Waiting for lower timeframe confirmation is our main tool to confirm strength within higher timeframe zones, and has really been the key to our trading success. It takes a little time to understand the subtle nuances, however, as each trade is never the same, but once you master the rhythm so to speak, you will be saved from countless unnecessary losing trades. The following is a list of what we look for:

- A break/retest of supply or demand dependent on which way you’re trading.

- A trendline break/retest.

- Buying/selling tails/wicks – essentially we look for a cluster of very obvious spikes off of lower timeframe support and resistance levels within the higher timeframe zone.

We typically search for lower-timeframe confirmation between the M15 and H1 timeframes, since most of our higher-timeframe areas begin with the H4. Stops are usually placed 1-3 pips beyond confirming structures.

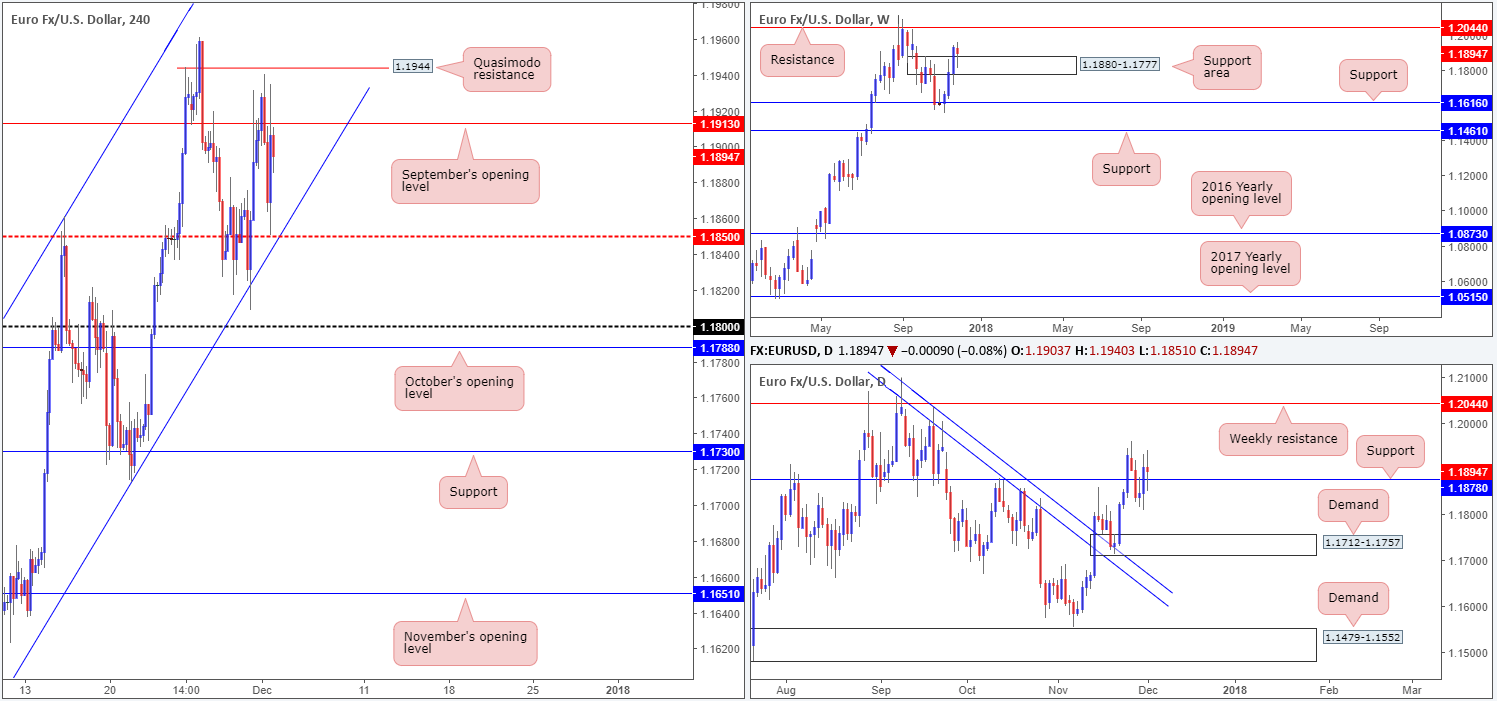

EUR/USD:

Weekly gain/loss: -0.28%

Weekly closing price: 1.1894

Despite registering a loss last week, the single currency remains trading with a reasonably strong bias to the upside. The weekly supply-turned support zone at 1.1880-1.1777, as you can see, kept upside buoyancy intact in the shape of a relatively strong weekly buying tail. For this reason, we believe the weekly stage is set for price to challenge the weekly resistance plotted at 1.2044 this week.

