A note on lower-timeframe confirming price action…

Waiting for lower timeframe confirmation is our main tool to confirm strength within higher timeframe zones, and has really been the key to our trading success. It takes a little time to understand the subtle nuances, however, as each trade is never the same, but once you master the rhythm so to speak, you will be saved from countless unnecessary losing trades. The following is a list of what we look for:

- A break/retest of supply or demand dependent on which way you’re trading.

- A trendline break/retest.

- Buying/selling tails/wicks – essentially we look for a cluster of very obvious spikes off of lower timeframe support and resistance levels within the higher timeframe zone.

- Candlestick patterns. We tend to stick with pin bars and engulfing bars as these have proven to be the most effective.

We typically search for lower-timeframe confirmation between the M15 and H1 timeframes, since most of our higher-timeframe areas begin with the H4. Stops are usually placed 3-5 pips beyond confirming structures.

EUR/USD:

Beginning with a peek at the weekly chart this morning, it’s clear to see that weekly price recently bumped heads with a weekly resistance line that stretches as far back as mid-2015. From this angle, we see very little standing in the way of price selling off from here. The closest higher-timeframe support structure can actually be seen down on the daily chart at 1.0714-1.0683: a daily support area.

Looking over to the H4 candles we can see that price launched itself north yesterday, breaching and eventually closing above the H4 supply at 1.0797-1.0780 (now an acting support area), the 1.08 handle and February’s opening base line at 1.0801. With H4 price now capped between the above said H4 barriers and a nearby H4 supply zone pegged at 1.0828-1.0814, where does one go from here?

Our suggestions: In view of the unit’s close proximity to the aforementioned weekly resistance level, a break to the downside is more likely, in our opinion. With that being the case, our team has noted that should H4 price close beyond the current H4 support area today, we will begin hunting for shorts on any retest seen at this area, targeting the H4 demand drawn from 1.0705-1.0723.

Data points to consider: There’s little scheduled news on the docket today.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Watch for price to engulf 1.0797-1.0780 and then look to trade any retest seen thereafter (stop loss: dependent on the rejection candle, as ideally we’d look to place it beyond the rejection candle’s wick).

