Japanese banks closed in observance of National Foundation Day.

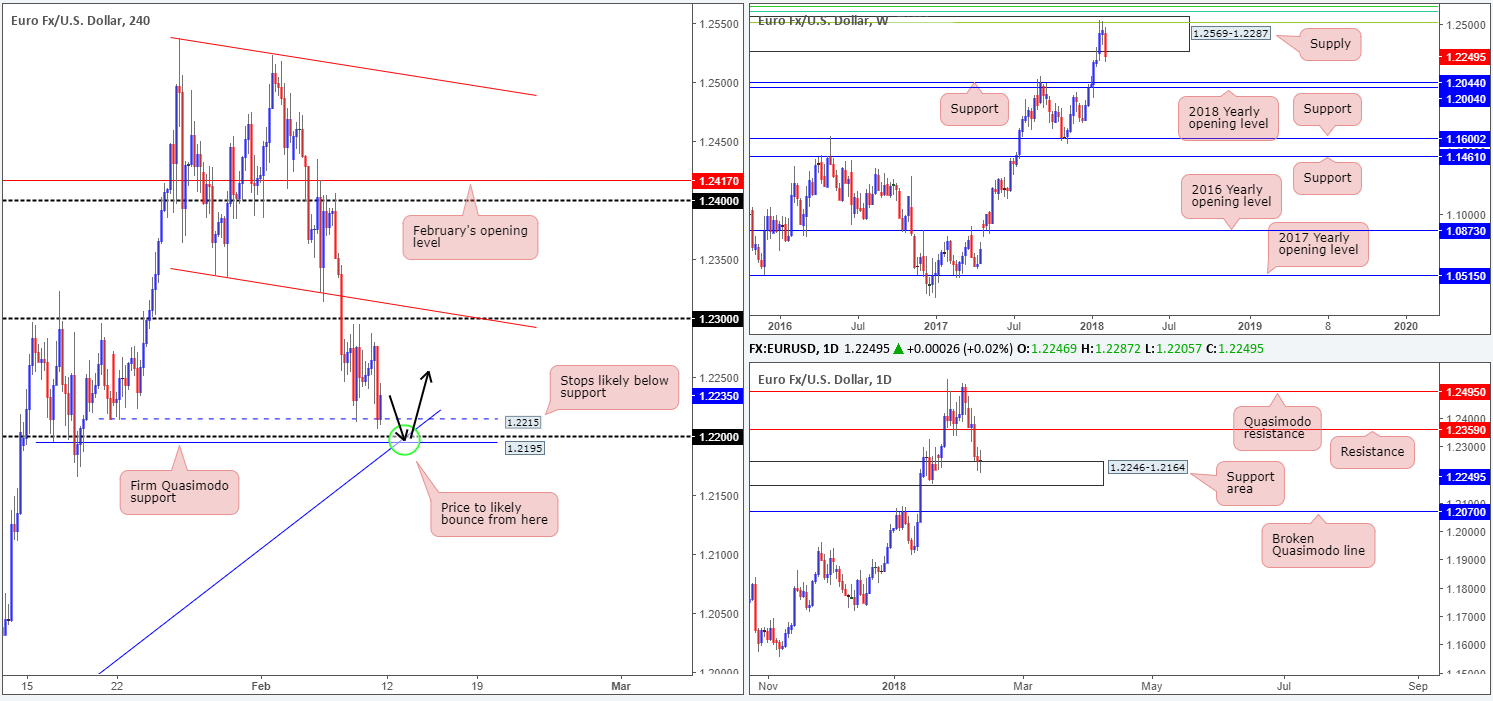

EUR/USD:

Weekly gain/loss: -1.70%

Weekly closing price: 1.2249

Renewed selling interest was seen from within the walls of a weekly supply at 1.2569-1.2287 last week, consequently breaking a reasonably dominant seven-week bullish phase. Erasing two weeks’ worth of gains, the euro concluded the session chalking up a near-full-bodied weekly bearish candle and potentially set the stage for a continuation move down to weekly support at 1.2044, followed closely by the 2018 yearly opening line at 1.2004. Another essential point to consider here is that the US dollar index is seen trading from a huge monthly support plotted at 88.50 (remember the EUR/USD and USDX are inversely correlated).