Daily support at 1.1878 was in the spotlight last week. Although the line suffered a minor breach on Tuesday, the unit managed to compose itself and cross back above the line on Thursday and hold (in the shape of a daily indecision candle) into the closing bell. A break above the 27/11 high at 1.1961 (daily chart) would likely place the aforementioned weekly resistance in the limelight.

The H4 candles were unable to sustain gains beyond September’s opening level at 1.1913, after very nearly clipping the underside of the H4 Quasimodo resistance at 1.1944 on Friday. This intraday weakness transported price down to the H4 mid-level support at 1.1850 (positioned nearby a H4 channel support extended from the low 1.1553), which, almost immediately, saw the euro switch tracks and surge more than 50 pips in a matter of minutes amid escalating political tension in the US.

Suggestions: Both weekly and daily structure state further buying could be on the cards this week. Yet, buying on the H4 timeframe is considered high-risk due to upside resistance. Not only do we have September’s opening level to contend with, we also have the aforesaid H4 Quasimodo resistance barrier located not too far above this.

As a result, we feel that the pair is ripe for an upside extension beyond 1.1944, targeting the large psychological band 1.20 (not seen on the screen), followed by the weekly resistance noted above at 1.2044.

Data points to consider: Spanish unemployment change at 8.00am; US factory orders m/m at 3pm GMT.

Levels to watch/live orders:

- Buys: Watch for H4 price to engulf 1.1944 and then look to trade any retest of this number seen thereafter ([waiting for additional confirmation in the form of a full or near-full-bodied H4 bull candle following the retest is advised] stop loss: ideally beyond the candle’s tail).

- Sells: Flat (stop loss: N/A).

GBP/USD:

Weekly gain/loss: 1.01%

Weekly closing price: 1.3472

The GBP/USD chalked up a fourth consecutive gain last week, increasing its value more than 130 pips. In consequence to this, weekly price concluded the week shaking hands with a weekly channel resistance extended from the high 1.2673. Regardless of the fact that this barrier was breached back in September, this line has proved worthy in the past and, therefore, may very well suppress buying this week and send the British pound lower.

Assuming that the weekly channel resistance holds ground, daily price shows that the unit could trade as far south as the daily support level pegged at 1.3371. To the upside, nevertheless, there’s room for the daily candles to push up to a daily Quasimodo resistance level penciled in at 1.3618 (sited beneath weekly resistance at 1.3683 – the next upside target beyond the current weekly channel resistance).

A quick recap of Friday’s trading on the H4 timeframe reveals that the pair failed to muster enough strength to breach the H4 mid-level resistance coming in at 1.3550 and sold off. UK’s manufacturing PMI surprised to the upside in November but was largely ignored. Despite a brief spate of buying (influenced by escalating political tension in the US) during US hours, H4 price wrapped up the week crossing paths with the H4 mid-level support at 1.3450, which happens to intersect beautifully with a H4 channel resistance-turned support taken from the high 1.3229.

Suggestions: Buying from the H4 mid-level support at 1.3450 may seem attractive knowing that the line fuses with a H4 channel, but it is not a setup we’d label high probability. Entering long as weekly price connects with weekly resistance tends to end in drawdown.

So, rather than buying 1.3450, we’re looking for H4 price to close beneath this level. A decisive H4 close lower coupled with a retest and a reasonably sized H4 bearish candle (preferably in the shape of a full or near-full-bodied candle) would, in our view, be enough to suggest shorts. Also of particular interest here is the H4 tail seen marked with a black arrow at 1.3432.This, we believe, has consumed the majority of buy orders beneath 1.3450, potentially opening up downside to the 1.34 handle, followed closely by October’s opening level at 1.3367 (sits directly below the daily support mentioned above at 1.3371).

Data points to consider: UK construction PMI at 9.30am; US factory orders m/m at 3pm GMT.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Watch for H4 price to engulf 1.3450 and then look to trade any retest seen thereafter ([waiting for a reasonably sized H4 bearish candle to form following the retest – preferably a full or near-full-bodied candle – is advised] stop loss: ideally beyond the candle’s wick).

