 1.20 line on the H4 timeframe and the weekly resistance level/AB=CD completion point at 1.2053. A full or near-full-bodied H4 bearish candle printed within this area would, in our view, be a mouthwatering setup, and one that we would have little hesitation getting involved in.

Data points to consider: US new home sales at 3pm GMT.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 1.2053/1.20 ([waiting for a reasonably sized H4 bearish candle to form – preferably a full or near-full-bodied candle – is advised] stop loss: ideally beyond the candle’s wick).

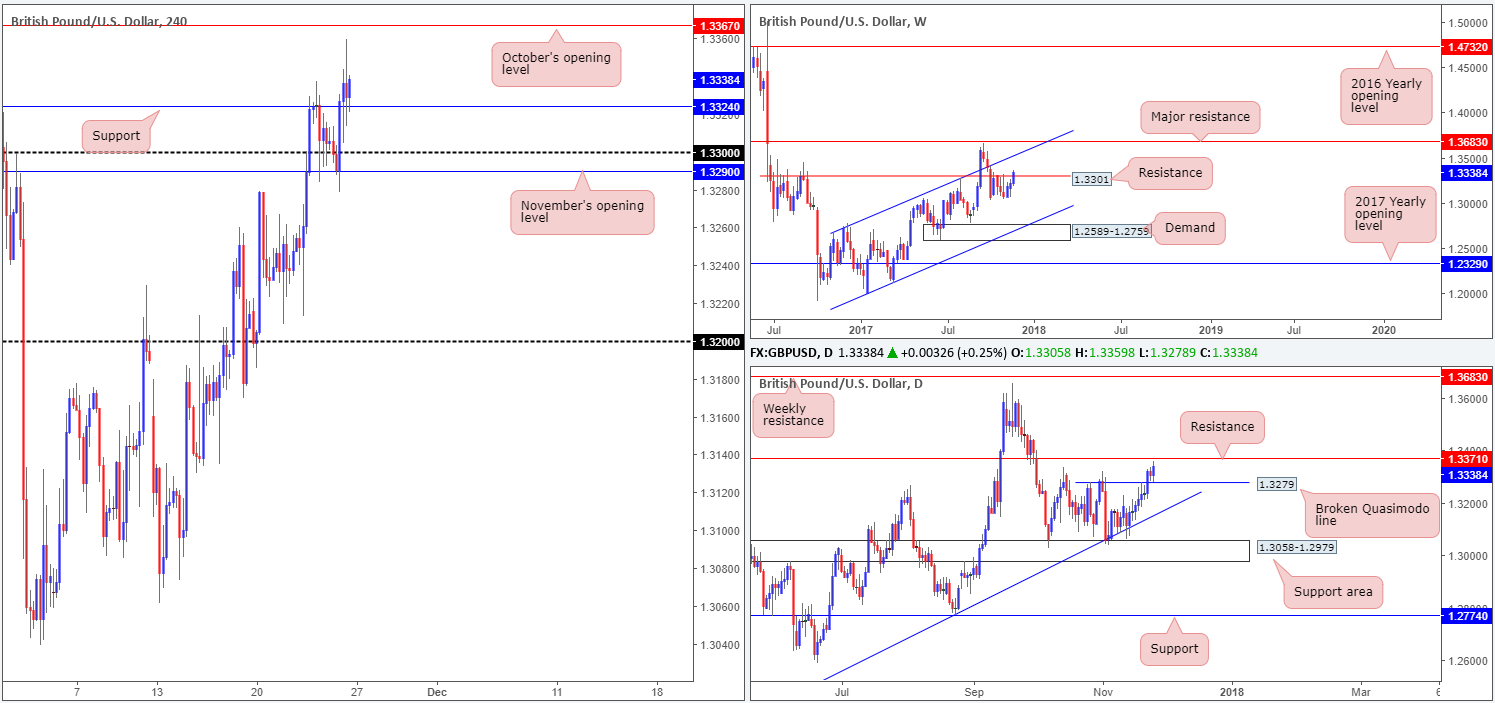

GBP/USD:

Weekly gain/loss: +0.90%

Weekly closing price: 1.3338

Since early October, the GBP/USD has been consolidating beneath a weekly resistance level coming in at 1.3301. Amid last week’s sessions, nevertheless, a strong wave of buying was seen which saw the British pound marginally close above the said resistance. As long as the unit continues to emphasize a bullish tone above 1.3301, it seems weekly action would be all set to extend up to a weekly channel resistance taken from the high 1.2673.