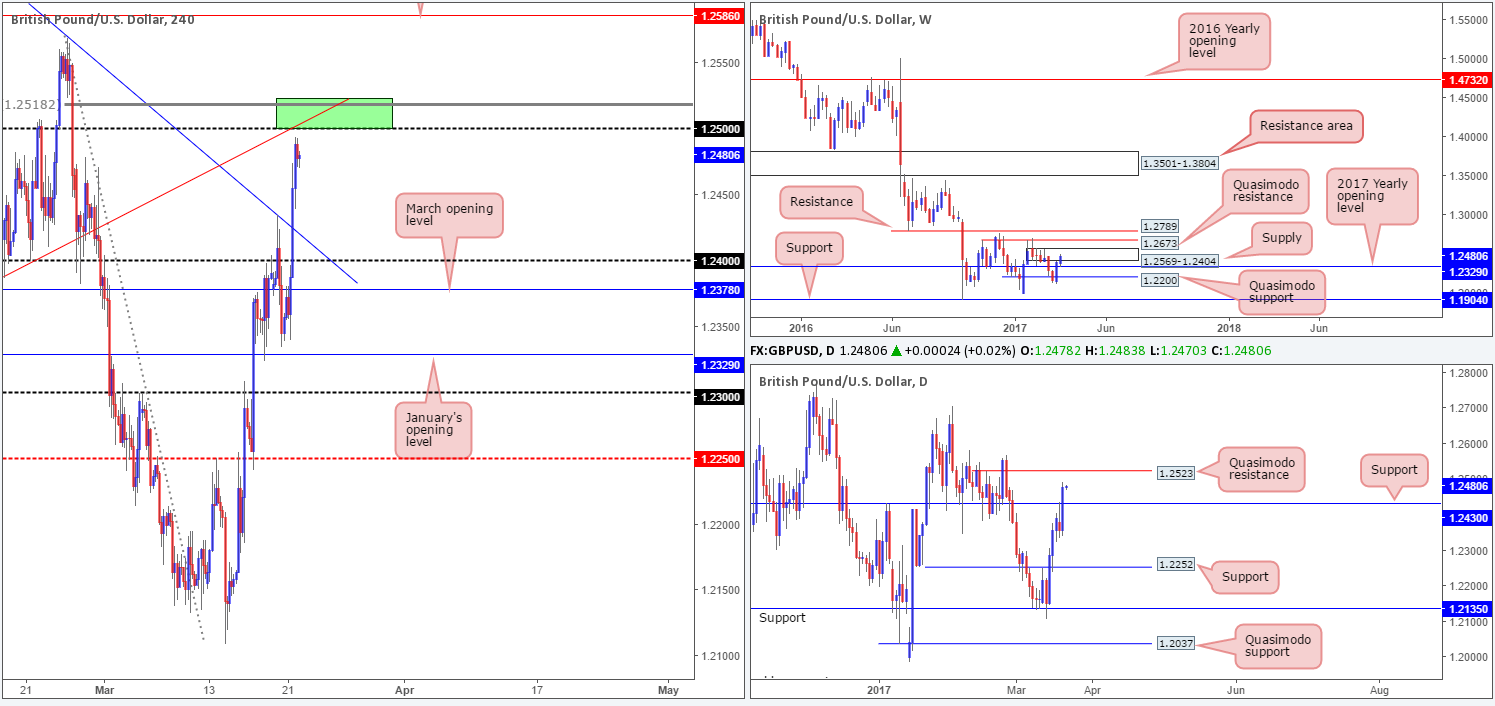

GBP/USD:

The GBP made considerable ground against its US counterpart on Tuesday, following upbeat UK inflation figures. The move broke through both a H4 trendline resistance extended from the high 1.2706 and a daily resistance logged in at 1.2430 (now acting support).

Thanks to this recent advance, there’s a rather attractive H4 sell zone seen just ahead (painted in green) at 1.2523/1.25. Supporting a bounce from this area is as follows:

- The 1.25 handle.

- A H4 trendline resistance taken from the low 1.2346.

- An 88.6% H4 retracement seen at 1.2518.

- A daily Quasimodo resistance level coming in at 1.2523.

- All of the above structures are located within weekly supply positioned at 1.2569-1.2404.

Our suggestions: Dependent on the time of day, a short from this area could be something to consider. Aggressive stops are seen at 1.2525, while conservative stops can be placed above the weekly supply at 1.2571. Ultimately, we’d look to ride this train down to at least the daily support hurdle mentioned above at 1.2430.

Data points to consider: There’s little scheduled news on the docket today.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 1.2523/1.25 (stop loss: 1.2571 [conservative]).

