Key risk events today:

Limited.

(Previous analysis as well as outside sources – italics).

EUR/USD:

Weekly gain/loss: +4.06%

Weekly close: 1.1132

Weekly perspective:

Leaving the 2017 yearly opening level at 1.0515 unchallenged, EUR/USD staged an impressive recovery off multi-year lows at 1.0635 last week.

Adding more than 430 points and recapturing all of the prior week’s losses, long-term flow made its way through the 2016 yearly opening level at 1.0873, potentially setting the stage for an approach to Quasimodo resistance at 1.1239.

Daily perspective:

Following a test of lows plotted just north of Quasimodo support from 1.0630 at the beginning of the week, by way of a long-legged doji indecision candle, trading volume increased to the upside. Thursday engulfed resistance at 1.0995, followed by a retest of the latter Friday that saw a break of resistance at 1.1075 and the 200-day SMA (orange – 1.1082). Both now serve as feasible support.

This may pave the way for further gains this week to resistance at 1.1239, essentially denoting the same level as the weekly Quasimodo resistance highlighted above.

H4 perspective:

Although Italy’s COVID-19 cases close in on the 100k mark and Spain’s count trailing not too far behind, the single currency caught a healthy bid against the buck into US hours Friday. This followed an earlier retreat from 1.11/1.1065 (green), a resistance area noted in Friday’s technical briefing, made up of the 50.0% retracement ratio at 1.1065, February’s opening level at 1.1094 and the 1.11 handle.

Technicians may also want to note the relative strength index (RSI) is seen testing overbought terrain.

Clearance of 1.11 builds a foundation to approach 1.12 this week, closely followed by January’s opening level at 1.1222, which also represents a Quasimodo resistance (blue arrow).

Areas of consideration:

With all three timeframes exhibiting scope to explore higher ground this week, a retest at 1.11, albeit factoring in the possibility of a fakeout through to daily support at 1.1075, may be on the cards. Successfully holding 1.1075/1.11, preferably by way of a H4 bullish candlestick pattern, may tempt buyers into the market early week for moves to 1.12ish, with the possibility of extending to weekly resistance plotted at 1.1239, a strong upside target for bullish scenarios.

In the event the above comes to fruition, buyers will likely begin offloading long positions at 1.1239 and consider bearish scenarios south of 1.12.

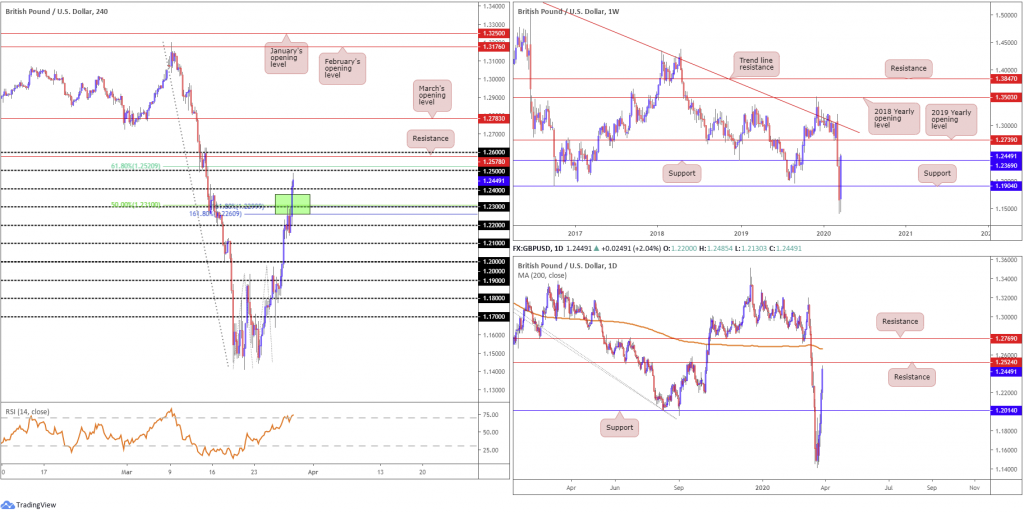

GBP/USD:

Weekly gain/loss: +6.78%

Weekly close: 1.2449

Weekly perspective:

A markedly healthier week for sterling, after clocking lows not seen since 1985, the pair registered gains of nearly 800 points, eclipsing the prior week’s losses and overcoming resistance at 1.1904 and 1.2369, both now representing support levels.