Moving down to the daily timeframe, we can see that price broke through a daily Quasimodo resistance at 1.3279 on Wednesday and retested it as support on Friday. The next upside target on this scale can be seen close by at 1.3371: a daily resistance level that boasts a reasonably strong history.

A brief look at recent dealings on the H4 timeframe shows that the pair broke above the 1.33 handle, following comments from the British Prime Minister and European Commission President Juncker. A session high of 1.3359 was achieved during US trading hours after retesting a H4 resistance-turned support at 1.3324. Of particular interest on this scale is that the next upside target can be seen at October’s opening level drawn from 1.3367, which aligns nicely with the daily resistance noted above at 1.3371.

Suggestions: Given that Monday’s sessions are notoriously slow, alongside a very light economic calendar, the team does not see the pair venturing outside of 1.3367/1.33 today.

A sell from 1.3367, considering its connection to the aforesaid daily resistance, could be an option for some traders. Personally though, we do not like the fact that weekly price had the strength to breach weekly resistance last week, as this shows the bulls are active. Therefore, we will not be attempting to sell 1.3367 and will instead remain on the sidelines during today’s sessions.

Data points to consider: US new home sales at 3pm GMT.

Levels to watch/live orders:

· Buys: Flat (stop loss: N/A).

- Sells: Flat (stop loss: N/A).

AUD/USD:

Weekly gain/loss: +0.66%

Weekly closing price: 0.7610

Although the commodity currency recouped some of its recent losses last week, weekly structure, in our view, remains unchanged from the previous weekly outlook. To the downside there is a particularly interesting weekly support we have our eye on. Merging with a weekly channel support extended from the low 0.6827, there’s a nice-looking weekly AB=CD (see black arrows) 161.8% Fib ext. point at 0.7496 that also aligns with a weekly 50.0% value at 0.7475 taken from the high 0.8125.

The story on the daily timeframe, nevertheless, shows that there is room for price to advance up to a nearby daily supply area coming in at 0.7695-0.7657. Looking to the downside, we do not see much stopping price from challenging last Tuesday’s low at 0.7532, followed closely by daily support penciled in at 0.7505.

For those who read previous reports on the AUD/USD you may recall that we highlighted a H4 resistance level seen at 0.7632, which happened to converge with a H4 AB=CD 161.8% ext. point at 0.7633. We also mentioned that although this level boasted strong confluence, it was a somewhat risky sell according to daily structure. This was largely because the lower edge of a daily supply at 0.7695-0.7657 sat only 25 or so pips above the H4 resistance, and thus could have encouraged a fakeout to take place.

As is evident from the H4 timeframe, the H4 resistance managed to hold firm. We did not short this level as we needed additional confirmation in the shape of a full or near-full-bodied H4 bear candle. The one that did print was far too big and provided little room for profit due to how close 0.76 was.

Suggestions: Put simply, the sellers will need to prove themselves further for us to short this market. A decisive H4 close below 0.76, followed up with a retest and a reasonably sized H4 full or near-full-bodied bearish candle would, in our book, be enough to warrant a sell, with an ultimate target set at 0.75.

Data points to consider: US new home sales at 3pm GMT.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Watch for H4 price to engulf 0.76 and then look to trade any retest seen thereafter ([waiting for a reasonably sized H4 bearish candle to form following the retest – preferably a full or near-full-bodied candle – is advised] stop loss: ideally beyond the candle’s wick).