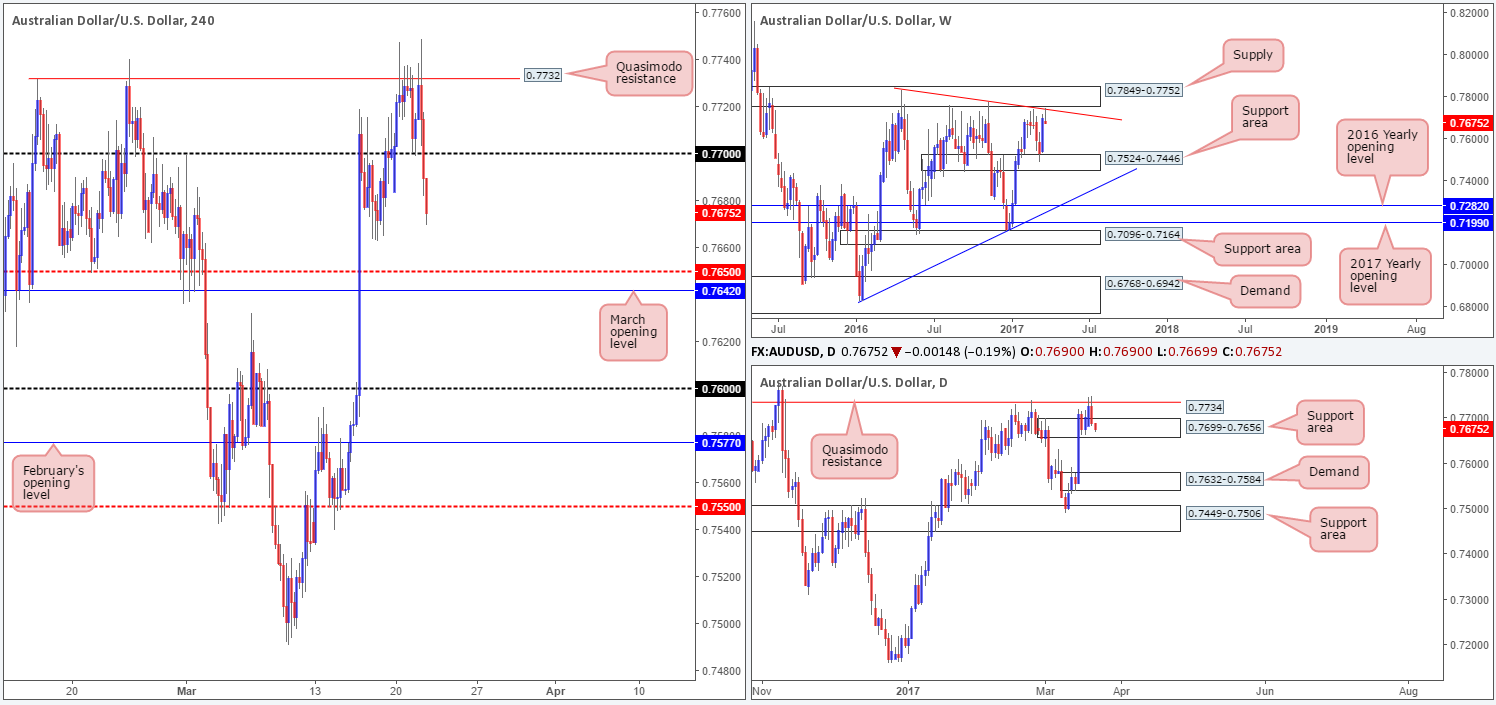

AUD/USD:

Having failed to sustain gains beyond the H4 Quasimodo resistance level at 0.7732 yesterday, the pair entered into something of a free-fall. The 0.77 handle was wiped off the chart, with price now looking set to challenge the 16th March lows at 0.7663, followed closely by the H4 mid-way support hurdle at 0.7650 and March’s opening base line at 0.7642. Whilst this selloff is indeed backed by a weekly trendline resistance taken from the high 0.7835, it may be worth noting that the daily candles are currently trading within a daily support area marked at 0.7699-0.7656.

Our suggestions: Although downside momentum appears incredibly strong right now, selling into a daily support area is just too risky for our liking. Before our team can consider shorts, a H4 close is required beyond March’s opening level at 0.7642. Not only will this likely clear our bids from within the current daily support area, it seems to also open up some space on the H4 chart down to the 0.76 handle. A H4 close below 0.7642, followed up with a strong retest would, in our view, be ideal grounds to sell this market!

Data points to consider: RBA Assistant Gov. Debelle speaks at 1.40am GMT.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Watch for price to engulf 0.7642 and then look to trade any retest seen thereafter (stop loss: dependent on the rejection candle, as ideally we’d look to place it beyond the rejection candle’s wick).