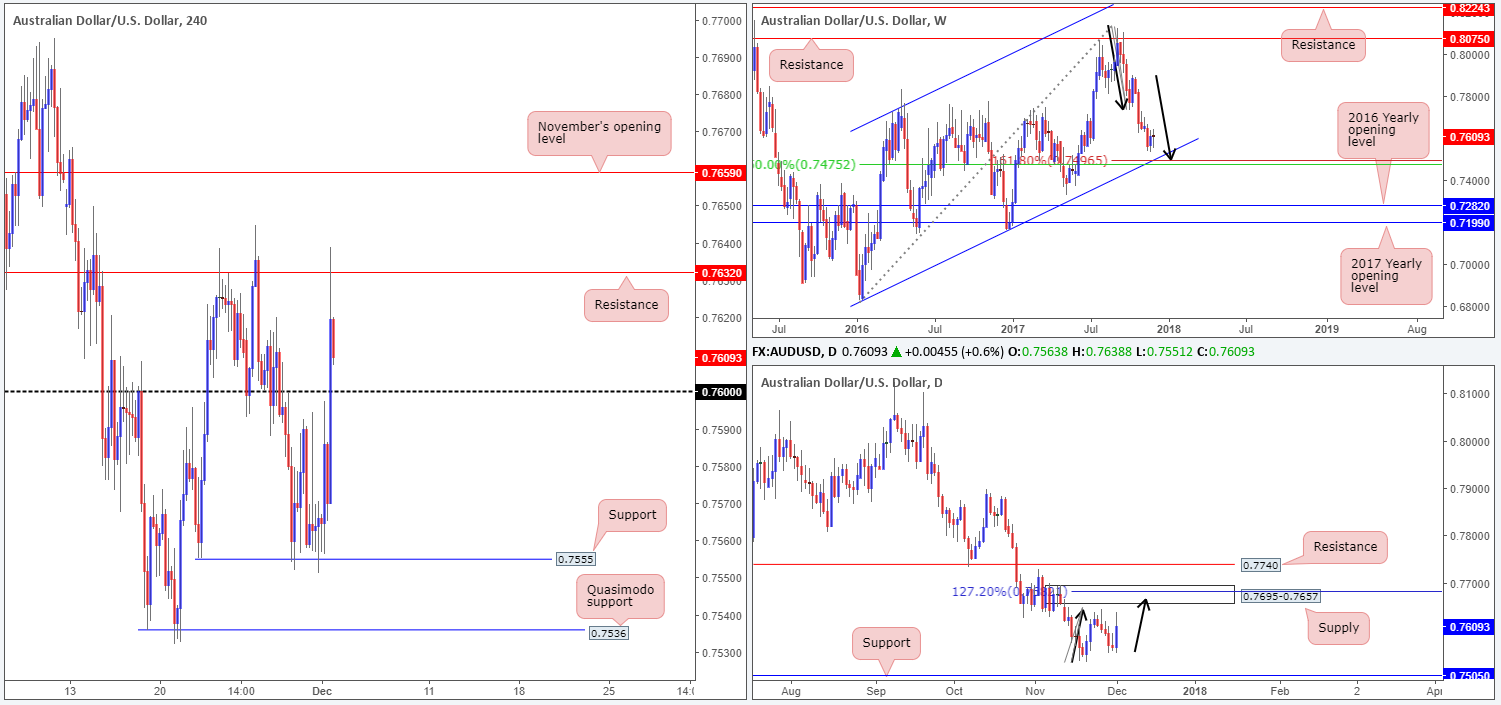

AUD/USD:

Weekly gain/loss: -0.01%

Weekly closing price: 0.7609

In spite of the fact that the AUD/USD ranged close to 100 pips last week, the pair ended the session unchanged and formed a clear-cut weekly indecision candle. Given this, we still have our eye on a particularly interesting weekly support. Merging with a weekly channel support extended from the low 0.6827 and a weekly 50.0% value at 0.7475 taken from the high 0.8125, there’s a nice-looking weekly AB=CD (see black arrows) 161.8% Fib ext. point situated at 0.7496.

A closer look at price action on the daily timeframe reveals that price painted a rather bearish picture from the word go last week. It was only on Friday did the tables turn and the bulls push higher. What this did, nonetheless, is highlight a potential daily AB=CD bearish formation (see black arrows) that completes around the 127.2% daily Fib ext. point at 0.7685, which is positioned within the upper walls of a daily supply zone at 0.7695-0.7657.

Across on the H4 timeframe, we can see that Friday’s upsurge took place amid the later hours of the day. President Trump’s former national security advisor, M.Flynn, pleaded guilty to lying to the FBI regarding talks with Russia’s ambassador. The 0.76 handle suffered a nasty break in response and only stabilized once H4 resistance at 0.7632 was brought into the fray.

Suggestions: According to our technicals, neither a long nor short is attractive at current prices.

We would be interested sellers within the aforesaid daily supply, specifically around the noted daily AB=CD completion point. On the buy side, the 0.75 handle is the area that continues to stand out, due to its weekly/daily confluence.

Data points to consider: AU. company operating profits q/q at 12.30am; US factory orders m/m at 3pm GMT.

Levels to watch/live orders:

- Buys: 0.75 region (50-70 pip stop loss).

- Sells: 0.7680 region (stop loss: 0.7720).

