Key risk events today:

Australia Company Operating Profits q/q; Caixin Manufacturing PMI; UK Manufacturing PMI; US and Canadian banks closed in observance of Labour Day.

EUR/USD:

Weekly gain/loss: -1.35%

Weekly close: 1.0987

Weekly perspective:

It was a brutal end to the week for Europe’s single currency, shedding more than 140 points versus the US dollar.

Long-standing demand at 1.1119-1.1295 finally gave way last week, hanging by a thread since the end of July. Continued selling could witness the unit knock on the 2016 yearly opening level’s door at 1.0873, which houses strong historical significance.

Adding to the bearish vibe, since topping in early 2018, the long-term trend remains pointing in a southerly bearing.

Daily perspective:

Leaving the trend line resistance (extended from the high 1.1412) unopposed, the pair rotated south by way of five back-to-back bearish candles in recent trade, ending August on a dismal note.

Friday’s session overdelivered, drawing price action through YTD lows at 1.1026 to within striking distance of a demand zone coming in at 1.0851-1.0950 (taken from April 25, 2017). Note the said demand base also encompasses the 2016 yearly opening level mentioned above on the weekly timeframe at 1.0873.

H4 perspective:

An underperformer in the G10 space, the single currency came under intense selling pressure Friday and breached the key figure 1.10. Aside from trading inversely with the buck, which tested 99.00 terrain (dollar index), month-end flows weighed and the currency largely shrugged off hawkish impulses via Italy clinching another 2-party Government coalition.

The key observation, from a technical perspective, is price running orders at 1.10, likely triggering additional short positions. With 1.10 now likely to serve as resistance going forward, further downside may be on the cards this week, targeting the top edge of daily demand at 1.0950, followed by the 2016 yearly opening level at 1.0873 on the weekly timeframe.

For traders who remained short sub August’s opening level at 1.1079, great work (see previous EUR/USD reports for further details).

Areas of consideration:

For those who want to press the bearish theme this week, the 1.10 handle is certainly an area of interest for many traders. A retest of this level coupled with a H4 bearish candlestick formation would, given the current standing on both weekly and daily timeframes, likely be enough to draw in additional downside sentiment. The reason behind requiring candlestick confirmation simply comes down to round numbers, particularly key figures, being prone to whipsaws (stop runs). In addition to this, a bearish candlestick pattern forming at 1.10 provides strict entry and risk levels to work with.

GBP/USD:

Weekly gain/loss: -1.00%

Weekly close: 1.2160

Weekly perspective:

Snapping a two-week bullish phase, the GBP/USD curved lower a few points south of the 2017 yearly opening level at 1.2329 (resistance) last week, set a couple of points beneath a major resistance area at 1.2365-1.2615. This seats the August 12 low at 1.2014 back in sight this week, closely shadowed by a potential support level coming in at 1.1904 – held price action strongly higher back in October 2016.

Daily perspective:

In conjunction with weekly flow, daily channel resistance recently entered the mix (taken from the high 1.3176) and held price action lower. Scope for additional downside this week is certainly plausible, with familiar support in view at 1.2037: a Quasimodo formation.

In the event we turn higher and push above the said channel resistance, however, the next upside objective on the daily scale can be seen at 1.2374, closely shadowed by a 50.00% retracement value plotted at 1.2399.

H4 perspective:

UK’s pound continued to languish sub 1.22 Friday, weighed by strong USD bidding. Those who read Friday’s technical briefing may recall the piece highlighting August’s opening level at 1.2159 as a potential base for long opportunities. The research team also noted two intersecting trend line supports (1.2014/1.2249), one of which entered the fight late Friday. A rebound from here could take shape towards 1.22, though getting much further beyond here is unlikely knowing both weekly and daily timeframes suggest lower levels. Therefore, trade with caution.

Areas of consideration:

With buyers unlikely to generate much energy off August’s opening level at 1.2159, sellers likely have the upper hand this week. Unfortunately, though, unless you drill down to the lower timeframes, the H4 chart exhibits limited room to manoeuvre between the two said H4 trend line supports and 1.21. Therefore, those looking to pursue a bearish theme this week might consider waiting for a H4 close to form beneath 1.21, with the daily Quasimodo support on tap as the initial downside target at 1.2037, closely trailed by the August 12 low at 1.2014 (underlined above on the weekly timeframe).