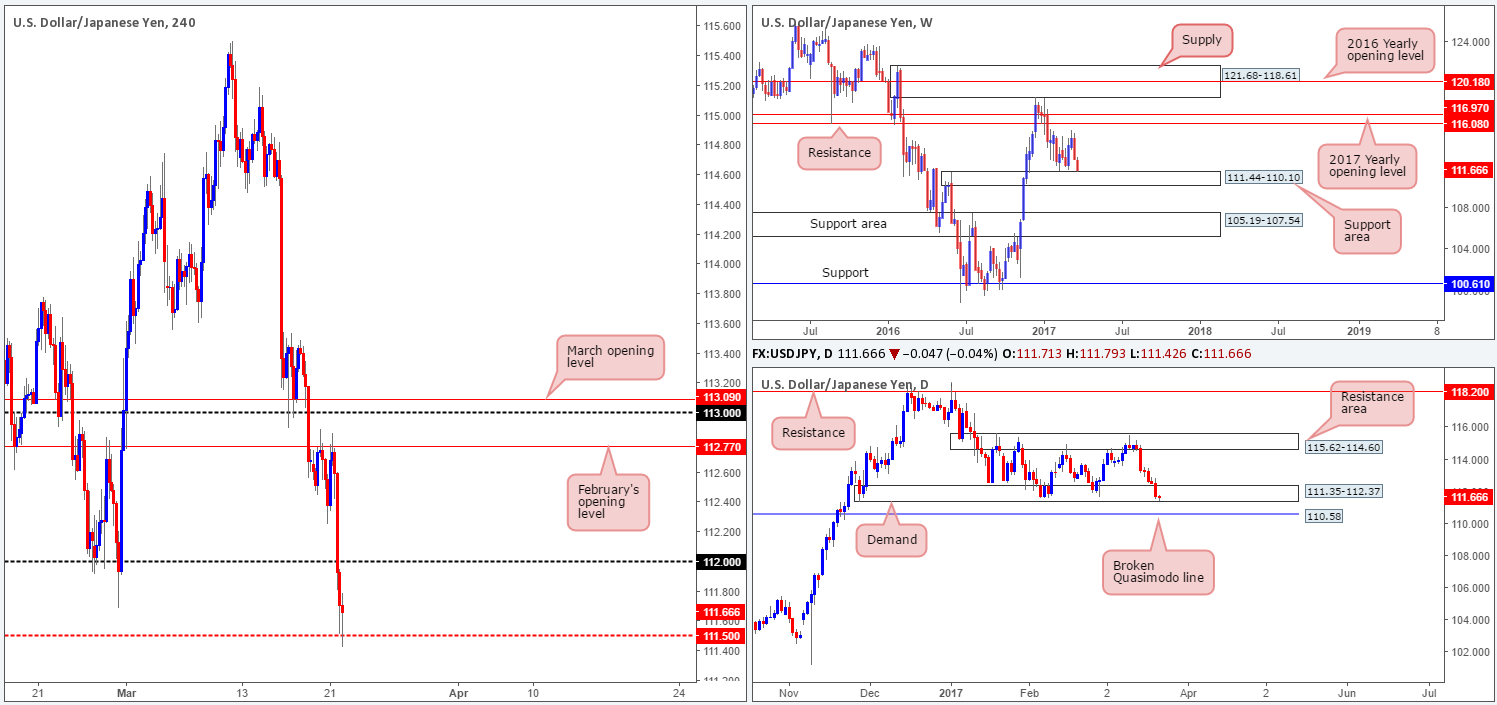

USD/JPY:

With US equity prices falling sharply yesterday, this, as you can see, revived demand for the safe-have yen! H4 price staged a rather aggressive selloff from the underside of February’s opening line at 112.77, consequently breaching the 112 handle and slam dunking itself into the H4 mid-way support barrier at 111.50 at the close. Whilst 111.50 is a support in and of itself, we would not consider it stable enough to justify a long. But, knowing that this number is placed within the walls of a daily support area at 111.35-112.37 along with weekly price skimming the top edge of a weekly support area at 111.44-110.10, the 111.50 level becomes a worthy contender as far as supports go.

Our suggestions: Should 115.50 produce a reasonably sized H4 bullish rotation candle today, a buy from here is high probability. Should the above come to fruition, we’d be looking for price to engulf 112 and head back up to retest February’s opening level. This, in our estimation, is a solid take-profit target.

Data points to consider: There’s little scheduled news on the docket today.

Levels to watch/live orders:

- Buys: 115.50 region ([waiting for a reasonably sized H4 bull candle to form is advised before pulling the trigger] stop loss: ideally beyond the confirming candle).

- Sells: Flat (stop loss: N/A).