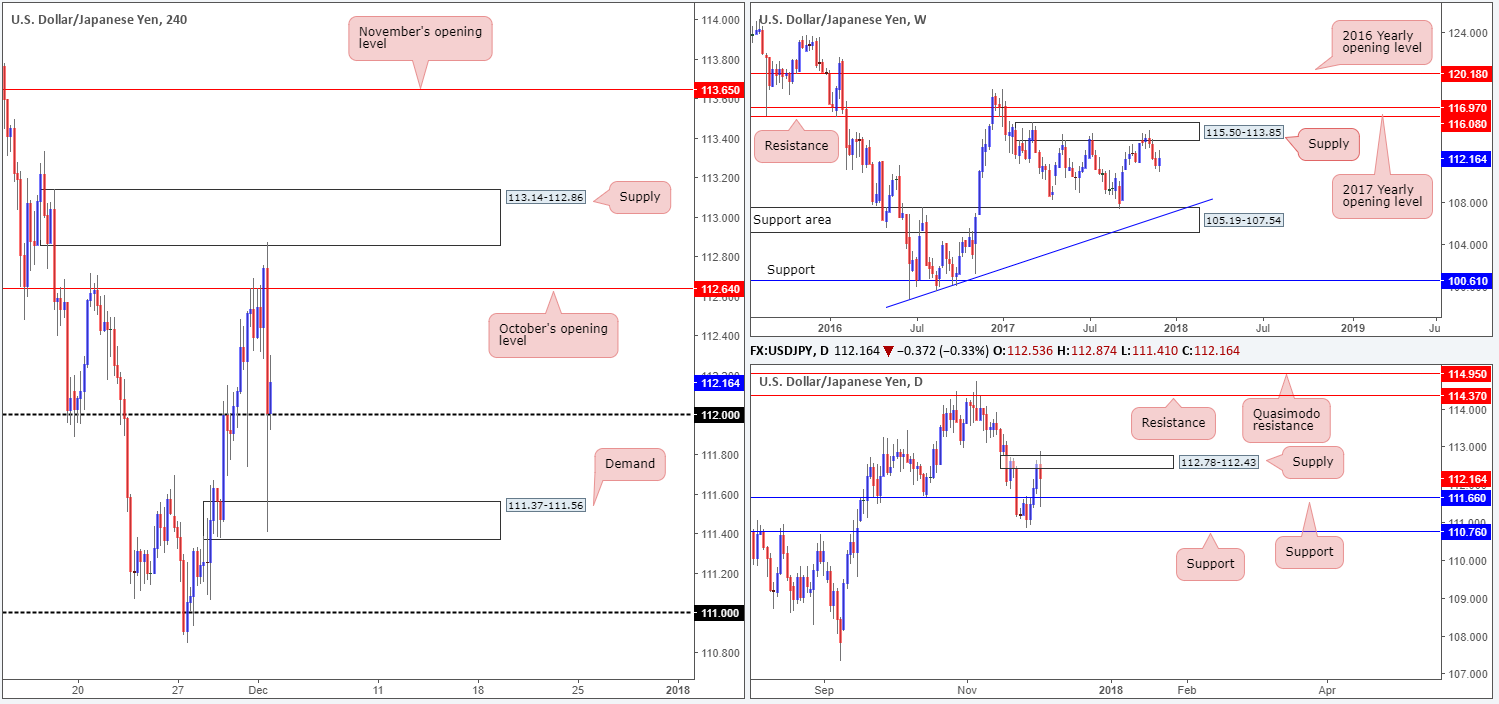

USD/JPY:

Weekly gain/loss: +0.57%

Weekly closing price: 112.16

The USD/JPY has spent the past three weeks plunging from weekly supply at 115.50-113.85. This sustained decline erased October’s gains and punched in a low of 110.84. Last week’s action, however, ran into unexpected support and consequently molded a relatively nice-looking weekly bullish engulfing candle. Is this sufficient enough to inspire buyers this week?

Elsewhere, daily action shows that price concluded the week closing between a daily supply zone fixed at 112.78-112.43 and a daily support level at 111.66. In order for the weekly bullish engulfing formation to function, the noted daily supply must be ingested beforehand. Beyond this supply, we have daily resistance at 114.37, shadowed closely by a tasty-looking daily Quasimodo resistance at 114.95, on the radar.

A brief look at recent dealings on the H4 timeframe reveals that the candles whipsawed above October’s opening level at 112.64 and crossed swords with the underside of a H4 supply base at 113.14-112.86. Shortly after, the pair fell sharply after reports emerged that Michael Flynn, Trump’s former national security advisor, will testify against Trump. The 112 handle suffered a nasty whipsaw in response, with H4 price only finding refuge once connecting with H4 demand pegged at 111.37-111.56.

