Key risk events today:

Australia Building Approvals m/m; Australia Company Operating Profits q/q; Caixin Manufacturing PMI; US ISM Manufacturing PMI.

EUR/USD:

Weekly gain/loss: -0.02%

Weekly close: 1.1015

Weekly perspective:

Longer-term flow continues to echo a bearish vibe, languishing south of a long-standing resistance area at 1.1119-1.1295. Since the beginning of November 2018, the pair has also remained compressed within a descending channel, formed from a high set at 1.1569 and a low of 1.1109.

Further selling going forward has the lower boundary of the descending channel to target, which happens to merge closely with the 2016 yearly opening level at 1.0873.

Concerning trend direction, the primary downtrend has been in motion since topping in early 2018 at 1.2555.

Daily perspective:

Last week’s price action was somewhat docile, confined to a narrow range of 50 points just south of the 50-day SMA (blue – 1.1039). Aside from the 1.0989 November 14 low possibly providing a ‘floor’, support is limited on this scale until reaching demand at 1.0851-1.0950 (holds the 2016 yearly opening level at 1.0873 within its lower boundary).

Upside hurdles beyond the aforementioned 50-day SMA can be seen at resistance drawn from 1.1072, followed by the 200-day SMA (orange – 1.1164). Note the longer-term moving average has been pointing south since June 2018.

H4 perspective:

Friday had Europe’s shared currency a shade higher against the buck, recording a session low at 1.0981 and highs of 1.1028. On the data front, annual Eurozone inflation rose 1.0% in November 2019, up from 0.7% in October.

Technically, the 1.0989/1.10 support zone remains in motion, consisting of the key figure 1.10, September’s opening level at 1.0989 and a 61.8% Fibonacci retracement at 1.0994. Indicator-based traders may also wish to note the relative strength index (RSI) ended the week marginally north of the 50.0 value.

1.0989/1.10 is likely a watched area for longs, given its historical significance (black arrows). The problem, however, is the lack of higher-timeframe support, as well as the constant threat of a fakeout through the 1.10 level, which occurred Friday (whipsaws are common viewing around psychological levels).

Areas of consideration:

An extension higher from 1.0989/1.10 on the H4 is a possibility this week, targeting H4 resistance located at 1.1055 as the initial take-profit zone. The fact H4 action took out the local high at 1.1025 Friday is a sign of buyer intent from the said H4 support zone. Therefore, a retest at 1.0989/1.10 (blue arrows) is certainly something to watch for today/early week.

A decisive close beneath 1.0989, on the other hand, opens the door to an intraday bearish theme, targeting H4 Quasimodo support at 1.0957 as the initial downside take-profit area. Keep in mind, weekly price suggests the 2016 yearly opening level at 1.0873 could eventually make an appearance, so keeping a portion of any short position open is an option here.

GBP/USD:

Weekly gain/loss: +0.76%

Weekly close: 1.2927

Weekly perspective:

The technical landscape on the weekly timeframe continues to support further upside in GBP/USD, exhibiting a bullish flag (typically considered a continuation pattern) forming just north of the 2019 yearly opening level 1.2739. A decisive push out of the said flagging formation may lead to the unit crossing swords with supply at 1.3472-1.3204, and long-term trend line resistance, etched from the high 1.5930.

Regarding the immediate trend, the market faces a downward trajectory from 1.4376, with a break of the 1.1904 low (labelled potential support) confirming the larger downtrend from 1.7191.

Daily perspective:

Since mid-October, candle action has been carving out a consolidation between a resistance area plotted at 1.3019-1.2975 and a well-placed support level at 1.2769. Beyond this range, Quasimodo resistance lies at 1.3102, whereas south of 1.2769, the 200-day SMA (orange – 1.2697) and 50-day SMA (blue – 1.2715) offer support. In addition, the 50-day SMA is seen marginally crossing above the 200-day SMA, often referred to as a ‘Golden Cross’.

H4 perspective:

Intraday movement observed buyers toughen their grip Friday, rebounding from lows of 1.2879 to a session high of 1.2942. The move took place amid a retreat in the US dollar across the board. 1.29 retains its spot as support, while resistance falls in at November’s opening level fixed from 1.2938 that converges closely with a local trend line resistance, extended from the high 1.2984.

Areas of consideration:

Longer term, additional upside is likely in store. Bullish flags, particularly formed on higher timeframes, are known for accuracy. Clearance of the upper edge of the daily range at 1.3019 and Quasimodo resistance at 1.3102 adds confidence the current weekly bullish flag is likely headed for higher ground.

Shorter term, nevertheless, entering long on the back of a H4 close formed above 1.2938 is certainly an idea worth exploring, with an initial upside objective set at 1.2975 (the lower edge of the current daily resistance area), followed by 1.30. Conservative traders may opt to wait for a retest at 1.2938 following the close higher; this helps avoid any whipsaws and, if the retest forms by way of a bullish candlestick pattern, provides entry/risk levels to work with.

AUD/USD:

Weekly gain/loss: -0.31%

Weekly close: 0.6760

Weekly perspective:

The Australian dollar yielded ground to the buck for a fourth successive session last week, hauling weekly price deeper into its current range between 0.6894/0.6677 (light grey). With a primary downtrend in play since early 2018, breaching the lower edge of the said range is likely, with the next support target not visible until around 0.6359.

Daily perspective:

In terms of the daily timeframe, price continues to explore ground beneath the 50-day SMA (blue – 0.6805). Although support may develop around the 0.6728ish region, traders likely have their crosshairs fixed on support pencilled in from 0.6677.

H4 perspective:

Since retesting the underside of 0.68, a slow grind lower has taken form. October’s opening level at 0.6750 represents the next downside target on the H4 timeframe, closely shadowed by Quasimodo support at 0.6751. September’s opening level at 0.6724 is also in sight, as well as the 0.67 handle.

Indicator-based traders may also to wish to note a consolidation phase is seen on the relative strength index (RSI), just south of the 50.0 mid-way value.

Areas of consideration:

From a technical perspective, sellers appear to have the upper hand right now. For any traders who remain short the retest at 0.68 (a noted move to watch for in previous reports) likely have October’s opening level at 0.6750 set as their initial take-profit zone.

A break of 0.6750 confirms the downside bias, and opens the door for additional intraday shorts, with 0.6724 eyed as the next possible support.

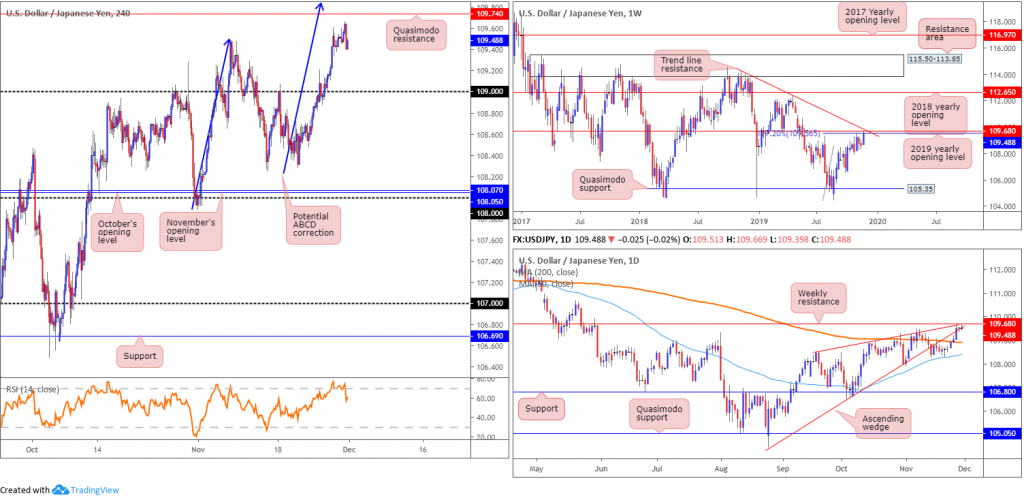

USD/JPY:

Weekly gain/loss: +0.79%

Weekly close: 109.48

Weekly perspective:

USD/JPY bulls entered an offensive phase over the course of last week, adding more than 85 points and pencilling in a near-full-bodied bullish candle.

Structurally, however, resistance is now in play, based on a 127.2% Fibonacci ext. point at 109.56 (taken from the low 104.44). Plotted close by is another layer of resistance formed at 109.68, the 2019 yearly opening level. Also sited nearby is trend line resistance, extended from the high 114.23.

In regards to the market’s primary trend, the pair has been entrenched within a range since March 2017, spanning 115.50/105.35.

Daily perspective:

In conjunction with weekly standing, price action on the daily timeframe is touching gloves with a ‘cradle point’ of a recently broken ascending wedge, formed from the low 104.44. This is likely viewed as a critical threshold, which given its alignment with weekly resistance, could entice strong selling this week. The next downside target on this scale can be found at the 200-day SMA (orange – 108.91).

H4 perspective:

In recent sessions, intraday action reached fresh six-month highs at 109.67, before spinning lower and settling in modestly positive territory. Quasimodo resistance at 109.74 is the next key technical level in sight, with the 109 handle denoting possible support.

109.74 is a favoured level, due to its connection with the current higher-timeframe resistances, and also a potential H4 ABCD correction (blue arrows) at 109.80.

Areas of consideration:

According to longer-term structure, this could be an ideal time to begin thinking about selling this market, with protective stop-loss orders positioned above weekly trend line resistance (114.23). As for take-profit targets, the 200-day SMA plotted on the daily timeframe offers a logical base for an initial target.

Traders who require more of a precise entry, H4 Quasimodo resistance at 109.74 offers a reasonably stable platform. Again, though, protective stop-loss orders can be placed above the noted weekly trend line resistance.

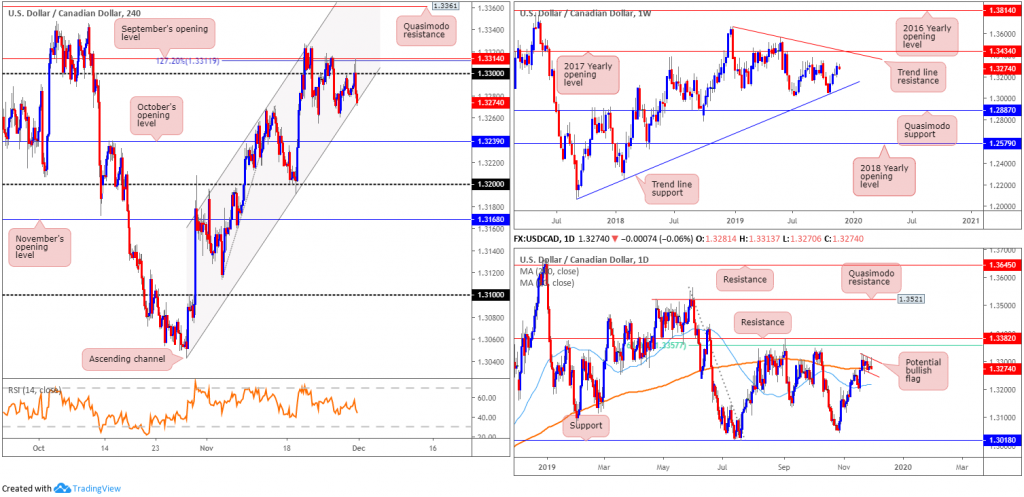

USD/CAD:

Weekly gain/loss: -0.17%

Weekly close: 1.3274

Weekly perspective:

Despite the prior week’s strong ascent, last week’s movement saw volatility diminish considerably, ranging no more than 60 points. The key technical observation on the weekly timeframe consists of a trend line support, extended from the low 1.2061, tops around 1.3342, the 2017 yearly opening level at 1.3434 and a trend line resistance, taken from the peak at 1.3661.

Overall, the immediate trend faces north since bottoming in September 2017, though this move could also be considered a deep pullback in a larger downtrend from the 1.4689 peak in early January 2016.

Daily perspective:

Recent action on the daily timeframe remains encased within a bullish flag pattern (red lines), following price breaking above the 200-day SMA (orange – 1.3277). A breakout above the said bull flag has the 61.8% Fibonacci retracement ratio at 1.3357 to target, as well as nearby resistance plotted at 1.3382. Flag failure, on the other hand, could draw in a retest at the 50-day SMA (blue – 1.3216).

H4 perspective:

Friday’s intraday movement, based on the H4 timeframe, once again, encountered resistance around the 1.33 neighbourhood, bolstered by nearby resistance in the shape of September’s opening level at 1.3314, and a 127.2% Fibonacci ext. point at 1.3311.