The next upside target for the week ahead falls in around the 2019 yearly opening level at 1.2739, with a break exposing long-term trend line resistance, taken from the high 1.5930.

Daily perspective:

Aside from Monday’s modest decline, the pound capitalised on the dollar’s decline and continued short covering.

After crossing above resistance at 1.2014 (now a serving support), resistance lies in wait around the 1.2524 neighbourhood, trailed closely by the 200-day SMA (orange – 1.2663).

H4 perspective:

A brief recap of Friday’s price action on the H4 timeframe reveals attempted rejection from 1.2369/1.2260 (the green zone). Comprised of weekly resistance at 1.2369, a 50.0% retracement ratio at 1.2310, the 1.23 handle and two 161.8% Fibonacci extension levels at 1.2299 and 1.2260, the area delivered little, lifting price north of 1.24 into the close along with the relative strength index (RSI) into overbought space.

The key observation on the H4 scale going forward is the 1.25 handle and 61.8% Fibonacci retracement ratio at 1.2520. A violation of this region could persuade further gains to resistance at 1.2578, taken from July 2019, and the round number 1.26.

Areas of consideration:

Higher-timeframe projections on the weekly timeframe forecasts additional gains this week until shaking hands with 1.2739.

Against the backdrop of longer-term flow, however, the 1.25 handle on the H4 may pose problems for buyers this week, owing to its convergence with a 61.8% Fibonacci retracement ratio at 1.2520 and daily resistance thrown in at 1.2524. Therefore, 1.2524/1.25 could be an area countertrend traders look to fade this week, targeting 1.24.

The next port of resistance falls in around the 1.26 handle on the H4 timeframe, enhanced by a H4 resistance level plotted at 1.2578, with the possibility of a fakeout seen to the 200-day SMA at 1.2663.

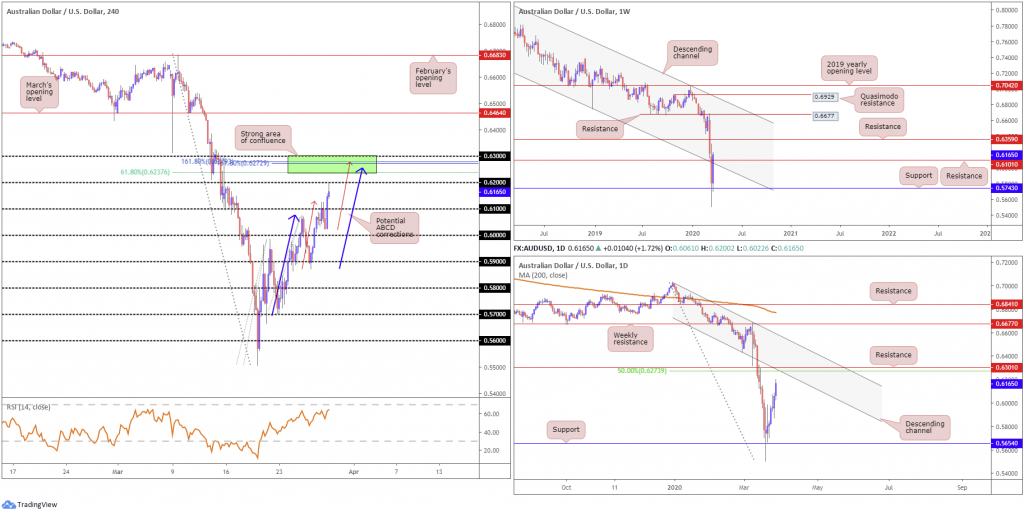

AUD/USD:

Weekly gain/loss: +6.17%

Weekly close: 0.6165

Weekly perspective:

The Australian dollar wrapped up the week a touch off best levels, accruing vigorous gains against the greenback exceeding 350 points.

While a slump could emerge this week, having seen weekly price only marginally close above channel support-turned resistance, taken from the low 0.6744, and resistance at 0.6101, skies remain clear for a push to resistance coming in at 0.6359.