A closer look at the market through the daily timeframe shows that the unit recently bumped heads with a daily support area 1.2246-1.2164 constructed back in late 2014. As of yet, there’s been little bullish intent registered from this zone – we seem to have entered a period of indecision (note Thursday and Friday’s daily indecision candles). Should the market print a rotation to the upside from here, price would likely look to reclaim the daily resistance level at 1.2359. A move lower this week, on the other hand, has a daily broken Quasimodo line at 1.2070 to target.

Rocking over to the H4 timeframe, we can see that intraday movement settled around the local H4 support at 1.2215 on Friday, following a modest selloff from highs of 1.2287 (early selling in US equities seem to have boosted demand for the US dollar and therefore pressured the EUR/USD lower). Directly beneath this support is a H4 Quasimodo support at 1.2195. Notice that this Quasimodo also brings together a H4 trendline support extended from the low 1.1736 and the 1.22 handle (green circle).

Potential trading zones:

As highlighted in Friday’s morning report, the H4 Quasimodo support, we believe, has ‘bounce’ written all over it. Besides merging with the noted H4 support structures, there are also likely a truckload of stop-loss orders lurking beneath the 1.2215 H4 support that when filled will become sell orders, and therefore provide liquidity for traders to lift prices from the 1.2195 neighborhood. One final point worth mentioning, which we believe adds weight to the H4 Quasimodo, is that the level is seen located within the lower limits of the aforementioned daily support area.

The only grumble we see here is the fact that weekly price is trading southbound, hence why we are only expecting a bounce from the highlighted H4 supports. Personally though, we would be looking for price to at least achieve 1.2250 from the bounce off of 1.2195.

Data points to consider: No high-impacting events on the docket today.

Areas worthy of attention:

Supports: 1.2195; H4 trendline support; 1.22 handle; 1.2215; 1.2246-1.2164; 1.2070; 1.2044; 1.2004.

Resistances: 1.2569-1.2287; 1.2359; 1.2250.