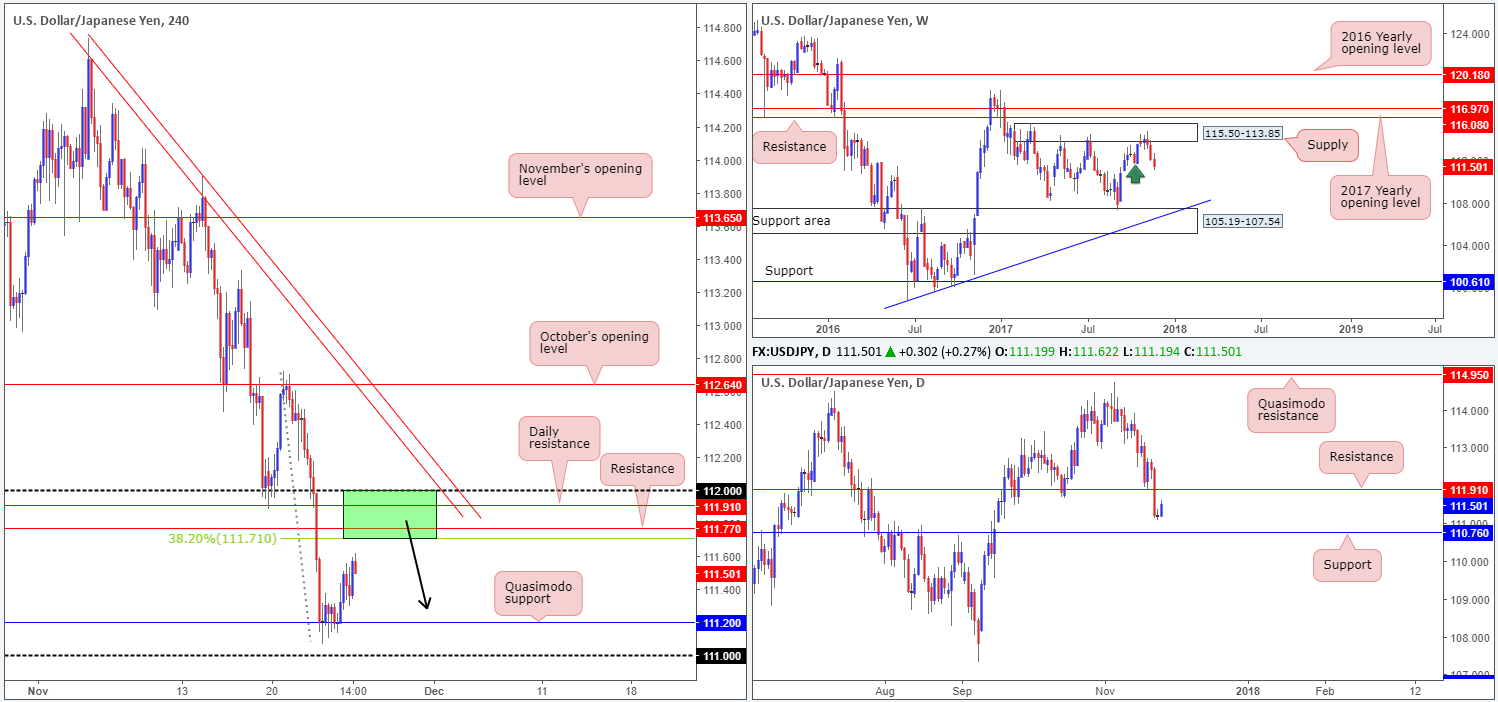

USD/JPY:

Weekly gain/loss: -0.49%

Weekly closing price: 111.50

Recent movement on the weekly timeframe shows that price extended losses last week, reaching lows of 111.06. With 111.68 (the low marked with a green arrow) now potentially out of the picture, there is, according to weekly structure, room for further downside down to as far as the weekly support area at 105.19-107.54, which aligns with a weekly trendline support taken from the low 98.78.

A closer look at price action on the daily timeframe highlights a nearby daily support level coming in at 110.76. This barrier, as you can see, has a moderately respectable history, so it is not one to be overlooked. Before reaching this area, nevertheless, traders have to be prepared for the possibility of a potential retest being seen around the underside of a recently broken daily support-turned resistance at 111.91, which, in our view, has an equally sound history.