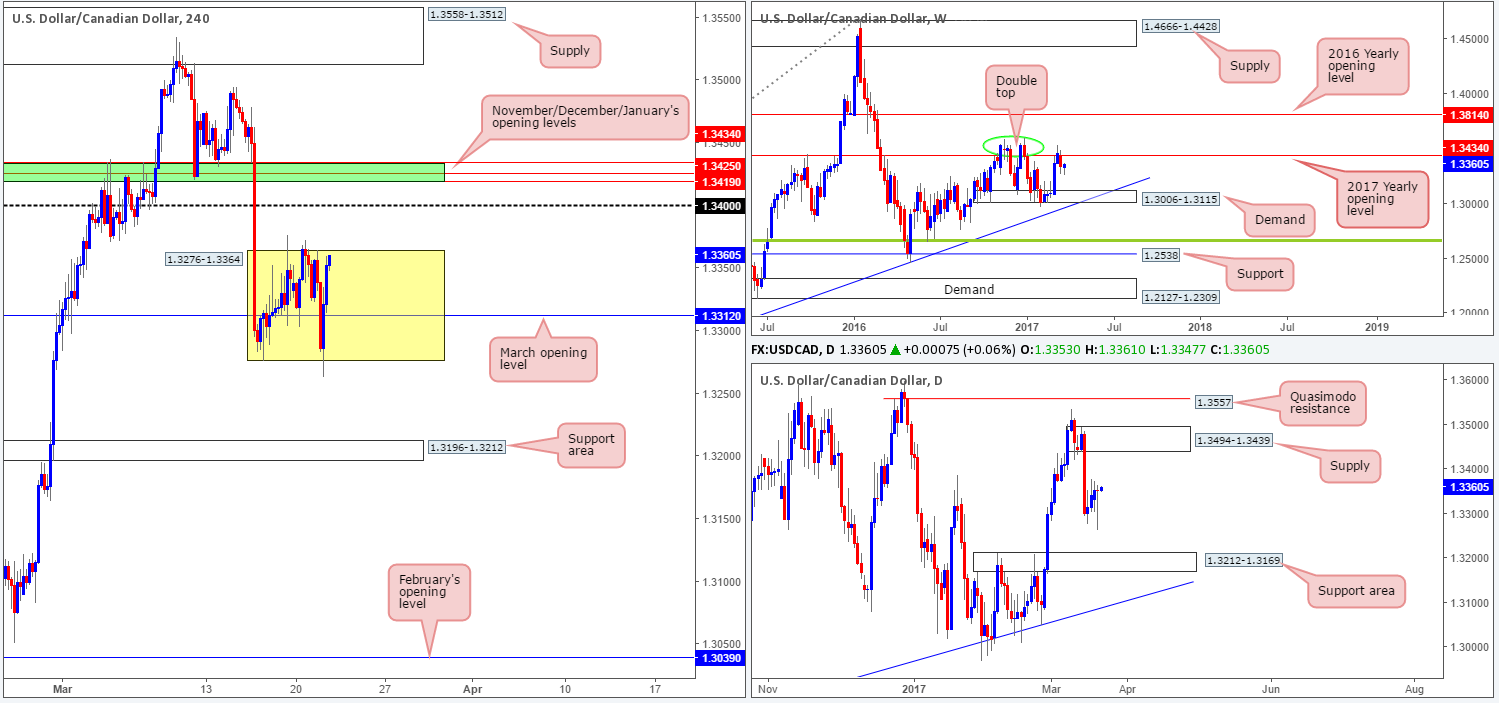

USD/CAD:

The USD/CAD staged an impressive comeback going into the US session yesterday on the back of declining oil prices. As we write, the pair is seen trading within touching distance of 1.3364 (the top edge of the current H4 range). A violation of this boundary could send the unit up to the 1.34 handle, or quite possibly the 1.3434/1.3419 area (November, December and January’s opening levels).

Right now, there is very little higher-timeframe structure in play so it’s difficult to judge direction. However, in the event that a break to the upside is seen, our team would be very interested in the 1.3434/1.3419 zone. The reason for this is simple. Psychological handles are prone to fakeouts, and with this H4 area lurking just above 1.34, we feel it’d be a fantastic barrier to help facilitate a fakeout.

Our suggestions: Look to short 1.3434/1.3419. For those concerned that a fakeout through this area may also take place, we would strongly recommend waiting for a lower-timeframe sell signal to form (see the top of this report).

Data points to consider: Crude oil inventories at 2.30pm, Canadian Gov. Council member Schembri speaks at 7.45pm GMT.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 1.3434/1.3419 ([waiting for a lower-timeframe sell signal to form is advised before pulling the trigger] stop loss: dependent on where one confirms this area).