Suggestions: Since H4 price closed back above 112 on Friday, as well as the market chalking in a weekly bullish engulfing candle, scope for further buying up to October’s opening level is a possibility. With that being said however, daily supply at 112.78-112.43, although suffered a minor breach on Friday, is not yet out of the picture, and therefore could subdue buying this week.

In light of the daily supply, our team has concluded that while a rally may take place from 112, it is just not a trade we’d feel comfortable involving ourselves in knowing that we’re buying into a daily area. As such, opting to remain on the sidelines may be the better alternative, at least for today.

Data points to consider: US factory orders m/m at 3pm GMT.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Flat (stop loss: N/A).

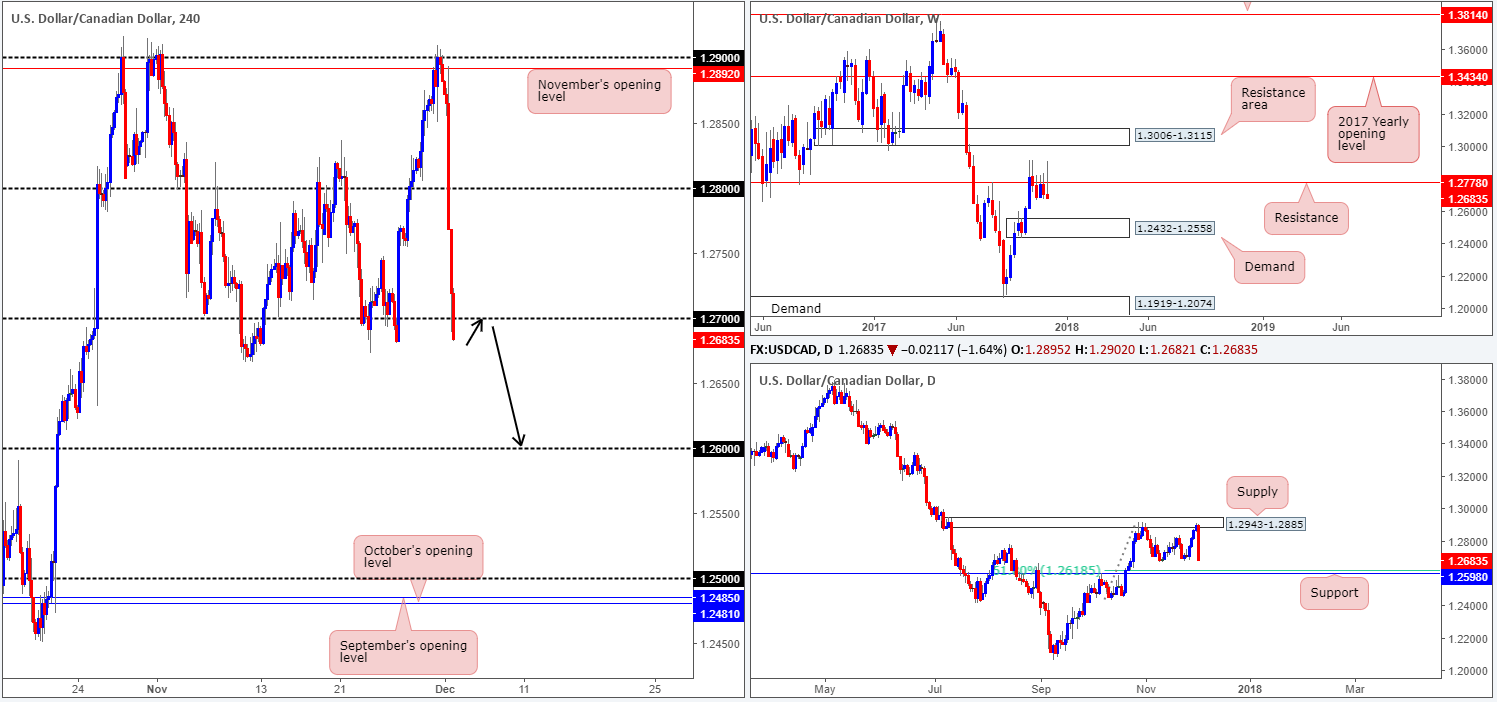

USD/CAD:

Weekly gain/loss: -0.24%

Weekly closing price: 1.2683

Upside remains capped on the weekly timeframe at 1.2778, as oil continues to reflect a bullish stance. The current weekly resistance level on the USD/CAD shares a strong history that dates back to early 2004, so it is not one to ignore! Couple this with the fact that last week’s weekly action chalked up a strong-looking bearish selling wick (likely capturing the attention of candlestick traders), further selling could be in the offing this week. In the event that the market continues to dip south from here, traders’ crosshairs will likely be fixed on the weekly demand at 1.2432-1.2558. Boasting a strong base, this demand area communicates strength and, therefore, will likely hold back sellers should the area come into play.