AUD/USD:

Weekly gain/loss: -0.22%

Weekly close: 0.6733

Weekly perspective:

The end of July witnessed the unit slip beneath notable support at 0.6828, now a serving resistance. The following weeks have been somewhat colourless, though, largely organised as indecision candles.

The long-term downtrend, intact since the beginning of 2018, remains unbroken, with further selling likely on the cards as the next support is not visible until 0.6395 on this timeframe (not seen on the screen).

Daily perspective:

Since elbowing beneath weekly support mentioned above at 0.6828, support at 0.6733 on the daily timeframe, along with a 127.2% AB=CD (black arrows) formation at 0.6735, entered the fray and held things higher. Despite this, the pair remains deeply in bearish territory and does not appear to have the firepower to cross swords with resistance at 0.6833 (June 18 low). The next support target beneath here can be found at 0.6605, a 161.8% Fibonacci extension level.

H4 perspective:

The seasonally adjusted estimate for total dwellings approved fell 9.7% in July, according to the Australian Bureau of Statistics, consequently forcing the AUD/USD lower in the early hours Friday. The intraday slide, however, found strong support a few points north of the 0.67 handle and managed to eke out marginal gains into the close.

During the month of August, traders have witnessed the H4 candles compress within the limits of a descending channel formation (0.6817/0.6745). Note also we have two psychological marks visible at 0.67 and 0.68, with a possible ABCD (black arrows) correction in process, terminating a few points north of 0.68.

Beyond the 0.68 handle, a close-fitting area of resistance (yellow) also resides between a 127.2% Fibonacci ext. point at 0.6862, a Quasimodo resistance at 0.6858 and August’s opening level at 0.6848.

Areas of consideration:

Considering the bearish theme on the higher timeframes, selling is likely the favoured approach this week. As such, the upper H4 descending channel limit is worthy of attention, as is 0.68 and the H4 resistance zone at 0.6862/0.6848. Traders are urged to consider waiting for additional candlestick confirmation before pulling the trigger, since it is impossible to know which area will hold, if any. Although entering on the back of a candlestick signal is not a guaranteed winning trade, it does place the odds in your favour and set strict entry and risk levels to work with.

Should we fail to reach the said barriers and push through 0.67 on a H4 closing basis, nevertheless, this will also open bearish scenarios towards at least 0.66ish.