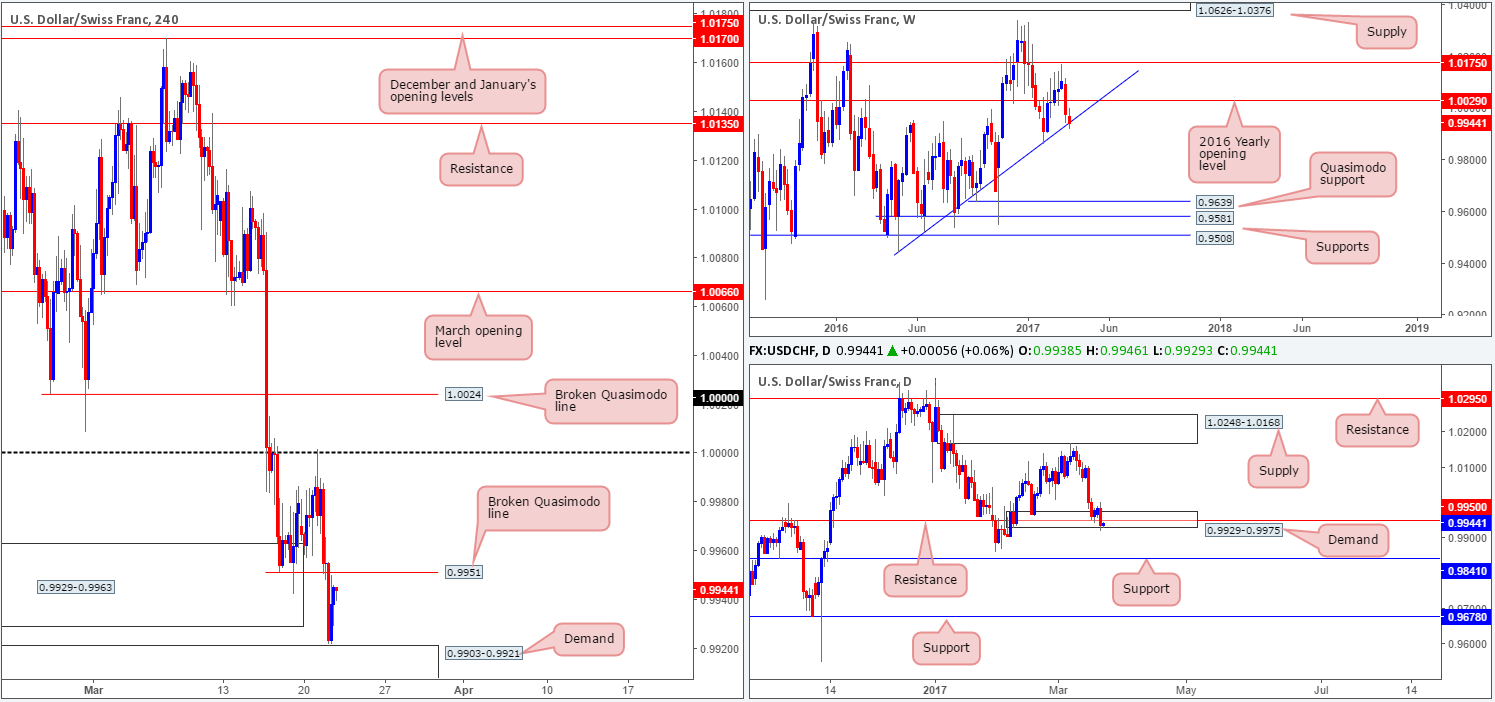

USD/CHF:

In view of weekly action now touching gloves with a weekly ascending trendline extended from the low 0.9443, shorting this market (medium term) may be a problem! Down on the daily chart, price closed below daily support at 0.9950 (now acting resistance), but failed to close below the daily demand in which it’s housed in at 0.9929-0.9975. Looking over to the H4 candles, we can see that the Swissy punched beyond the H4 demand at 0.9929-0.9963 and missed the next H4 demand seen just below it at 0.9903-0.9921 by a cat’s whisker.

Our suggestions: Given the above points, and taking into account that H4 price is capped between the H4 demand base at 0.9903-0.9921 and a H4 broken Quasimodo line at 0.9951, this market is a difficult piece to read at the moment.

In order to go long, we would prefer to see a daily close back above the daily resistance at 0.9950. As for shorts, we would not even attempt to go down this trail given the weekly trendline currently in play! Therefore, we feel it is best to remain on the sidelines today.

Data points to consider: There’s little scheduled news on the docket today.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Flat (stop loss: N/A).

