Updated August 2020

Did you know you don’t have to be right each time you interact with the market?

You don’t even need to be correct 50% of the time to succeed.

Once a trading system is mastered, one with an edge, trading should be no more than a repetitive chore – almost boring. Because humans have a tendency to complicate things and dislike being wrong, however, trading becomes difficult.

Detaching yourself and adopting a probability-based mindset can help achieve consistency in the markets. Unfortunately, the majority of traders, regardless of their experience level, are incapable of doing this. Most choose to focus efforts on whether the next trade will be a winner or loser.

Trading Expectancy

Trading expectancy, or statistical expectancy, delivers an effective (and objective) method of evaluating a trading system’s performance. In simple terms, trading expectancy is the average amount a trader can expect to win/lose using a particular system. While the probability of each individual trade is random, the statistical measure can be applied to a large enough sample size of trades. It is commonly recommended at least fifty trading examples be recorded to be statistically significant.

The following components are needed to calculate trading expectancy:

Estimate the win/loss ratio – how many trades produced a winning reaction over how many concluded a loss. From the trade samples, divide the value of winning setups by the total number of trades taken. This provides a win/loss ratio. By way of a basic example, imagine 100 trades are recorded. Out of 100, 40 trades are winners and 60 are losers. The win/loss ratio, in this case, is approximately 40%.

Although the method produced 60 losing trades, it does not necessarily invalidate the trading system. This is the point many traders become confused.

Some of the most profitable systems have win/loss ratios less than 50%.

The risk/reward ratio must be taken into account – the average size of a profitable trade divided by a typical losing trade. Imagine winning trades frequently register $200 and losing trades $100, a risk/reward ratio of 1:2, meaning on every winning trade the trading system yields two times the risk.

Merge the two aforementioned ratios to reach an expectancy ratio. We know the strategy has a 40% chance of producing a winning trade. We also know, on average, winning trades achieve two times the risk.

Assuming an account of 10,000 USD and a risk of 2% each trade:

200 USD * 40 winning trades = 8,000 USD

100 USD * 60 losing trades = 6,000 USD

Trading profit = 2,000 USD

Based on this, we see we have a method boasting positive expectancy, despite losing 60% of the time.

While the above illustrates a profitable method, you must also consider trading fees and commissions. Another point to be aware of is historical calculations are not a guarantee the method will produce the same results in future trades – it is a guide.

Yet, what is crystal clear from the above calculations is it’s unnecessary to win every trade. In fact, if a strategy generates three times the risk on winning trades, for example, a risk/reward ratio of 1:3, the system can afford to lose 70% of trades and still, over a large enough sample size, offer a return.

Thinking in Probabilities

Probability is a measure of how likely an event is to occur out of the number of possible outcomes.

If we understand the trading system recognises a positive expectancy, a high probability of making money over the long term, is there a need to stress whether the next trade will be a winner or not? As you become more experienced, you’ll understand there is little point in getting excited over the next trade.

To think in probabilities is easy in theory, though somewhat difficult to implement in reality, particularly when hard-earned money is on the line.

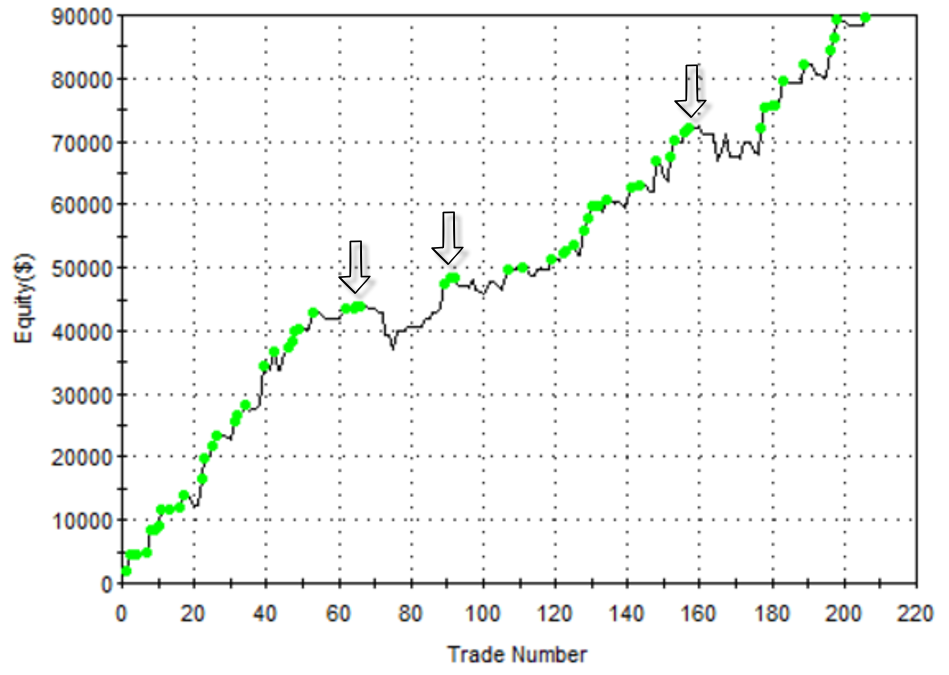

As demonstrated in figure A, over the course of 220 trades the account grew considerably. This could have been over a year, five years or a trader’s entire career. It does not matter. What is important is understanding an individual trade should, as long as you keep to the (tested and proven) trading rules and money/risk management strategy, have minimal impact on the collective outcome.

Do we panic if we have a loss, do we panic if we have two, or even three consecutive losses? While psychologically challenging for most, the answer is no. Remember, there is no way of knowing the outcome of each individual trade you take. Do you think the trader who managed the account in figure A panicked when the equity curve turned (see black arrows)? Unlikely given the results.

Trading a system with a clear edge and following it religiously, while adopting a probability-based mindset, are core components to successful trading.

Thinking in probabilities will not happen overnight. It takes time – time well spent – to develop this essential skill.

The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets does not warranty, guarantee or make any representations, or assume any liability regarding financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www.icmarkets.com.au, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness. All such information is subject to change at any time without notice. IC Markets assumes no responsibility for the content of any linked site.

The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site. IC Markets is not liable for any harm caused by the transmission, through accessing the services or information on this site, of a computer virus, or other computer code or programming device that might be used to access, delete, damage, disable, disrupt or otherwise impede in any manner, the operation of the site or of any user’s software, hardware, data or property.