Following a somewhat lackluster session on ‘holiday’ Thursday, which consisted of H4 price consolidating around the top edge of a H4 Quasimodo support at 111.20, the bulls went on the offensive throughout Friday’s sessions, reaching a high of 111.62. Overhead, however, there is an interesting sell zone seen between 112 and 111.71. Comprised of a psychological band at 112, the daily resistance mentioned above at 111.91, a H4 resistance coming in at 111.71 and a 38.2% Fib resistance at 111.71, this area is likely to hold ground should it be tested today. Our confidence in this area comes from both the surrounding confluence and the space seen for the market to move lower on the higher timeframes (see above).

Suggestions: 112/111.71 is an ideal location to hunt for shorts, in our humble view. Aggressive traders may wish to enter short at 111.71 and place stops above 112. With that being said, however, this would be a risky move since you’re opening yourself up to unnecessary drawdown, and there is always a chance that the 112 handle could be faked. To that end, our plan of attack here will be to simply wait and see how H4 price responds once/if price enters the green H4 sell zone. A reasonably sized H4 bear candle, preferably a full or near-full-bodied candle would, in our opinion, be a high-probability signal to short, targeting 111.20 as your initial take-profit zone.

Data points to consider: US new home sales at 3pm GMT.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 112/111.71 ([waiting for a reasonably sized H4 bearish candle to form – preferably a full or near-full-bodied candle – is advised] stop loss: ideally beyond the candle’s wick).

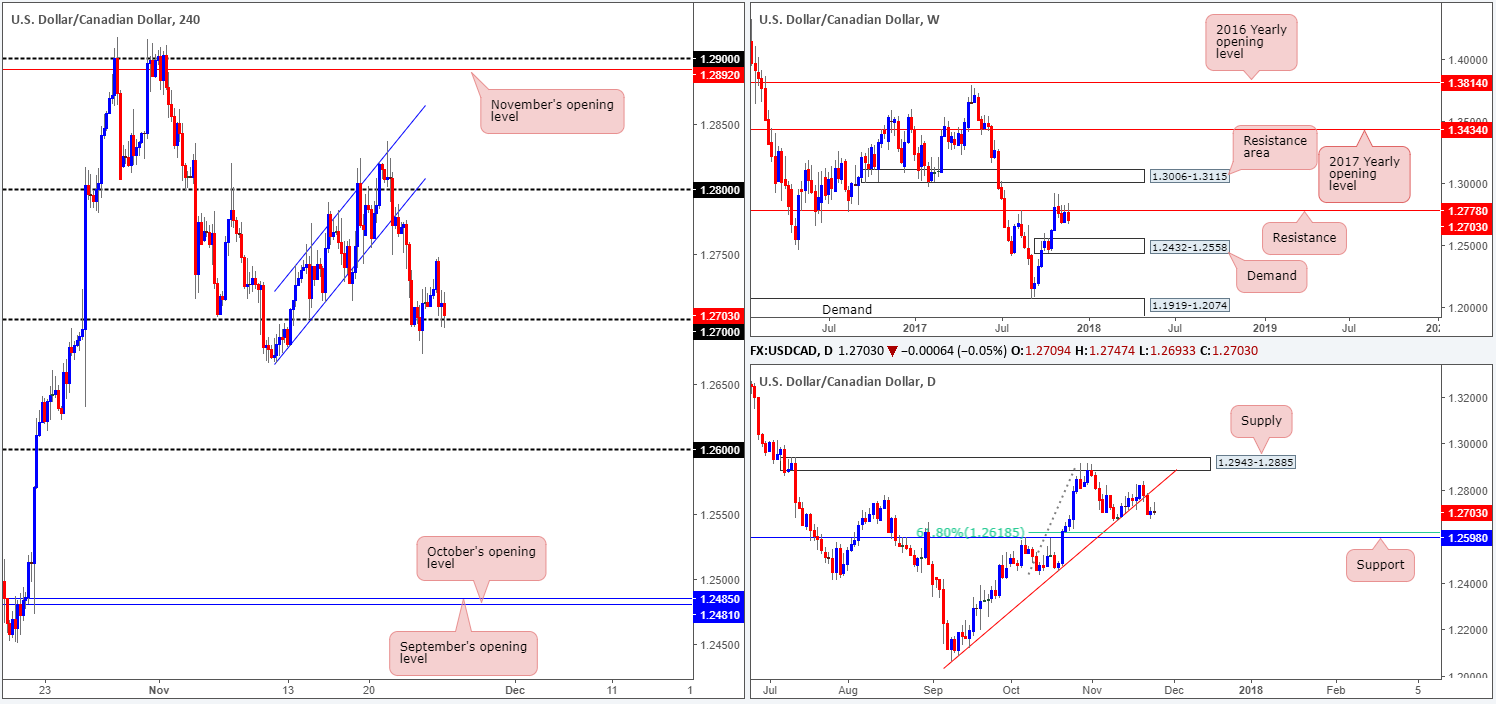

USD/CAD:

Weekly gain/loss: -0.40%

Weekly closing price: 1.2703

Upside remains capped on the weekly timeframe at 1.2778, despite higher oil prices. This weekly resistance level shares a strong history that dates back to early 2004, so it is not one to ignore! In the event that the market continues to dip south from here this week, traders’ crosshairs will likely be fixed on the weekly demand at 1.2432-1.2558. Boasting a strong base, this demand area communicates strength and, therefore, will likely hold back sellers should the area come into play.

During the course of Wednesday’s sessions, the USD/CAD engulfed the daily trendline support extended from the low 1.2061 and, according to our analysis, opened up downside to the daily support level sitting at 1.2598. The pair is likely to find some support here if it comes into play with it having been a strong barrier of resistance over the past couple of months, as well as sharing its space with a 61.8% daily Fib support at 1.2618.

A quick recap of Friday’s trade on the H4 timeframe shows price extended to a high of 1.2747 in early trading, but failed to sustain gains beyond this point, consequently dropping back to revisit the 1.27 handle into the closing bell.

For those who follow our reports on a regular basis you may recall that we were short this market from 1.2764. We liquidated the majority of our position once price came into contact with 1.27 on Wednesday and moved the stop-loss order down to 1.2735. Unfortunately, we were taken out of this position on Friday.

Suggestions: Although our sell has been liquidated there is still a clear bearish vibe present, as weekly price is seen trading from resistance at 1.2778 and daily action shows room to push as far south as support penciled in at 1.2598. This is primarily why we were holding a portion of our position in the market.

Suggestions: Ultimately, we’re looking for H4 price to break back below 1.27 today. A decisive H4 close below 1.27, followed up with a retest and a H4 bearish candle (full or near-full bodied) would be enough to warrant a short down to 1.26. Remember, 1.26 shares its space with daily support mentioned above at 1.2598, so it makes for an ideal take-profit zone.

Data points to consider: US new home sales at 3pm GMT.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Watch for H4 price to engulf 1.27 and then look to trade any retest seen thereafter ([waiting for a reasonably sized H4 bearish candle to form following the retest – preferably a full or near-full-bodied candle – is advised] stop loss: ideally beyond the candle’s wick).