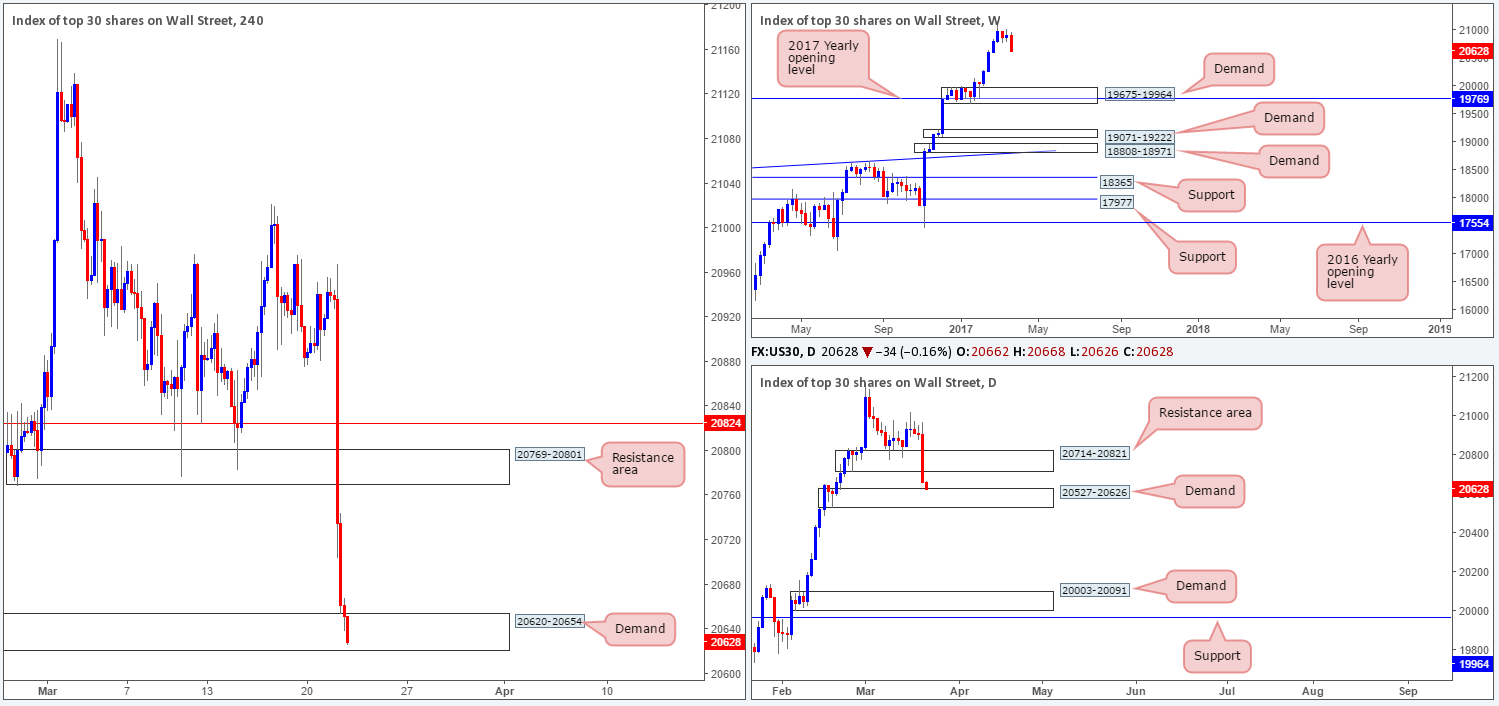

DOW 30:

US stocks fell sharply going into the early hours of US trading yesterday. The index dropped 250 points on the day (open/close) and took out multiple tech supports along the way! As you can see, the H4 candles ended the session shaking hands with the H4 demand at 20620-20654, which happens to be positioned around the top edge of a daily demand base coming in at 20527-20626.

With the bulls yet to make an appearance, and the weekly chart indicating that this market has the potential to selloff all the way back down to the weekly demand area pegged at 19675-19964, we have no intention of buying this market just yet!

Our suggestions: To prove buyer intent within the current H4 demand, we would need to see a reasonably sized H4 bullish rotation candle form from here. This would, in our opinion, be enough evidence to justify a buy trade, targeting the underside of the daily resistance area at 20714, followed closely by the H4 resistance area at 20769-20801.

Data points to consider: There’s little scheduled news on the docket today.

Levels to watch/live orders:

- Buys: 20620-20654 ([waiting for a reasonably sized H4 bull candle to form is advised before pulling the trigger] stop loss: ideally beyond the confirming candle).

- Sells: Flat (stop loss: N/A).

