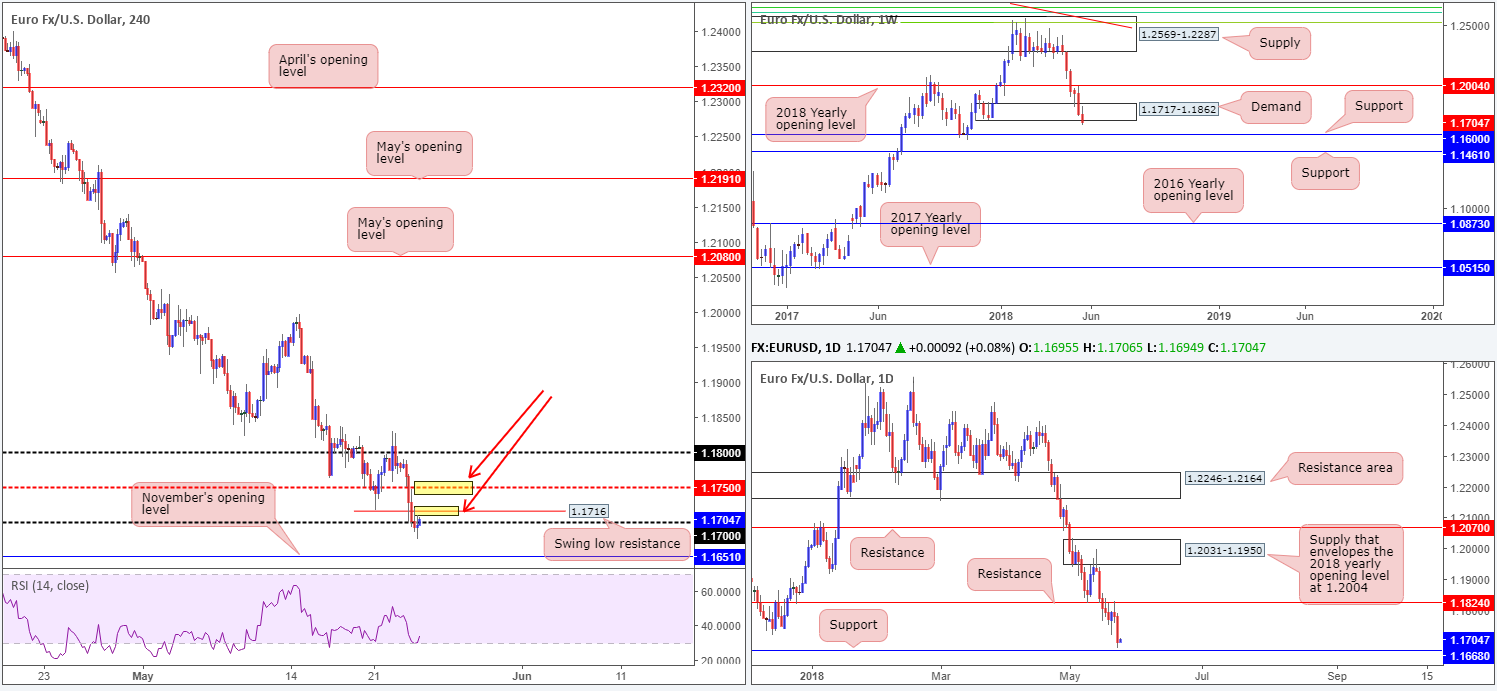

EUR/USD:

The euro, as you can see, is trading markedly lower this morning. Soft Eurozone manufacturing, as well as continuing worries emanating from Italy, pressured the currency lower amid the early hours of London, bringing H4 price toward the 1.17 handle. During US trade, lows of 1.1675 were hit following the FOMC meeting minutes, with a mild recovery ensuing thereafter.

While H4 price is currently seen battling for position around the 1.17 handle, daily price appears poised to shake hands with support priced in at 1.1668. This is interesting since over on the weekly timeframe a break of demand at 1.1717-1.1862 recently took place, potentially exposing support derived at 1.1600.