Medium-term flow also remains compressing within the confines of an ascending channel, taken from the low/high of 1.3042/1.3268. With Friday concluding at the lower edge of this channel, support around October’s opening level at 1.3239, followed by the 1.32 handle, are barriers certainly worthy of note this week.

WTI prices also turned sharply lower Friday, despite a lack of immediate fundamental catalysts at the time. On the data front, Canadian GDP expanded at an annualised rate of 1.3% y/y in Q3, higher than the expected rate of 1.2%. The m/m and q/q rates of expansion fell in line with expectations at 0.1% and 0.3%, respectively.

Areas of consideration:

Entering long at the current H4 channel support is, of course, an option, though the barrier lacks confluence, both locally and on the higher timeframes. Waiting for additional candlestick confirmation to form before pulling the trigger is, therefore, worth considering (entry/risk can be set according to this structure).

A decisive H4 close below the current H4 channel support may entice sellers, though is considered a chancy short, as the position, almost immediately, must contend with the lower edge of the current daily bullish flag.

The H4 Quasimodo resistance at 1.3361 is also likely of interest to many traders for potential shorts, knowing it fits between daily resistance at 1.3382 and the 61.8% Fibonacci retracement ratio at 1.3357.

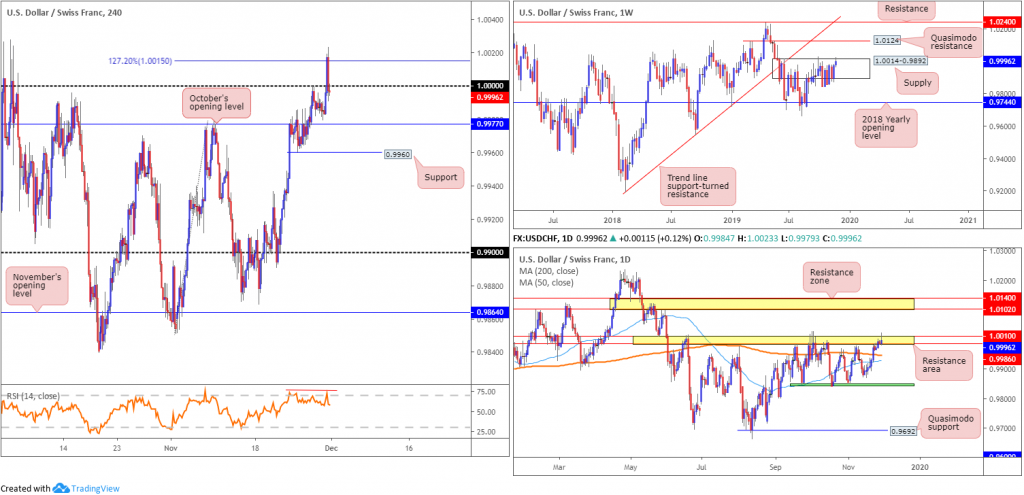

USD/CHF:

Weekly gain/loss: +0.25%

Weekly close: 0.9996

Weekly perspective:

Early October witnessed the beginning of a two-month long consolidation within the walls of a supply zone at 1.0014-0.9892. A week prior to this, however, a penetration to the outer edge of the supply area’s limit was seen, possibly tripping a portion of buy stops and weakening sellers. Therefore, the recent push higher should not really come as a surprise.

Further buying this week has Quasimodo resistance at 1.0124 in sight, followed by resistance at 1.0240 and trend line support-turned resistance, extended from the low 0.9187.

According to the primary trend, price also reflects a slightly bullish tone.

Daily perspective:

As evident from the daily timeframe, recent buying absorbed both the 50-day SMA (blue – 0.9928) and 200-day SMA (orange – 0.9947). Traders may also want to acknowledge that since mid-September, the unit has been busy carving out a consolidation between support around the 0.9845ish region (green) and a resistance area coming in at 1.0010/0.9986. Note the week concluded by way of a shooting star pattern (considered a bearish signal) that pierced the upper zone of the aforesaid range.

H4 perspective:

Trading volume increased exponentially going into Friday’s US session, sending USD/CHF through orders at 1.0000 (parity) to resistance in the shape of a Fibonacci extension point at 1.0015, and then back beneath 1.0000. The amount of buy stops this move triggered was likely enormous, both from traders short 1.0000 and those attempting to buy the breakout higher.

