‘You become what you think about all day long’ ― Ralph Waldo Emerson

Our thoughts have an immense effect on what paths we take in life. Talk to any coach, mentor or motivational speaker and they will very likely embrace and support positive affirmations. Think about it. If your mind’s narrative is constantly driven by negative thoughts and fears, you will likely struggle to meet your desired goals, be it trading or in other areas of your life!

So, without further ado, let’s dive into our first trading affirmation!

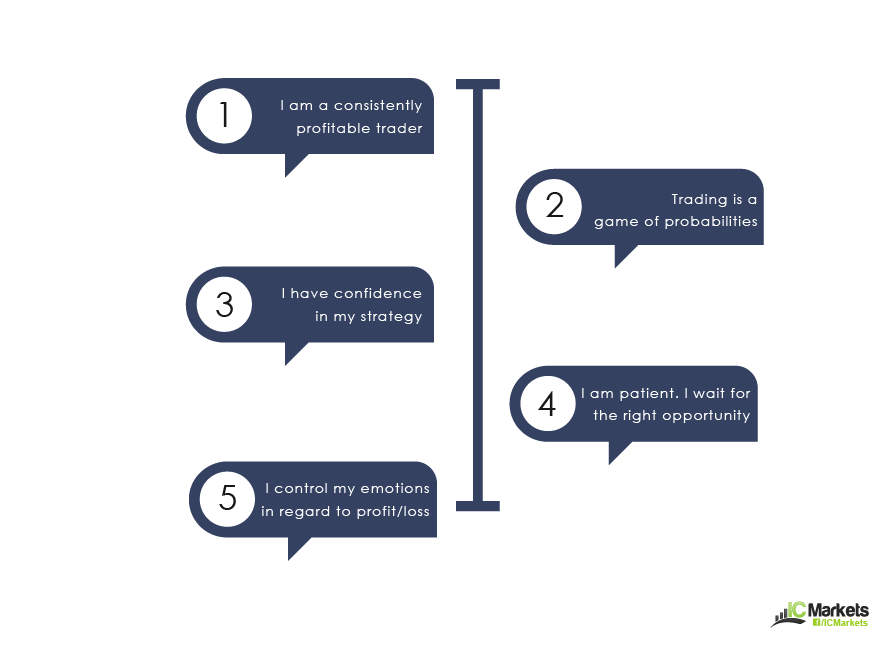

I am a consistently profitable trader

Voicing this affirmation first thing sets an incredibly positive theme for the day. Even if you have not reached a level of consistency yet, do not be afraid to say it! Also important is expressing it in present tense, rather than future tense. Using future tense will effectively nudge your goal into the future, much like hanging a carrot in front of a donkey!

Trading is a game of probabilities

Does every trade have to be a winner? Of course it doesn’t! Losing trades are a part of the business. In fact, win rate counts for very little if you’re losing more on your losing trades than you net on your winners.

If you take only 50 trades per year – that equates to approximately one trade each week – you only need to win 20 of those 50 trades (assuming your winners make twice the initial risk) to have a profitable year (this is a 40/60 win/loss ratio). We discuss the thinking behind probabilities in depth here: Thinking in Probabilities

I have Confidence in my Strategy

Without confidence in your trading strategy, you’ll likely end up throwing in the towel as without the guidance of a trusted method you’ll have no purpose and question every move you make. This is NOT how profitable traders operate. If you are trading a strategy that resonates with your personality – for example has been back tested and forward tested using a small live account – then saying this affirmation each trading day will help you recall the hard work you have already put in to develop your method.

I am patient. I do not chase trades. I only trade when opportunities present themselves to me.

Making the mistake of trading for the sake of trading is a disaster waiting to happen. A common misconception is that you need to trade regularly to make money. Whilst it is true that you do need to place trades to profit, you do NOT have to trade every day. Check out this article: What Snipers Teach you about Trading where we emphasize the need to think like a military sniper in trading.

I control my emotions in regard to profits and losses.

Humans are emotional creatures. There’s no getting away from that! Both profit and loss have the ability to cause an emotional tornado within us. Experiencing a profitable trade, or a string of profitable trades, can induce a sense of confidence – a sense of euphoria if you will. A loss, or a string of losses, will likely force the unaware on a path of destruction that has come to be known as ‘revenge trading’.

Controlling one’s emotions is seen as a key component to success in this business.

So, why do positive affirmations work?

Many successful people attribute their successes to a positive mindset. Jim Carrey and Denzel Washington, both A-list American actors, openly supported affirmations in the early stages of their careers. In addition to this, there’s also a plethora of credible sources proving that affirmations are worthwhile. We found this site to be particularly interesting: Science of Affirmative Proof

Will affirmations work for you and your trading? Well, unless you try you’ll never know! Spend some time creating a few positive affirmations that when read aloud evoke a strong personal connection. Attach them to your monitor using post-it notes. That way, you’ll see them (and hopefully read them) while switching on your computer.