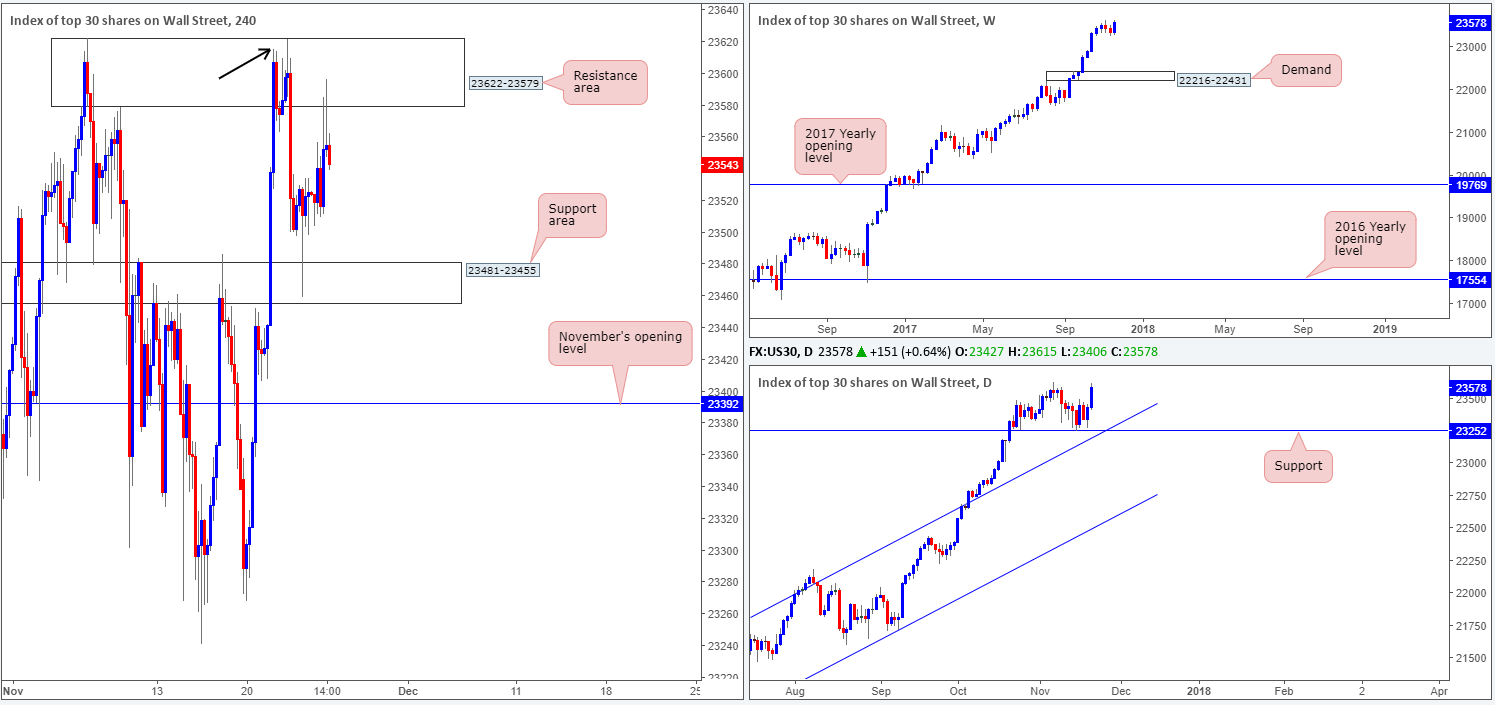

DOW 30:

Weekly gain/loss: +0.86%

Weekly closing price: 23578

Breaking a mild two-week bearish phase, US equities advanced during the course of last week’s segment, chalking up a near-full-bodied weekly bull candle and engulfing recent losses. In the event that the bulls are able to maintain a presence this week, it’s likely we’ll be seeing fresh record highs.

Monday’s action, as can be seen on the daily timeframe, established support around the 23252 neighborhood. As you can see though, it wasn’t until Thursday’s sessions did we see the bulls move into a higher gear and push north.

Before we all get too excited and slam that buy button though, the H4 resistance area at 23622-23579 has proven troublesome. In addition to this, there is also a minor H4 Quasimodo resistance seen marked with a black arrow at 23615 to contend with.

Suggestions: We feel the safest approach to trading this market is to simply wait. Wait for H4 price to engulf the noted structures and record fresh record highs. That way, one would be in a position to potentially take advantage of any retest seen at the top edge of the broken area as support. Considering the strength of the underlying trend, we believe this would be a tasty location to look for long opportunities.

Data points to consider: US new home sales at 3pm GMT.

Levels to watch/live orders:

- Buys: Watch for H4 price to engulf 23622-23579 and then look to trade any retest seen thereafter ([waiting for a reasonably sized H4 bullish candle to form following the retest – preferably a full or near-full-bodied candle – is advised] stop loss: ideally beyond the candle’s tail).

- Sells: Flat (stop loss: N/A).

