EUR/USD

EUR/USD is still struggling following the sharp rejection off 1.05 resistance last week. It has found decent support at 1.0425, but it is looking vulnerable and a retest of the recent low at 1.0350 seems likely in the near-term. However, in the less likely event that we see a clear breakout above 1.05, the short squeeze would likely extend to at least 1.06 as short positioning in the Euro is stretched.

GBP/USD

GBP/USD managed to find support at 1.2230, but rallies have been weak and selling interest remains decent. Following the break below 1.23, there is now not much support until 1.2115/20, and it is likely that the pair will test that level in the near-term. To the topside, traders can expect decent resistance at the former support level at 1.23, followed by 1.2390.

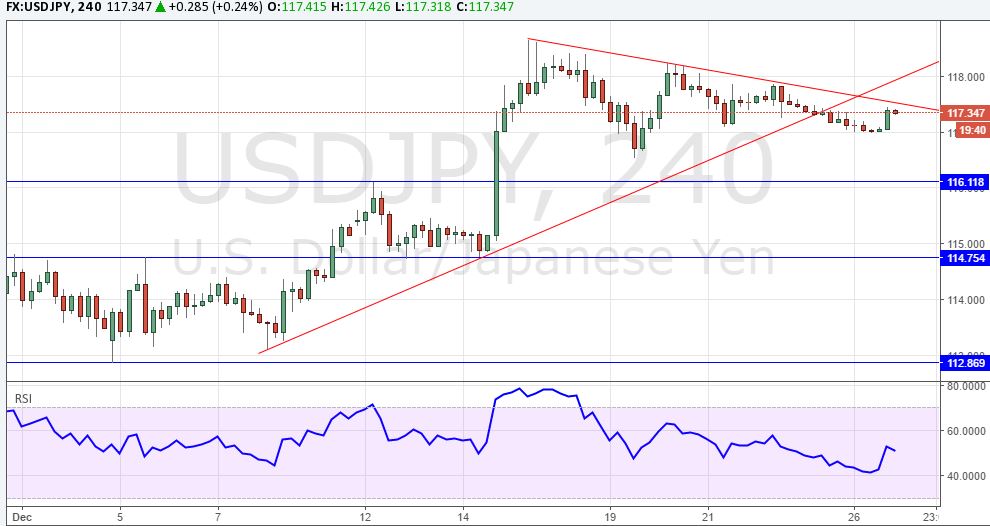

USD/JPY

USD/JPY broke out of a triangle pattern and below a key trendline from the early December lows. However, losses have been limited so far, as buying interest remains strong. The pair bounced off 117 support today and rose back to 117.45 It is facing resistance at the falling trendline from the Dec 15 high, followed by 118.00 and 118.60. The resistance area between 118 and 118.60 will be a tough one to crack, and the Daily & Weekly chart still show overbought conditions, suggesting a deeper retracement might be needed before the rally extends towards 120. Traders should look at 116.10/20 for key support.

AUD/USD

AUD/USD found solid support at 0.7160, and the H4 chart is still showing bullish RSI divergence. However, the outlook remains bearish overall, and rallies have been weak so far, as AUD/USD struggled at 0.7220 resistance yesterday. It would need a clear break above 0.7280 to confirm the short-term bottom at 0.7160 and pave the way for a move to 0.74. On the other side, the 0.7150/60 support area is a major one, and a clear break below would signal that AUD/USD will decline to 0.70 in the near-term.