Areas of consideration:

Given the overall strength of the sellers right now, a pullback in this market is likely to be weak. Watch for selling action to emanate from the swing low H4 resistance at 1.1716/H4 mid-level resistance at 1.1750 (see red arrows). The ultimate downside target from this point is the weekly support mentioned above at 1.1600.

Today’s data points: ECB monetary policy meeting accounts; US unemployment claims; US existing home sales; FOMC member Bostic speaks.

GBP/USD:

The British pound took on more bearish heat during Wednesday’s trade as UK inflation declined to a 13-month low. Falling inflation further dents chances of a rate hike, particularly after the Bank of England delayed May’s anticipated hike as a result of poor economic growth.

From a technical standpoint, H4 price bottomed just north of the 1.33 handle, helped by the fact that price put in a 1:1 AB=CD to the downside (see red arrows). Given this, and the fact that H4 price recently crossed back above the H4 mid-level number 1.3350, the pair could potentially challenge 1.34, or with a little oomph behind it, the H4 resistance area at 1.3488-1.3453/61.8% H4 resistance value printed at 1.3471.

Further pressuring upside at the moment is daily support seen at 1.3314, which happens to also be positioned within the walls of weekly demand at 1.3301-1.3420.

Areas of consideration:

On account of the above movement, the team has noted to keep eyeballs on 1.34 and the aforementioned H4 resistance area for possible shorting opportunities. We’re particularly fond of the H4 resistance area since it is sited just south of the 2018 yearly opening level on the weekly timeframe (next upside target on the weekly scale) at 1.3503, and also located within the walls of a daily resistance area planted at 1.3458-1.3534 (next upside target on the daily scale).

Today’s data points: BoE Gov. Carney speaks; UK retail sales m/m; US unemployment claims; US existing home sales; FOMC member Bostic speaks.

AUD/USD:

Going into the early hours of London trade on Wednesday, the commodity currency penciled in a bottom off lows of 0.7522 and rotated north. Taking cues from stronger US equity prices, the pair managed to recoup a large portion of the day’s losses and place the unit within striking distance of the 0.76 handle.

As we hope is clearly demonstrated on the H4 chart, further buying in this market could bring the piece above 0.76 to 0.7650ish in the shape of a 1:1 AB=CD move (see blue arrows). This area not only closely interacts with a H4 channel resistance etched from the high 0.7566, it also is positioned within a daily resistance area at 0.7626-0.7665.

Areas of consideration:

All eyes are currently on the 0.7650 point for shorts, owing to its surrounding confluence. As for stop-loss placement, we strongly recommend using the H4 supply seen above at 0.7682-0.7655, since it is glued to the underside of weekly supply at 0.7812-0.7669. The first support target from 0.7650 would have to be around the 0.76 neighborhood.

Today’s data points: US unemployment claims; US existing home sales; FOMC member Bostic speaks.