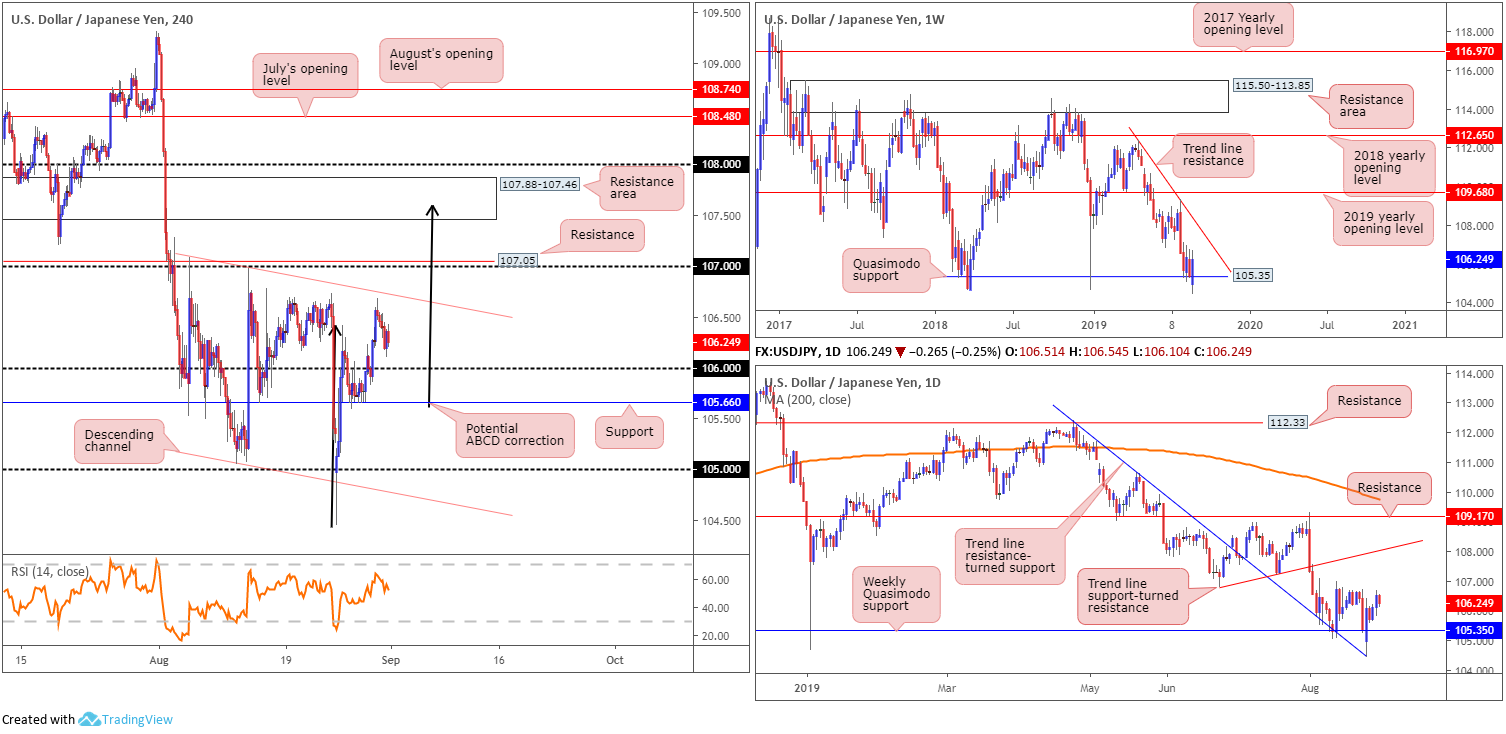

USD/JPY:

Weekly gain/loss: +0.85%

Weekly close: 106.24

Weekly perspective:

Quasimodo support at 105.35 – a level that proved its worth by holding the unit higher at the beginning of the year – held form last week, despite clocking fresh YTD lows at 104.44. Outside of this base, limited support is evident until 100.61 (not visible on the screen), whereas a push north has trend line resistance (extended from the high 112.40) to target.

Daily perspective:

Monday witnessed trend line resistance-turned support (pencilled in from the high 112.40) enter the fold at the beginning of last week, lifting the unit strongly higher. Although not as hurried, price surpassed Monday’s high Thursday, with Friday unable to breach its range.

Tops set at 106.77 remain the next upside objective on this scale, followed by trend line support-turned resistance (taken from the low 106.78).

H4 perspective:

The USD/JPY’s second straight advance ran into headwinds Friday. After topping at 106.68 Thursday, the unit pulled back Friday and reclaimed a large portion of Thursday’s gains. Technically, we could be looking at a revisit of 106 as support today, though a test of channel resistance taken from the high at 107.09 is just as likely.

Outside of these areas, support falls in close by at 105.66, followed by the 105 handle. Resistance, nonetheless, can be seen around 107 and 107.05. It might also be of interest to some traders the RSI indicator is meandering south of overbought territory, and there’s possibility for an ABCD completion (black arrows) that terminates within the walls of a resistance area at 107.88-107.46.

Areas of consideration:

Although we have weekly price indicating the possibility of further buying from its Quasimodo support at 105.35, tops on the daily scale around 106.77, along with H4 resistances highlighted above, are likely to hamper upside attempts.

In the event we do push for higher ground, though, and shake hands with the H4 resistance area at 107.88-107.46, a selloff from here could be in store. Not only does this area meet closely with trend line resistance on the weekly timeframe, it also boasts a connection with the daily trend line support-turned resistance. Thus, this area is certainly worthy of the watch list this week.