Daily perspective:

Starved of resistance, following a rejection off support at 0.5654 in the shape of a doji candlestick pattern, focus has shifted to resistance at 0.6301. Joined closely with a 50.0% retracement ratio carved in at 0.6273 and a channel support-turned resistance, extended from the low 0.6433, this area could be an issue for buyers this week.

H4 perspective:

After tripping buy-stop liquidity above 0.61 Friday, European morning trade dipped to lows of 0.6023, though managed to latch onto a strong bid into US hours as the USD decline deepened. Recent hours saw a mild rejection develop off 0.62, underlining the possibility a retest may form at 0.61 this week.

What’s also notable from a technical perspective on the H4 timeframe is two potential ABCD corrections (blue/red arrows), terminating at 0.6255 and 0.6281. Joining this region is the 0.63 handle, two 161.8% Fibonacci extensions at 0.6279 and 0.6272, a 61.8% Fibonacci retracement at 0.6237 and daily resistance at 0.6301 (green).

The relative strength index (RSI), for those who follow momentum-based indicators, loiters around 65.00, a touch south of traditional overbought ground.

Areas of consideration:

Traders’ crosshairs are likely fixed on 0.63ish and surrounding confluence (0.63/0.6237) as an upside target for any long positions this week.

Further to this, 0.63/0.6237 also represents a potential spot to consider bearish setups, in view of the supporting structure.

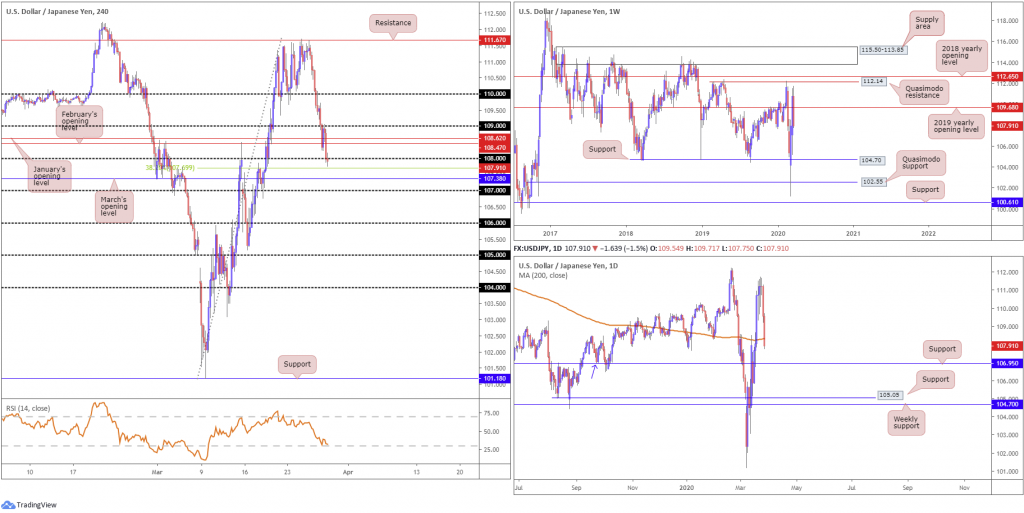

USD/JPY:

Weekly gain/loss: -2.57%

Weekly close: 107.91

Weekly perspective:

Leaving Quasimodo resistance at 112.14 unopposed, USD/JPY pared a large portion of the prior-week’s gains last week, wiping off more than 280 points.

Sustained downside this week is free to navigate lower levels until touching gloves with a familiar area of support coming in at 104.70.

It might also interest some traders to note 104.70 denotes the lower boundary of a multi-month range between the said base and Quasimodo resistance mentioned above at 112.14.

Daily perspective:

Entering the later stages of the week, the US dollar surrendered considerable ground to the Japanese yen, with USD/JPY eventually dipping its toes south of the 200-day SMA (orange – 108.30) and exposing feasible support off 106.95. Note the said support level was a prior Quasimodo support (blue arrow).

H4 perspective:

Against the yen, the dollar fell 1.50% Friday to 107.91 yen, as the US dollar index handed back more gains, crossing through 99.00 with eyes now on 98.00.

Technical development on USD/JPY had the candles dip to waters south of 1.08 into the close, following a retest at the underside of 109 amid early London that cleared February and January’s opening levels at 108.47 and 108.62, respectively.