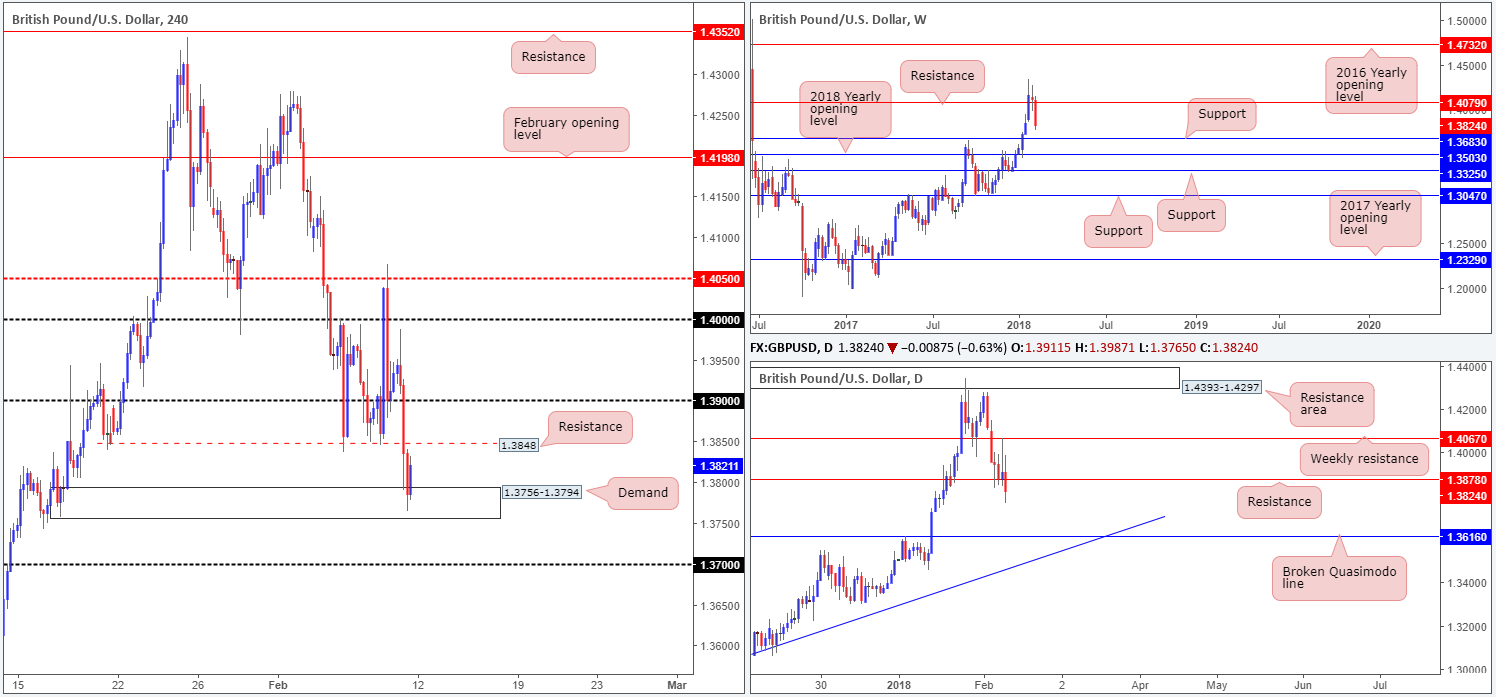

GBP/USD:

Weekly gain/loss: -2.12%

Weekly closing price: 1.3824

Over the course of last week’s movement, the GBP/USD experienced a substantial downside move, losing more than 2%, or 295 pips.

On the weekly timeframe, this has placed the couple within close proximity to a weekly support band coming in at 1.3683. Therefore, make sure to keep an eyeball on this level during the week, traders.

The story on the daily timeframe shows that daily support at 1.3878, although held firm mid-week, eventually gave way (now acting resistance). This, in our technical view, has unlocked the door to a void as there’s little support on this scale stopping price action from extending losses this week until we collide with a daily broken Quasimodo line at 1.3616 (sited below the aforementioned weekly support).

Leaving the 1.40 handle unchallenged on Friday, the British pound came under significant pressure and aggressively engulfed the 1.39 handle. Influenced by weak UK trade figures and a strong US dollar on risk aversion, H4 price ended the week crossing swords with a H4 demand seen at 1.3756-1.3794.

Potential trading zones:

Given the unit mildly pared losses from the noted H4 demand going into the close, we know that active buyers are (or were) present. For that reason, selling based on the higher-timeframe structure may not be the best path to take right now.

Waiting for the H4 demand to be consumed and retested as a resistance area would, in our opinion, not only be a safer method of shorting, but it’d also confirm bearish strength on the bigger picture and open up downside to the 1.37 handle, which, as you can probably see, is shadowed closely by the aforementioned weekly support.

For us, a sell on a retest of 1.3756-1.3794 would be considered an intraday trade, as active buyers highly likely reside around the 1.37 handle/ weekly support.

Data points to consider: No high-impacting events on the docket today.

Areas worthy of attention:

Supports: 1.37 handle; 1.3756-1.3794; 1.3683; 1.3616.

Resistances: 1.3848; 1.3878; 1.40/39 handle.