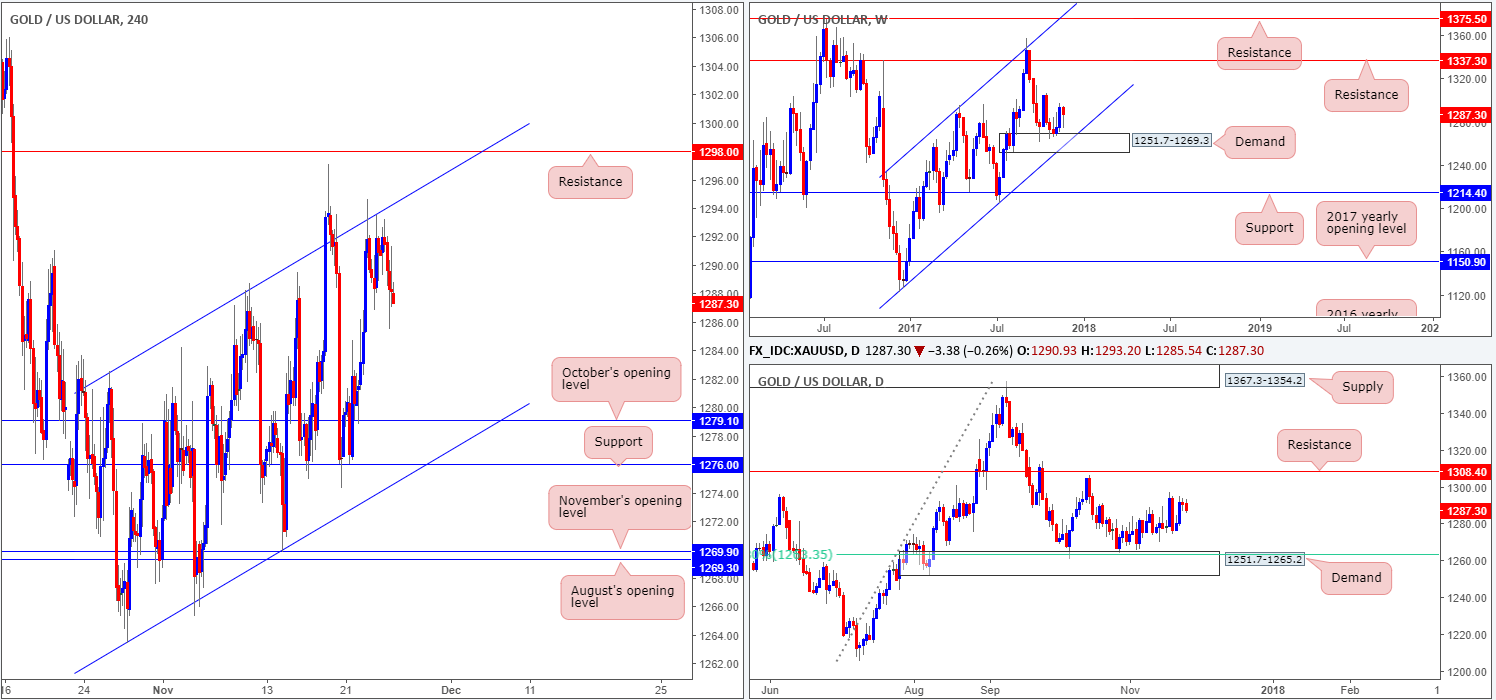

GOLD:

Weekly gain/loss: -0.44%

Weekly closing price: 1287.3

Even though the yellow metal failed to extend the prior week’s gains, last week’s weekly buying tail is, we believe, a sign that active buyers still reside around the top edge of the weekly demand planted at 1251.7-1269.3.

After connecting with daily demand at 1251.7-1265.2 (housed within the lower limits of a weekly demand base seen at 1251.7-1269.3) in late October, the gold market has since been grinding north. The next upside objective on the daily scale can be seen at 1308.4: a resistance level that boasts a reasonably strong history.

Influenced by Wednesday’s FOMC meeting, the dollar tumbled and correspondingly propelled the yellow metal higher. Try as it might, however, gold was unable to muster enough strength to breach the H4 channel resistance penciled in from the high 1282.5. As you can see, price remained capped beneath this line going into the week’s close. As we mentioned in Friday’s report, knowing that the metal is somewhat bolstered by higher-timeframe demands, a sell in this market might be considered a risky move. Although there is clearly an offered tone being seen on the H4 timeframe at the moment, we still stand by our initial analysis. It is just not worth the risk, knowing that you’re potentially selling into a bunch of higher-timeframe buyers.

Suggestions: Opting to stand on the sidelines is, in our opinion, still the better, and, let’s face it, much safer path to take at this time.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Flat (stop loss: N/A).