Although mild bearish divergence is seen on the relative strength index (RSI – red line), this is treacherous ground for shorts. Granted, the buy stops triggered will likely play a key factor in professional money selling this market, though this is never a guarantee.

Areas of consideration:

Knowing weekly supply at 1.0014-0.9892 is weak, conservative sellers will likely want to see 0.9960 taken out before committing funds to a position. Scope for a push to 0.99 beneath here is certainly a possibility, according to the H4 timeframe. However, the two said SMAs on the daily timeframe may cause support.

A decisive close back above 1.0000 this week may also prompt additional buying. Ultimately, though, a daily close above 1.0010/0.9986 is required before strong buyers likely jump onboard. As such, longs above 1.0000 could also be an option this week.

Dow Jones Industrial Average:

Weekly gain/loss: +0.76%

Weekly close: 28074

Weekly perspective:

Despite a brief spell in negative territory the week prior, the index struck fresh records for a fourth successive week, clocking highs of 28174.

Support at 27335, along with trend line support etched from the high 26670. remains a key focal point on the weekly timeframe this week.

Daily perspective:

Local demand at 27474-27647, sited a few points north of the said weekly support levels, held price action higher on November 20. Aside from this zone, there is really is no other support structure visible on this scale.

H4 perspective:

US Stocks fell broadly lower Friday, a day after the Thanksgiving holiday that left the market slightly below its record highs. The Dow Jones Industrial Average erased 112.59 points, or 0.40%; the S&P 500 lost 12.65 points, or 0.40% and the tech-heavy Nasdaq 100 declined 41.02 points, or 0.49%.

H4 support remains in place in the shape of a trend line support, extended from the low 25710, which was brought into motion by the week’s close.

Areas of consideration:

With the trend continuing to form higher peaks, this remains a buyers’ market.

The current H4 trend line support offers a potential platform for buyers, though given trend lines are open to whipsaws, traders may opt to entering on the back of additional candlestick confirmation. Not only does this help identify buyer intent, it also provides traders entry and risk levels.

A break of the current trend line support, however, may lead to a run towards H4 support coming in at 27713. A H4 close south of the said trend line, therefore, may also be viewed as a bearish signal, particularly if the broken trend line is retested as resistance in the shape of a bearish candlestick signal.

XAU/USD (GOLD):

Weekly gain/loss: +0.12%

Weekly close: 1463.6

Weekly perspective:

Last week was reasonably noneventful, with candle action maintaining a position south of a notable resistance area at 1487.9-1470.2. Further rejection off the underside of 1487.9-1470.2 potentially sets the long-term stage for a move towards two layers of support at 1392.0 and 1417.8.

Daily perspective:

With respect to daily activity, action remains hovering north of a support area coming in at 1448.9-1419.9. Note this area aligns closely with a 38.2% Fibonacci retracement ratio at 1448.5 and is further bolstered by the completion of a three-drive pattern – black arrows.

Upside from this area, nonetheless, is limited by a channel resistance, pencilled in from the high 1557.1, closely shadowed by the 50-day SMA (blue – 1485.6).

H4 perspective:

In light of Friday’s sizable move higher, the ascending wedge pattern (1445.5), which broke to the downside November 21, is struggling. The light at the end of the tunnel, however, may be the recent formation of a H4 ABCD bearish correction (blue arrows) at 1465.5, which converges with a 50.0% retracement at 1464.5. This may be enough to entice additional sellers into the market. Failure of this pattern, however, will likely lead to a retest at October opening level at 1472.8.

Areas of consideration:

Traders confident in the H4 ABCD pattern may look to enter short on the back of this formation, targeting the top edge of the daily support area at 1448.9 as the initial downside base. Conservative stop-loss placement is seen above October’s opening level at 1472.8.

The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets does not warranty, guarantee or make any representations, or assume any liability regarding financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www.icmarkets.com.au, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness. All such information is subject to change at any time without notice. IC Markets assumes no responsibility for the content of any linked site.

The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site. IC Markets is not liable for any harm caused by the transmission, through accessing the services or information on this site, of a computer virus, or other computer code or programming device that might be used to access, delete, damage, disable, disrupt or otherwise impede in any manner, the operation of the site or of any user’s software, hardware, data or property.