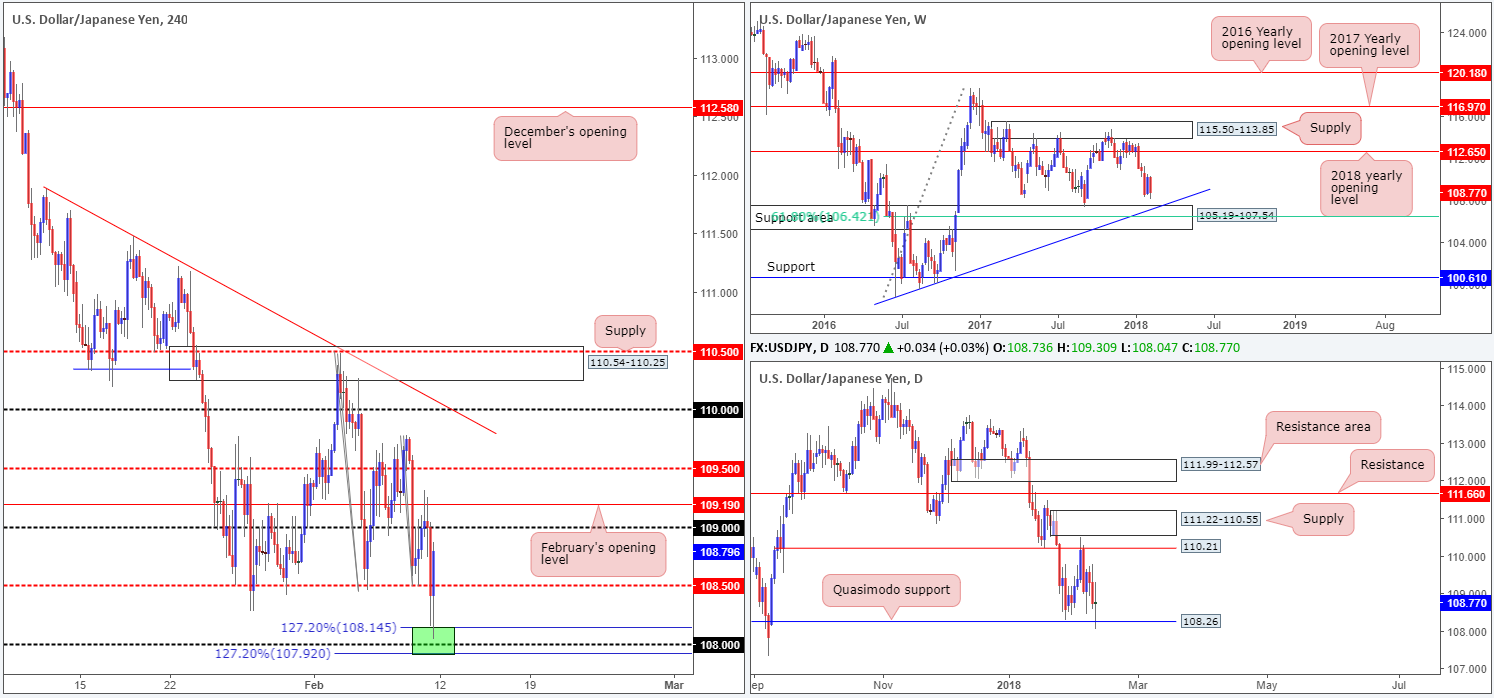

USD/JPY:

Weekly gain/loss: -1.20%

Weekly closing price: 108.77

For the past couple of weeks, we have seen weekly price base just ahead of a weekly support area at 105.19-107.54, which happens to intersect beautifully with a weekly trendline support etched from the low 98.78 and a weekly 61.8% Fib support at 106.42. Traders will also do well to remember that this weekly area has served this market since late 2013, so it is certainly not one to overlook!

Turning the focus down to the daily timeframe, one will see that the basing action on the weekly timeframe is likely due to daily price attempting to carve out a range between a daily Quasimodo support at 108.26 and a daily resistance logged in at 110.21. Also noteworthy here is the head of the aforementioned daily Quasimodo support is bolstered by the current weekly support area.

A quick recap of Friday’s movement on the H4 timeframe shows that the USD/JPY clocked fresh monthly lows of 108.04 amid risk aversion during US trading. The pair, as you can see though, quickly pared a large portion of immediate losses from the green H4 zone at 107.92/108.14 (comprised of two H4 127.2% Fib extensions and a psychological handle seen housed within at 108), as US equity prices rebounded.

Potential trading zones:

In a nutshell, this is what we have to work with right now:

- Weekly price could potentially drive down to 107.50ish to connect with the aforementioned weekly structures.

- Daily Quasimodo support in play at 108.26, but appears fragile given Friday’s daily indecision candle.

- H4 action somewhat restricted. Upside limited by the 109 handle and February’s opening line at 109.19.

This not a buyers’ market right now. Not only is weekly price pointing to a potential downside move, but nearby H4 structure is just too close for comfort!

The same goes for selling unfortunately. Yes, there is room on the weekly to press lower, and price may respond from 109.19/109 on the H4 timeframe. However, selling into a daily Quasimodo is not really a trade we’d label high probability.

Therefore, seeing as how there is not really a clear path today, remaining on the sidelines may be a better play.

Data points to consider: No high-impacting events on the docket today. Japanese banks closed in observance of National Foundation Day.

Areas worthy of attention:

Supports: 107.92/108.14; 108.50; 108.26; weekly trendline support; 105.19-107.54.

