EUR/USD:

EUR/USD ran into decent resistance at 1.0615 overnight, and fell back to 1.0575. Nevertheless, short-term techs have turned bullish and it is likely that we will see a test of the late December high at 1.0650 soon.

Intraday support can be expected at 1.0550, but the key area traders should be watching is 1.0480/1.05, where EUR/USD is likely to encounter decent demand.

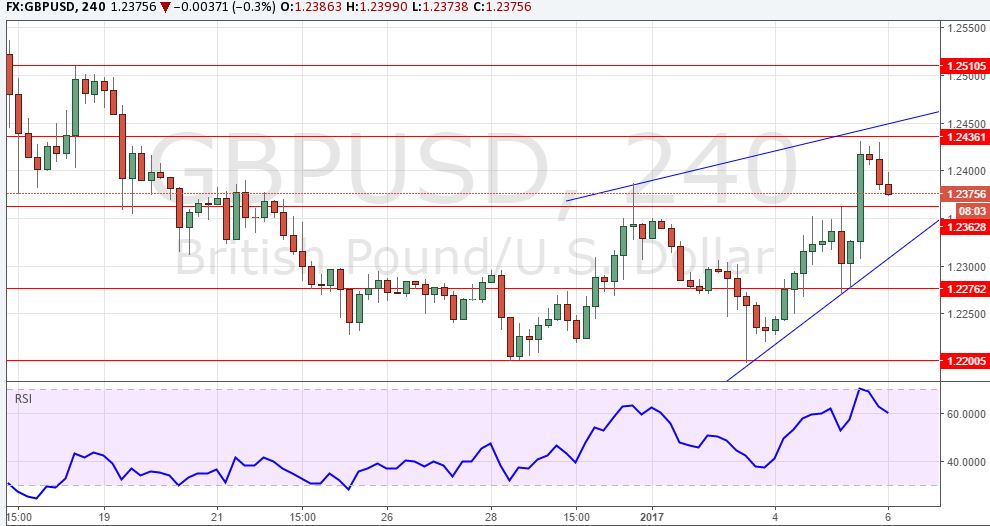

GBP/USD:

GBP/USD took out 1.2360 resistance without much difficulties yesterday, but decent resistance remains at 1.2435, which it has not been able to crack yet. Above that level, expect strong selling interest around the 1.25 level.

To the downside, support is now seen at 1.2360, followed by 1.2275. Overall, techs remain bearish, but if we see a solid bounce off 1.2360 support, it could signal an extension of the rally towards 1.25.

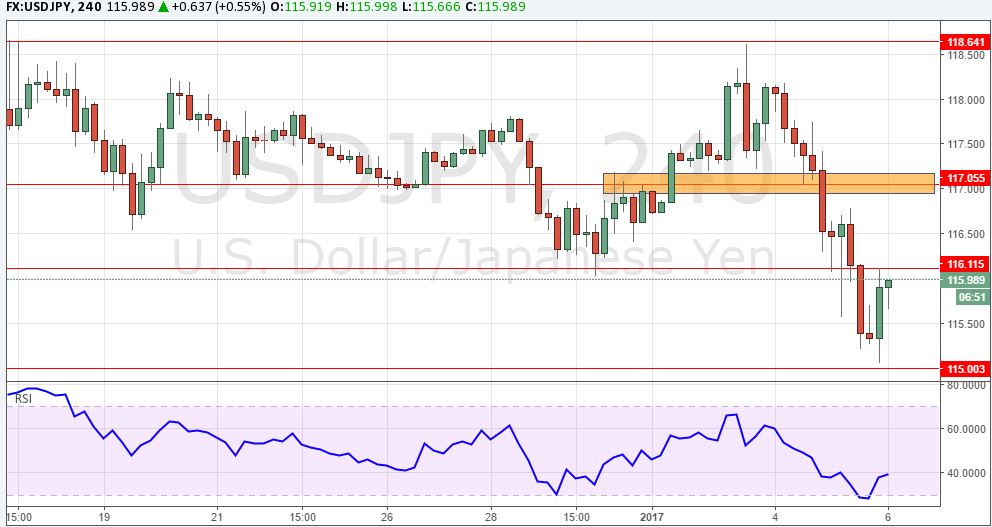

USD/JPY:

The break below 116 support yesterday triggered a lot of momentum selling and the pair eventually fell to 115.05.

While it has bounced in Asia, the short-term technical outlook has changed to negative, and traders looking to establish short positions should keep an eye on the former resistance area between 106.80 and 107.00.

AUD/USD:

The pair remains very well bid, even though it failed on the first try to break above 0.7355 resistance.

Nevertheless, further gains seem likely and decent support can be expected at 0.7280 and 0.7245/50.

NZD/USD:

NZD/USD was rejected at 0.7040, a level we highlighted in several of our previous tech reports. The New Zealand Dollar has been lagging, and it is less likely that it will be able to extend gains significantly from here, as 0.7040/50 resistance is tough.

We have also falling trendline resistance from the mid-November high. This makes long AUD/NZD also an attractive trade.

USD/CAD:

USD/CAD bounced off 1.32, but it would need a clear break above 1.3380 resistance for short-term techs to turn bullish again, which seems a bit far away at the moment.

Key support is seen at the rising trendline from the May 2016 low.

XAU/USD:

While $1180 resistance proved to be tough on the first try, momentum remains strong and further gains seem likely.

The key area to watch is still $1200-05, and a break above would pave the way for a $1250 test.