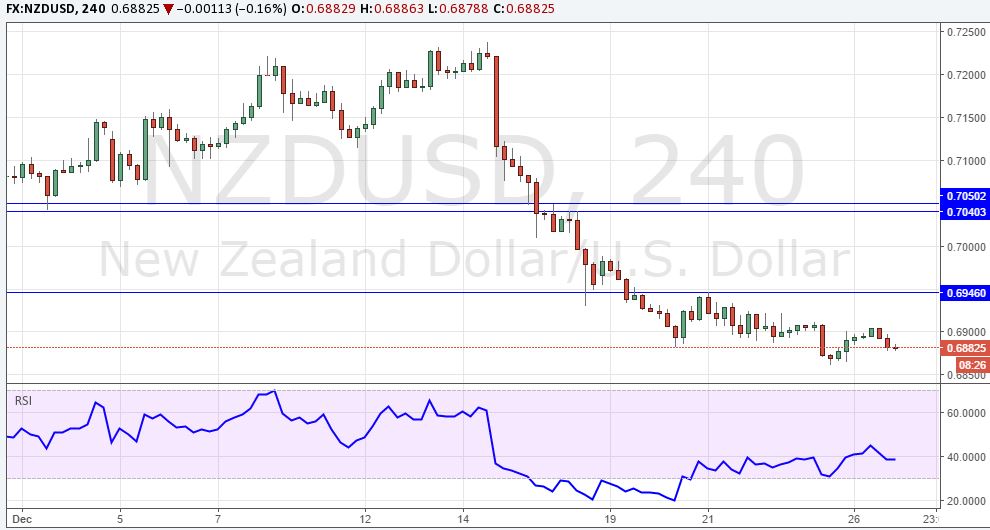

NZD/USD

The price action in NZD/USD continues to look bearish as well. While it managed to bounce ahead of 0.6850, resistance above 0.69 proved to be too tough. For traders looking to establish a short position, the 0.7040/50 area is an attractive one, and NZD/USD will likely encounter strong resistance there. However, it is still more than 100 pips away. Immediate resistance can be expected at 0.6920, followed by 0.6945 (Dec 21 high). Overall, the outlook remains negative and selling rallies the preferred strategy.

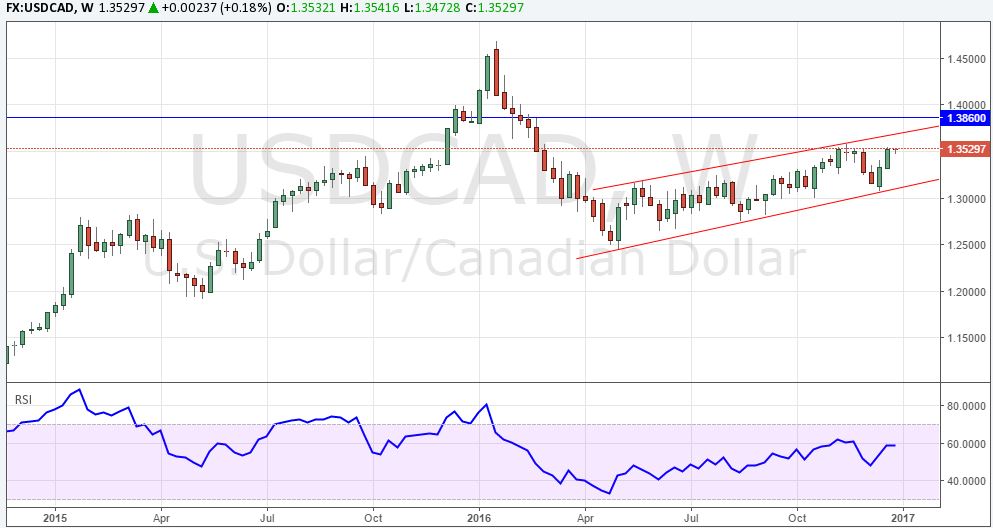

USD/CAD

USD/CAD momentum has slowed down over the holidays, but it is likely to test the 1.36 resistance level soon, and a break above would signal a move to at least 1.3860, as there is no significant resistance in-between.

XAU/USD

Gold has been slowly rising in the past few trading sessions and is currently approaching $1140. Keep an eye on the price action around the former support level at $1151, which now acts as key resistance. A rejection off that level would pave the way for a move to $1100.