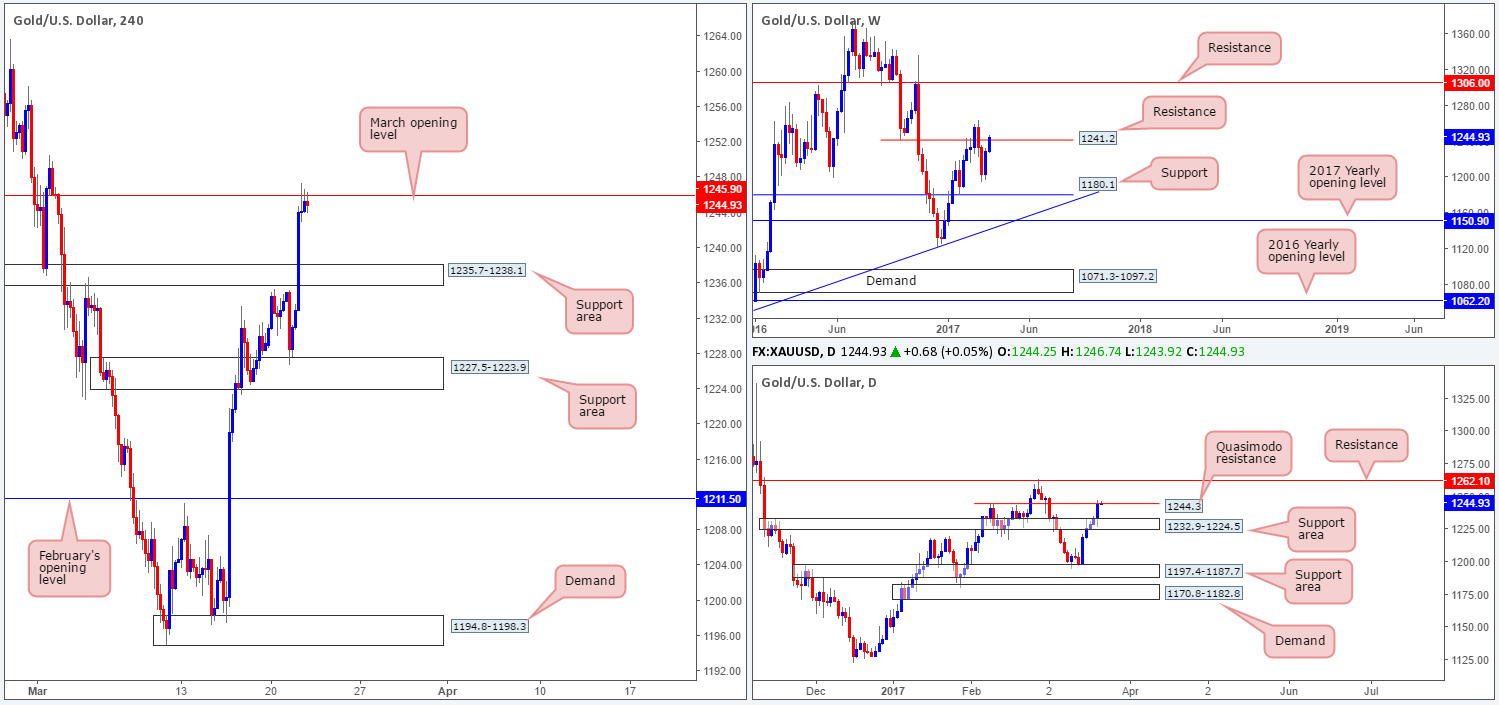

GOLD:

Across the board we saw the US dollar take a hit. This, as you can see, lifted the price of gold higher, breaking through a H4 resistance area at 1235.7-1238.1 (now a support zone) and tagging March’s opening level at 1245.9 by the day’s end.

While 1245.9 is holding ground, there has not been much bearish intent registered from here as of yet. However, considering that weekly resistance at 1241.2 and the daily Quasimodo resistance at 1244.3 are both in play right now, we do expect to see a H4 bearish rotation candle present itself from 1245.9 today.

Our suggestions: Should this be the case, we would look to sell the close of the H4 bearish candle and target the H4 support area mentioned above at 1235.7-1238.1.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 1245.9 region ([waiting for a reasonably sized H4 bear candle to form is advised before pulling the trigger] stop loss: ideally beyond the confirming candle).