Up until Thursday, USD/CAD bulls were on the offensive. Shaped by four near-full-bodied daily bull candles, the pair managed to climb into the walls of a daily supply zone coming in at 1.2943-1.2885. It was from here, however, that things took a turn for the worse. Completely erasing the week’s gains and closing Friday’s session in the shape of a strong full-bodied daily bearish candle, this has perhaps opened up downside to daily support at 1.2598 this week (merges with a 61.8% Fib support at 1.2618).

Looking over to the H4 candles, one can see just how aggressive selling was on Friday. Reasons for this move, as far as we can see, are as follows:

- OPEC’s decision to extend oil output cut.

- Strong oil buying on Friday.

- USD/CAD weekly resistance and daily supply mentioned above.

- Upbeat Canadian Job’s figures.

- Reports of M. Flynn, Trump’s former national security advisor, preparing to testify against the president.

For those who read Friday’s report, you may recall that the desk was interested in selling the 1.29 handle/November’s opening level at 1.2892 (H4 timeframe). We also mentioned that in order for this zone to be considered valid, a full or near-full-bodied H4 bearish candle would also be required. As you can see, there was a nice-looking H4 signal candle printed in the early hours of Friday. Unfortunately though, we were away from the desk at the time! Well done to any of our readers who caught this move – a stunning way to end the week!

Suggestions: Given how strongly H4 price closed sub 1.27 on Friday along with both weekly and daily timeframes indicating further downside, additional selling could be seen down to the 1.26 base today/this week.1.26 converges with daily support structures, so it makes for a worthy take-profit level! Beyond this line, we’d be looking at the top edge of weekly demand mentioned above at 1.2558.

For us to become sellers, we require a retest of 1.27 as resistance and a full or near-full-bodied H4 bearish candle to form following the retest. This will show that bearish intent remains and also help avoid an unnecessary loss.

Data points to consider: US factory orders m/m at 3pm GMT.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 1.27 region ([waiting for a reasonably sized H4 bearish candle to form – preferably a full or near-full-bodied candle – is advised] stop loss: ideally beyond the candle’s wick).