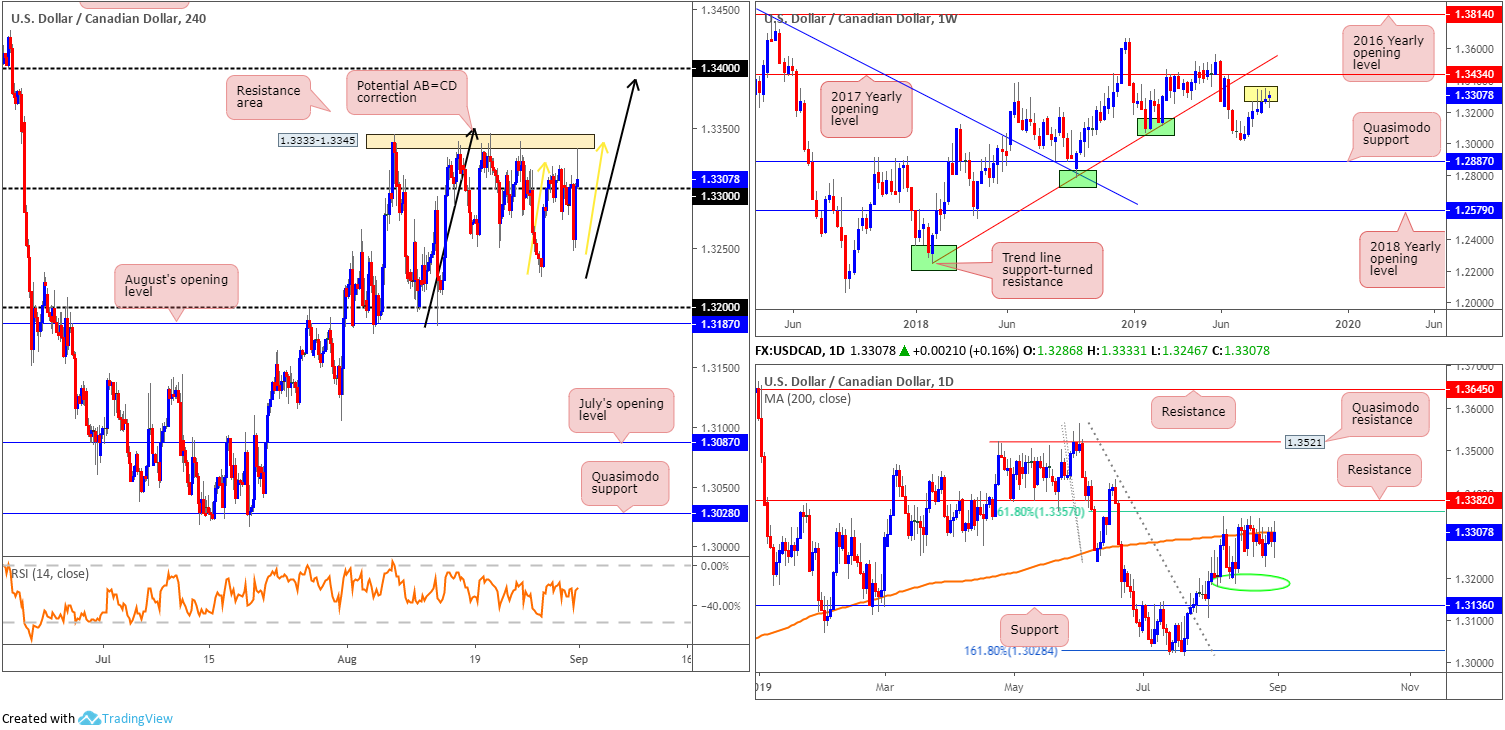

USD/CAD:

Weekly gain/loss: +0.19%

Weekly close: 1.3307

Weekly perspective:

Since the beginning of the month, longer-term movement has been lethargic, shaped in the form of back-to-back selling wicks and a half-hearted buying tail last week (yellow).

