Nowadays, you’d be hard pressed to go a day without reading or hearing about cryptocurrencies, and for good reason.

2017 proved to be the year of cryptocurrencies. Popular instruments achieved unprecedented growth, smashing record after record.

A universe once ruled by Bitcoin has seen a new band of cryptocurrencies emerge, such as Ethereum, Litecoin and Bitcoin cash.

Bitcoin (BTC/USD)

Bitcoin (BTC), first published in 2009 in a cryptography mailing list by Satoshi Nakamoto, has evolved into the most capitalised and traded cryptocurrency in the world. Bitcoin is a form of digital exchange, with each transaction logged on Bitcoin’s public database (blockchain). As things stand, Bitcoin’s volume is a staggering $5,653,320,192 (CoinMarketCap), seizing more than 50% of the overall market volume.

Currently, Bitcoin boasts gains in excess of 850% so far this year. Not bad for a year’s work.

Ethereum (ETH/USD)

Despite Ethereum (ETH) only being on the cryptocurrency stage since 2015, it controls the second largest market share of volume at $1,396,480,000 (CoinMarketCap). Ethereum is like Bitcoin. It operates using the same principles, though has its own unique technology.

While Bitcoin has witnessed exponential growth this year, it has been outperformed by ETH, which, at a current price of $480.36 (CoinMarketCap), is up more than 5500%. Absolutely monstrous gains by any stretch of the imagination.

Litecoin (LTCUSD)

Released in 2011, Litecoin (LTC) is often referred to as being the ‘silver’ to Bitcoin’s ‘gold’, as it’s technically identical, despite being cheaper. As of current price ($91.60), Bitcoin’s younger brother controls 2.95% ($429,591,008) of the overall market volume (CoinMarketCap).

Although controlling only a small piece of the crypto cake, Litecoin is up an astounding %1900 this year. Investing only $1000 at the start of the year, your account would now stand at a cool $19,000.

Bitcoin cash (BCH/USD)

Bitcoin cash (BCH) is essentially a duplicate of the Bitcoin blockchain, with one additional feature: extra block size capacity.

Released this year in August, the instrument trades at $1,622.57 (CoinMarketCap).

As of writing, BCH currently boasts a market cap of $27,300,835,485 and a volume reading of $1,391,459,968 (CoinMarketCap).

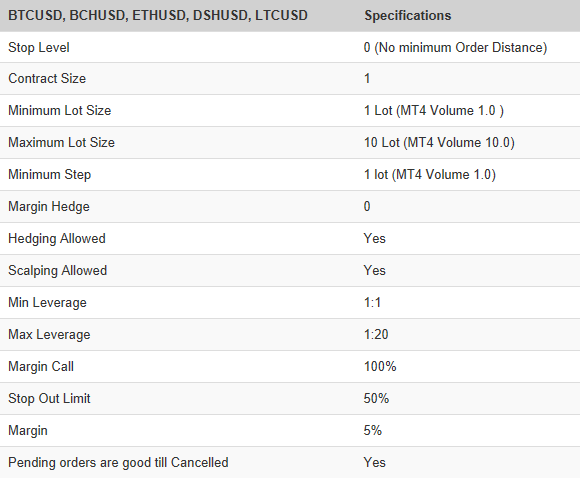

Specifications:

Bitcoin example:

- A 10-pip Bitcoin move: 5877.00 — 5878.00 = 10 pips.

- Margin calculation: current price (5877.00) * BTC size 1 / 20 leverage.

Jump aboard the cryptocurrency train with IC Markets

Aside from crypto’s rapid price movements, offering mouth-watering return on investment, here’s some other great reasons to trade cryptocurrencies with IC Markets:

- Structured platform. As opposed to some cryptocurrency exchanges, IC Markets is regulated by the Australian Securities and Investments Commission (ASIC), and is among the leading Australian brokers.

- IC Markets cryptocurrency products trade as a CFD, allowing clients to trade both long and short – a feature not available on most cryptocurrency exchanges. This means traders get exposure to cryptocurrency prices without worrying about the risks related to storing it, and counterparty risks from the exchange.

- Signing up for an IC Markets account is a simple process and can be opened with as little as $200.

Start Trading Cryptocurrencies

Trade Bitcoin, Ethereum, Litecoin, Dashcoin or Bitcoin cash against the US dollar in three simple steps:

- Register for an IC Markets account here: IC Markets Open Live Account

- Deposit funds.

- Select which cryptocurrencies CFDs you wish to trade.

Try a Demo Account or Open a Live Account

Cryptocurrencies are, undeniably, attention-grabbing instruments, with analysts forecasting further upside. Therefore, this is an exciting time to think about getting involved with these products.

Notes: