A note on lower-timeframe confirming price action…

Waiting for lower timeframe confirmation is our main tool to confirm strength within higher timeframe zones, and has really been the key to our trading success. It takes a little time to understand the subtle nuances, however, as each trade is never the same, but once you master the rhythm so to speak, you will be saved from countless unnecessary losing trades. The following is a list of what we look for:

- A break/retest of supply or demand dependent on which way you’re trading.

- A trendline break/retest.

- Buying/selling tails/wicks – essentially we look for a cluster of very obvious spikes off of lower timeframe support and resistance levels within the higher timeframe zone.

- Candlestick patterns. We tend to stick with pin bars and engulfing bars as these have proven to be the most effective.

We typically search for lower-timeframe confirmation between the M15 and H1 timeframes, since most of our higher-timeframe areas begin with the H4. Stops are usually placed 3-5 pips beyond confirming structures.

EUR/USD:

For those who read Thursday’s report you may recall our desk suggesting that the bears may have the upper hand in this market. As you can see, H4 price closed below the H4 support area at 1.0797-1.0780, and quickly retested it as a resistance. In view of the higher timeframes also challenging a weekly resistance level at 1.0819, we have entered short on the close of the previous H4 bear candle at 1.0783 and placed our stop above February’s opening level (1.0801) at 1.0807.

Our suggestions: With the closest the higher-timeframe support structure not coming into view until we reach the daily support area formed at 1.0714-1.0683, we feel our trade will reach the H4 demand at 1.0705-1.0723 which happens to be positioned around the top edge of the aforementioned daily support area.

Data points to consider: Eurozone PMI data at 8-9am. FOMC member Evans speaks at 12pm and US core durable goods orders comes in just after at 12.30pm GMT.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 1.0783 ([live] stop loss: 1.0807).

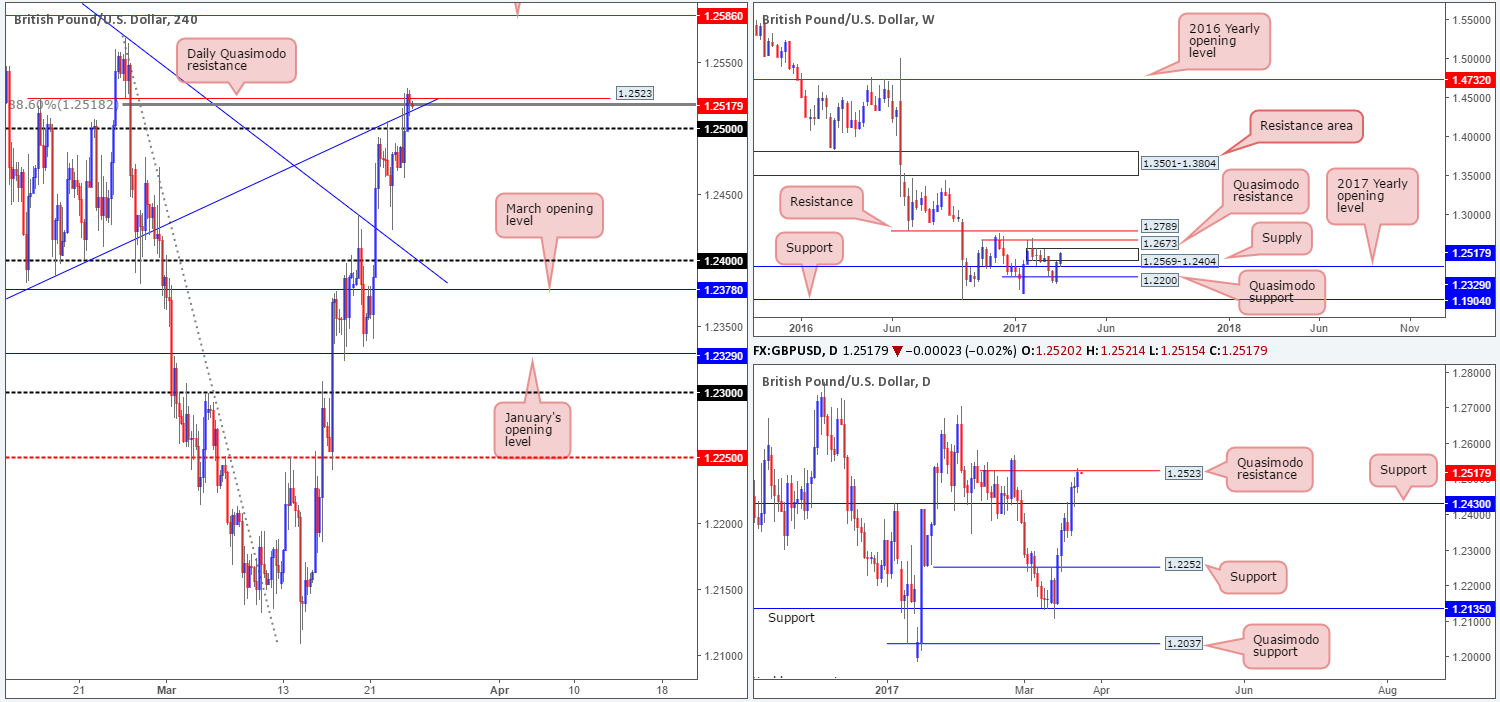

GBP/USD:

Daily bulls printed their third consecutive bullish candle yesterday, consequently lifting the pair up to a daily Quasimodo resistance line seen at 1.2523. This daily resistance, coupled with weekly price displaying supply at 1.2569-1.2404, places this market in overbought territory from a structural perspective.

However, given that the H4 candles recently closed above both the trendline resistance taken from the low 1.2346 and the 88.6% retracement seen at 1.2518, we’d need to see the bears not only close back below these structures, but also the nearby 1.25 handle, before our team considers shorting this pair.

Our suggestions: Ultimately, we’re recommending holding fire and waiting for the bears to prove themselves before committing. A decisive close beyond 1.25 would, in our view, be an important bearish cue to begin hunting for shorts on any retest seen to the underside of this region. Targets from this point can be seen at the H4 mid-way support logged at 1.2450, followed by the 1.24 handle.

Data points to consider: FOMC member Evans speaks at 12pm and US core durable goods orders comes in just after at 12.30pm GMT.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Watch for price to engulf 1.25 and then look to trade any retest seen thereafter (stop loss: dependent on the rejection candle, as we’d look to place the stop beyond the rejection candle’s wick).

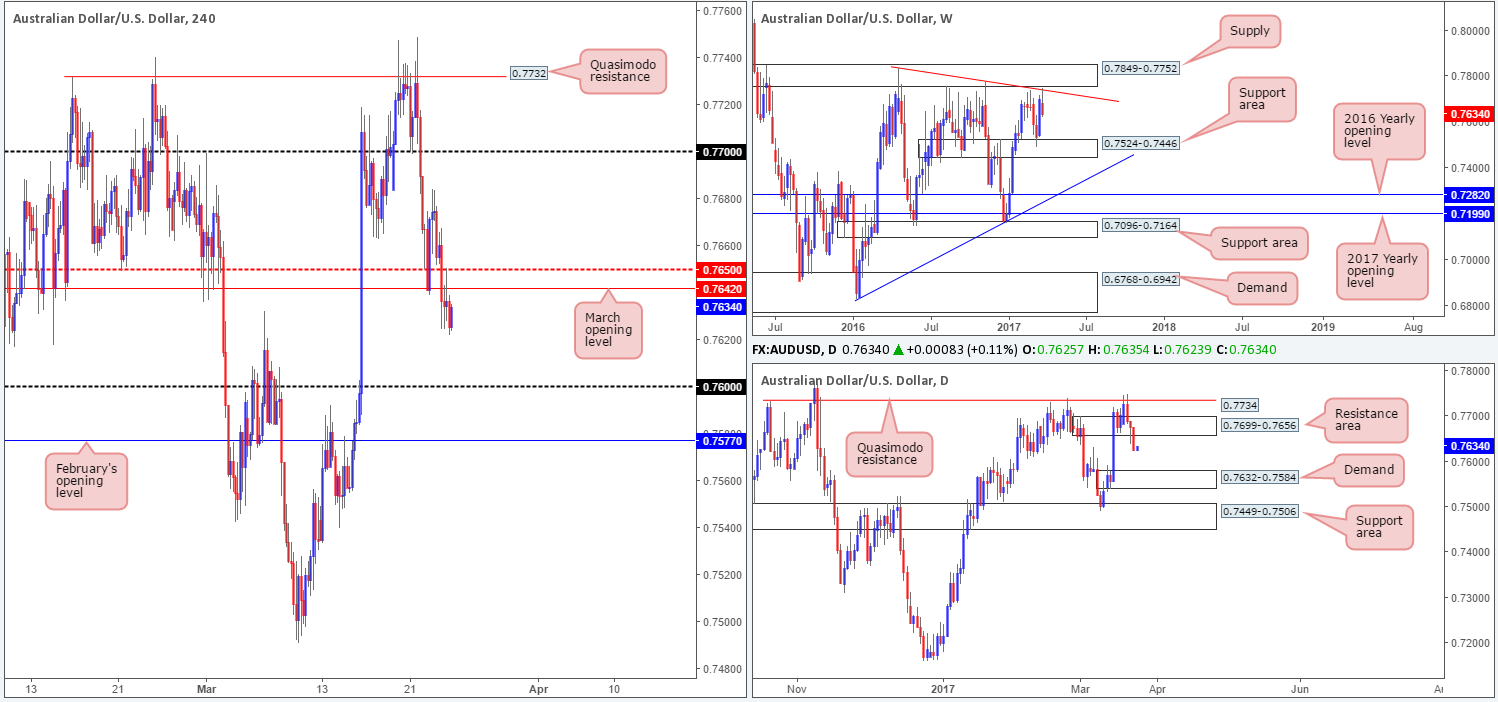

AUD/USD:

Working our way from the top this morning, weekly bears appear to be in fine form as they continue selling this market after clipping the underside of a trendline resistance taken from the high 0.7835. On the condition that this pair remains in the red, the next port of call can be seen at 0.7524-0.7446: a weekly support zone. In conjunction with weekly price, we can see that yesterday’s daily candle ran through the support area at 0.7699-0.7656, and has potentially opened up the runway south down to demand coming in at 0.7632-0.7584 (located a few pips above the aforementioned weekly support area).

Swinging across to the H4 chart, March’s opening level at 0.7642 is currently doing a superb job in holding the unit lower. The next area of focus from this angle is seen relatively close by at the 0.76 handle, followed by February’s opening level at 0.7577 (positioned within the above noted daily demand).

Our suggestions: Initially our team showed interest in shorting the underside of March’s opening base line. Unfortunately, we missed the first retest. Therefore, should we be lucky enough to witness price retest this level for a second time today, our desk would drill down to the lower-timeframe structure and hunt for a sell setup (see the top of this report), which would likely enable us to enter with a tighter stop, and thus increase risk/reward.

Data points to consider: FOMC member Evans speaks at 12pm and US core durable goods orders comes in just after at 12.30pm GMT.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 0.7642 region ([waiting for a lower-timeframe signal to form is advised before pulling the trigger] stop loss: dependent on where one confirms this area).

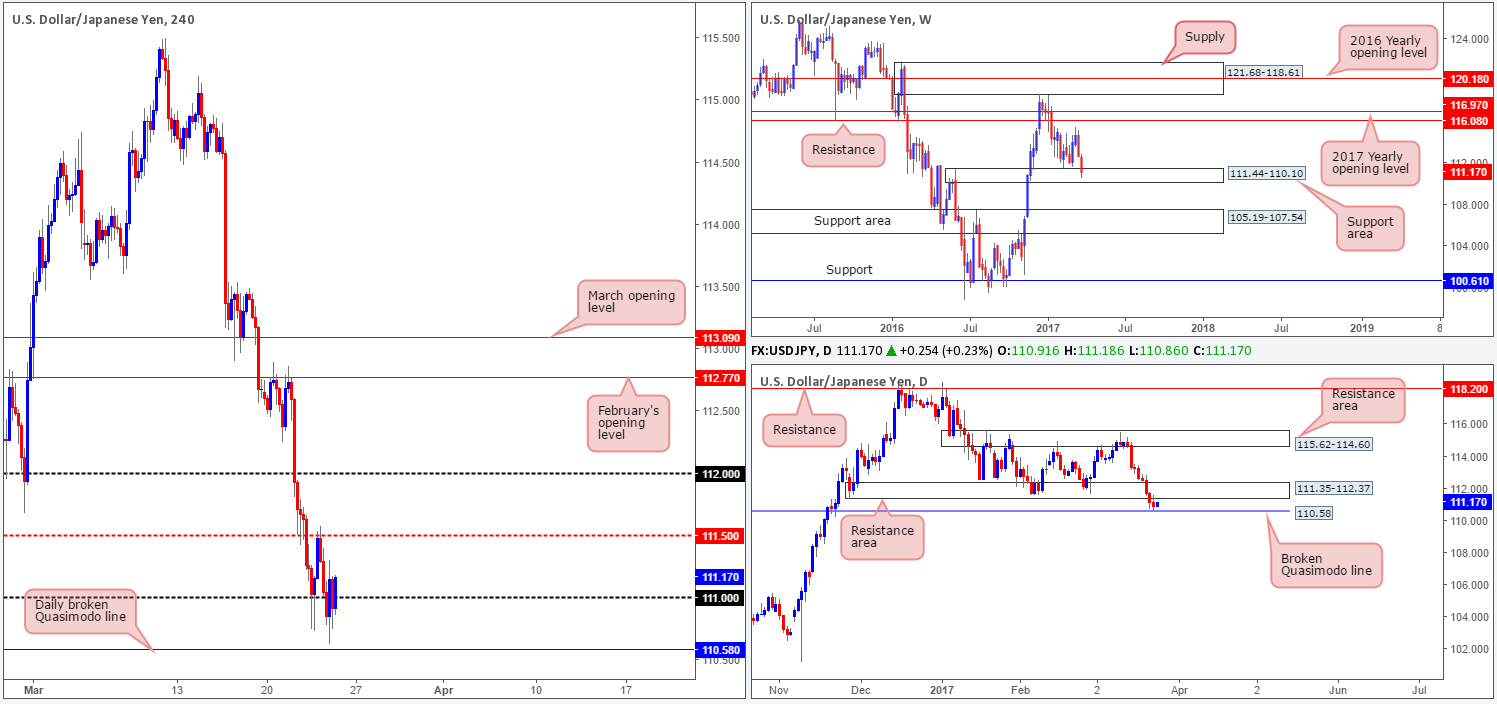

USD/JPY:

Despite the pair closing lower for its eighth consecutive day yesterday, weekly price remains trading within the walls of a support area at 111.44-110.10. In addition to this, daily action is also seen capped between a resistance area at 111.35-112.37 and a nearby broken Quasimodo line at 110.58.

Although the H4 candles are currently trading above the 111 handle, we do not see much to hang our hat at this level. For the time being, momentum looks stronger to the downside as very few bullish candles have printed over the past few days. Furthermore, a buy from here would place one in direct conflict with the underside of the above said daily resistance area. And a sell from this base would, of course, position one against potential weekly buyers from the support area (see above).

Our suggestions: While 111 could remain intact today, we would prefer to wait and see if price touches gloves with the daily broken Quasimodo line mentioned above at 110.58 before looking to go long. That way, traders have the option of placing their stops beyond the weekly support area and also have some room to play with up to the aforementioned daily resistance zone.

Data points to consider: FOMC member Evans speaks at 12pm and US core durable goods orders comes in just after at 12.30pm GMT.

Levels to watch/live orders:

- Buys: 110.58 region (stop loss: ideally beyond the current weekly support area at 110.08ish).

- Sells: Flat (stop loss: N/A).

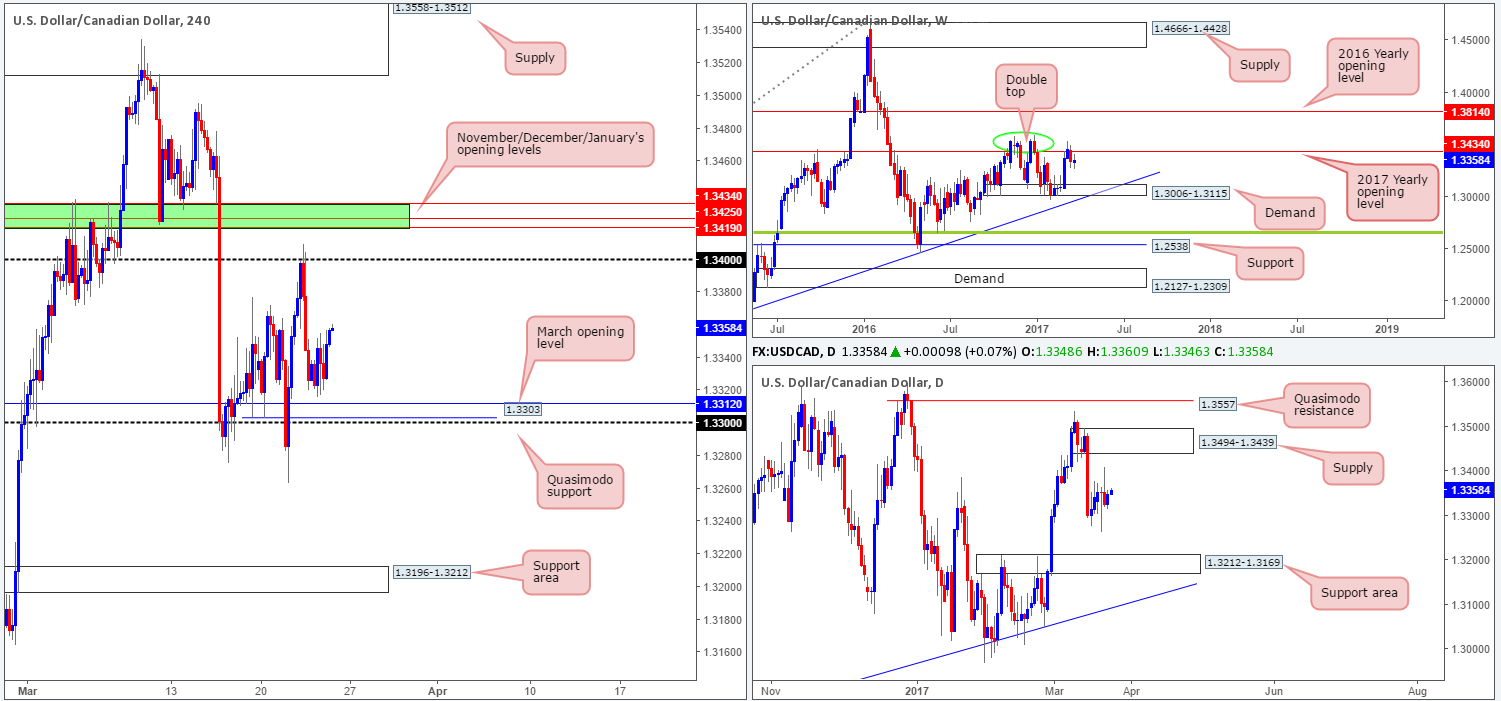

USD/CAD:

Price took on more of a subdued stance yesterday, ranging around 40 pips on the day. As of current (H4) price, the next area of focus to the upside can be seen at the 1.34 handle, followed closely by 1.3434/1.3419 (November, December and January’s opening levels). Beneath current price, however, we still have an eyeball on the 1.33/1.3312 neighborhood (a H4 Quasimodo support at 1.3303, the 1.33 handle and March’s opening base line at 1.3312).

Weekly action is currently seen trading below the 2017 yearly opening level at 1.3434, and shows room to drop lower from here. Daily flow on the other hand, offers very little in terms of direction at the moment, given that the unit is seen meandering mid-range between a supply coming in at 1.3494-1.3439 and a support area at 1.3212-1.3169.

Our suggestions: Essentially, we have our eye on two zones today:

1. The H4 1.33/1.3312 neighborhood. We would strongly advise waiting for a lower-timeframe confirming signal to take shape before pressing the buy button (see the top of this report), due to the lack of higher-timeframe confluence seen here.

2. The H4 1.3434/1.3419 region. When these monthly levels converge, we typically find that they hold firm the majority of the time offering at least a bounce. Also of note is the 1.34 handle. Psychological levels are prone to fakeouts, and with 1.3434/1.3419 lurking just above 1.34, we feel it’d be a fantastic barrier to help facilitate a fakeout.

Data points to consider: FOMC member Evans speaks at 12pm and US core durable goods orders comes in just after at 12.30pm. Canadian inflation report at 12.30pm GMT.

Levels to watch/live orders:

- Buys: 1.33/1.3312 ([waiting for a lower-timeframe buy signal to form is advised before pulling the trigger] stop loss: dependent on where one confirms this area).

- Sells: 1.3434/1.3419 ([waiting for a lower-timeframe sell signal to form is advised before pulling the trigger] stop loss: dependent on where one confirms this area).

USD/CHF:

Wednesday’s rebound from the 0.99 handle extended higher on Thursday, bringing the unit up to within touching distance of a H4 broken Quasimodo line at 0.9951. While this level also converges nicely with a daily resistance pegged at 0.9950 and a H4 61.8% Fib resistance planted at 0.9956, we have to take into account that weekly price is trading back above the weekly trendline support taken from the low 0.9443.

Before our desk considers buying this market, the daily supply zone at 1.0001-0.9957 would need to be engulfed. A sell from the 0.9950 region on the other hand, is something that interests us. Yes, by selling here, you’re effectively shorting into potential weekly flow, but given the confluence surrounding this number, a bounce will likely be seen.

Our suggestions: To be on the safe side, a short from 0.9950 will only be considered valid should we manage to pin down a lower-timeframe sell signal (see the top of this report). From that point, the 0.99 barrier would the first take-profit zone.

Data points to consider: FOMC member Evans speaks at 12pm and US core durable goods orders comes in just after at 12.30pm GMT.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 0.9950 region ([waiting for a lower-timeframe sell signal to form is advised before pulling the trigger] stop loss: dependent on where one confirms this area).

DOW 30:

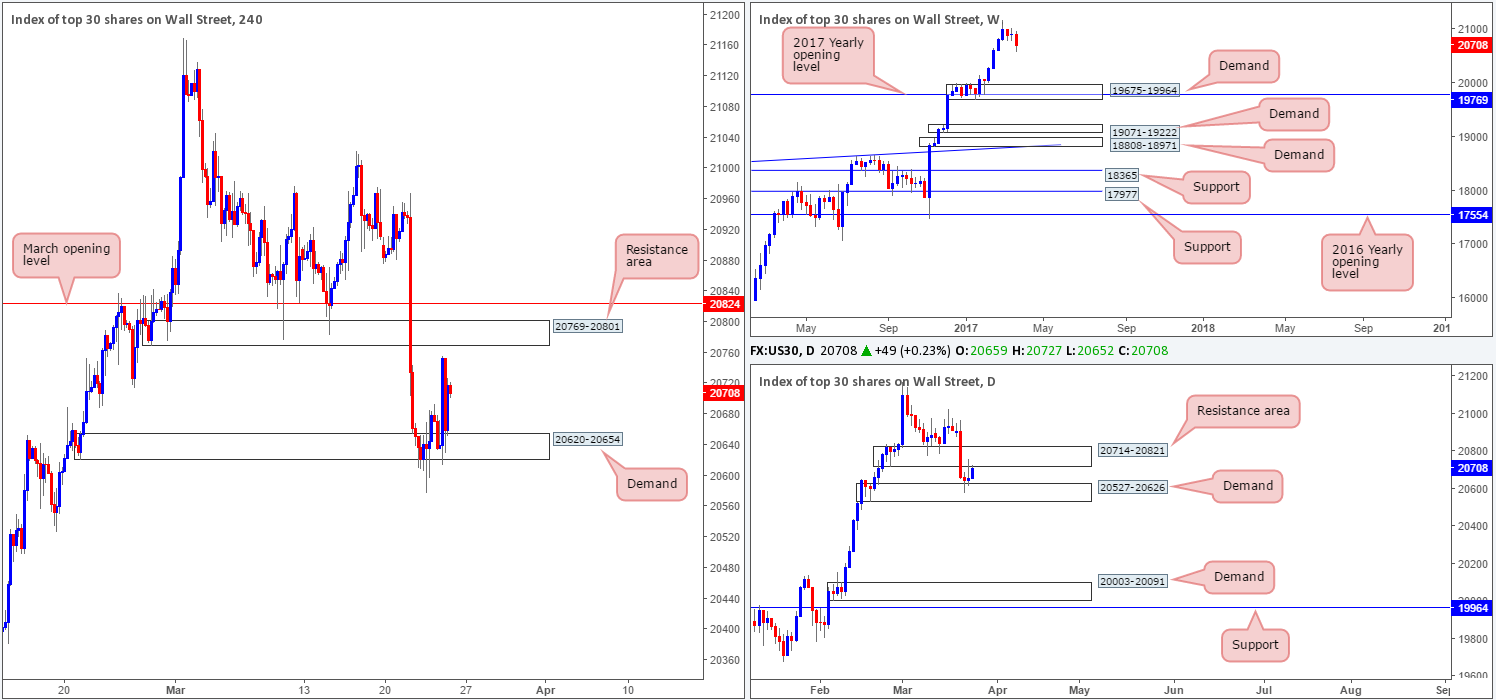

Thanks to the daily resistance area seen printed at 20714-20821, daily flow chalked in a relatively aggressive selling wick yesterday. Over on the H4 chart, demand at 20620-20654 remains intact despite suffering multiple whipsaws. The next area of concern on this scale can be seen at 20769-20801: a resistance area that’s shadowed closely by March’s opening base line at 20824. The weekly chart recently topped at a record high of 21170, and shows room to drop down as far as the demand area at 19675-19964, which happens to fuse with the 2017 yearly opening level at 19769.

Our suggestions: With the daily candles sandwiched between the aforementioned resistance area and demand zone at 20527-20626, trading this market is tricky, especially as H4 price is also trading mid-range between the above noted H4 demand and resistance area!

As such, we intend on remaining flat into the close and reassessing the situation on Monday.

Data points to consider: FOMC member Evans speaks at 12pm and US core durable goods orders comes in just after at 12.30pm GMT.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Flat (stop loss: N/A).

GOLD:

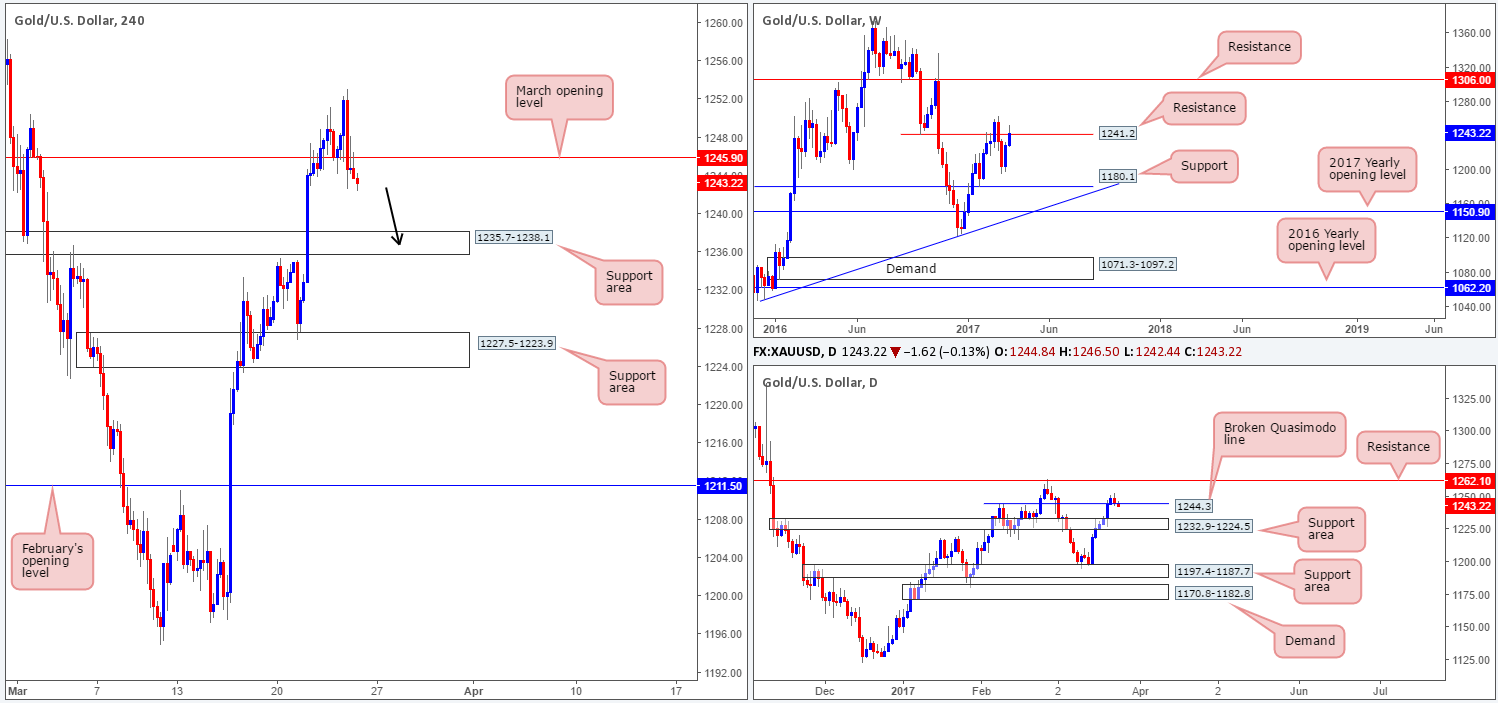

Going into the early hours of yesterday’s US segment, the yellow metal traded to a high of 1253.0 and then aggressively plunged back below March’s opening level at 1245.9. As of current price, H4 action looks to be on course to connect with the support area coming in at 1235.7-1238.1. By the same token, the weekly chart shows that the buyers and sellers continue to battle for position around the resistance line pegged at 1241.2, and daily flow is trading back below the Quasimodo resistance at 1244.3.

Our suggestions: With the recent developments, and the recently closed H4 bearish candle formed at the underside of 1245.9, we believe a short in this market is valid with stops above the H4 candle wick (1246.5) at 1247.0, and an initial take-profit objective set at the H4 support area drawn from 1235.7-1238.1. However, seeing as how the team is already short the EUR, we’ll pass on this setup.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Shorting at current price is valid, in our opinion, with stops placed at 1247.0