Resistances: 109 handle; 109.19; 110.21.

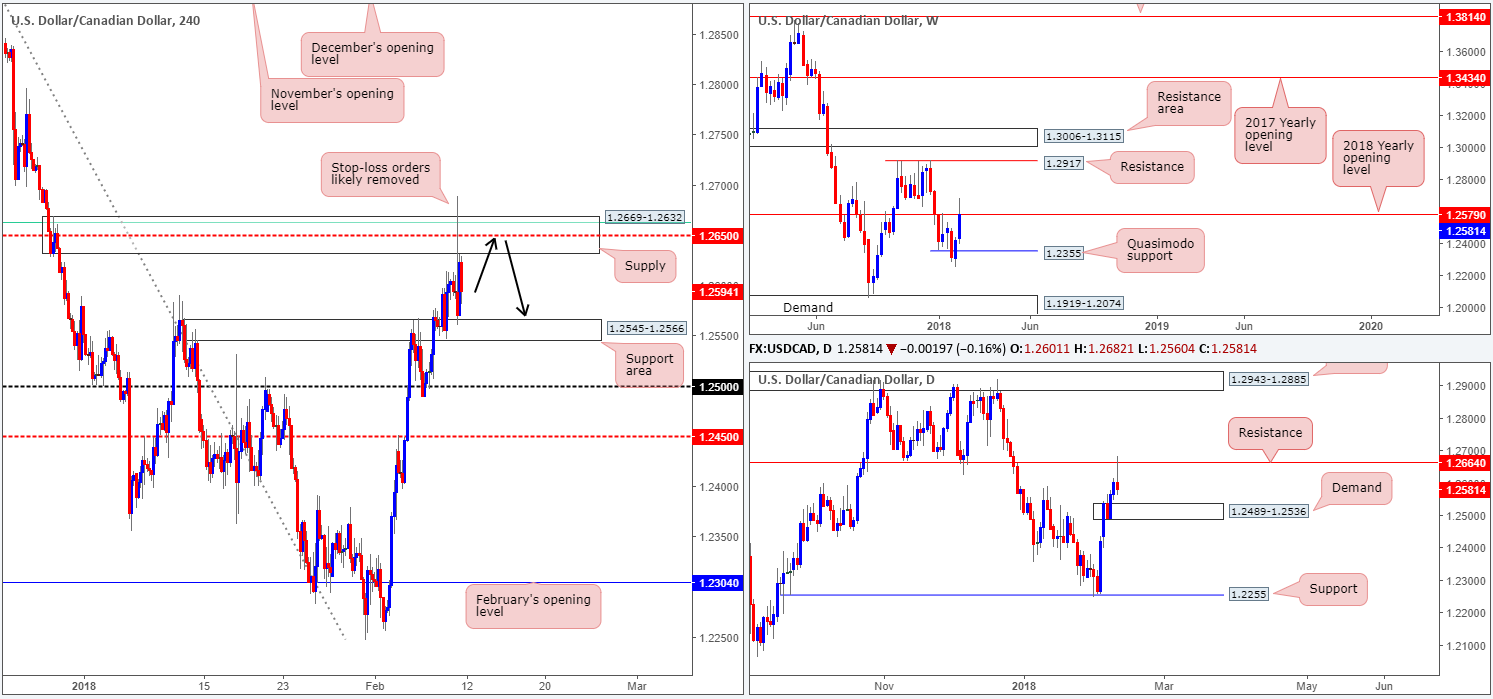

USD/CAD:

Weekly gain/loss: +1.24%

Weekly closing price: 1.2581

The USD/CAD enjoyed another successful week, bidding price to highs of 1.2688.

As is evident from the weekly timeframe, the week concluded trade around the 2018 yearly opening level at 1.2579. Selling interest from this region could lead to a move being seen down to challenge a weekly Quasimodo support level coming in at 1.2355. Alternatively, a move to the upside may call for a rally up to as far as 1.2917: a clear ceiling of weekly resistance.

As we move down to the daily timeframe, one can see that last week’s mild correction was (from a technical standpoint) likely due to a daily resistance level plotted at 1.2664. The result of this reaction formed a reasonably nice-looking daily selling wick, which has likely caught the attention of candlestick traders. Unfortunately, there’s limited downside on this scale as a daily demand area is seen at 1.2489-1.2536.