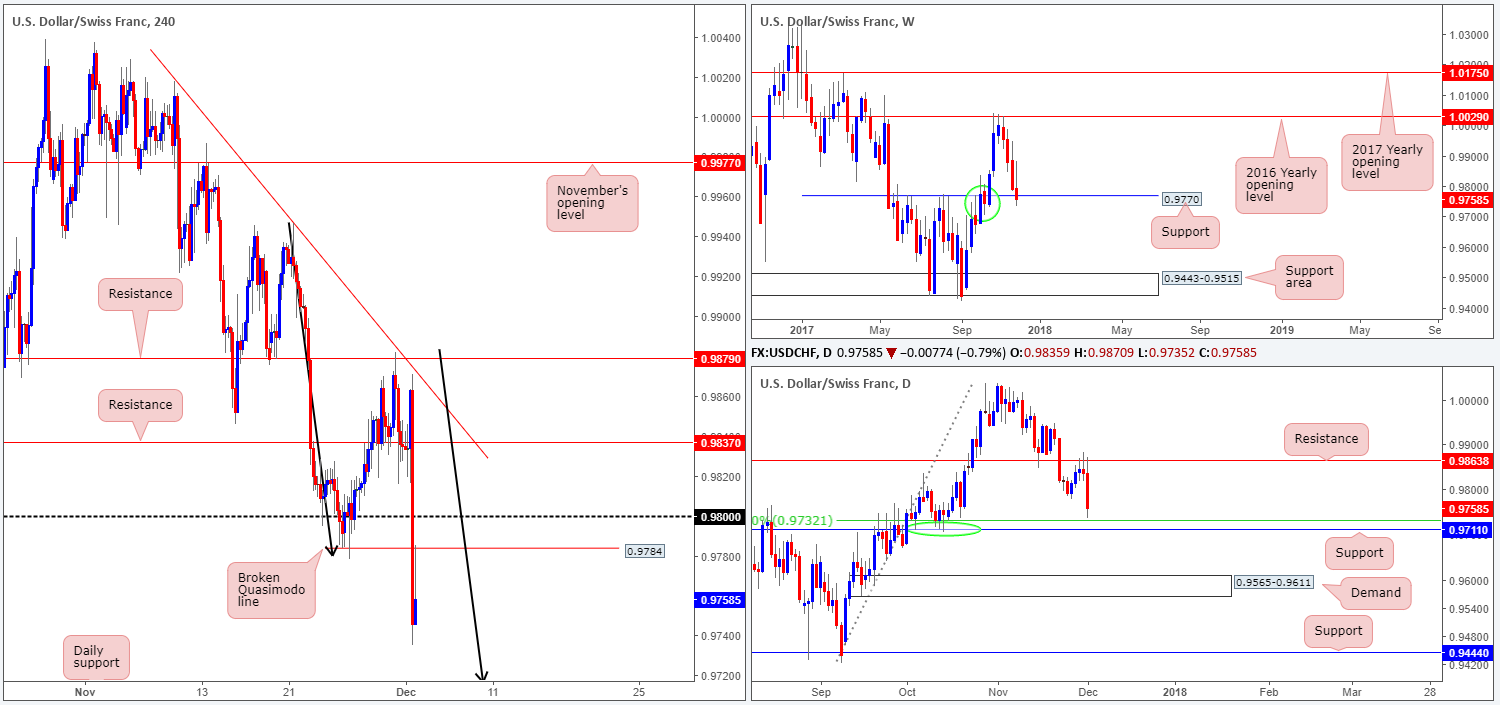

USD/CHF:

Weekly gain/loss: -0.36%

Weekly closing price: 0.9758

USD/CHF extended losses last week and marginally closed below weekly support at 0.9770. Before we all get too bearish this market, however, consider the base of weekly demand to the left of current price marked with a green circle at 0.9704-0.9783. This area is the reason we have yet to label the broken support a resistance, since weekly price, in our opinion, still has the potential to rotate to the upside this week.

On the daily timeframe, we can see that price ended the week closing within striking distance of a daily support at 0.9711 (positioned directly beneath a daily 50.0% value at 0.9732). Should a test of this level be seen today/this week and fails to hold, the next point of interest can be seen at 0.9565-0.9611: a daily demand area that boasts strong bullish momentum.

The pair lost more than 100 pips amid Friday’s US segment, reaching lows of 0.9735 on the day. In one fell swoop, H4 price stormed through multiple H4 tech supports as the dollar came under pressure amid escalating political tension in the US. After bottoming at 0.9735, the unit mildly pared losses into the close causing H4 price to revisit the underside of a recently broken H4 Quasimodo support at 0.9784.

Suggestions: With weekly support at 0.9770 still in the fight, and a daily support seen not too far off at 0.9711, a long around the completion point of a H4 AB=CD (black arrows) bullish point at 0.9715 could be an option today/this week. Stop placement here is tricky though because below 0.9715 is the 0.97 handle which could potentially act as a magnet to price. For that reason, we believe the safest position for stops is around 0.9666 (below August/October’s opening levels at 0.9672/0.9680 – not seen on the screen). Yes, it is a rather large stop, but let’s keep in mind that we are trading from higher-timeframe levels here, so gains should equally be just as big!

Data points to consider: US factory orders m/m at 3pm GMT.

Levels to watch/live orders:

- Buys: 0.9715 region (place stops at 0.9666).

- Sells: Flat (stop loss: N/A).