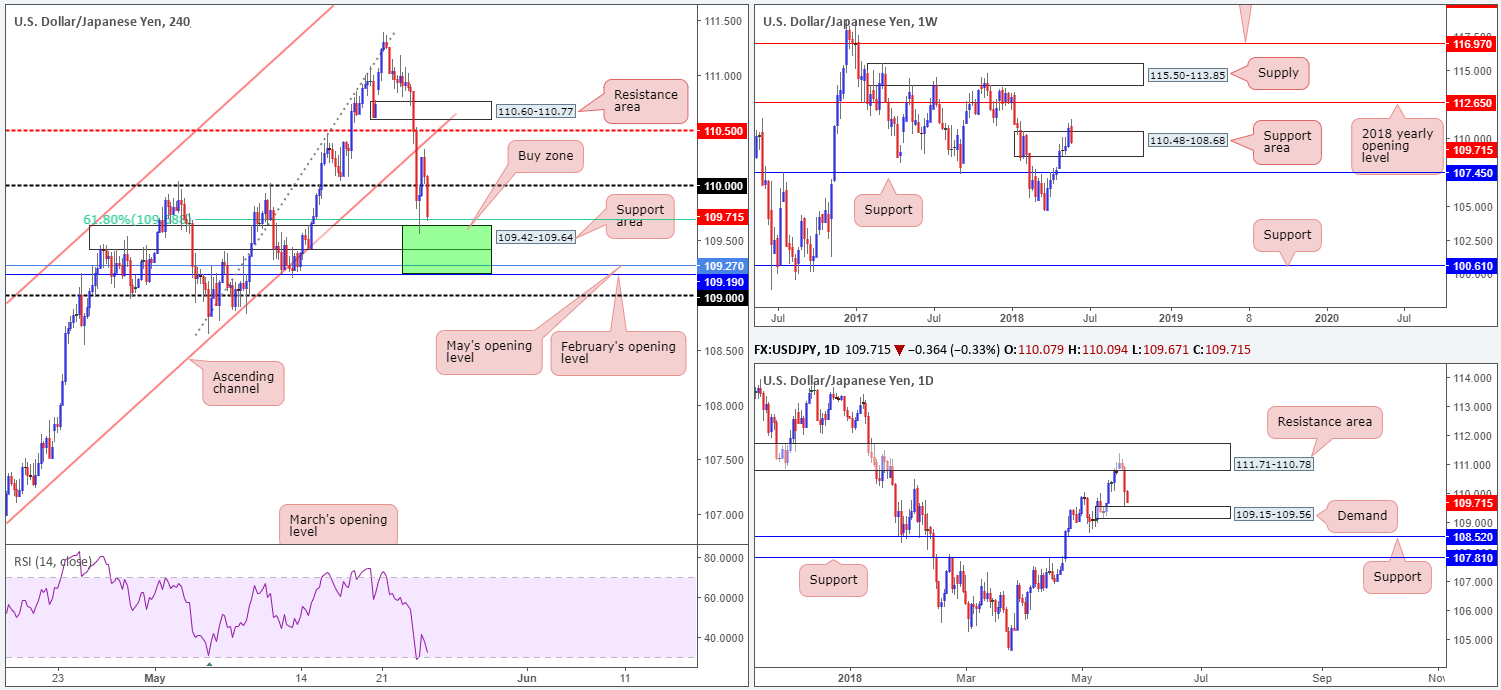

USD/JPY:

In recent movement, the USD/JPY bounced beautifully from a H4 support area at 109.42-109.64, which happens to be sited just beneath a 61.8% H4 Fib support at 109.70. Buying momentum quickly diminished above 110, however, and has since collapsed in recent hours. A break of the current H4 area of support could lead to price challenging February and May’s opening levels at 109.19/109.27.

The story over on the bigger picture displays a clear daily demand seen positioned nearby at 109.15-109.56. Note that this area encapsulates the current H4 demand and nearby monthly opening levels. Should this zone give way, support at 108.52 is likely the next base on the hit list.

Turning the focus up to the weekly timeframe, nevertheless, the unit is currently trading within the walls of a support area drawn from 110.48-108.68. Further upside from here has the 2018 yearly opening level at 112.65 to target, whereas a move lower brings support at 107.45 into view.

Areas of consideration:

In light of current structure, between 109.19/109.64 appears to be a logical area (marked in green on the H4 timeframe) to consider longs from.

To help avoid being whipsawed out of a trade on a fakeout to 109 seen just below, you may want to consider waiting for H4 price to chalk up a full or near-full-bodied bull candle before pulling the trigger. Stop-loss orders can then be positioned below the rejecting candle, with the first point of concern labelled at 109.

Today’s data points: US unemployment claims; US existing home sales; FOMC member Bostic speaks.

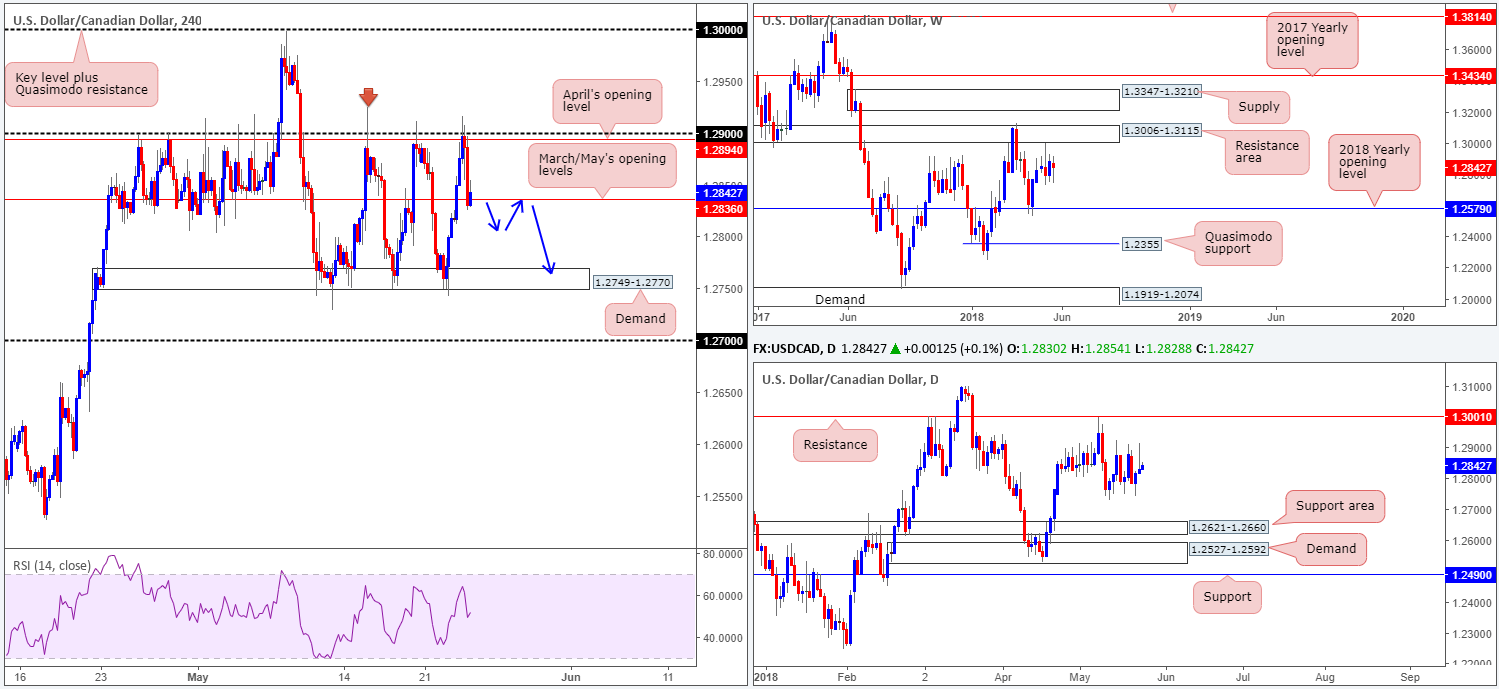

USD/CAD:

As can be seen from the H4 timeframe this morning, the USD/CAD remains entrenched within a reasonably well-defined range between H4 demand at 1.2749-1.2770 and the 1.29 handle. After shaking hands with the top edge of this range on Wednesday, the pair collapsed on the back of FOMC’s latest minutes and challenged March/May’s opening levels at 1.2836.

Despite the ranging motion seen on the H4 scale, weekly price continues to reflect a bearish stance. After coming within inches of tapping the underside of a weekly resistance area at 1.3006-1.3115 two weeks ago, further selling is possible at least until the 2018 yearly opening level at 1.2579. In conjunction with weekly flow, daily movement also shows room to press lower, with the next downside target not coming into view until we reach a daily support area noted at 1.2621-1.2660.

Areas of consideration:

Well done to those who caught the short off 1.29. This was a noted area to look for shorting opportunities in Wednesday’s report.

Should further downside take place, as suggested on the higher timeframes, and close below/retest 1.2836, adding to shorts could be an option here, with an initial target objective set at the lower edge of the noted H4 range.

Today’s data points: US unemployment claims; US existing home sales; FOMC member Bostic speaks.

USD/CHF:

Following a sharp drop in prices on Tuesday, Wednesday’s action bottomed around the 0.99 handle going into London trade. Helped by the fact that this number is bolstered by May’s opening level at 0.9907, traders were clearly bidding this market in anticipation of the FOMC’s minutes. Buying quickly halted after the release, though, jolting from highs of 0.9977 in the shape of a H4 bearish pin-bar formation.

Given that there’s also a H4 resistance area at 0.9969-0.9956 in play, coupled with a daily resistance level plotted at 0.9949, further downside is certainly a possibility today. Adding to this, we can see that weekly price continues to echo a clear bearish tone at present. Following a test of the 2016 yearly opening level at 1.0029 two weeks back, price action shows little support on the horizon until connecting with the 2018 yearly opening level marked at 0.9744.

Areas of consideration:

While intraday sellers may find shorting at current price attractive since downside appears reasonably free until we reconnect with 0.99 again, medium-term swing traders will likely exercise a little bit of patience before selling.

Should H4 price cross below 0.99, we feel this would be a strong enough cue to begin considering shorts. Yes, price would still be engaged with a nearby daily demand at 0.9871-0.9920, but overhead pressure from weekly sellers should be enough to overcome buying around this zone. Therefore, keep eyes out for a H4 close below 0.99 that’s followed up with a retest as resistance. The first take-profit target from this point falls in around H4 support noted at 0.9835.

Today’s data points: US unemployment claims; US existing home sales; FOMC member Bostic speaks.

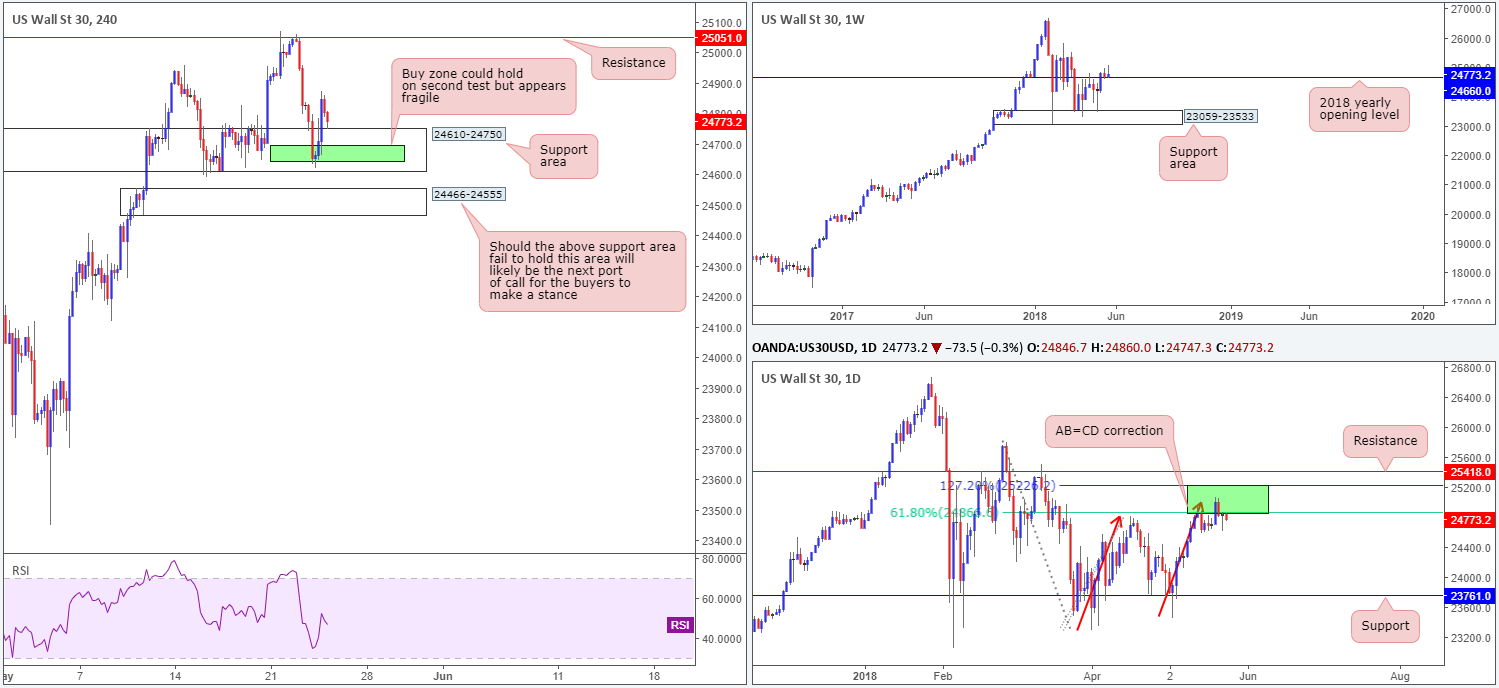

Dow Jones Industrial Average:

Although most members felt it would soon be appropriate to raise rates again if the outlook remained intact at Wednesday’s FOMC’s minutes, there was little to get excited about in terms of market movement. The Dow initially put in a strong push to the upside (see H1 timeframe), but failed to sustain gains beyond highs of 24871.

For those who read Wednesday’s report you may recall that the team highlighted a H4 buy zone marked in green within a H4 support area (24610-24750) between 24644/24694. Well done to any of our readers who took advantage of this zone as price responded nicely to it!

Weekly price continues to hover above the 2018 yearly opening level on the weekly timeframe at 24660. As of current action, the index has yet to produce anything meaningful to the upside from here. Daily movement, on the other hand, remains flirting with a particularly interesting area of resistance drawn from 25229/24866. The area marked in green is comprised of a 61.8% daily Fib resistance value and a 127.2% AB=CD (see red arrows) daily Fib ext. point.

Areas of consideration:

The green area underscored on the H4 timeframe remains a zone of interest today, owing to its connection with the aforementioned 2018 yearly opening level. However, caution is advised. Traders need to prepare for the possibility that this area may give way on a second test and head for the fresh H4 demand seen plotted just below it at 24466-24555. This is largely due to where we are trading from on the daily timeframe. So, engage with caution!

Today’s data points: US unemployment claims; US existing home sales; FOMC member Bostic speaks.

GOLD (XAU/USD)