The impact of Friday’s less-than-stellar Canadian job’s print prompted an immediate spike to fresh tops of 1.2688, penetrating the top edge of a H4 supply at 1.2669-1.2632 and likely removing sellers’ stop-loss orders. The day ended with the unit closing mid-range between the said H4 supply and a nearby H4 support area drawn from 1.2545-1.2566, which is positioned a few pips above the aforesaid daily demand base.

Potential trading zones:

Should H4 price revisit the noted H4 supply area today/this week, a short trade could very well be an option. We say this not only because this area houses a H4 61.8% Fib resistance at 1.2663 and H4 mid-level resistance at 1.2650, it’s also due to the daily resistance level at 1.2664 being placed within the upper limits of the zone.

However, seeing as how the H4 zone was faked on Friday, sellers may be guarded. As such, you may want to consider waiting for additional H4 candle confirmation in the form of a H4 full or near-full-bodied bearish candle to take shape. This way you can be reasonably confident sellers are involved and price will likely reach the nearby H4 support area at 1.2545-1.2566, thus giving enough room to reduce risk to breakeven.

Data points to consider: No high-impacting events on the docket today.

Areas worthy of attention:

Supports: 1.2545-1.2566; 1.2489-1.2536; 1.2355.

Resistances: 1.2669-1.2632; 1.2664; 1.2579.

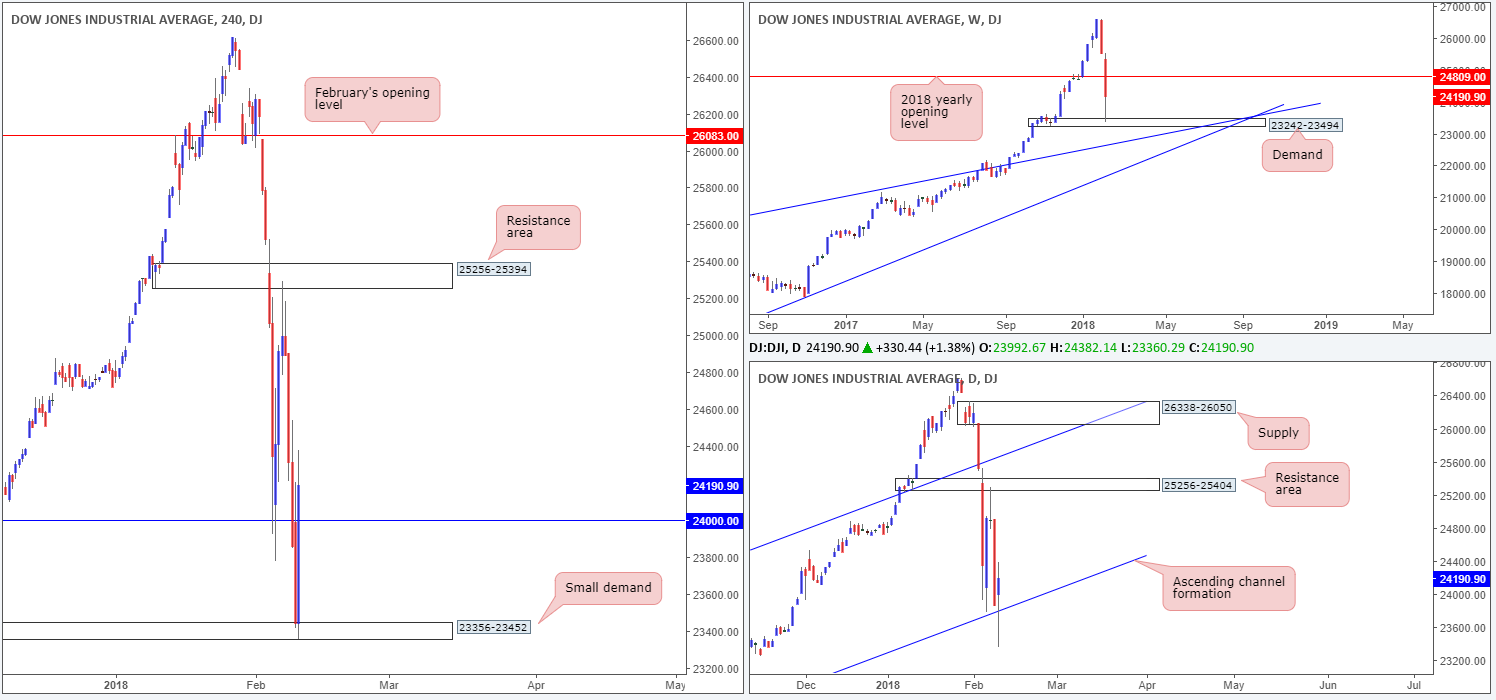

DOW 30:

Weekly gain/loss: -5.21%

Weekly closing price: 24190

US equity markets were once again under pressure last week, printing hefty losses amid concerns that faster-than-expected inflation will lead to more rate hikes this year.

Last week’s downside move, however, did find some refuge from a weekly demand base coming in at 23242-23494. Despite the week’s losses, the strong correction tail seen from here could encourage further buying this week and bring the index back up to the 2018 yearly opening level at 24809. This demand base was further bolstered by a daily channel support extended from the low 17883, which, on the daily scale, shows that its next upside target can be seen at 25256-25404: a daily resistance zone which held beautifully on Wednesday.

Branching over to the H4 timeframe, we can see that H4 price ended the day (Friday) 1.39% in the green after recovering from a small H4 demand base at 23356-23452 (seen positioned within the current weekly demand area).

Potential trading zones:

Given the H4 close back above 24K on Friday, and the strong correction seen from weekly demand mentioned above at 23242-23494 as well as the supporting daily channel support, further buying could be on the cards this week. With that being the case, should the H4 unit retest 24K as support today/early this week, a long trade could be an option (targeting the H4 resistance area at 25256-25394) as long as H4 price proves buyer intent here. What we mean by this is simply waiting for a H4 full or near-full-bodied bull candle to form, before pulling the trigger. That way you help avoid an unnecessary loss!

Data points to consider: No high-impacting events on the docket today.

Areas worthy of attention:

Supports: Daily channel support; 23242-23494; 23356-23452; 24000.

Resistances: 25256-25394; 25256-25404; 24809.