Price action exhibits scope to approach the 2017 yearly opening level at 1.3434, closely shaded by trend line support-turned resistance pencilled in from the low 1.2247. Should we turn lower and leave the said resistances unchallenged, however, traders’ focus will likely be on the 1.3016 July 15 low, followed by Quasimodo support at 1.2887.

Daily perspective:

In terms of where the research team stands on the daily timeframe, the unit is shaking hands with the underside of its 200-day SMA (currently circulating around 1.3309). Overhead, nearby resistance resides at a 61.8% Fibonacci ratio drawn from 1.3357 and resistance coming in at 1.3382, whereas a rotation lower has 1.3190 (green circle) as the next base of support, followed by a well-placed support at 1.3136. Note the clear-cut retest by way of a bullish engulfing formation off this barrier at the end of July.

H4 perspective:

Friday’s chart studies reveal the H4 candles remain fluctuating around 1.33. As underscored in Friday’s technical briefing, we have a resistance area coming in at 1.3333-1.3345 also in motion, which comes with a local AB=CD correction (yellow arrows) at 1.3339. Beyond here, the research team notes limited resistance until crossing swords with 1.34, which, if we move this far north, may complete by way of an AB=CD approach (black arrows) at 1.3393. To the downside, Friday’s low at 1.3247 is in sight, as is Tuesday’s low at 1.3225 and the 1.32 handle.

Areas of consideration:

In essence, the market has weekly price portending a move higher, at least until reaching 1.3434. Contrary to this, daily flow is capped at the underside of its 200-day SMA at 1.3309, with a break of this dynamic resistance suggesting a move to 1.3357, the 61.8% Fibonacci resistance value.

Longs above the H4 resistance area at 1.3333-1.3345 are challenging, given daily resistances, therefore tread with caution.

Shorts from the 1.34 handle, although not likely to enter the fray today/early week, are possibly of interest for some traders. Not only does it come with a H4 AB=CD approach, nearby resistance on the daily timeframe falls in at 1.3382. Despite this confluence, nonetheless, traders are urged to wait for additional H4 candlestick confirmation before executing a trade, as a fakeout through 1.34 to weekly resistance at 1.3434 may be on the cards.