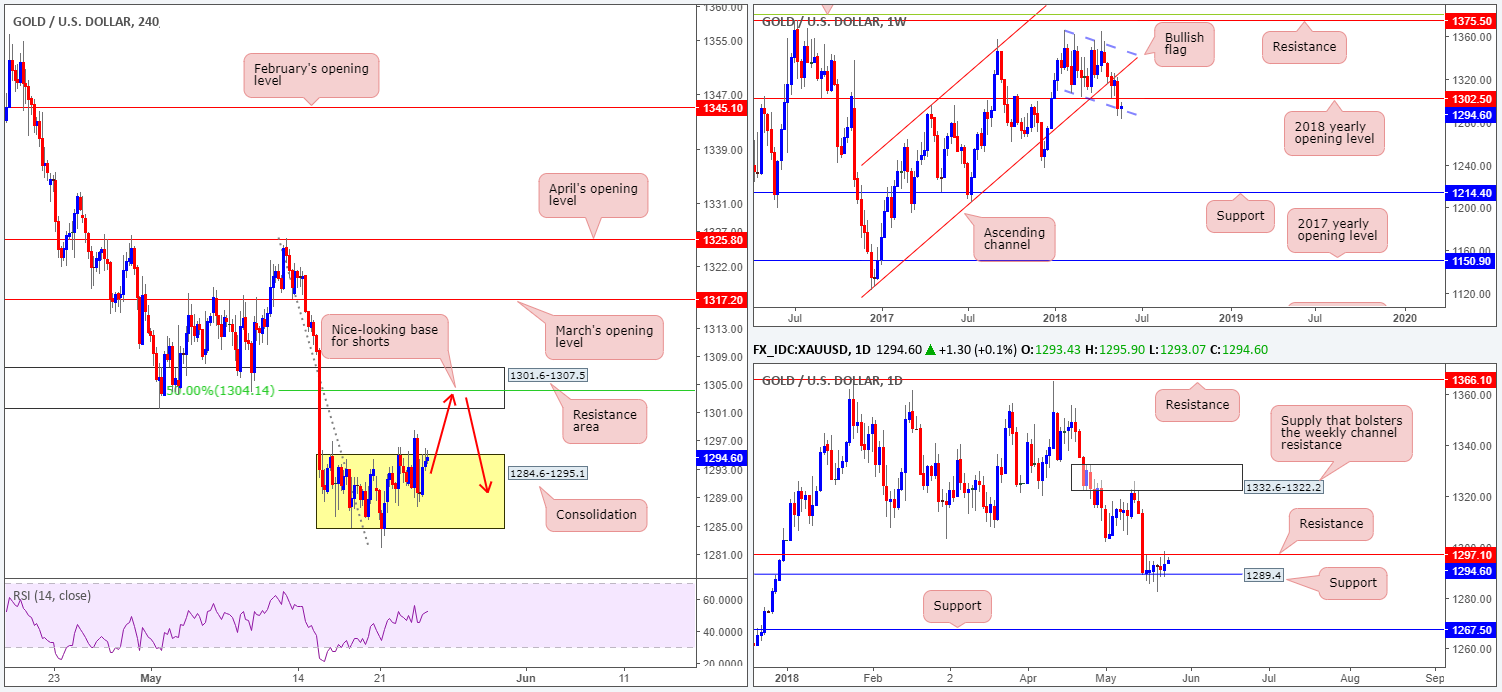

Wednesday’s trade was somewhat subdued as H4 price spent the day teasing the top edge of its current range at 1295.1. As mentioned in Wednesday’s report, a break higher from here has the H4 resistance zone to target at 1301.6-1307.5, whereas a move lower could potentially expose December’s 2017 opening level at 1274.8 (not seen on the screen).

Daily price remains lodged between a daily support level drawn from 1289.4 and a daily resistance level priced in at 1297.1. A move south from here could open up the gates for price to challenge daily support seen at 1267.5.

Looking over the weekly chart shows us that price is respecting the lower edge of a weekly bullish flag formation taken from the low 1307.2, despite pushing to lows of 1282.2. Further buying from this point could see the 2018 yearly opening level at 1302.5 brought into play.

Areas of consideration:

In view of Wednesday’s lackluster session, the team still has eyes on the current H4 resistance area for shorts. Why this is simply comes down to the area fusing with the aforementioned 2018 yearly opening level and a 50.0% H4 resistance value at 1304.1.

The first take-profit area from this point will likely be around the top edge of the current H4 range at 1295.1.

The use of the site is agreement that the site is for informational and educational purposes only and does not constitute advice in any form in the furtherance of any trade or trading decisions.

The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets does not warranty, guarantee or make any representations, or assume any liability with regard to financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www.icmarkets.com.au, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness. All such information is subject to change at any time without notice. IC Markets assumes no responsibility for the content of any linked site. The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site.

IC Markets is not liable for any harm caused by the transmission, through accessing the services or information on this site, of a computer virus, or other computer code or programming device that might be used to access, delete, damage, disable, disrupt or otherwise impede in any manner, the operation of the site or of any user’s software, hardware, data or property.