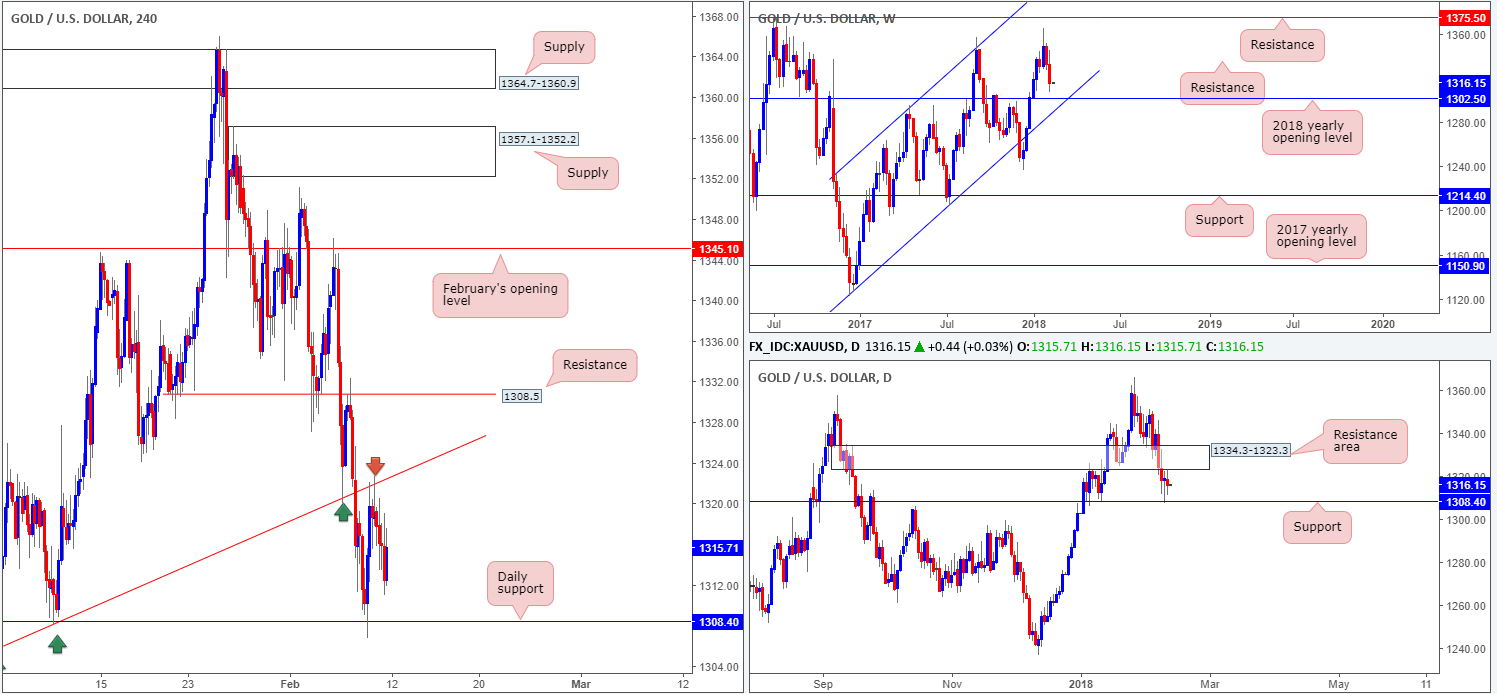

GOLD:

Weekly gain/loss: -1.27%

Weekly closing price: 1316.1

Commodity prices tumbled for a second consecutive session last week, as the US dollar made headway from a monthly support seen on the US dollar index at 88.50. As you can see from gold’s weekly chart, this has placed the yellow metal within a reasonably close distance to the 2018 yearly opening level at 1302.5 (and also a weekly channel support drawn from the low 1122.8), which may offer the market support in the event it is brought into the mix.

Turning the focus down to the daily timeframe, we can see that over the past few sessions price has been tightly consolidating between a daily support level coming in at 1308.4 and a daily resistance area printed at 1334.3-1323.3. A violation of the current support would likely give an early indication that we’re heading to the 2018 mark mentioned above.

A brief look at recent dealings on the H4 timeframe reveals that a recently broken H4 trendline support-turned resistance taken from the low 1305.6 remained in play on Friday, eventually forcing price to lows of 1311.0.

So, in short here’s what we’re looking at right now:

- Weekly flow on course to clash with the 2018 yearly opening level at 1302.5. We expect this line to at least bounce price.

- Daily price not offering much until either the current daily resistance area or the daily support is consumed.

- H4 movement also not presenting much in terms of near-term direction, as both the aforesaid H4 trendline resistance or daily support have equal chance of seeing action this week (the H4 trendline resistance merges with the daily resistance area).

Potential trading zones:

In the event that H4 price retraces and pays another visit to the noted H4 trendline, a sell from this region is attractive down to the noted daily support, as long as H4 proves seller intent beforehand. What we mean by this is price simply printing a H4 full or near-full-bodied bearish candle from the line.

Areas worthy of attention:

Supports: 1308.4; 1302.5; weekly channel support.

Resistances: H4 trendline resistance; 1334.3-1323.3.

This site has been designed for informational and educational purposes only and does not constitute an offer to sell nor a solicitation of an offer to buy any products which may be referenced upon the site. The services and information provided through this site are for personal, non-commercial, educational use and display. IC Markets does not provide personal trading advice through this site and does not represent that the products or services discussed are suitable for any trader. Traders are advised not to rely on any information contained in the site in the process of making a fully informed decision.

This site may include market analysis. All ideas, opinions, and/or forecasts, expressed or implied herein, information, charts or examples contained in the lessons, are for informational and educational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise.

The use of the site is agreement that the site is for informational and educational purposes only and does not constitute advice in any form in the furtherance of any trade or trading decisions.

The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets does not warranty, guarantee or make any representations, or assume any liability with regard to financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www.icmarkets.com.au, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness. All such information is subject to change at any time without notice. IC Markets assumes no responsibility for the content of any linked site. The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site.

IC Markets is not liable for any harm caused by the transmission, through accessing the services or information on this site, of a computer virus, or other computer code or programming device that might be used to access, delete, damage, disable, disrupt or otherwise impede in any manner, the operation of the site or of any user’s software, hardware, data or property.