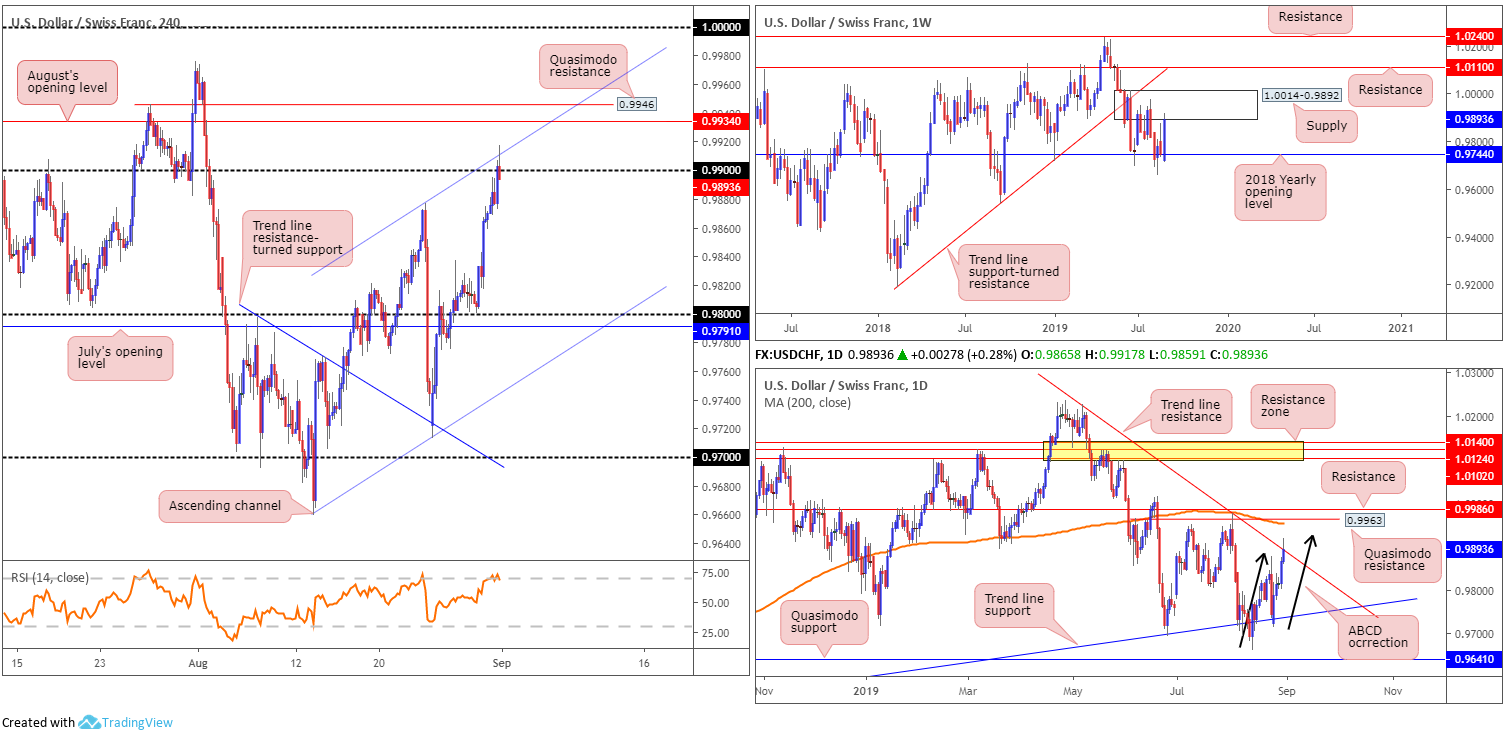

USD/CHF:

Weekly gain/loss: +1.53%

Weekly close: 0.9893

Weekly perspective:

USD/CHF bulls entered an offensive phase last week, firming off the 2018 yearly opening level at 0.9744 in the mould of an outside day formation. Although likely to stimulate candlestick enthusiasts, supply at 1.0014-0.9892 made an appearance.

In the event buyers brush aside the said supply this week (unlikely a straightforward feat), resistance at 1.0110 is in view, as is a long-term trend line support-turned resistance taken from the low 0.9187.

Daily perspective:

A closer interpretation of price action on the daily timeframe shows an impressive recovery off trend line support (etched from the low 0.9542), which crossed paths with a trend line resistance extended from the high 1.0226. What’s also notable from a technical standpoint is the ABCD correction (black arrows) at 0.9923ish (a potential bearish cue).

Areas of interest beyond the said resistances fall on Quasimodo resistance at 0.9963, a 200-day SMA (orange – 0.9955) and resistance coming in from 0.9986.

H4 perspective:

Upside momentum – tallying around 150 points over the past five trading sessions on the back of USD bidding across the board – drew the H4 candles beyond 0.99 to channel resistance (drawn from the high 0.9877) Friday. With buy stops likely tripped above 0.99, and sellers involved from H4 channel resistance, lower levels beneath 0.99 could be on the cards this week, targeting 0.98.

Well done to any of our readers who managed to hold longs off the retest at 0.98 (a noted move to watch for last week).

Areas of consideration:

There are several technical aspects supporting a bearish theme this week.

- Weekly price is seen testing the underside of supply at 0.9892.

- Daily price can be found at the underside of a trend line resistance that’s combined with an ABCD approach.

- H4 action ran stops above 0.99, tested channel resistance, and closed back beneath 0.99.

According to our chart studies, sellers are likely to make an appearance today, with 0.98 set as an ultimate take-profit target. Logical stop-loss placement can be seen above Friday’s high 0.9917.

Dow Jones Industrial Average:

Weekly gain/loss: +3.00%

Weekly close: 26398

Weekly perspective:

Snapping a four-week losing streak, US equities rotated sharply higher last week according to the Dow Jones Industrial Average. Adding more than 750 points by way of an outside day candlestick configuration, the index concluded the week a short walk from notable resistance priced in at 26667. A violation of this level places the all-time high 27388 in sight.