Sidestepping 1.08 this week shines the torch on nearby support by way of a 38.2% Fibonacci retracement from 107.69, March’s opening level at 107.38 and the 107 handle. Note daily support at 106.95 may reinforce the 107 base.

Areas of consideration:

Although beneath 1.08 is filled with two possible H4 supports, higher-timeframe direction points to moves toward the 1.07 neighbourhood. For that reason, we may witness intraday action continue to sag in the early stages of the week, providing potential opportunity to profit on the short side.

With a portion of sell-stop liquidity filled under 108, a decisive retest of the latter this week would be a welcomed sight for most price-action based technicians, targeting 1.07 as the initial take-profit zone.

USD/CAD:

Weekly gain/loss: -2.54%

Weekly close: 1.3971

Weekly perspective:

Off best levels ahead of January 18th high at 1.4690 (2016), USD/CAD clawed back the majority of the prior week’s advance, shedding 360 points into the week’s end.

This saw the return of channel resistance-turned support, extended from the high 1.3661, albeit offering little respite, with eyes on the 2016 yearly opening level at 1.3814 as support this week.

Daily perspective:

Wednesday poured cold water over support at 1.4292 (now a serving resistance), with Friday concluding the week a touch beneath support priced in at 1.4000, also now serving as a possible resistance this week.

Well-grounded support rests close by at 1.3807, with additional layers of support exposed at 1.3653 and 1.3520. With respect to the 200-day SMA (orange – 1.3266), we are turning higher after drifting lower since August 2019.

H4 perspective:

Friday had the Bank of Canada (BoC) lower its target for the overnight rate by 50 basis points to ¼ percent. This unscheduled rate decision brings the policy rate to its effective lower bound and is intended to provide support to the Canadian financial system and the economy during the COVID-19 pandemic (Bank of Canada press release).

USD/CAD caught a short-lived bid to highs of 1.4154 in response to the BoC’s surprise rate cut, though persistent selling observed in the US dollar index south of 100.00 erased USD/CAD daily gains out of a noted support area between 1.3961, a 50.0% retracement at 1.3983, the 1.40 handle, a 127.2% Fibonacci extension point at 1.4020 and an ABCD (black arrows) completion around 1.4040 (upper green).

Levels beyond 1.3961/1.4040, assuming we overthrow 1.39, points towards 1.3781/1.3841 (lower green), made up of H4 support at 1.3781, the 1.38 handle, a 61.8% Fibonacci retracement at 1.3822 and a 161.8% Fibonacci extension point at 1.3841.

Areas of consideration:

Weekly price suggests an extension to the downside might be in store this week to the 2016 yearly opening level at 1.3814. This, along with daily price also indicating a run to support at 1.3807, the 1.3781/1.3841 H4 support zone is perhaps on the radar this week as a downside target for any short sales.

1.3781/1.3841 will also likely be interpreted as a potential reversal zone, not only due to its H4 confluence, but also given weekly and daily support reside within the area as well (1.3814/1.3807).

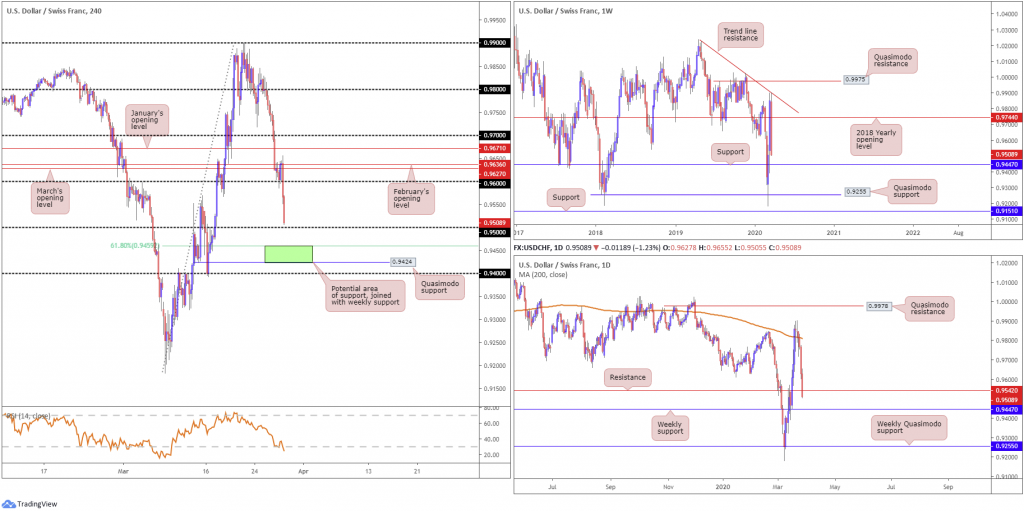

USD/CHF:

Weekly gain/loss: -3.49%

Weekly close: 0.9508

Weekly perspective:

Organised as a near-full-bodied weekly bearish candle, the US dollar fell 340 points against the Swiss franc over the course of last week, after fading trend line resistance, etched from the high 1.0236, and swarming the 2018 yearly opening level at 0.9744.

The outlook on the weekly timeframe appears prepped for additional loss this week to support at 0.9447, with a break exposing Quasimodo support at 0.9255.

Daily perspective:

After taking hold of the 200-day SMA (orange – 0.9811), support coming in at 0.9542 (now a serving resistance) gave way Friday, perhaps confirming a visit to weekly support at 0.9447 this week. However, this does not rule out the possibility of a retest at 0.9542 before trekking lower.

H4 perspective:

Despite a modest uptick from 0.96 Friday, candle structure failed to sustain gains north of February’s opening level at 0.9636, collapsing amid US hours on the back of broad-based USD selling.

Enveloping orders around the 0.96 handle, shaped by way of two dominant near-full-bodied bearish candles, has likely laid the foundation for a move to 0.95 in early trade this week.

0.95, owing to a lack of local support or higher-timeframe convergence, is unlikely to offer much respite if challenged. 0.9459, the 61.8% Fibonacci retracement ratio, is a more appealing support as it aligns closely with weekly support at 0.9447, albeit with the possibility of a whipsaw forming to a nearby H4 Quasimodo support at 0.9424.

Indicator-based traders will also note the relative strength index (RSI) testing oversold territory.

Areas of consideration:

Higher-timeframe direction suggesting scope for lower levels this week, at least until reaching weekly support at 0.9447, points to the possibility of 0.95 giving way on the H4 timeframe.

Intraday bearish scenarios sub 0.95, therefore, are an idea, though pencil in the 61.8% Fibonacci retracement ratio at 0.9459 as the initial downside target. It is around this neighbourhood, chart studies portend a reversal to the upside, bolstered by weekly support highlighted above at 0.9447 and the H4 Quasimodo support at 0.9424 (green).

With the possibility of a fakeout materialising to 0.94, however, some buyers may seek additional candlestick confirmation before pulling the trigger, targeting 0.95 as the initial port of call to the upside.

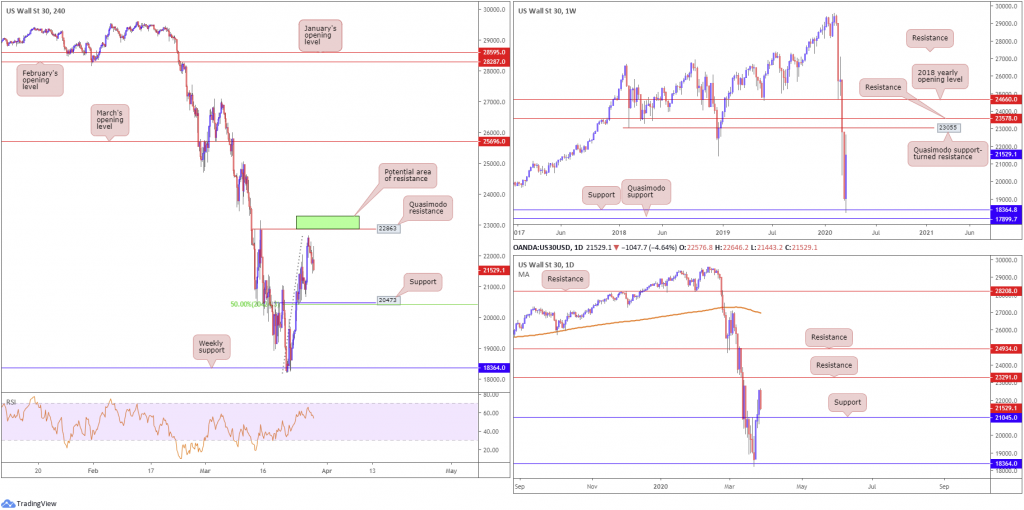

Dow Jones Industrial Average:

Weekly gain/loss: +13.15%

Weekly close: 21529

Weekly perspective:

Reclaiming 70% of the prior week’s losses off support at 18364 last week, price has Quasimodo support-turned resistance at 23055 surfacing nearby, closely shaded by resistance parked at 23578.

