EURUSD:

EUR/USD fell yesterday to the lowest level seen since early 2003, after another rejection off 1.05 resistance.

The outlook remains bearish and the recent price action confirmed that selling interest continues to be high. Traders should keep an eye on the area between 1.0435 and 1.0445 for immediate resistance, while major resistance is now seen at 1.05 and 1.0590.

GBPUSD:

GBP/USD came under pressure as well, although it managed to bounce off 1.22 support once again. However, the support level is looking increasingly fragile and given how weak the rallies are, it seems we will soon see a break below it.

Sub-1.22, there is no significant support level until 1.2080. To the topside, expect decent resistance at 1.23 and ahead of the 1.24 level (1.2385-1.24 area).

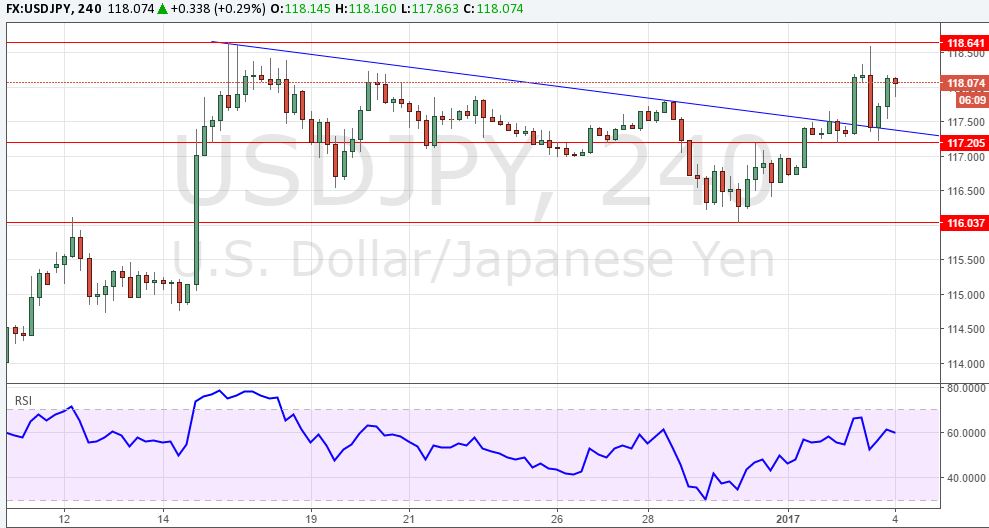

USD/JPY:

In USD/JPY, resistance at 118.65 proved to be too strong on the second test, and a sharp sell-off followed. However, it managed to bounce off 117.20 and rallied in the overnight session, breaking back above 118.

While the reaction at 118.65 was intense, the pair still remains very well bid, and it seems only a matter of time until the aforementioned obstacle is cleared, and above, there is little resistance then until 120. To the downside, keep an eye on the 117.20 support level, followed by 116.50 & 116.05/10.

AUD/USD:

The Australian Dollar remains bid despite the overall USD strength. AUD/USD is currently still struggling with 0.7245 resistance, but momentum remains positive and a breakout seems imminent. Above that level, resistance is noted at 0.7310, and a break above that level would then pave the way for a move towards 0.75. Overall, further AUD/USD gains seem likely in the near-term.

Traders looking to avoid having a direct USD short position, could also consider AUD/JPY.

NZD/USD:

NZD/USD has a mixed short-term outlook, and failed to follow the Australian Dollar higher.

It ran into strong resistance at 0.6980 and eventually fell back to 0.6890 overnight. Further consolidation seems likely.

USD/CAD:

USD/CAD is consolidating after the sharp reversal off 1.36. It had a decent bounce off 1.34 (which is also the 38.2 % Fibo of the December rally), but failed so far to rally significantly. Traders should keep an eye on the 1.3475 resistance level (Dec 26 low and 23.6 % Fib of Dec rally), as a break above would switch short-term techs back to bullish and suggest another test of 1.36.

To the downside, strong support is seen between 1.3340 and 1.3360, but given the strong bounce off 1.34 and Oil prices coming under pressure again, it seems less likely that we will see that area being tested that soon.

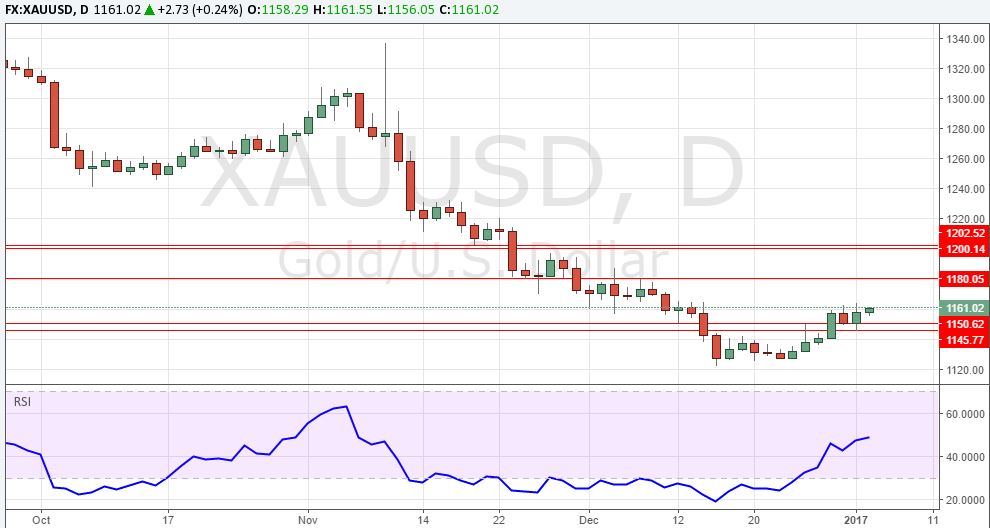

XAU/USD:

Gold still looks fairly bullish in the short-term, and we should see a test of $1180 resistance soon.

However, the medium-term outlook remains bearish and it will likely encounter strong selling interest in the $1200-05 area.