Daily perspective:

Since early August, the daily candles have been bounded by Quasimodo support coming in at 25198 and a resistance area forged at 26539-26200. What’s notable from a technical perspective is the said resistance zone is sited just south of weekly resistance at 26667, and daily price produced a mediocre shooting star pattern within the bounds of the said resistance area.

H4 perspective:

US stocks closed higher Friday, sealing their first weekly gain in five weeks as investors remained hopeful for a resolution to the US/China trade conflict. In spite of this, the index still registered its largest monthly decline since May. The Dow Jones Industrial Average added 41.03 points, or 0.16% Friday; the S&P 500 also added 1.88 points, or 0.06%, though the tech-heavy Nasdaq 100 declined 11.31 points, or 0.15%.

Recent upside drove the H4 candles through a familiar resistance zone at 26434/26328 (comprised of resistance at 26434, a 127.2% Fibonacci ext. point at 26328 and a 61.8% Fibonacci retracement value at 26402). This is the fourth time the index visited this area this month. Beyond here, the research team notes limited resistance until connecting with July and August’s opening levels at 26811 and 26799, respectively, and a 127.2% Fibonacci extension point at 26783. Before we reach this far north, though, traders must contend with weekly resistance at 26667, and in the more immediate, potential selling out of the daily resistance area mentioned above at 26539-26200.

Areas of consideration:

Despite probing above the H4 resistance area at 26434/26328 and weekly price producing a bullish outside day, buyers may lack going forward, according to our chart studies. Resistance on the weekly timeframe at 26667 and the daily resistance area at 26539-26200 spoils any bullish scenario above the said H4 resistance area. Therefore, tread with caution.

As for a bearish theme, waiting for weekly resistance to enter the mix might be an idea before considering shorts this week. This, alongside a daily close back within the aforementioned daily resistance area, would be considered a strong sell signal.

XAU/USD (GOLD):

Weekly gain/loss: -0.42%

Weekly close: 1520.3

Weekly perspective:

Breaking a strong four-week bullish phase, bullion rotated lower from notable resistance priced in at 1536.9 (boasts strong historical significance – check late 2011 and early 2012) last week by way of a near-perfect shooting star formation (considered a bearish signal).

As we registered highs not seen since April 2013, last week’s pullback may only be a minor blip and find nearby channel resistance-turned support (taken from the high 1375.1) offers a floor this week.

Daily perspective:

In tandem with weekly flow, daily movement noted a bearish engulfing formation off resistance at 1550.4 Thursday, and generated additional downside Friday. The next downside hurdle on this scale, nonetheless, comes in at a support area from 1495.7-1480.3, sited just south of the weekly channel support.

H4 perspective:

Weighed by robust USD bidding, the yellow metal maintained a bearish posture Friday, firmly engulfing support at 1528.0 and retesting the underside of the level as resistance.

For those who read Friday’s report you may recall the following:

With all three timeframes exhibiting potential to explore lower ground a move lower is on the cards. Given the current uptrend, however, traders may want to consider waiting for the H4 candles to print a decisive close beneath 1528.0 and open the runway south to 1493.7. By doing so, traders have the option of either selling the breakout candle directly or waiting and seeing if a retest at 1528.0 materialises, preferably in the form of a bearish candlestick pattern (entry/risk can be determined according to this formation).

Areas of consideration:

Well done to any of our readers who managed to jump aboard the retest at 1528.0 Friday, which offered a H4 bearish outside day as confirmation. Holding out for H4 support at 1493.7 and reducing risk to breakeven once/if the position rolls over at least a 1R risk/reward is likely the best way forward.

The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets does not warranty, guarantee or make any representations, or assume any liability regarding financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www.icmarkets.com.au, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness. All such information is subject to change at any time without notice. IC Markets assumes no responsibility for the content of any linked site.

The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site. IC Markets is not liable for any harm caused by the transmission, through accessing the services or information on this site, of a computer virus, or other computer code or programming device that might be used to access, delete, damage, disable, disrupt or otherwise impede in any manner, the operation of the site or of any user’s software, hardware, data or property.