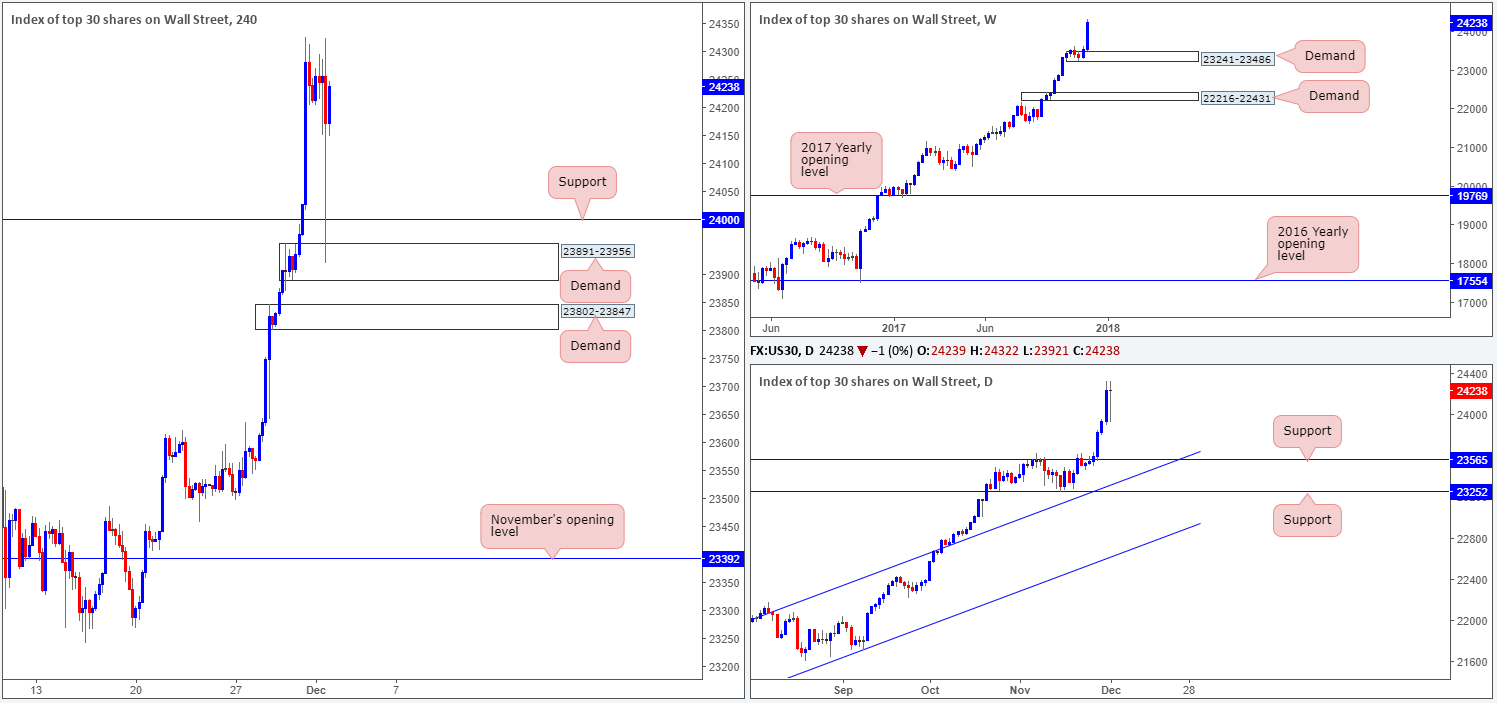

DOW 30:

Weekly gain/loss: +2.86%

Weekly closing price: 24238

Over the course of last week’s sessions US equities put in a strong performance, surging to fresh record highs of 24325. What this move did was help create a strong-looking demand base seen on the weekly timeframe at 23241-23486.

Apart from Friday which remained unchanged despite ranging 400 points, each day during last week’s sessions chalked up a close higher (see daily chart). Concerns over the recent Russia probe towards the US president softened market sentiment on Friday. As is evident from the H4 timeframe, the index aggressively stabbed lower, whipsawing through the 24K mark and shaking hands with a H4 demand area at 23891-23956. As you can see, losses were quickly trimmed and, as mentioned above already, the day ended unchanged.

Suggestions: As the H4 demand area at 23891-23956 proved itself worthy on Friday, this is an area, alongside the H4 demand printed below it at 23802-23847, we’ll be watching this week for potential longs. Given that there is a chance H4 price could fake below the upper H4 demand base to connect with the one below, a H4 full or near-full-bodied candle must take shape in order to confirm buyer intent, before we’d feel comfortable pulling the trigger.

Data points to consider: US factory orders m/m at 3pm GMT.

Levels to watch/live orders:

- Buys: 23891-23956 ([waiting for a reasonably sized H4 bullish candle to form – preferably a full or near-full-bodied candle – is advised] stop loss: ideally beyond the candle’s tail). 23802-23847 ([waiting for a reasonably sized H4 bullish candle to form – preferably a full or near-full-bodied candle – is advised] stop loss: ideally beyond the candle’s tail).

- Sells: Flat (stop loss: N/A).

GOLD:

Weekly gain/loss: -0.64%

Weekly closing price: 1279.9

The past week saw the yellow metal push lower and form a weekly bearish engulfing candle.

Should this candle formation be of concern for traders who are currently long from the weekly demand at 1251.7-1269.3? It is difficult to judge from where we’re sitting. Here’s why. On the one hand, this weekly demand is bolstered by a weekly channel support etched from the low 1122.8, therefore promoting strength. On the other hand, each time the demand base is tested, price fails to print a higher high, which could mean that sellers are overwhelming buying momentum here.

Last week’s descent has placed daily candles within touching distance of daily demand at 1251.7-1265.2, which is not only positioned within the lower limits of the weekly demand mentioned above, it also houses a 61.8% daily Fib support at 1263.3.

With the US dollar taking a hit during Friday’s US segment, it was no surprise to see that gold had advanced. Leaving August/November’s opening levels seen on the H4 timeframe at 1269.3/1269.9 unchallenged, the metal aggressively ran through October’s opening level at 1279.1 and slammed into a H4 broken Quasimodo line at 1286.8, which was enough to force the H4 candles to pullback and retest Oct’s open level into the closing bell.

Suggestions: From our perspective, this is a somewhat difficult market to trade at the moment. Weekly action is challenging to read given the conflicting price action and H4 price does not show enough confluence to base a trade from.

With the above notes in mind, we see little choice but to remain on the sidelines today.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Flat (stop loss: N/A).