Both levels are worthy contenders for the watchlist this week.

Daily perspective:

Lower on the curve, daily activity retested support coming in from 21045 Thursday. Follow-through gains failed to materialise Friday, however, shifting eyes away from resistance at 23291 back to support mentioned above at 21045.

H4 perspective:

Major US benchmarks slumped Friday, snapping a three-day bullish phase as investors’ focus remains on the economic fallout from the coronavirus pandemic. The Dow Jones Industrial Average declined 915.39 points, or 4.06%; the S&P 500 also erased 88.60 points, or 3.3%, and the tech-heavy Nasdaq 100 concluded lower by 308.75 points, or 3.91%.

The candles retested support at 20473 Wednesday and rallied to highs at 22585 Thursday, closing within striking distance of Quasimodo resistance at 22863. Friday’s decline repositioned the spotlight back towards support at 20473 (alongside a 50.0% retracement at 20433), though before reaching this far south, daily support at 21045 is set to make an appearance.

Areas of consideration:

Having seen weekly price trade within striking distance of resistance around 23055, there’s a chance we may witness this level enter the fold this week. In addition, H4 chart studies, to the upside, points the finger towards possible resistance emerging off a Quasimodo formation at 22863, along with daily price revealing resistance at 23291.

In light of the confluence 23291/22863 brings to the table (green H4), a H4 bearish candlestick configuration printed from this zone this week could trigger a wave of selling.

H4 support is also an area worth keeping an eye on this week, which aligns with 50.0% retracement support at 20433. However, do remain aware a test of this level involves a breach of daily support at 21045, which given it held last Thursday, remains feasible support as well.

XAU/USD (GOLD):

Weekly gain/loss: +8.50%

Weekly close: 1626.1

Weekly perspective:

Adding nearly $130, demand for the yellow metal intensified last week, consequently clawing back a large portion of lost ground realised over recent weeks.

Conquering resistance at 1536.9 (now a serving support), focus has shifted to resistance at 1681.1, with a break underlining Quasimodo resistance at 1741.9.

Daily perspective:

Meanwhile, daily price recently made its way through resistance at 1550.3, now a serving support level. Like the weekly timeframe, daily movement exhibits scope to firm as far north as weekly resistance at 1681.1, followed by daily Quasimodo resistance at 1689.3.

H4 perspective:

H4 price remains facing off with supply at 1650.3-1633.3 (green), though is showing signs of weakening. Mid-week observed price break out of a tight bullish flag pattern (1643.1/1601.7) – generally considered a continuation pattern. Interestingly, another potential bullish flag pattern materialised at the tail end of the week (1645.5/1613.7).

Engulfing the said supply, could land Quasimodo resistance in the net at 1667.7, followed by the bullish flag take-profit target at 1680.3 (blue arrows), the weekly resistance at 1681.1 and then the daily Quasimodo resistance at 1689.3.

In terms of the relative strength index (RSI) we have the value meandering a touch south of overbought territory.

Areas of consideration:

Ultimately, given the room visible to press higher on the higher timeframes, traders will likely look to pyramid current long positions if we print a H4 close out of the recent H4 bullish flag, targeting H4 Quasimodo resistance at 1667.7 as the initial upside base.

The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets does not warranty, guarantee or make any representations, or assume any liability regarding financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www.icmarkets.com.au, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness. All such information is subject to change at any time without notice. IC Markets assumes no responsibility for the content of any linked site.

The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site. IC Markets is not liable for any harm caused by the transmission, through accessing the services or information on this site, of a computer virus, or other computer code or programming device that might be used to access, delete, damage, disable, disrupt or otherwise impede in any manner, the operation of the site or of any user’s software, hardware, data or property.